Accounting 2024, April

What is the purpose of the audit, the objectives of the audit

It is not uncommon for owners of large firms to bring in outside experts to carry out audits and identify any possible inconsistencies and weaknesses in their company's systematic workflow. Thus, an internal audit is organized at the enterprise, the purpose of which is to check the functioning of the accounting department and related operational procedures carried out in the company as a whole

Depreciation policy of an enterprise - definition, elements and characteristics

This article examines the essence of the company's depreciation policy, its focus and characteristics. The main methods for calculating depreciation are presented. The features of the state depreciation policy are considered

Provisions - what is it? Meaning of the word

This article is about the interpretation of the word "provision". It is indicated what kind of lexical meaning this language unit is endowed with. To enrich the vocabulary, we will also indicate the synonyms of the word "provisions". Let's give examples of sentences

How is legal leave paid?

The right of citizens to annual paid leave is provided for by the Labor Code. The same document spells out the procedure for calculating, accruing and paying vacations. Depending on the field of activity, according to the law, a person is en titled to from 24 to 55 days of rest per year. If the employee does not have the opportunity or desire to take a vacation. he can receive monetary compensation in the amount of average earnings

How to calculate compensation for vacation upon dismissal?

Compensation for leave is assigned upon dismissal of an employee who has unused days of rest. The article explains how this payment is correctly calculated. Responsibility measures are given for employers who violate the requirements of the law

Direct debit - what is it? Withdrawing funds without the order of the account holder

Direct debit - what it is, why and in what cases it is used and how legitimate such actions of a banking organization are

Doubtful accounts receivable is Concept, types, general write-off rules

The article includes all the key aspects of the concept of "accounts receivable", starting from its theoretical essence and ending with the analysis of theoretical issues that an accountant may encounter in the course of their professional activities. It will be useful both for students of economic universities and for practitioners striving for development in the professional field

VostokFin: how to deal with them? collection agency

Collection business is a profitable and profitable business, because employees receive a good percentage for their work from the amount of debt. Most often, they manage to influence a person so that he sells his property and pays off his debt. Who are collectors? How do they affect the client and what can be expected from them?

How to find out OKPO by TIN of an organization

Statistical codes (OKPO, OKVED, OKOPF, etc.) the newly created enterprise receives upon registration. They have different purposes - they may be required in the preparation of reports, in the preparation of primary documentation, and so on. It is worth noting that in addition to your statistics codes, you may need to know the codes of the counterparty with which the company operates. How to find counterparty statistics codes? To do this, it is not necessary to contact the Rosstat authorities or use the services of companies that

How to find out the debt by TIN

Modern and very convenient service allows you to find out the debt by TIN without a personal trip to the tax office. It provides an opportunity to obtain all the necessary information on existing debts to individuals and legal entities. The Internet service gives access to data on tax debts in all spheres of human life. Debts to transport, land, property funds and all other organizations are taken into account

Restructuring is a complex process

The word "restructuring" is a borrowing from the English language, it means a change in the structure, order, structure. The term is general, so the processes denoted by this concept can be found in any kind of activity. For example, in Western financial practices there is such a thing as "company restructuring"

Forfeit is a serious violation

In business turnover, such a term as a pen alty is often considered. This concept, in accordance with Russian legislation, is considered in the Civil Code (Article 330 of the first part). In it, a fine, a pen alty fee, which are synonymous with a forfeit, are designated as amounts determined by law or an agreement paid to the creditor if the obligation is not fulfilled properly

Collectors: legal or not? How to talk to collectors

Today, there are a huge number of collection agencies. In fact, they are not a state body, but use all the methods permitted by state law. That is why the attitude of people to collectors is very different. Many are interested in the question: collectors - legally or not, they act and take measures in relation to debtors

How to deal with collectors: practical recommendations

It is pointless to argue about whether or not to take a bank loan. It all depends on the circumstances: for some, this opportunity helps a lot, while for others it turns into a real hard labor. Often, credit organizations turn to collectors - private firms offering their debt collection services. The activities of such organizations are poorly regulated by law and therefore often there are various abuses of their powers on their part

How to find out the debt from bailiffs?

