Taxes

Taxes in England for individuals and legal entities. UK tax system

Last modified: 2025-01-24 13:01

The UK tax system applies throughout the United Kingdom: England, Scotland (there are some specific differences), Wales, Northern Ireland and the island territories, including oil drilling platforms in British territorial waters. The Channel Islands, the Isle of Man and the Republic of Ireland have their own tax laws

What type of activity is covered by a patent? Patent for IP for 2019: permitted activities

Last modified: 2025-06-01 07:06

Doing business in the Russian Federation, as well as in other countries, involves the transfer of a certain amount to the budget. The amount of funds required to be paid depends on the tax regime chosen by the entrepreneur or organization. We will find out what options the state offers and whether it is profitable for an individual entrepreneur to acquire a patent

VAT: how the abbreviation stands for, purpose of tax, rates

Last modified: 2025-01-24 13:01

Within the framework of this article, the decoding and characterization of VAT as one of the most popular taxes of our time in our country is considered. All possible tax rates for today are characterized. Options for a transitional period at a rate of 20% in 2019 are presented. Specific examples of calculation are given

Personal income tax accrual: calculation, calculation procedure, payment

Last modified: 2025-06-01 07:06

In the framework of this article, the basic characteristics of personal income tax, the basis for its calculation, and the use of tax deductions are considered. Organization of accounting. Payment options are presented for both individuals and individual entrepreneurs

German payroll tax. Average salary in Germany after taxes

Last modified: 2025-01-24 13:01

In the framework of this article, the existing system of taxation from wages in Germany is considered. The main characteristics of taxes, rates, formation of the tax base are presented. The characteristics of various tax classes for calculating taxes are given

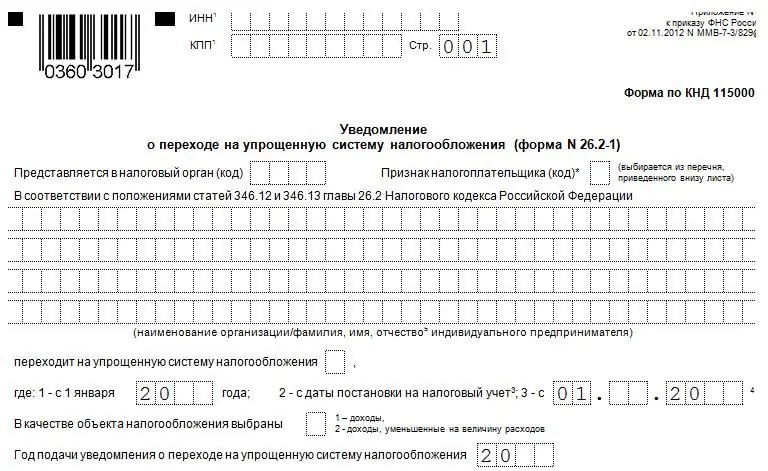

Using the simplified tax system: system features, application procedure

Last modified: 2025-06-01 07:06

This article explores the characteristics of the most popular taxation system - simplified. The advantages and disadvantages of the system, conditions of application, transition and cancellation are presented. Different rates are considered for different objects of taxation

TC RF Chapter 26.1. Taxation system for agricultural producers. Single agricultural tax

Last modified: 2025-01-24 13:01

The article describes the features and nuances of the taxation system for agricultural producers. The rules for the transition to this system, as well as the requirements for taxpayers are given. The rules for calculating tax and accounting for income and expenses are indicated

How to sell an apartment without taxes: legal ways to avoid paying tax

Last modified: 2025-01-24 13:01

The article tells how to sell an apartment without tax. The main methods are given to obtain a complete exemption from personal income tax or reduce the tax base. There are cases when it is necessary to transfer a declaration and other documents to the department of the Federal Tax Service

What is a property deduction, who is en titled to it and how to calculate it? Article 220 of the Tax Code of the Russian Federation. property tax deductions

Last modified: 2025-01-24 13:01

Russia is a state in which citizens have a lot of rights and opportunities. For example, almost every citizen of the Russian Federation has the right to receive a property deduction. What it is? Under what conditions can it be issued? Where to go for help?

List of documents for a tax deduction for an apartment. Property deduction when buying an apartment

Last modified: 2025-01-24 13:01

Fixing a tax deduction when buying real estate in Russia is accompanied by significant paperwork. This article will tell you how to get a deduction when purchasing a home. What documents will need to be prepared?

