Banks

The most profitable bank for a loan: which one to choose? Tips for borrowers

Last modified: 2025-01-24 13:01

When applying for a consumer loan, the bank plays a key role. The lender is responsible for the terms of the loan, including the interest rate. Not wanting to overpay, borrowers are looking for the most profitable bank for a loan. Depending on the type of loan, the leaders of the lending market differ

Rating of bank cards: an overview of cards with the best conditions

Last modified: 2025-01-24 13:01

To choose the best banking product, it is recommended to pay attention to the ratings of bank cards. They allow you to evaluate the benefits of credit cards and debit cards. This will speed up the selection process and allow the client to gain confidence in their decision

OTP credit card: reviews, terms of use, is it worth opening

Last modified: 2025-01-24 13:01

OTP is famous for its profitable loans, the terms of which are known to many customers. But not everyone knows the features of credit cards. In 2019, the bank offers 3 products with a credit limit. But is it worth it to issue an OTP credit card?

How to get a bank guarantee to secure a contract: procedure, conditions, documents

Last modified: 2025-01-24 13:01

The article describes how to obtain a bank guarantee to secure a contract. The main varieties of this guarantee are listed, as well as the requirements that contractors must meet. It tells about the principle of operation of this banking offer

Bank "Rocketbank": reviews. Divorce or not?

Last modified: 2025-01-24 13:01

Choosing a bank is a responsible matter. And now they often advertise "Rocketbank". What it is? Does this bank really exist? Is it worth it to apply?

Sberbank: how to call an operator - instructions and tips

Last modified: 2025-01-24 13:01

Sberbank is a large financial institution in Russia. Many customers require expert service advice. To do this, you can not only contact the Sberbank branch directly, but also call the call center. This article will talk about communication with Sberbank operators

How to make money on deposits? Bank deposit with monthly interest payments. The most profitable deposits

Last modified: 2025-01-24 13:01

In the modern world, in conditions of absolute lack of time, people are trying to secure some additional, passive income. Almost everyone is now a client of banks or other financial institutions. In this regard, many quite legitimate questions arise. How to make money on bank deposits? Which investments are profitable and which are not? How risky is this event?

Installing a payment terminal: a package of documents. Features of Sberbank

Last modified: 2025-01-24 13:01

How and why is the payment terminal installed? They are almost always found in malls and stores. What should be considered during installation? What package of documents is needed and who to contact? Is there a choice of terminal models?

Bank accounts: current and current account. What is the difference between a checking account and a current account

Last modified: 2025-01-24 13:01

There are different types of accounts. Some are designed for companies and are not suitable for personal use. Others, on the contrary, are suitable only for shopping. With some knowledge, the type of account can be easily determined by its number. This article will discuss this and other properties of bank accounts

Bank card with cashback and interest on the balance: an overview of the best offers

Last modified: 2025-01-24 13:01

Today, bank cards are very popular. They can be credit or debit. Each of them offers its own possibilities. A bank card with a cashback has its own advantages. Offered by various banks

Message from Sberbank: "Authorization cancelled". What is it, in what cases does the error occur?

Last modified: 2025-01-24 13:01

When working with Sberbank cards, customers sometimes encounter a problem when their operation is not completed. In this case, after payment, an SMS from 900 comes with the message: "Authorization cancellation". Sberbank thus warns the owner about the presence of a failure in the system. What is the reason for the error and how to solve the problem?

How long is a credit card? What to do when it ends

Last modified: 2025-01-24 13:01

Credit cards are issued for a fixed period. After the expiration of the validity period, they must be replaced. The owner must know the expiration date of the credit card in order to avoid a delay. Request a replacement card before the expiration date. Otherwise, the client runs the risk of missing the planned payment, since he will not be able to deposit money to a blocked card in the terminal or through the Internet bank

Money has disappeared from the Sberbank card: what to do, how to get it back? Types of fraud with bank cards

Last modified: 2025-01-24 13:01

Sberbank takes care of the protection of bank cards. But it cannot 100% protect customers from the activities of scammers. Employees of the bank and government agencies regularly encounter requests from customers who have lost money from a Sberbank card. In order not to become a victim of scammers, you need to know the tricks of modern scammers

How to withdraw money from a Sberbank account: methods, limits, commission

Last modified: 2025-01-24 13:01

Sberbank enables citizens to accumulate cash on deposits, accounts and cards. If the owner of an account with Sberbank decided to withdraw funds, he can do this in several ways. But in the process of an expense transaction, difficulties may arise: commission, refusal to conduct an operation, submission of additional documents. To get cash on time, you should know the nuances of how to withdraw money from an account with Sberbank