Everyone got into debt at least once in their life. If the amounts are small, then they can still be remembered somehow. But when money needs to be returned to several instances at once, confusion can begin. If you do not pay off the debt on time, then at the most unexpected moment it can come out sideways. For example, during check-in for a flight, it turns out that the bank wrote a statement of claim against you and won the process. How to find out debt from bailiffs?

Russia's record external debt and the outflow of capital from the country: what the numbers say and what to expect in the future

If you look at the numbers describing the state of Russia's external debt, 2013 promises to be another record high. According to preliminary data, as of October 1, the total amount of borrowings broke a record and amounted to approximately $719.6 billion. This value is more than 13% higher than the same indicator at the end of 2012. At the same time, the Central Bank predicts an outflow of capital from the Russian Federation at the level of 62 billion this year

Collection of receivables: terms and procedure

Collection of receivables is required in a situation where debtors do not repay their debts to the company on time. The article describes what methods of recovery can be used by the enterprise. Lists different methods to return funds after a court decision

Evaluation of receivables: methods, features of the procedure, examples

In the process of carrying out business activities, accounts receivable (RD) arise. This may be the amount of funds for the supply or the value of goods that the lender plans to receive at the agreed time. DZ is accounted for in the balance sheet at actual cost and includes settlements: with buyers/customers; on bills; with subsidiaries; with the founders on contributions to the capital; on advances

Receivables in the balance sheet: which line, accounts

Receivables in the company's balance sheet are reflected in the accounting accounts, in the company's statements and are constantly monitored by accountants. Where exactly is the debt reflected and in what lines is it indicated? Features of the analysis of receivables

Maternity leave and the hassle associated with its registration

This article reveals the concept of maternity leave, its legal side, as well as the basic rules for applying for maternity leave

Alimony from sick leave: deduction rules, amount and calculation examples

Based on the law, child support from sick leave can be withheld. And even in the case when the payer does not intend to transfer funds. Under such circumstances, a claim may be filed. As a result, the necessary funds will be withheld on the basis of a court decision. But the best option is the agreement of the former spouses

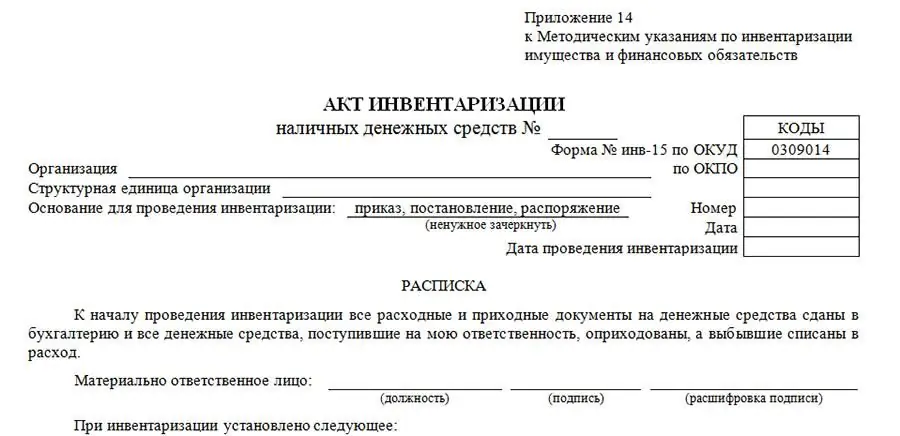

Drawing up the results of the inventory: a list of documents, the procedure for compiling

Filing out the results of the inventory is a significant step in a full-fledged and high-quality audit. To do this, the members of the inventory commission must draw up a set of documents containing the information obtained during the verification process. Based on this documentation, a decision is made by the head of the company regarding the prosecution of violators

Wages are paid in accordance with Article 136 of the Labor Code. Rules for registration, accrual, conditions and terms of payments

The Labor Code says that any employee must receive a decent wage for their own work, commensurate with their contribution. Let's talk further about how wages should be paid, what are the features of its accrual, and also what kind of regulatory acts govern this process

