2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

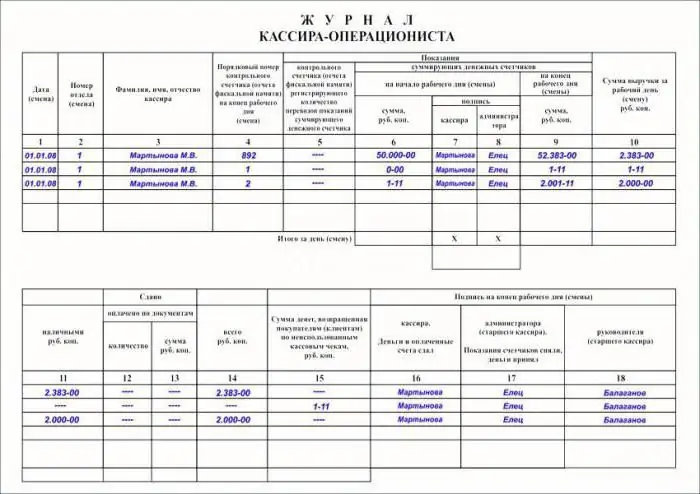

Journal (book) cashier-operator - a type of documentation that must be maintained for each cash register in the organization. At the same time, it is important not only to register and issue it correctly, but also to enter daily entries in this accounting book according to the established pattern without corrections. Let's analyze all the current requirements for the cashier's journal for 2016-2017

Definition and role of a journal

Another name for the cashier's book is form KM-4. It is obligatory from 25.12.1998 according to the Decree No. 132 of the State Statistics Committee. For each KKM (cash register), one such summary document is required. Keeping this journal is the responsibility of the teller, cashier who serves customers with the help of cash registers and accepts cash from the latter as payment for products, services, work, etc. This book is the primary accounting documentation for the accounting of incoming funds.

In KM-4, readings taken from KKM are recorded daily,and amounts of money passed through the cash register. At the beginning and end of the day, the employee writes down the readings of the KKM meters (the so-called Z-report) into it - the difference between them will be considered the revenue for the current day. The main role of the cashier's log is to reconcile the actual balance of money in the cash register with what the cash machine counted.

Formatting and filling rules

When registering a cashier-operator journal, it is important to pay attention to the following details:

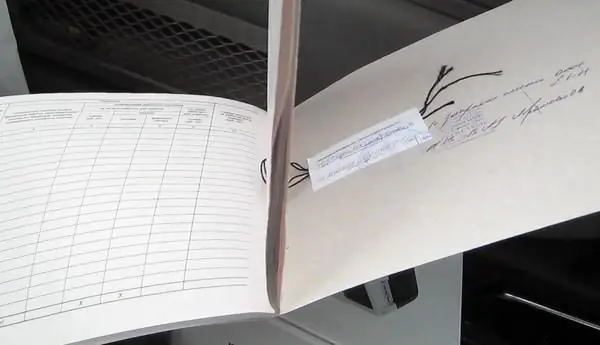

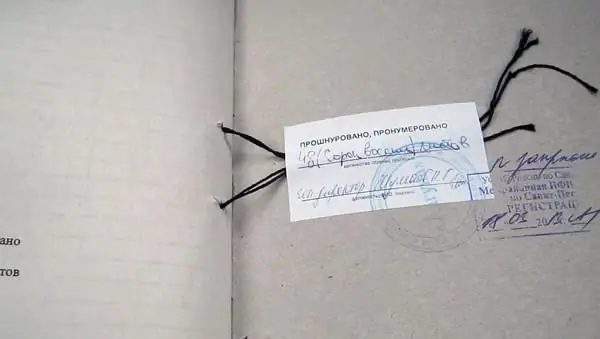

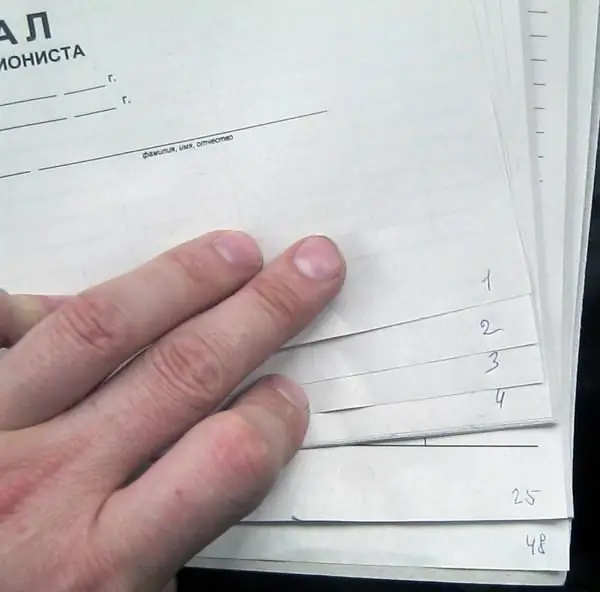

- KM-4 is mandatory to flash the entire book or only sheets.