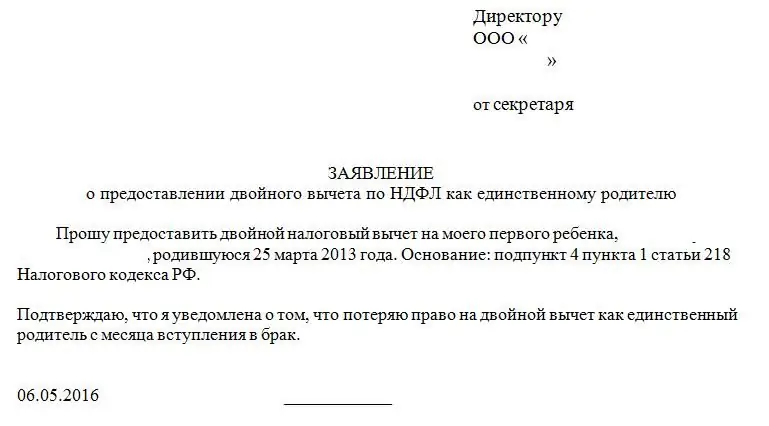

Tax deduction at birth of a child: application, who is en titled to a deduction, how to get

Last modified: 2025-01-24 13:01

The birth of a child in Russia is an event that is accompanied by a certain amount of paperwork. Parents acquire special rights when replenishing the family. For example, for a tax deduction. How to get it? And how is it expressed? Look for the answer in this article

Who can get a tax deduction: who is eligible, documents to receive

Last modified: 2025-01-24 13:01

The article explains who can get a tax deduction, as well as what types of refunds exist. Documents that will have to be prepared to receive any kind of this benefit are given. Describes the difficulties that arise when making a deduction

Tax on lottery winnings in Russia: how much is taxed on winnings

Last modified: 2025-01-24 13:01

This article explains how tax is calculated and paid on lottery winnings. The basic rules for drawing up a declaration are given, as well as the measures of responsibility for violations related to the payment of a fee or the submission of reports

How to avoid taxes: legal ways to reduce the amount of tax

Last modified: 2025-01-24 13:01

The article tells how to evade taxes for entrepreneurs and individuals. Rules for reducing property tax, personal income tax and other types of fees are given. Lists the rules for reducing the tax burden on business owners or individual entrepreneurs

What to pay tax on car sales?

Last modified: 2025-01-24 13:01

Tax liabilities in Russia raise a lot of questions. Especially when it comes to selling property. This article will tell you all about the taxes associated with the sale of cars

Municipal debt is Concept, management and maintenance, restructuring

Last modified: 2025-01-24 13:01

Municipal debt is the debt obligations of the municipality in the aggregate. This also includes guarantees issued to other borrowers. In our article, we will consider the concept of municipal debt, structure, types, restructuring, and also touch on issues of maintenance and management

Income tax refund: reasons, filling in the declaration and necessary documents

Last modified: 2025-01-24 13:01

As you know, the basic rate of income tax, as before, is thirteen percent, and according to this amount, the calculation is made with the payment of personal income tax. But there are a number of cases in which payers can return part or all of the transferred amount from wages if they have every reason to deduct

Transport tax in Krasnoyarsk: rates, benefits, procedure and terms of payment

Last modified: 2025-01-24 13:01

For the fact that a citizen or organization owns a car, you have to pay. This is no secret to anyone. This article will talk about the transport tax in Krasnoyarsk. How to calculate it? What benefits are available in this region?

Deduction for 3 children: procedure, necessary documents and determination of the amount

Last modified: 2025-01-24 13:01

In Russia, the population has a huge variety of unique rights. But not everyone knows about them. And not everyone understands how to implement them. Today we will be interested in the deduction for 3 children. What's this? Who is en titled to it? How can I claim such a benefit? Answers to all these questions and more are provided below. Practice shows that understanding the relevant topic is not difficult

Application for a tax deduction: description, procedure for filling out, necessary information

Last modified: 2025-01-24 13:01

Tax deduction is the right of many Russian citizens. But not everyone knows how to arrange it. This article will talk about obtaining tax deductions in a particular case. What is needed for this? What difficulties do citizens face?