Accounting documents are The concept, rules for registration and storage of accounting documents. 402-FZ "On Accounting". Article 9. Primary accounting documents

Proper execution of accounting documentation is very important for the process of generating accounting information and determining tax liabilities. Therefore, it is necessary to treat documents with special care. Specialists of accounting services, representatives of small businesses who keep independent records should know the main requirements for the creation, design, movement, storage of papers

What is primary documentation in accounting? Definition, types, features and requirements for filling

Accounting of any enterprise deals with primary reporting. The list of primary documentation in accounting includes several mandatory papers. Each of them is related to the stages of the business process. If the employees of the organization do not maintain primary documentation in "1C: Accounting", the company will face tangible sanctions

Irregular working hours: concept, definition, legislation and compensation

Irregular working hours - a concept in the Labor Code, which is quite common in practice and is applied within the framework of labor legislation. What does it mean and what features does it have? Let's talk about all this further in more detail

What is rationing: concept, definition, types, methods and formulas for calculations

What is rationing? This is a controlled distribution of limited resources, goods or services, or an artificial reduction in demand. Rationing revises the size of the ration, which is the allowed part of the resources allocated per day or some other period of time. There are many forms of this control, and in Western civilization people experience some of them in daily life without realizing it

Inventory: what is it, features of the conduct, necessary forms and acts

Accountants know that inventory is an indispensable and necessary measure for keeping records. No less information about it is possessed by those who are responsible for managing divisions, departments, and the company as a whole. Individual specialists from different departments can take part in the inventory. At some enterprises, this is the responsibility of a special department of material support

Retained earnings: where to use, sources of formation, account in the balance sheet

If a company makes a net profit, it can distribute it according to its needs. This affects the further development of the organization. Where can you use retained earnings, how does it affect the company's activities? These questions will be discussed further

Average monthly income: calculation formula. Documents confirming income

Average monthly income from work is not the same as the average wage. Unlike the average salary, which is used for statistical surveys, the average salary is used for practical purposes. How does an employer find out the average monthly income of an employee?

Rules for filling out a certificate 2 personal income tax: step by step instructions, required forms, deadlines and delivery procedure

Individuals are required to transfer taxes accrued on their income to state budget funds. To do this, a certificate of 2 personal income tax is filled out. This document displays data on income and tax deductions of individuals. The employer is obliged to submit this documentation annually to the relevant regulatory authorities at the place of its registration. Instructions and rules for filling out certificate 2 of personal income tax will be discussed in the article

Basic forms of cashless payments: concept, types, classification and documentation

Accounting for unprepared people contains a lot of obscure terms. What can I say, sometimes even those who work in a related field get lost. To prevent this from happening, you need to learn. In the article, we will consider not only the main forms of cashless payments, but also the principles of their use

Profit of the enterprise: formation and distribution of profit, accounting and analysis of use

Every organization in a market economy works to make a profit. This is the main goal and indicator of the effectiveness of the use of available resources by the company. There are certain features of the formation of profit, as well as its distribution. The further functioning of the company depends on the correctness and validity of this process. How the formation of the profit of the enterprise and the distribution of profits takes place will be discussed in the article

Determining the financial result: accounting procedure, accounting entries

Each organization carefully monitors such an indicator as the financial result. Based on its analysis, it is possible to draw a conclusion about the effectiveness of the organization. The definition of the financial result is carried out according to a certain methodology. The procedure for accounting for income and profit, accounting entries will be discussed in the article

Electronic document management: advantages and disadvantages, the essence of the system, ways of implementation

The article presents the advantages of electronic document management, and also lists the main steps to implement it in the work of any enterprise. The shortcomings of this system are indicated, as well as the main difficulties that the owners of firms have to face

Write-off of workwear upon dismissal of an employee: the concept of workwear, commissioning, orders of the Ministry of Finance and conducting postings

Decommissioning of workwear upon dismissal of an employee is required if it is impossible to use protective equipment for another specialist or the former employee refused to return the items. For this, the accountant of the company uses actual postings, which allows you to fix the write-off in accounting