- The signature on the control sheet must be the hands of the individual entrepreneur or the head of the organization. It must be certified by a seal, if the latter is used by the institution.

- In the book, each sheet must be numbered, starting from the first. Pages do not need to be numbered.

- On the last sheet, a note is obligatory: “The journal numbered, laced and sealed with a signature (and seal) … sheets.” Part of this text must go on the control sheet.

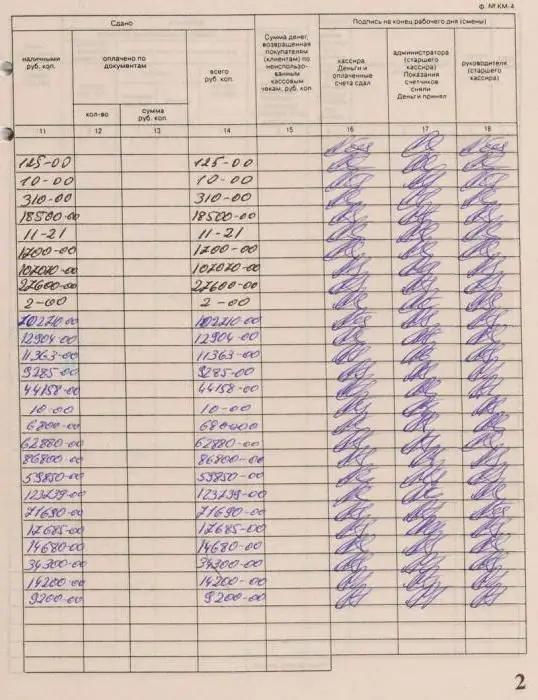

How to fill in the journal of the cashier-operator correctly (you will see a sample of a specific entry below)? The rules are:

- You can only write in the book with a ballpoint or ink pen with dark blue ink.

- Entries are made in strict chronological order. One line is one cash day.

- The source for records is only the Z-report - the information should not bethe result of independent calculations. If several such reports were taken during the cash day, then data on each of them must be entered in the book.

- Each entry must be certified by the signature of the cashier, individual entrepreneur and manager.

- The book should not contain corrections and blots.

If a cashier-operator makes a mistake in an already made entry, you can correct it by following the instructions below:

- Incorrect data must be crossed out, then indicate the correct information next to it, as well as the date of correction.

- The cashier himself, as well as his immediate supervisor, certifies the blot with his signature.

- If the scale of the error is measured by several pages or sheets, then it is allowed to strike them crosswise.

If all blots are corrected according to the specified scheme, then they should not be punishable for the employee.

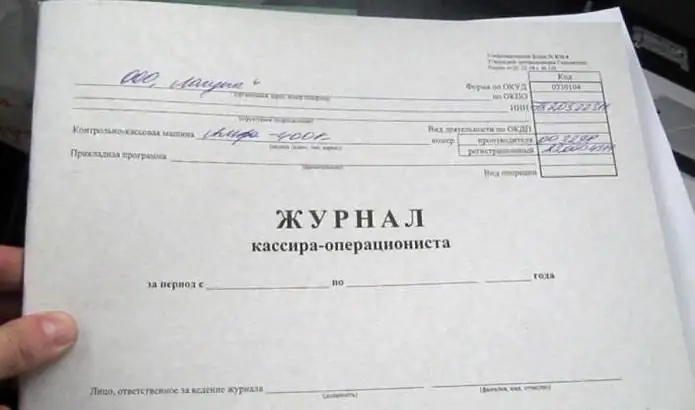

Title page requirements

The title page of the journal of the cashier-operator should be drawn up as follows before the direct presentation of the book to the tax office:

- The full name of the institution, its address should be written at the top.

- Further - information about KKM - brand, type, model. On the right side - the manufacturer's number and the registration number, which is reported by the CTO or the tax inspector when registering the device.

- It is obligatory to indicate when the filling of the book was started, and subsequently - when the last entry was made.

- It is necessary to indicate the position and full name of the responsible person -cashier working under an employment contract.