Declaration of 3 personal income tax when selling a car

Last modified: 2025-01-24 13:01

Any car owner should know when and by whom a 3-personal income tax declaration is drawn up when selling a car. The article provides the rules for filling out and the deadlines for submitting this type of report. Lists the ways of compiling and submitting a document

Special tax regime: simplified taxation system

Last modified: 2025-01-24 13:01

There are several tax regimes in Russia. This article will focus on the special tax regime - USN. All data is given with the latest legislation

How much to pay per year for IP: taxes and insurance premiums, the procedure for accrual

Last modified: 2025-06-01 07:06

Deciding to start and run your own business is not an easy task. In order to avoid difficulties with regulatory authorities, you need to study your duties as an individual entrepreneur in advance. What taxes and fees must a sole proprietor pay? Let's take a closer look in the article

Tax Code, Art. 220. Property tax deductions

Last modified: 2025-01-24 13:01

The rules in accordance with which mandatory contributions to the budget are made are established by the Tax Code. Art. 220 defines a number of preferential conditions for subjects. They are determined depending on the specifics of deductions and the circumstances of the appearance of the object of taxation

Exemption from transport tax: the right exemption for exemption, conditions for obtaining, necessary documentation, registration rules and legal advice

Last modified: 2025-01-24 13:01

At the beginning of 2018, a rumor appeared on the net about the exemption from transport tax for all categories of citizens. This is nothing more than a misunderstanding, since the transport tax refers to mandatory payments, it is paid once a year, and its amount depends on the region of residence and the power of the vehicle

Lottery tax. Lottery Winning Tax Percentage

Last modified: 2025-01-24 13:01

The article addresses the following questions: is it necessary to pay tax on lottery winnings, what is the tax rate on lottery winnings, who, when and how should they pay lottery taxes

Wage fund and its composition

Last modified: 2025-01-24 13:01

The wage fund is the funds of organizations spent on wages, bonuses and additional incentives for employees for a specific period of time

Tax declaration (FTS)

Last modified: 2025-01-24 13:01

The concept of a declaration for the Federal Tax Service reveals Art. 80 NK. This document acts as a kind of payer's report on his obligations to the budget

Tax sanction is Concept and types. Tax offenses. Art. 114 Tax Code of the Russian Federation

Last modified: 2025-01-24 13:01

The legislation establishes the obligation of organizations and individuals to make mandatory contributions to the budget. Failure to do so is punishable by tax pen alties

Excisable goods are recognized List of excisable goods

Last modified: 2025-01-24 13:01

Excises are a type of indirect taxes. They are levied on payers who produce and sell certain categories of products. Excises are included in the cost of goods and, accordingly, are passed on to the final consumer

How and where to find out the tax debt?

Last modified: 2025-01-24 13:01

Many citizens of modern countries have a question: how to find out the tax debt? If you have never received a notification from the tax office, this does not mean at all that you are clean before the law and the state. Since the above action is the responsibility of every citizen of the country, it is necessary to find out about your debts yourself

Transport tax: rates, payment terms, declaration

Last modified: 2025-06-01 07:06

Every car owner must pay vehicle tax. The article explains how it is calculated correctly, what rates are used, and how the fee is paid. Describes all the changes made in 2018

How to find out tax arrears

Last modified: 2025-01-24 13:01

Taxes need to be de alt with on time. This article will tell you how to check the tax debt in Russia

The tax service of the Russian Federation: structure and main functions

Last modified: 2025-01-24 13:01

Taxes as a central institution for the formation of budget revenues have a not so long history (up to 200 years). The origin of this science took place in the 16th century, but it received its main development in Russia at the beginning of the 18th century

How and where can I find out the TIN debt?

Last modified: 2025-01-24 13:01

Currently, everyone knows about the existence of the tax system. The majority of the population, moreover, conscientiously and timely pay the due amount, but sometimes it happens that some debt obligations arise. In this case, you need to find out your debt by TIN

Desk audit of taxpayers

Last modified: 2025-01-24 13:01

A desk audit is a type of audit conducted within the tax authority in pursuance of the Tax Code of the Russian Federation. This type of review of documentation is carried out on the basis of tax returns provided by the payer, as well as other documents that would confirm the calculation and payment of taxes

How to fill in personal income tax-3? 3-NDFL: sample filling. Example 3-NDFL

Last modified: 2025-01-24 13:01

Many citizens are faced with the question of how to fill out personal income tax forms 3. In fact, everything is quite simple, you can do it yourself and for free. This publication contains recommendations that will help you understand the answer to the question posed. The most important thing is to carefully read and follow them

The amount of personal income tax in Russia. The amount of the tax deduction

Last modified: 2025-01-24 13:01

Many taxpayers are interested in the amount of personal income tax in 2016. This payment is familiar, perhaps, to every working person and entrepreneur. So, it is worth paying special attention to it. Today we will try to understand everything that can be related to this tax. For example, exactly how much you have to pay, who should do it, are there ways to avoid this "contribution" to the state treasury

STS restrictions: types, income limits, cash limits

Last modified: 2025-01-24 13:01

Each entrepreneur who plans to use the simplified taxation regime must understand all the restrictions of the simplified tax system. The article explains what limits apply to revenue for a year of work, to the value of existing assets and to the number of employees in a company