What is salary indexation: essence, types, features and rules of conducting

The article describes what wage indexation is, by whom and when it is carried out, and also what coefficient is set. The rules for fixing information on the periodic increase in the salary of employees in the regulatory documentation of private companies are given

Decreasing balance method: features, formula and example

With the non-linear method, the repayment of the value of property is uneven throughout the entire operational period. Declining balance depreciation involves the application of an acceleration factor

The procedure for accruing vacation benefits and payments

Vacation and temporary disability benefits are one of the main types of benefits. Everyone has the right to know what is the procedure for their calculation and accrual

How to create a reserve for vacation pay. Formation of a reserve for vacation pay

In art. 324.1, clause 1 of the Tax Code contains a provision requiring taxpayers who plan to calculate the reserve for vacation pay to reflect in the documentation the method of calculation they have adopted, as well as the maximum amount and monthly percentage of income under this article

Primary accounting documents: list and rules of execution

Primary accounting documents are used in every enterprise. All of them are important in their own way, and must be taken into account in the work. They are drawn up according to the forms of primary accounting documents of accounting registers. A complete list of them and the rules for registration are presented in this article

How vacation pay is calculated: calculation examples

The concept of leave in relations between an employee and an employer was introduced by Vladimir Ulyanovich Lenin in 1918. Since then, Russians have no idea what it's like to work without paid leave. The term for the bulk has not changed - it is almost a month, which is set for the fully worked 12 months. But how are vacation days calculated in material terms?

Calculation of average earnings upon dismissal: calculation procedure, rules and features of registration, accrual and payment

To get confidence in the correctness of all accounting calculations upon dismissal, you can easily do all the calculations yourself. The calculation of the average earnings upon dismissal is carried out according to a special formula, which, with all the features, is given and described in the article. Also in the material you can find examples of calculations for clarity

Sample regulation of interaction between departments, examples

Each enterprise has local documents regulating its activities. One of the most significant is the regulation of interaction between departments. For the head of the organization, it is an effective management tool

How to calculate average earnings: step by step instructions

One of the concepts that a personnel officer, a novice payroll accountant, a payroll economist needs to know is the concept of average earnings. The employee, in turn, knowing how this value is calculated helps to control the correctness of the payments accrued to him, to predict his income. After all, the size of the average earnings affects many types of payments. How to correctly calculate the average earnings, discussed in the article

The concept of economic and accounting profit: definition, features and formula

Before you start your business, you need to draw up a clear action plan and calculate financial performance. The most basic of these is profit. However, it can be calculated in different ways. And you need to clearly understand the difference between accounting profit and economic profit. The boundary between these terms is rather narrow. But it is important for a financial specialist to be able to distinguish between these terms

Travel expenses: payment, size, postings

In order to fulfill their official duties, employees are often sent on business trips. All expenses related to travel, accommodation and meals are paid by the organization. Read more about how the accrual and payment of travel expenses in 2018 is carried out

Consolidated reporting: compilation, analysis

Specialists of all organizations face standard accounting forms. They contain information about the operations, financial position of the enterprise. If two or more organizations are in legal and financial relationships, then consolidated statements are prepared

Procurement budget: essence of compilation, indicators and formation

During the preparation of the budget, sales and production plans are transformed into indicators of income and expenses of departments. In order for each of the departments to be able to achieve the intended goals, it is necessary to purchase materials within the cost plan. For this purpose, a procurement budget is formed

Overhead costs are Definition, concept, classification, types, expense item and accounting rules

An estimate is a calculation of the costs of production and sale of goods. It includes, in addition to direct costs for the purchase of materials, wages, as well as indirect (overhead) costs. These are expenses that are directed to the creation of working conditions. They cannot be attributed to the costs of the main production, as they are the key to the proper operation of the organization

How the donor day is paid: calculation procedure, rules and features of registration, payroll and payments

The need for donated blood is constantly increasing. This remedy has no analogues. An adult person can donate blood in the absence of contraindications. Legislators for donors have provided a number of guarantees. One of them is the payment to the employee of donor days. Let's take a closer look at how it works

Profitability of fixed assets: calculation formula and rules

The production assets of a firm determine its value, power, market place and ability to accumulate income. Management pays special attention to the efficiency of asset use. If the asset is misused, it loses its usefulness. Economists determine the economic effect in terms of profitability of fixed assets

Net sales in the balance sheet: string. Sales volume in the balance sheet: how to calculate?