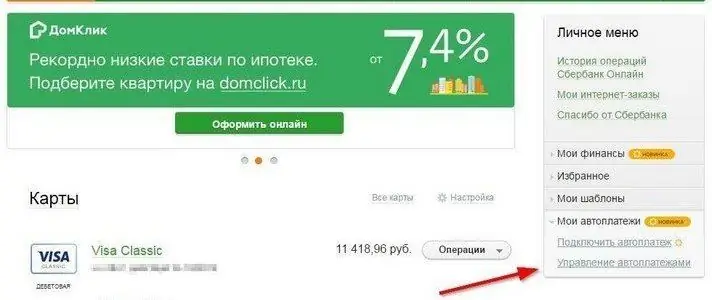

How to remove auto payment from a Sberbank card: step by step instructions

Last modified: 2025-01-24 13:01

Sberbank has a wide variety of services that make life much easier. Some of them are provided free of charge, while others require payment. The "Auto Pay" option can be very useful, but it needs to be turned off from time to time. But how to do that? Look for the answer in this article

How to get bank details at a Sberbank ATM: procedure, processing of a request and terms of consideration

Last modified: 2025-01-24 13:01

To get the details of a bank card, it is not necessary to take your passport with you and look for the nearest branch: Sberbank has the opportunity to find out the data at any ATM. Self-service devices operate around the clock and are located not only near offices, but also in popular places: shopping centers, bus stops, clinics. If the client does not know how to take the details at a Sberbank ATM, he should take the card with him and read the advice of experienced users

How old do you get a credit card? What documents are needed to apply for a credit card

Last modified: 2025-01-24 13:01

Credit card processing is popular with banks as customers appreciate the convenience of the product. But not everyone has access to a means of payment with a grace period, because the bank imposes certain requirements on the borrower. Not all customers know how many years they give a credit card and what certificates are needed to obtain it. Terms and rates for credit cards in banks are different, but there are common points

"Binbank" - license revocation. "Binbank" - rating by assets

Last modified: 2025-01-24 13:01

The problems of Binbank began in the spring of 2017. The bank asked the state regulator for reorganization, as it was unable to continue its financial activities in the territory of the Russian Federation. In the media, information about the unstable position of the creditor "leaked" in August 2017. Since then, there have been rumors about a possible revocation of the license of Binbank. What happened to the famous brand, and what are the forecasts of financial specialists regarding it now?

Money transfers "Zolotaya Korona": reviews, features, conditions and tariffs

Last modified: 2025-01-24 13:01

Transferring money between cards and accounts does not cause any problems, but what if a person does not have a card or it is lost / blocked, and he urgently needs money? The way out can be transfers that do not require an account and link to a specific place. Money transfers "Zolotaya Korona" are ready to offer their customers a quick transfer of finances to the addressee with a minimum commission and the ability to receive cash at any of the points of the specified city

Sberbank cards: replacing them in different situations

Last modified: 2025-01-24 13:01

Payment plastic is issued for a certain period, after which it becomes necessary to replace the card. In case of unplanned cases: loss, damage, blocking, change of surname and other situations, the Sberbank card is also reissued. Replacement is carried out in one of the branches of the bank. What needs to be done for this procedure, we will consider in the article

Bank "Russia": customer reviews, services, deposits and maintenance

Last modified: 2025-01-24 13:01

This bank has a developed network of offices and branches. In total, their number today is about sixty. The main clients of the presented financial organization are corporations and various enterprises. The list of bank services for corporate clients is very wide. Individuals can select financial products from a standard list

How to withdraw a large amount from a Sberbank card? Tips, Features

Last modified: 2025-01-24 13:01

Sberbank cards are used by almost every Russian over 18 years old. The most demanded operation is cash withdrawal in bank terminals. Credit card holders can receive the required amount only within the limit on the card. But sometimes customers need more money than the conditions for issuing cash. In order not to pay a commission to the bank, you should use one of the tricks on how to withdraw a large amount from a Sberbank card

When and why does Sberbank not work? Reasons, features

Last modified: 2025-01-24 13:01

Sberbank services are used by 70 million Russians, not counting clients abroad. The bank is distinguished by its reliability and stability. But even in his work there are occasional failures. What should clients do if Sberbank does not work and how to understand the causes of problems?