Replacement of KM-4 form

Before starting work, the book of the teller must be registered with the Federal Tax Service. By this time, it should already have a completed title page, pagination, and the entry on the last page that affects the control sheet has been stitched.

A new journal should be started only when the old one is completely filled (each form is designed for 1000 entries). The reason for the replacement may also be the obvious dilapidation of the book or its significant damage.

Columns of the KM-4 journal and their meaning, verification formulas

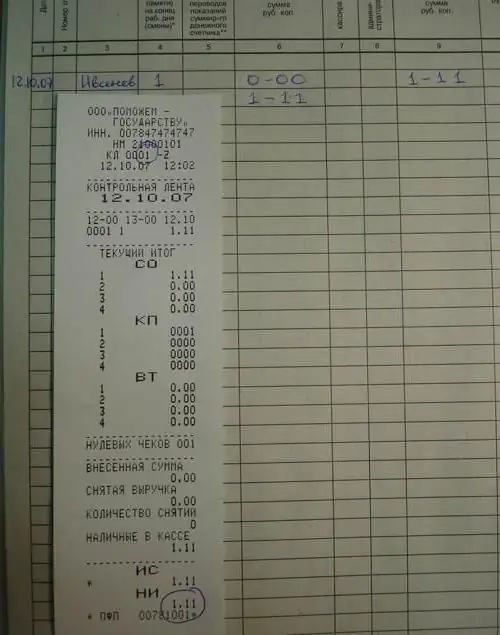

Speaking of how to correctly fill out the cashier-operator journal, a sample of which you have already seen in the photo, we will analyze all the columns existing in it, revealing their meaning.

| Count | Name | Information entered |

| 1 | Date of change | Enter the date printed in the check - Z-report |

| 2 | Department number | The column is filled in if there is a division into sections within the organization |

| 3 | Name of responsible person | If the journal is maintained by the same cashier, then it is permissible to indicate the full name in the initial line, and in subsequent lines put dashes (--//--) |

| 4 | Count of the serial number of the control counter at the end of the shift | The ordinal number of the Z-report is written - this information is visible in itmost |

| 5 | Fiscal memory report (control meter), registering the sum of transfers of total meter readings | Some cashiers write down the number of sales per day here, some duplicate the information from column 4. Most advise leaving this section blank |

| 6 | Indications of summing counters at the beginning of the day | Non-resettable total of the end of the previous shift (yesterday's Z-report) - matches the data in column 9 of the previous entry |

| 7 | Cashier's signature | |

| 8 | Administrator's signature | |

| 9 | Data of totalizing counters at the end of the shift | Non-resettable total at the end of the working day |

| 10 | Amount of Daily Revenue | Specified in the Z-report. To check it, you can calculate it like this: column 9 - column 6=column 10 |

| 11 | Cash deposited | Amounts of cash given by the teller to the main cash vault. You can check the correctness of the calculations using the formula: column 10 - column 13 - column 15=column 11 |

| 12 | Paid according to documentation, pcs | Records here the number of products whose purchase was paid for by cards, travelers checks, etc. |

| 13 | Paid according to documents, rub. | Amount of purchases from column 12 |

| 14 | Total RUR rented out | The entire amount of money handed over to the chief teller is indicated - both cash andcashless. If there were no erroneously knocked out checks, return of goods, then the data from here is equal to column 10 |

| 15 | Amounts returned to customers on unused KKM checks | Erroneously punched checks, return of goods must also be entered in the KM-3 form |

| 16 |

Signatures at the end of the cashier shift, administrator, leader |

Columns 17 and 18 can be signed with one hand |

| 17 | ||

| 18 |

Let's consider the filling of the journal on a specific example.

How to fill out the register of the cashier-operator: sample

Suppose, at the closing of the shift on May 10, 2017, the cashier removed report No. 3210. According to it, the daily revenue amounted to 23845.12 rubles. The non-resettable total was 50645.20 rubles. His figures for yesterday - 26800.08 rubles. The goods were returned in the amount of 2114.50 rubles. We will enter information into KM-4.

| Box number | Information |

| 1 | 10.05.2017 |

| 2 | --- |

| 3 | Ivanova A. A. |

| 4 | 3210 |

| 5 | --- |

| 6 | 26800.08 |

| 7 | (Signature) |

| 8 | (Signature) |

| 9 | 50645.20 |

| 10 | 23845.12 (50645.20 - 26800.08) |

| 11 | 21730.62 (23845.12 - 2114.50) |

| 12 | --- |

| 13 | --- |

| 14 | 21730.62 |

| 15 | 2114.50 |

| 16 | (Signature) |

| 17 | (Signature) |

| 18 | (Signature) |

Return and storage of funds

How to fill in the register of the cashier-operator? The sample demonstrates the return of goods to consumers. Such situations, in addition to being entered in KM-4, must be entered in KM-3. The return occurs through the main cash desk of the organization, less often through the KMM of a certain teller.