Annually, enterprises prepare financial statements. According to the data from the balance sheet and income statement, you can determine the effectiveness of the organization, as well as calculate the main planned indicators. Provided that the management and finance department understand the meaning of terms such as profit, revenue and sales in the balance sheet

Why do we need BDR and BDDS?

To control the financial flows in the enterprise, the management makes different budgets and balances. These reports are supplemented by BDR and BDDS. The abbreviations hide the budget of income and expenses, as well as the cash flow budget. The purpose of these reports is the same, but they are generated in different ways

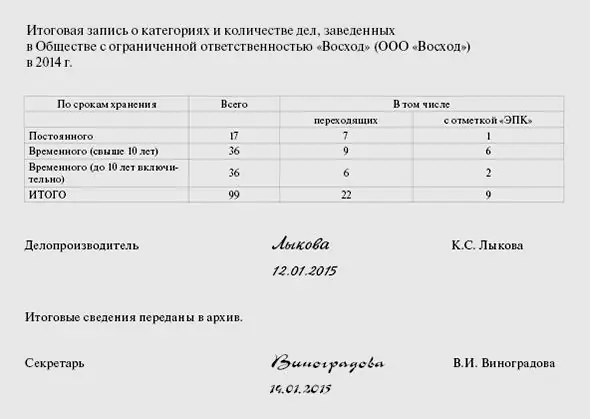

Nomenclature of affairs of the organization: samples of filling. How to make a nomenclature of affairs of the organization?

Each organization in the process of work is faced with a large document flow. Contracts, statutory, accounting, internal documents… Some of them must be kept at the enterprise for the entire period of its existence, but most of the certificates can be destroyed upon expiration of their validity. In order to be able to quickly understand the collected documents, a nomenclature of the organization’s cases is compiled

Accounting 76 account: balance, credit, debit, postings

All financial transactions are reflected in the accounts. This publication will discuss what account 76 “Settlements with various creditors and debtors” is intended for, into which categories it is divided. The article will provide examples to help you better understand the topic under consideration

91 account - "Other income and expenses". Account 91: postings

Analysis of the profit or loss received by the enterprise based on the results of the reporting period should be based on the structure of this indicator. This will provide an opportunity for further planning of expenses and stabilization of income values

How are sick leaves calculated?

With the onset of cold weather, people are often exposed to aggressive environmental factors. Such an influence provokes the development of colds. In this regard, one of the most discussed topics among accountants is how sick leave is calculated. After all, the well-being of the employee depends on the literacy of a specialist in this matter, on the one hand, and the reputation of the company on the other

How are payments made to an employee in case of redundancy?

Often, staff leave the company of their own free will or due to a number of violations committed by them in the course of their activities. However, sometimes situations arise when it is necessary to reduce staff in order to maintain the same productivity. It is unprofitable for the employer to draw up the above reason for dismissal in accordance with the articles of the Labor Code, since huge payments are due to the employee upon reduction

Receivables - accounting, repayment, write-off

Receivables may appear in the process of concluding transactions involving installment or sale of goods, provision of services on credit. The funds, which include the receivables of the enterprise, are withdrawn from the economic turnover of the organization, which, of course, cannot be attributed to the pluses of its financial activities

Comparison of the values of the balance sheet item of the ordinary and simplified forms

The material compares balance sheet items of a simplified form and a regular one. Explanations are given on what form it is better to take, in what forms to report to the owners

Authorized and share capital: definition, features and specifics of the calculation