How to find out bank details: the easiest and fastest ways, tips

Last modified: 2025-01-24 13:01

Using a bank card is convenient: for payment in stores, it is enough to present only a plastic carrier. But if the client expects to receive a transfer by card account number, he should be aware of how to find out the bank details. There are several simple ways to get information about the bank details on the card and other deposits

Rocketbank: reviews of employees and customers

Last modified: 2025-01-24 13:01

Mobile Internet is among the most dynamically growing segments of the Russian economy. More and more Russians are starting to use the corresponding online services, are actively purchasing gadgets, installing applications for them. Against the backdrop of this trend, entrepreneurs create various startups

"Tinkoff Bank": job reviews, conditions and average salary

Last modified: 2025-01-24 13:01

"Tinkoff Bank" differs from other creditors by the absence of branches. The first online bank in Russia attracts young and ambitious employees who are willing to try their hand at the banking business. Feedback on work in Tinkoff Bank will allow you to consider the attractiveness of the employer for potential employees of the company

Acquiring "Alfa Bank": tariffs and conditions

Last modified: 2025-01-24 13:01

Alfa-Bank was one of the first in Russia to offer acquiring services to its customers. This is a modern service that provides an opportunity to make convenient and fast payments using a variety of plastic bank cards. Thanks to special systems, such transactions are carried out with maximum comfort and security for each client

How to top up a card without a card: the most profitable money transfer options

Last modified: 2025-06-01 07:06

Credit and debit cards are a universal way to make payments. With the help of cards, you can purchase services and goods, make payments in favor of other persons, withdraw money, use your money abroad. The plastic products of Sberbank are the most popular among the population. In the article, we will consider how to replenish a card without a card

How to check an account on a Sberbank card: options, instructions

Last modified: 2025-01-24 13:01

Mobile banking service is a set of specific services that a financial institution provides using mobile devices. By using short commands, you can request almost any data on the card for a small fee or completely free of charge (it all depends on banking conditions). In response to such commands, SMS with the necessary information is received

Where is the security code on the map and what does it mean

Last modified: 2025-01-24 13:01

In the article, we will consider where the security code is located on a plastic card. Shopping along with ordering services on the Internet has long been a part of modern life. And here you can not do without plastic cards, and already familiar to everyone, Visa, and, in addition, Mastercard. The main thing to know about when planning purchases is how to use them correctly. You need to be aware of where the special security code is located

Bonuses "Thank you from Sberbank": where you can pay, features and conditions

Last modified: 2025-01-24 13:01

"Thank you from Sberbank" acts as a bonus program, in which for each purchase that is paid for by a card, points called "Thank you" are credited to bonus customer accounts. In the first three months, their value, as a rule, is one and a half percent of the purchase price, and in the next 0.5%. When paying for goods from partners, the accrued points can reach up to 20% of the money spent

Virtual card "Russian Standard": terms of registration and use

Last modified: 2025-01-24 13:01

The main purpose of the virtual product is to ensure the safety of the client from the actions of fraudsters when making purchases on the Internet. By entering the main card details, a person risks becoming a victim of unscrupulous sellers, skimming or phishing, as a result of which attackers have access to the main card data and the ability to make payments on third-party sites or transfer funds

"Auto payment" from "Tinkoff": how to disable? The main ways to disable the service from the card and cancel auto payment

Last modified: 2025-01-24 13:01

For many years, Tinkoff Bank has been a leader in the financial and credit market. High popularity is explained by simple design and loyal requirements for potential customers. The system allows you to forget about the monthly payment of loans and utilities. However, if the details of the service user have changed or payments have ended, you need to know how to disable "Auto payment" in Tinkoff Bank in order to save money on the card

Brokerage services of Sberbank of Russia. Reviews

Last modified: 2025-01-24 13:01

By entrusting a small amount of money to a reliable intermediary, you can count on making a profit. This reality was embodied by Sberbank of Russia for people who do not have experience and special knowledge in the field of investment activity

What are the conditions for the "Pension-plus" deposit of Sberbank of Russia?

Last modified: 2025-01-24 13:01

The "Pension-plus" deposit is a convenient tool that allows citizens to receive passive income. In the article, we will consider the main points that are related to the conditions and maintenance of this deposit program

How to activate the Belarusbank Internet banking code card: methods and instructions

Last modified: 2025-01-24 13:01

"Belarusbank" provides its customers with a wide range of services. One of these services is online financial management through the Internet banking system. Each client of the bank can connect the system and use it from anywhere in the world. Set up takes a few minutes

Individual investment account with Sberbank

Last modified: 2025-01-24 13:01

Bank investments are one of the most effective and reliable ways to earn and keep your savings. Most of the bank's clients, having decided to invest money, consider only the option of opening a deposit account. And they ignore more interesting and profitable instruments for financing. For example, investment accounts

Power of attorney for a bank from a legal entity: sample, features of filling, necessary forms and documents

Last modified: 2025-01-24 13:01

Drawing up a power of attorney for both individuals and legal entities has some nuances. Even turning to a specialist for help, you need to know how the procedure goes, what documents you need to have with you, how long it will take to process, etc. In this article, we will talk about how a power of attorney is drawn up for a bank from a legal entity

