2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

Let's talk about securities that have been waiting in the wings for more than 35 years. We are talking about bonds in 1982. Another name by which they are known is OGVVZ. Transcript - bonds of the state internal winning loan, the last of their kind, issued in the Soviet Union. Are they of value today? Or is it plain paper? Can they be exchanged for real money? Where can it be done? We will answer these and other questions in the article.

What is this?

A bond is one of the varieties of securities. In essence, it is a debt document. That is, it gives the right to its owner, holder to receive from the issuer (person, institution that issued the bond) the amount of money indicated in the paper. It can be equal to the amount of the debt, and include interest.

In most cases, bonds are issued to accumulate capital, which will later be directed toimplementation of a large scale project. The profit received as a result of the operation of the latter allows the issuer to repay the debt to the holders in the future.

Who issues bonds? The issuer can be either an organization, a legal entity, or the state. Depending on the type of loan, such securities are divided into the following:

- External.

- Domestic.

- Departmental.

About Soviet bonds

As for the debt securities of 1982, they were issued by the USSR to raise funds for the state treasury. Subsequently, payments on them were recognized as the state debt of the Soviet Union. It passed to the Russian Federation, which is considered the successor state.

Sberbank was considered the agent of the Ministry of Finance for payments on these bonds. He was responsible for selling and buying these securities, as well as for receiving compensation on them.

Why is there interest?

Why did the public's interest in securities issued decades ago increase? Popularity returned to them thanks to the actions of the Russian 74-year-old pensioner, a resident of the Ivanovo region Yu. Lobanov.

The man, like many citizens of the former Soviet Union, was the owner of 1982 bonds. However, he began to actively resolve the issue of obtaining the required funds for securities. Initially, the pensioner applied to various courts. But did not receive any satisfactory answer.

As a result, Yu. Lobanov decidedseek help from the European Court of Human Rights. The case was considered and, moreover, decided in favor of the pensioner. The 1982 bonds held by Yu. Lobanov were valued at about 1.5 million rubles. It was paid to a pensioner as financial compensation.

This case under discussion just became the reason for interest in long-forgotten bonds.

How many were produced?

The 1982 loan bonds (other name - "Brezhnev loan") were issued in huge numbers. By its volume, one could even say that it is supposedly the second currency of the state.

There is still no exact data on how many securities were sold. The reason for the inaccuracy is that the issue of government bonds in 1982 then increased to uncontrollable levels.

But one thing is clear: the Russian Federation, as the successor of the USSR, had to pay its citizens a huge debt on these securities.

Who were they issued to?

The 1982 winning bonds were printed for the sole ownership of citizens. An annual return of 3% was assumed. Three denominations of bonds were issued - 25, 50 and 100 rubles.

Purchasing them, the citizens did not expect to get a good profit. Not everyone can call such a loan of funds to the state voluntary. The Soviet Union at that moment only needed to receive a certain amount of money from the population.

As many expected, bond payments were delayed indefinitely. There was no precise information onabout how much a security is worth in the current period, by what amount its value will increase after a certain period of time. If citizens returned bonds, they received cash for them in the amount of less than face value.

That's why people weren't in a hurry to get their 1982 home loan payments. Why did many of these papers "wait" for the collapse of the Soviet Union.

After the USSR collapsed

After the collapse of the USSR, the holders of the 1982 winning loan bonds found themselves in an uncertain position. The state, which was supposed to return their money on securities, ceased to exist.

But in 1992, the Russian Federation offered citizens to sell their 1982 bonds. Few took advantage of this offer: the price was symbolic (translated into new money) even in comparison with the face value. Not to mention that every year, according to the terms of the loan, interest should have been accrued on this amount.

For example, a 100-ruble (in Soviet money) bond was bought at a price of 160 rubles in new Russian money. Therefore, most paper holders did not take advantage of this offer.

Exchange for Russian bonds

Let's take a closer look at the situation in 1992. Then the exchange of Soviet bonds of 1982 for similar securities of a Russian loan started. Thus, from October 1, 1992, the holders of these bonds had two options:

- Get small but cash for your Soviet bonds. As we alreadymentioned, a 100-ruble bond in 1982 was valued at 160 Russian rubles.

- Exchange Soviet bonds for similar 1992 Russian loan securities.

All the necessary operations were then carried out in the branches of Sberbank. The same banking organization, together with the media, informed the population about the progress of the process.

Repurchase of 1982 Soviet Union debt securities completely ceased on December 31, 1994. But by that time, not all citizens had decided what to do with their bonds. Many of them were left lying at home.

1995 Legislature

The 1982 Winning Home Loan Bonds came up again in 1995. The reason for this is a legislative act signed by the president. It was devoted to the obligation of material compensation for all savings to former citizens of the Soviet Union. There was a clarification in the act: not only bank deposits were compensated, but also lost income on securities.

According to this law, domestic government bonds of 1982 were converted into "debt rubles". State experts estimated their value according to the new Russian currency, made calculations so that the price of the bond would not "burn out" after inflation.

Payments on securities in 1982 were carried out by the state. But again, not all citizens decided to take advantage of the new proposals. It was about the amount of monetary compensation:

- Max payout perbonds for ordinary depositors - 10 thousand rubles.

- The maximum payout on bonds for veterans of the Great Patriotic War is 50 thousand rubles.