The existence of any economic company at first is carried out at the expense of contributions from its founders. In JSCs and LLCs, these contributions form the authorized capital. The share capital is the authorized capital of partnerships. Read more about how it is formed, registered and taken into account, read on

99 account - "Profit and Loss". Debit and credit of account 99

Accounting accounts are designed to record all monetary transactions in them. In this review, 99 Profit and Loss account will be considered in detail. The reader will learn about what functions it performs, whether it can have its own categories, how to work with it and close it. The information is accompanied by examples that help to better understand the topic

Accounting 70 account. Transactions, credit and balance

70 account is designed to summarize all employee pay data. In this publication, the reader will learn a lot of interesting information about the account “Settlements with payroll employees”, its correspondence, balance, and examples will help to master the material

Business transaction: types, accounting, accounts

A business transaction is a separate action, as a result of which the volume, composition, use and placement of funds and their sources change. In economic terms, any fact has 2 addresses. Changes in one object provoke an adjustment in another by the same amount

Depreciable property: definition, requirements and features

Depreciable property is recognized as property, products of intellectual labor owned by an economic entity and used by it to generate income. At the same time, the period of useful operation of such objects should be at least 12 months. The initial cost of depreciable property must be more than 10 thousand rubles

Profit calculation: accounting and economic profit

The analysis of the economic activity of the enterprise is carried out using two approaches, which are conditionally called economic and accounting. The second is based on the analysis of costs that are included in the financial statements. For economic analysis, not only a set of real indicators of reports is used, but also opportunity costs, that is, a benefit that is recognized as lost

What is profit in Russia

Profit is a simple and intuitive term which, like other capital-raising instruments, is the difference between net income from product sales and cost of goods sold, together with operating costs

Return of goods from the buyer: some nuances

The accountant of every enterprise sooner or later faces such a phenomenon as the return of goods from the buyer. Some features of this operation are discussed in the article

Formation of accounting policy: basics and principles. Accounting policies for accounting purposes

Accounting policies (AP) are specific principles and procedures applied by the company's management for the preparation of financial statements. It differs in certain ways from accounting principles in that the latter are rules, and policies are the way a company adheres to those rules

Electricity metering: rules and features

Currently, electricity metering is one of the most important activities. Since energy resources are used too actively today, it is necessary to monitor their consumption

Tax liability: down payment

Tax payments are an integral part of our lives. There are many nuances in this area, for example, when drawing up a declaration, establishing a temporary payment procedure, and so on. Literacy in these matters will help to avoid many unpleasant situations, so it would be nice to consider what an advance payment means

Payment order: filling order, purpose

The payment order is mentioned in the Regulation of the Central Bank No. 383-P of 2012. This settlement document is created in a banking institution to make a partial transfer of funds

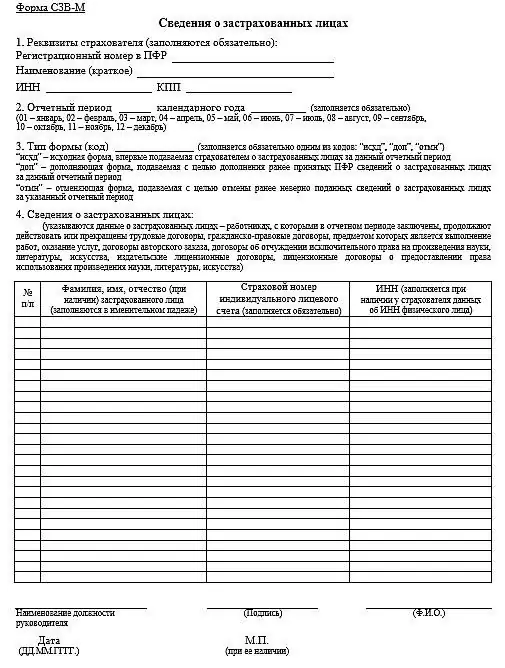

Report on the SZV-M form: how to fill out, who is obliged to hand over, a pen alty for late delivery

The article describes how to fill out the SZV-M, what information is entered into this document, and also when and in what form the report is submitted to the PF department. The main mistakes made by employers are given, as well as what fine is paid for the identified violations

What is an accounting entry? Definition, model accounts, compilation procedure

The definition of "accounting entries and accounts" often confuses people without accounting and economic education. Therefore, almost always individual entrepreneurs and founders of small companies hire an experienced accountant either for a permanent period or resort to his services from time to time. Novice accountants also often do not fully understand the essence and meaning of these simple terms. What is an accounting entry?