International transfers. How to transfer money through Western Union

Last modified: 2025-01-24 13:01

The Western Union international money transfer system is one of the most popular in the world. With its help, you can quickly and safely send money to anywhere in the world, and be sure that the addressee will definitely receive it. We will talk about how to make such a transfer in this article

MasterCard Mass, Sberbank: description, conditions, service rates

Last modified: 2025-01-24 13:01

What is this MasterCard Mass? What cards of this payment system are issued by the largest commercial bank in the country, Sberbank? How much does the annual card maintenance cost? We consider all this in order below

Swiss bank in Moscow

Last modified: 2025-01-24 13:01

Many believe that a Swiss bank may be of interest only to millionaires, officials or criminals who need to hide their illegally obtained we alth. Or famous and public figures who do not want to advertise their income for one reason or another. But in fact, every adult can open an account in one of the banks in Switzerland

Are there Sberbank ATMs in Evpatoria?

Last modified: 2025-01-24 13:01

Often, when someone travels to another city on a business trip, on vacation, or for some other reason, the first question that comes up is: is there an ATM there? And this is not surprising, because now the card system is everywhere. People do not carry cash in their wallets, but use cards. This article discusses whether there are ATMs of Sberbank of Russia in Evpatoria

International Bank for Economic Cooperation: structure, tasks, functions, role of the organization in the world

Last modified: 2025-01-24 13:01

International financial organizations are created on the basis of multilateral international agreements and are designed to promote the development of the economies of the participating countries, simplify financial settlements between them, and maintain a stable state of national currencies. Among the most significant international institutions are the Bank for Reconstruction and Development, the World Bank, the Bank for International Settlements and the International Bank for Economic Cooperation (IBEC), which will be discussed in the article

Bank account: the concept and principles of number assignment

Last modified: 2025-06-01 07:06

Despite the fact that a huge number of bank accounts are opened in Russia today, and almost every person owns one, or even several, the population has practically no knowledge of what it is and what they are. And the bank account number is just an incomprehensible set of numbers for many

The concept of "banking days": what is it?

Last modified: 2025-01-24 13:01

In many financial documents, such a concept as banking days is quite common. Based on their number, pen alties may be charged for late performance of obligations. This or that number of banking days is given for the execution of any transactions, the transfer of funds, etc. In the legislation, this concept is also often used, so it is worth understanding it in more detail

Debit cards with cashback: overview, comparison, benefits

Last modified: 2025-01-24 13:01

Today there is a huge variety of online stores, as well as other resources that allow us to make purchases. If in the usual stores we are used to using discount cards or similar systems that give us a certain discount on a particular product, then on the Internet it is even easier, like at gas stations, etc

Banking and its regulation

Last modified: 2025-01-24 13:01

The banking sector has a complex structure and is regulated by the state. The legislation provides for a number of requirements for obtaining a banking license. The Central Bank conducts regular supervision over the transparency of activities and the financial position of banks

Bank guarantee: types, terms, conditions and features

Last modified: 2025-01-24 13:01

Bank guarantee is one of the most effective ways to ensure the security of the transaction. A fee is charged for this service. What are the terms of the bank guarantee? What documents are needed for this. How much does such a service cost. Calculation example

Pledged property of Alfa-Bank: features, implementation and requirements

Last modified: 2025-01-24 13:01

Sooner or later everyone has to take bank loans for large amounts. In order to confirm your solvency, you need to either make a significant down payment or bring reliable guarantors. If this is not possible, then there is only one option left - to take a loan secured by existing real estate. If the payer repays the loan on time or ahead of schedule, then the burden on the apartment or car is removed

Credit card "Binbank": customer reviews

Last modified: 2025-01-24 13:01

The broad line of products today offers customers sufficient service for comfortable cashless payments along with many additional bonuses and options. In order to evaluate the advantages endowed with Binbank plastic, it is necessary to choose the optimally suitable type of lending

Bank "Tinkoff" - refinancing loans from other banks: features, conditions and reviews

Last modified: 2025-01-24 13:01

This is a very profitable service. According to the basic conditions, a person without any problems (subject to certain requirements) can pay off the debts of other banks in Tinkoff. Refinancing a loan in this bank is just beginning to gain well-deserved popularity. At the same time, the conditions offered are very acceptable (it is Tinkoff that is considered one of the most loyal financial institutions in relation to its customers)

"NS Bank": customer reviews, services, features and interest rates

Last modified: 2025-01-24 13:01

Commercial banking organization "NS Bank" was founded in 1994, and has a general license from the Bank of Russia. This financial institution is a member of the mandatory deposit insurance systems, is included in the Register of banks and other credit organizations that have the right to issue bank guarantees for payment of customs duties