After denomination

The situation with the Russian loan bonds of 1992 was complicated by the fact that on January 1, 1998, the ruble was denominated. Accordingly, the face value of these securities was recalculated in accordance with the current price dynamics for that time.

As a result, the following ratio became relevant:

- Denomination 500 rubles - 50 kopecks.

- Denomination 1000 rubles - 1 ruble.

- Denomination 10 0000 rubles - 10 rubles.

The Ministry of Finance determined that under these conditions the bonds were redeemed from the population before 10/1/2004. Then this period was extended - until December 25, 2005. This was determined by Federal Law No. 173 (2004).

The last samples of the 1992 Russian loan bonds were redeemed by the state in December 2005. To date, the redemption of these securities of the Russian Federation has been terminated.

How are things this year?

USSR bonds of 1982 are still kept by former citizens of the Soviet Union. But do they have any value to their owners today?

Today it is no longer possible to receive payments on bonds from the state structure. The state does not deal with this issue.

The only way out for bondholders is to turn to private companies specializing inbuying and selling various securities. However, Soviet bonds are not listed on the modern stock market. It is possible to find a buyer who will purchase them only at a symbolic price, which is even lower than the original (25, 50, 100 rubles) in Soviet money. As practice shows, a citizen today will not receive more than 500 modern Russian rubles for his bonds of 1982.

In the network you can find information about the corporation ASB (Insurance Deposit Agency). In particular, there is such data:

- Buying 100 ruble bonds for 49 thousand modern Russian rubles.

- Buying 50 ruble bonds for 25 thousand modern Russian rubles.

However, this information is not official and verified. Most of all, it looks like an ordinary newspaper "duck".

The owners of Soviet bonds have one more way out - to leave their securities in the "waiting mode" until the time when real redemption is offered for them. There are two reasons for this decision:

- The redemption of these government bonds has no statute of limitations. That is, in fact, they will not turn into ordinary pieces of paper even after 100 years.

- FZ 162 assumes that these Soviet bonds may in the future be transferred to a group of targeted debt obligations of the Russian Federation.

At the moment, it is impossible to receive real payments. Only symbolic. Therefore, it makes sense to sell such a bond for a fee to a collector.

Fatecitizens' savings

A special commission of the Ministry of Finance gathered about the pre-reform savings of former Soviet and now Russian citizens. Discussions established the following:

- The internal state debt of the USSR will not turn into any securities in the future. Otherwise, its payment threatens with serious consequences for the domestic state budget.

- Compensations for pre-reform savings of citizens will be paid until December 25, 2020. This applies to Soviet deposits in Sberbank, transfers to Rosgosstrakh, certificates of the same Sberbank, treasury bills of the RSFSR and the USSR.

- The 1982 bonds have been determined to be fully discharged. This issue is closed by the state.

Summarizing all of the above, today it is unrealistic to get real money for your 1982 bonds. Theoretically, there is hope that this will become possible in the future, because these securities are perpetual. The population had a chance to exchange these bonds for cash in 1992-1994. At the same time, it was possible to make an exchange for Russian loan bonds of 1992, payments on which were made until the end of 2005.

Recommended:

Will they give a car loan with a bad credit history: conditions for obtaining, procedure, necessary documents, tips and reviews

Purchasing a car with borrowed funds, customers prefer to issue a targeted loan in banks. This allows you to lower the interest rate, which ultimately reduces overpayments and allows you to quickly pay off the debt. Since most of it will be used to repay the principal amount, and not to pay accrued interest. Among the potential customers there are those who are wondering if they will give a car loan with a bad credit history

What is the difference between the cadastral value and the inventory value? Determination of the cadastral value

Recently real estate has been valued in a new way. The cadastral value was introduced, providing for other principles for calculating the value of objects and as close as possible to the market price. At the same time, the innovation led to an increase in the tax burden. The article describes how the cadastral value differs from the inventory value and how it is calculated

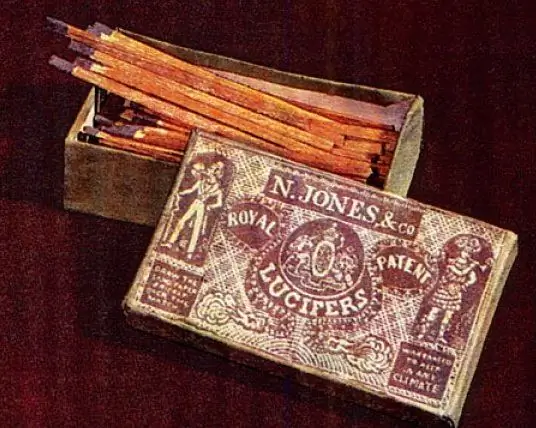

How were matches made before and how are they made today? Swedish matches

The article is devoted to the history of the creation of matches - from their very first prototypes to modern ones. It also tells about the famous Swedish matches, the evolution of the chemical components of the match head and stickers for the box

What were Stalin's skyscrapers called? Why were Stalin's skyscrapers given such a name?

Skyscrapers were able to build in the USSR. Vivid proof of this is Stalin's skyscrapers. Why did the great leader build these buildings? What were Stalin's skyscrapers called before, and what is their fate today?

Currency of Tanzania: nominal and actual value, possible purchases, history of creation, banknote design author, description and photo

The article tells about the national currency of the African state of Tanzania. Contains information about the history of the currency, its rate in relation to other banknotes, real value, as well as a description and interesting facts about it