Chart of accounts of budgetary organizations: main sections, accounting features

Budget accounting in accounting is a system for registering and summarizing information about the state of assets and liabilities of the Russian Federation and its subjects, as well as municipalities. Also, the definition of budget accounting includes all operations that lead to a change in the assets and liabilities of the constituent entities of the Russian Federation and municipalities. The chart of accounts of budgetary entities is a list of accounts on which budgetary institutions perform operations

Signs of fixed assets: concept, types, classification

For any economic activity, means of production are needed to ensure its efficiency. These have specific features. These funds require a special attitude towards themselves, which is expressed in a special consideration of three points: their entry into the organization, internal movements, and disposal. In this article, we will consider the concept and characteristics of fixed assets, as well as analyze the classification of the category

Financial transactions are Definition of the term, types, essence of finance

Financial transactions are an integral element of business activity, necessary to ensure its stable operation. Each enterprise carries out various financial transactions, which is associated with its organizational and legal form and line of business. In the article we will consider the main types of financial transactions, we will study their features

Consolidated balance sheet: description and compilation procedure

Consolidated balance sheet is a type of financial statements, which is filled in by almost every company. With the help of this document, it becomes possible to summarize information about the property of the organization, track changes in dynamics. Based on the information received, current and strategic decisions are made in the course of enterprise management. What is a balance sheet, as well as the basic principles of its preparation will be discussed in the article

Cost centers: accounting, organization, grouping

One of the main tasks of any accounting in the enterprise is the calculation of the cost of one unit of manufactured products. The success of the company's activities directly depends on its formation, since costs affect the size of the selling price, and cost data are fundamental in managing current business processes and making managerial decisions

Objects and functions of management accounting

Doing business, carrying out production activities by a participant in commodity-money relations is a complex and multifaceted process that requires constant attention and control. The main functions of management accounting are designed to help the owner make informed decisions in a timely manner based on reliable and up-to-date information

Audit assessment of audit risk: types, methods, calculation

In today's world of business development and commercial enterprises, external audit services are becoming increasingly important. Auditing activity is an integral element of controlling the legality of business procedures carried out by a particular firm. Therefore, the audit, as the fundamental principle of an independent non-departmental audit by third-party auditors, is aimed at expressing a recommendation opinion on improving and optimizing the financial condition of the company

Types and methods of valuation of fixed assets

Within the framework of this article, the main types of valuation of fixed assets in a company will be considered. The methods of work in the accounting process are considered. The basics of assessing the effectiveness of the use of fixed assets are presented

What is labor rationing? Basic concepts, organization, types, methods of calculation and accounting

Thinking about what labor rationing is, many of us have associations of production, an uninterrupted workflow. This term is of great importance in economic planning. And although today you can often hear the opinion that the rationing of the work of workers is an echo of the Soviet system of production, most industrial enterprises are in no hurry to abandon the use of this tool

Legal framework for auditing: definition, rules and procedures for auditing

Performance results, financial performance of the enterprise are systematized and analyzed by independent audits. Analysis of financial statements by a third-party organization, and not by the owner of the business, allows you to objectively evaluate the effectiveness of economic activity, identify weaknesses and identify hidden reserves for increasing the financial well-being of the company

How to calculate the average per capita income of a family: calculation procedure, formula, recommendations

In order for a family to be recognized as poor, citizens must prove that the income per family member is less than the subsistence level. To do this, you need to figure out how to calculate the average per capita income of a family, where to apply for registration, and also what documents you need to prepare

Experience 40 years, what benefits are due: the legislative framework, the recalculation of pensions and expert advice