Beeline card: user reviews, conditions, pros and cons

Last modified: 2025-01-24 13:01

Not many people know that in communication stores you can get not only SIM cards or buy phones, but also a payment card. This project has been implemented for several years jointly with RNCO "Payment Center". We will tell you about the conditions, as well as about the tariffs, find out all the nuances with the features of the card, its advantages and disadvantages. Among other things, we will figure out whether it is worth making out Beeline plastic. Reviews about the card will be presented at the end of the article

Bank "Active Bank": customer reviews, loans and deposits

Last modified: 2025-01-24 13:01

Finding a good bank is not easy. An expert financial institution is able to increase money with the help of a deposit and issue a loan on favorable terms. One of the leading banks in Saransk "Active Bank" has been serving clients since 1990 and at the moment has practically no competitors in its field, annually taking the highest places and becoming the winner of industry awards

How to get Sberbank card details at an ATM: step by step instructions, tips and tricks

Last modified: 2025-01-24 13:01

Wishing to transfer wages to a Sberbank card, customers often ask themselves what is required for this? In order for an employer or an individual to transfer funds to a plastic card, you must provide its details. You can recognize them by your passport at the bank office, but for this you will have to stand in line. It is much faster to look at the information in one of the thousands of terminals of the company. To do this, you need to have an idea of u200bu200bhow to get the details of a Sberbank card at an ATM

Recovery of a credit history in a bank: all the ways

Last modified: 2025-01-24 13:01

If the borrower's credit history is not perfect, there is a high probability that the lender will refuse to issue a loan. But in any situation, do not despair, you can try to go the way of restoring your credit history. There are several ways to do it legally and on your own

Sberbank bonuses: partners, program description, conditions, features, tips

Last modified: 2025-01-24 13:01

In the context of the struggle in the banking services market, every financial institution is trying to attract customers with loy alty programs. One of the most popular is the return of cashback for purchases from the card. Sberbank was among the first organizations to introduce such bonuses. Sberbank partners charge them for each purchase and purchased service in their network

Bank "Soyuz": customer reviews, maintenance, services and interest rates

Last modified: 2025-01-24 13:01

This financial institution was founded in 1993, at that time the organization was established in the form of a joint-stock commercial bank "Alina Moscow". However, in 1999, the bank was acquired by one of the largest insurance companies in the country, Ingosstrakh, in connection with which the organization was renamed Ingosstrakh-Soyuz, a commercial joint-stock bank

How does an individual entrepreneur withdraw money from a current account? Methods for withdrawing cash from the current account of an individual entrepreneur

Last modified: 2025-01-24 13:01

Before you register yourself as an individual entrepreneur, you should take into account that withdrawing funds from the current account of an individual entrepreneur is not quite easy, especially at first. There are a number of restrictions, according to which merchants do not have the right to withdraw funds at any time convenient for them and in any amount. How does an individual entrepreneur withdraw money from a current account?

How to return a card forgotten at a Sberbank ATM? Sberbank: support service

Last modified: 2025-01-24 13:01

Using ATMs is easy and convenient, but not always safe for cards. Sometimes devices fail and can "swallow" a credit card. At least once in a lifetime, every credit card owner wondered how to return a card forgotten at a Sberbank ATM. There are several ways and tips for this. So, how to avoid losing the card in the future?

Banks with revoked licenses: list, reasons for the ban on banking operations, bankruptcy and liquidation

Last modified: 2025-01-24 13:01

If a bank fails to meet its financial obligations to depositors, it may face revocation of its license. Every year about 80 commercial banks go bankrupt. The consequences for clients who placed a deposit in such an institution or took out a loan are negative. But depositors do not always have an idea of how things are going with the bank to which they have entrusted their savings. The list of banks with revoked licenses allows you to find out who went bankrupt and what to do with loans and deposits

How to find out the expiration date of the card: several methods

Last modified: 2025-01-24 13:01

As an example, we consider how to find out the validity period of a Sberbank card: visually inspect. On the front side, just below the card number and above the owner's name and surname, there are four digits separated by a /. Example: 02/21. The first two digits are the last month of use, the second two are up to what year. The indicated figures indicate that this plastic can be used until February 2021, and more specifically, until the 28th (29th in a leap year) February 23:59:5

Transfers through Sberbank: features of the procedure

Last modified: 2025-01-24 13:01

Money transfer services are currently in high demand, so many financial institutions provide them. Among them is Sberbank, which allows you to send money not only within the country, but also abroad. The bank offers its customers several tariffs, among which you can choose the most suitable one