All cash stored in the cash drawer must be handed over at the end of the shift to the immediate supervisor, individual entrepreneur or to the main cash desk. The operator does not have the right to dispose of these amounts after making an entry in the journal.

Acquiring

Acquiring is a cashless payment using bank cards. This relatively recent innovation sometimes confuses when filling out the teller's journal - the daily revenue column includes a larger amount than what is stored at the cash desk. In addition, the employee must keep a record of consumers (keep their copies of checks for himself) who paid by bank transfer.

How to fill out the register of the cashier-operator correctly, the samples in this article clearly showed. This book is one of the most importantdocuments in the conduct of settlement and cash activities. Its absence, just like its loss, entails fines imposed by the inspection bodies of the Federal Tax Service, both to the employee and the organization.

Recommended:

TTN - what's this? How to fill out TTN correctly? Sample filling TTN

TTN is a consignment note. Filling out this document is distinguished by a lot of features and subtleties that are useful for everyone working in the field of transportation of goods to know

Cash check - how to fill it out? Sample

The article indicates the basic requirements for filling out cash checks, lists their pros and cons. The process of receiving money by check in a bank is also described

Symbols in the time sheet. How to fill out a time sheet (sample)

Working time and its accounting are important components of any organization, allowing you to control the activities of the company and discipline employees. In order to simplify this procedure, a special form was developed - a time sheet

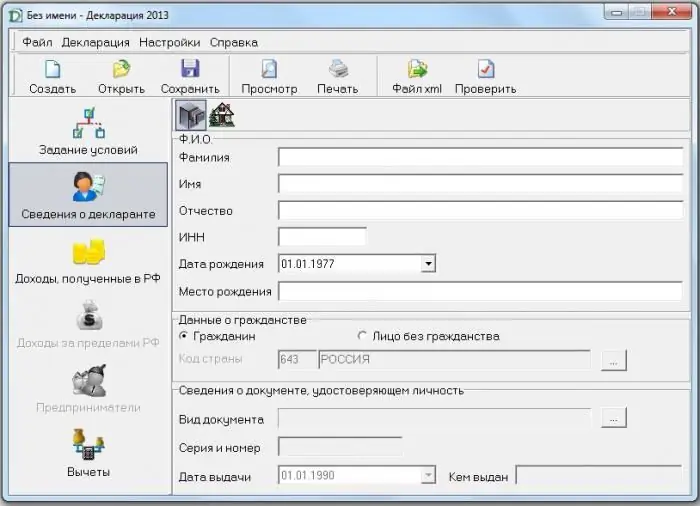

Declaration 3-personal income tax: how to fill it out correctly

From time to time in our lives there come moments when we need a 3-NDFL declaration. Not all taxpayers know how to fill it out. Yes, and the fear of messing up something discourages doing this business. However, everything is not so scary. The main thing is to be careful when filling out and not be nervous. And within the framework of this article, we will try to tell in detail when a 3-personal income tax declaration is needed, how to fill it out and how to simplify this process

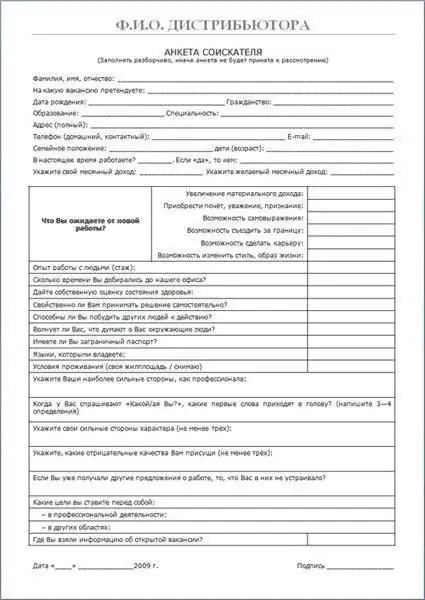

Sample questionnaires for employment: how to fill them out correctly

Let's look at sample job application forms. What blocks does the document consist of, how to fill it out correctly? What information can be requested in the questionnaire? We will talk about all this in the article