Sooner or later, a person faces the question of the size of the pension, as well as the benefits to which he may be en titled. To a large extent it depends on what experience will be gained. The article will discuss what you can count on for a work experience of 40 years, what benefits are provided and whether the pension will be recalculated

How the advance is calculated: calculation procedure, rules and features of registration, accrual and payment

The correctness and timeliness of payroll is a matter of interest not only to the accounting department, but also to the employee himself. There are different types of payments such as advance payment, vacation pay, compensation payments, and each of them has its own rules and approved benchmarks

Accounting is a system Definition, types, tasks and principles

Accounting is an ordered type of system designed to collect, record and summarize data in monetary terms through documentary, continuous and continuous accounting of all economic transactions. In this article, we will consider the essence, meaning and varieties of the category. In addition, we will touch on the principles and tasks of accounting

Financial standard - what is it?

Standards help bring different situations to a common denominator. How does it look in the financial sector? First of all, this approach relates to reporting. In this case, the financial standard helps to bring information about the position of the organization into a typified form

IFRS 10: concept, definition, international standards, single concept, rules and conditions for financial reporting

In the framework of this article, we will consider the main issues of applying the standard IFRS (IFRS) 10 “Consolidated Financial Statements”. We will study issues related to accounting and reporting of parent and subsidiaries, the concept of an investor in the framework of IFRS 10

How sick leave is paid: calculation procedure, rules and features of registration, payroll and payments

The form of the disability sheet is approved by order of the Ministry of He alth and Social Development. This paper confirms that the employee was absent for a good reason. On its basis, a person is paid temporary disability benefits. Attention is drawn to the fact that not all medical organizations can issue such leaflets

The objectives of the audit: purpose, stages of implementation

In the framework of this article, we will consider the basics of conducting an audit, its goals, stages, main types and objects. All materials are compiled taking into account the modern requirements of the legislation of the Russian Federation and take into account the current regulations and standards

List of primary accounting documents and rules for their execution

Many operations are performed daily at the enterprise. Accountants issue invoices to counterparties and send them money, calculate salaries, pen alties, calculate depreciation, prepare reports, etc. Dozens of documents of various kinds are issued daily: administrative, executive, primary. The last group is of great importance for the activities of the enterprise

Accounting for bank guarantees in accounting: features of reflection

In today's economic conditions, a bank guarantee remains one of the most popular services of financial institutions. It is used as a tool to insure the risks that may occur if the counterparty refuses to fulfill its obligations. In practice, there are often difficulties with the tax and accounting accounting of bank guarantees. In the article we will deal with the nuances of reflecting information

The main purpose of budgeting. The concept, essence of the process and tasks of budgeting

What is the main purpose of budgeting? Why is this process taking place? Why is it needed? What tasks are being performed? What is the essence of this process? How is the overall system structured? These, as well as a number of other questions, will be answered in the framework of the article

Payment of sick leave: calculation and terms of payment, size

The amount of payment directly depends on the length of service of a person and on average earnings. As part of the calculation of the average earnings, they take the amount of his labor income for the last two years, starting from the moment the employee's disability began. That is, any payments for which the employer accrued insurance premiums

Interim accounting reporting: features, requirements and forms

The Tax Code establishes the obligation of economic entities to form annual and interim financial statements. The purpose of the first document is clear - it contains information about the facts of the economic activity of the enterprise for the reporting period. These data are necessary to verify the correctness of the compilation of records, the reliability of the reflection of operations. As for the preparation of interim financial statements, not all experts understand its importance

Rules for filling out UPD: types of services, procedure for registration with samples, necessary forms and relevant examples

There are many questions about the rules for filling out the UPD (universal transfer document), because there are a limited number of samples with already entered data. The tax authorities are accustomed to returning the paper for correction without explaining what exactly is incorrectly drawn up and how to correct the error

Mutual settlements between organizations: drawing up an agreement, necessary documents, forms of forms and rules for filling out with examples

Settlement transactions (offsets and settlements) between business entities are quite common in business practice. The result of these operations is the termination of the mutual rights and obligations of participants in civil relations