Rebranding of Sberbank: essence, directions, costs

Last modified: 2025-01-24 13:01

Transformation of a well-known brand is a fairly common phenomenon in the banking industry. This is due to the fact that companies are trying to meet the preferences of modern consumers. This applies, as a rule, not only to the quality of services, but also to design. The most notable event in the financial market, as a rule, is the rebranding of Sberbank

How valid is the 2-personal income tax certificate for a loan: validity period, procedure for obtaining

Last modified: 2025-01-24 13:01

How valid is the 2-personal income tax certificate for a loan, why else do people need it, and also, how can citizens get it? Such questions often arise from people. In short, this document is provided upon request to various organizations, it discloses information about the income of an individual

Bank worker: disadvantages and advantages of the profession. bank job

Last modified: 2025-01-24 13:01

A bank employee is a fairly broad concept, which includes economists with different levels of knowledge and skills, ranging from simple cashiers to managers. But any such employee must have a special education in the field of economics. The more qualified a bank employee is, the more opportunities he gets when moving up the career ladder

The average market value of the total cost of a consumer loan of the Central Bank: where to find out how to calculate

Last modified: 2025-01-24 13:01

What is the average market value of the total cost of consumer credit of the Central Bank. What laws regulate who should adhere to its size. What does this measure, introduced by the Central Bank of Russia, mean for the borrower

A few simple rules that a bank client must follow in order to use only the right products

Last modified: 2025-01-24 13:01

Now almost every capable person uses the services of at least some bank. Many pay loans and use cards, others receive pensions and benefits on their accounts, someone has savings on a deposit. But even those who do not have any of the listed products pay utility and other payments, actually using financial services. Each client of the bank wants to be served quickly and efficiently, and they take money for it at a minimum. But it doesn't always work out that way

Salary card – bank doors open for employees and employers

Last modified: 2025-01-24 13:01

The times when employees of enterprises and organizations stood in line at the coveted window to receive their salaries are long gone in most companies. Today, the place of cash has been taken by a salary card - a tool that is convenient for both the employer and employees

Best debit cards: market overview and reviews

Last modified: 2025-01-24 13:01

More and more people prefer to store money electronically. For this, a plastic card is used. Varieties of such banking products are offered by all banking institutions. What is a debit card and what are its features? We will consider this topic further

Sberbank, card replacement: reasons, methods. How to renew a Sberbank card

Last modified: 2025-01-24 13:01

This article will tell you how to change and renew a Sberbank card, as well as under what circumstances it is necessary to refer to the process of reissuing plastic. With proper preparation, there will be no problems with the process

The four largest banks in America

Last modified: 2025-01-24 13:01

The article tells about the history of the creation and development of the four largest banks in America: Bank of America, JPMorgan Chase, Citigtoup and Wells Fargo. Brief background information is given on the volume of assets, the number of branches, customers and ATMs around the world. It also describes the activities of financial corporations

NPF Sberbank: reviews. NPF of Sberbank: profitability

Last modified: 2025-01-24 13:01

How does the activity of the NPF of Sberbank correlate with the positions of the parent organization, which is the leader of the credit and financial market in Russia? How profitable can cooperation with this non-state pension fund be?

Sberbank: details for transferring to the card. Sberbank details for transfer to the card

Last modified: 2025-01-24 13:01

Most of the owners of bank cards from Sberbank and other banking institutions do not even suspect that their plastic card, which they use daily, has its own bank account

IBAN - what is it? International bank account number

Last modified: 2025-01-24 13:01

In today's society, international transfers have become very popular. And it is no secret that it is more convenient to carry them out from a bank account. When you need to receive a transfer from the countries of the European Union and the European Economic Area, as well as some other countries, the sender will ask you for an IBAN code. What is it and why is it needed?

How to find out the account number of a Sberbank card: basic approaches

Last modified: 2025-01-24 13:01

Having received a Sberbank plastic card, many of us mistakenly think that the beautiful numbers stamped on it are the account number where the money is flowing. But it's not. The money is not on the card, but on the bank account, the number of which is assigned to each plastic card. Simultaneously with the issuance of the card, bank employees open an account for the client, to which funds will be received in the future - in the form of scholarships, pensions, wages or transfers

IBAN - what is it? What does the bank's IBAN number mean?

Last modified: 2025-01-24 13:01

If at least once in your life you have had to transfer funds to European countries, then the concept of “IBAN code” is familiar to you. The sender needs to name it to complete the transfer. To find out the IBAN number, it is enough to come to any banking institution and open a current account. Employees of some financial institutions may recommend a SWIFT code to the sender, which can also be used to receive a transfer

Deposit is Deposits in banks. Interest on deposits

Last modified: 2025-01-24 13:01

Bank deposit is one of the investment instruments that is considered the most accessible and safe even for people who do not know all the intricacies of financial management and banking

Clearing is The concept, types and functions of clearing

Last modified: 2025-01-24 13:01

In financial and banking activities, there are a lot of terms, the essence of which is difficult to understand by name. One of them is clearing. In simple words, the exchange procedure. Companies, banks, countries can exchange goods, services, securities. A clearing company is an intermediary that brings together sellers and buyers

PayLate payment system: reviews, features and interest

Last modified: 2025-01-24 13:01

Today, many goods and services can be purchased without leaving home. To do this, it is enough to have a bank card and access to the Internet at hand. If there is no money available, you can apply for a loan even in a payment system, even in a microfinance organization. If you do not want to apply for a loan, you can buy goods in installments online. The PayLate service has been developed specifically for this purpose. User reviews about this system, as well as the scheme of its functioning, we will consider further

Credit note what is it? Definition

Last modified: 2025-01-24 13:01

In the financial industry, there are many terms for transactions. One of them is a credit note. This tool is used in transactions between suppliers and buyers in international trade. Organizations that are building a business not only in Russia, but also abroad should understand what a credit note is

Break-even overclocking of the deposit

Last modified: 2025-01-24 13:01

Many traders, especially beginners, often do not have enough funds to properly invest. The main principle of risk management is that no more than 2% of the deposit should be invested in one transaction during intraday trading

How to check an account with Sberbank: hotline, Internet, SMS and other ways to check an account and bonuses

Last modified: 2025-01-24 13:01

Cash is slowly but surely becoming a thing of the past, becoming part of history. Today, payments in almost all spheres of life are made using bank cards. The benefits of such changes are clear. One of the most important is a convenient service that allows you to receive information about the status of your account at any time. Let's consider this possibility in more detail on the example of the largest participant in the Russian banking system. So, how to check an account with Sberbank?

History of money. Money: history of origin

Last modified: 2025-01-24 13:01

Money is the universal equivalent of the value of goods and services, which is part of the financial system of each country. Before adopting a modern look, they went through a centuries-old evolution. In this review, you will learn about the history of the first money, what stages it went through and how it changed over time

The history of the bank. Bank: how was it created?

Last modified: 2025-01-24 13:01

Banks give the population undeniable advantages. They accumulate financial resources, carry out various payment transactions, issue loans and service various categories of securities. This review will consider the history of the emergence of banks

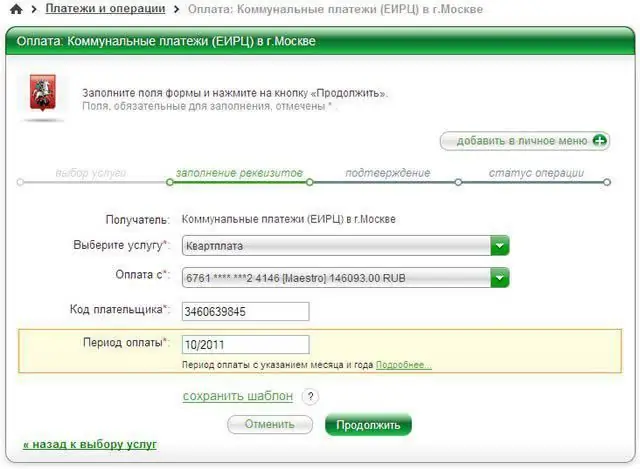

How to pay utility bills through online Sberbank: a step by step guide

Last modified: 2025-01-24 13:01

Paying utility bills online is now very common. But not everyone knows how to do it. Sberbank comes to the rescue. It's easy and simple for everyone to pay utility bills. How exactly?

Payment systems: rating, comparison, reviews

Last modified: 2025-01-24 13:01

We present to your attention the rating of electronic payment systems, which includes the most popular and well-established services. All the products described below can be found on the official developer resources, so there should be no problems with testing

Country risk and methods of its assessment

Last modified: 2025-01-24 13:01

Expansion of ties of the economic space contributes to the emergence of risks that are inherent in this business in a foreign country. An investor interested in the optimal placement of funds in an unfamiliar market may face an unstable political regime, corruption, defaults and other adverse events. All these factors are related to country risks

Card with an individual design Sberbank: development and production time

Last modified: 2025-01-24 13:01

In recent years, more and more people have appeared who want to stand out from the background of the general mass of people. This was the impetus for the development of a new area - the development of unique design solutions. Design development is also popular in the manufacture of plastic bank cards. Banks, focusing on the preferences of their customers, offer them the application of all kinds of images on cards. What does Sberbank offer?

Activity of the Central Bank of Russia

Last modified: 2025-01-24 13:01

The Central Bank of Russia is a national institution endowed with the right to issue money and regulate the entire monetary policy of the country. This is the most common definition, but to be more correct, there is no exact term

List of banks in Saratov: where to get a loan without references and collateral

Last modified: 2025-06-01 07:06

The list of banks in Saratov is undergoing changes in the course of implementation of the policy of the Central Bank of the Russian Federation. From 2014 to 2017, the regulator withdrew the licenses of the defendants from both the third hundred and the first. But the backbone of actors remains a reliable and indestructible stronghold of the financial aspirations of Saratov

Gazprombank credit card: how to apply, conditions

Last modified: 2025-01-24 13:01

Russian banks issue loans to adult and capable citizens of the country, subject to the provision of evidence of financial loy alty. Credit card "Gazprombank" is available only to participants of the "salary project". If the employer has chosen GPB for the accumulation and distribution of the payroll fund, then the employees of the enterprise have the right to apply for debt plastic

Bank "Legion": license revocation. The Central Bank deprived Legion of a license

Last modified: 2025-01-24 13:01

Complication struck in the summer of 2017 on various clients of Legion Bank. The revocation of the license hit the well-being of depositors in ten cities across the country. The register of creditors' claims was closed on November 29. The external administration takes measures to liquidate a financial market participant

List of banks included in the deposit insurance system for individuals in 2014

Last modified: 2025-01-24 13:01

The largest number of financial institutions located in the capital. Therefore, the choice for opening an account for a Moscow client is made easier. The only precaution is to check the list of banks included in the deposit insurance system on the DIA Agency website

Key rates in Russian banks. Key rate of the Central Bank of the Russian Federation

Last modified: 2025-06-01 07:06

Recently, the term "key rate" has appeared in the speech turnover of Russian financiers. And there is also the refinancing rate. So it's not the same thing?

Ariary is the currency of Madagascar

Last modified: 2025-01-24 13:01

Madagascar is one of the few French colonies that has moved from words to deeds on the issue of abandoning the CFA franc. Many say that the use of the system in the hands of the French bankers is a continuation of colonialism, but things are still there, and not in Madagascar

What does Verified by Visa mean?

Last modified: 2025-01-24 13:01

Paying for purchases and services on the Internet is becoming more and more fashionable, convenient and easy way of cashless payments. Unfortunately, along with this, the activities of fraudsters in the field of online payments are on the rise. It is enough for an attacker to get hold of information about the numbers indicated on the card in order to leave the victim without funds. Payment systems are aware of the seriousness of the threat of cyber fraud, therefore they have introduced an additional degree of protection for payment cards under the general name 3D-Secure

CSC - what is it? About the technology, its functions and features

Last modified: 2025-01-24 13:01

Paying for goods or services via the Internet can cause difficulties for inexperienced users. For example, to complete a purchase, the site usually prompts you to enter payment card details for cashless payments: card number, expiration date, holder's first and last name, and CVV/CVC code. This article will help you understand and answer questions such as CSC - what is this code, where to find it, and what is it for

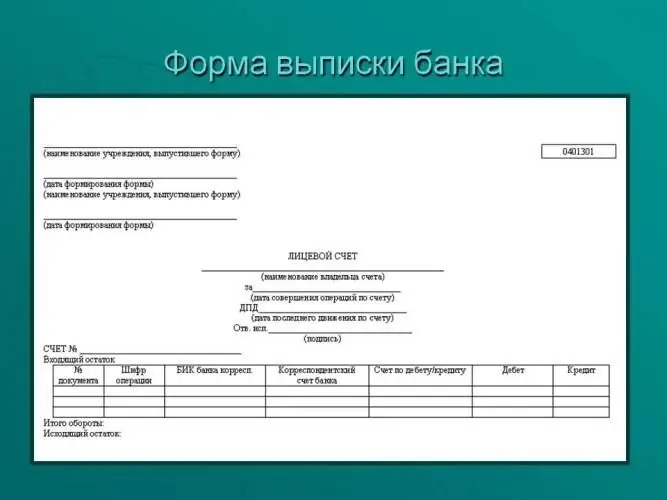

A bank statement is The concept, necessary forms and forms, design examples

Last modified: 2025-01-24 13:01

When purchasing any banking product, any client, sometimes without knowing it, becomes the owner of an account with which you can carry out income and debit transactions. At the same time, there must certainly be a certain tool that allows any client to exercise control over the movement of their own funds. This is a bank statement. This is a document that is usually issued upon request to the client. However, not everyone is aware of this possibility

The interest rate of the Central Bank: features, calculation rules and interesting facts

Last modified: 2025-01-24 13:01

Many Russians turn to the Central Bank. Mortgage, the interest rate of which, unfortunately, is quite high, is quite popular today. For many young families, it is the only way to buy their own apartment or house