Taxes for summer cottages - description, requirements and recommendations

Last modified: 2025-01-24 13:01

Many people dream or plan to buy their own summer cottage with a cozy house and land where they could build a small garden or recreation area. The acquisition of such property is a positive and memorable event, but it carries not only joy, but also some responsibility. First of all, newly-made owners need to know what tax on a summer cottage is supposed to pay

Filling out a 3-personal income tax return: instructions, procedure, sample

Last modified: 2025-01-24 13:01

Filling out a 3-personal income tax return: what does a taxpayer need to know in order to avoid mistakes? Nuances and features of reporting in the form 3-NDFL

Engine power tax: rates, calculation formula

Last modified: 2025-01-24 13:01

Taxes in Russia raise many questions among taxpayers. Especially when it comes to tax payments on engine power. The article will talk about him. What to pay attention to first of all?

Tax benefits for large families: types, documents for obtaining and design features

Last modified: 2025-01-24 13:01

Undoubtedly, those parents who raise more than two children need financial support. Regardless of the goals, they contribute to solving the country's demographic problem. In response, the state offers families with many children certain tax benefits, but not all Russian regions support such an initiative

Economic content of taxes: types, principles of taxation and functions

Last modified: 2025-06-01 07:06

Balance in approaches to resolving issues of replenishing the budget through tax collections is expressed in the multidirectional observance of the interests of subjects of economic infrastructure. This is a necessary condition for the stable development of economic systems. Eliminating the shortcomings and risks of an excessive increase in this burden is impossible without understanding the economic content of taxes, especially in the context of goals aimed at increasing the investment attractiveness of the country

Preparation of 3-NDFL declarations for individuals

Last modified: 2025-01-24 13:01

The article describes how the 3-personal income tax declaration is drawn up for individuals. The reasons why citizens should form this document are given. The deadline for submission of reports and pen alties for violation of the deadline are indicated

What taxes does an individual pay: the subtleties of taxation, the amount and timing of deductions

Last modified: 2025-01-24 13:01

Approaching the question of what taxes an individual should pay, it is worth noting that there is a whole list of these taxes. Most of this list is not mandatory for every person. So what taxes does an individual have to pay without fail, and which of them must he pay under certain conditions?

Income tax in France: features

Last modified: 2025-01-24 13:01

We know everything or almost everything about the Russian tax system, but there is little information about how things are with this in the world. Let's fix this. Today we will talk about the taxation system in France. Why don't people evade taxes under a rather strict system? Understanding the article

Taxes, their types and functions. Federal, state and local taxes

Last modified: 2025-01-24 13:01

The question of taxes is always considered quite acute. Citizens do not understand why they need to pay various fees and why the state regularly raises them. Moreover, not everyone knows what types of taxes exist in Russia. Let's try to fill in these gaps in knowledge and discuss taxes, their types and functions. This will allow you to understand for what purpose you need to pay various and fees

Transport tax for 150 l. With. - calculation formula and payment terms

Last modified: 2025-06-01 07:06

When people choose a car to buy, they evaluate the make of car, model, chassis features, cost, and many other parameters of the vehicle (hereinafter referred to as the vehicle). Much attention is paid to engine power. True, the last parameter is important not only from the point of view of the dynamics of the car, but also from the point of view of calculating the car tax for this vehicle

How much personal income tax is calculated from salary: calculation procedure, accrual conditions

Last modified: 2025-06-01 07:06

Fulfilling duties in the workplace, each specialist expects to receive financial rewards in return. In other words, wages. From the point of view of the legislation of the Russian Federation, this is profit, which must be taxed without fail. It is paid by both legal entities and individuals. Since we are talking about employees, for them the legislation provides for the mandatory payment of personal income tax

Transport tax: rates, benefits, calculation, payment terms

Last modified: 2025-01-24 13:01

In Russia, transport tax raises many questions. This article will explain how the corresponding tax is calculated, as well as how it can be calculated. How to check if there is a tax debt on a car? The answers to these questions and more are presented in this article

Single simplified tax for individual entrepreneurs

Last modified: 2025-01-24 13:01

Individual entrepreneurs who are just starting a commercial activity, as well as legal entities, have the opportunity to choose one of two taxation systems: simplified or general. Our article will discuss a simplified form of taxation for individual entrepreneurs, the amount of tax and other important aspects on the topic

Personal income tax return for an apartment: procedure, necessary documents and calculation of the amount of tax deduction

Last modified: 2025-01-24 13:01

Personal income tax deduction for an apartment in Russia raises many questions among the population. For example, where to start this procedure. This article will tell you everything about the refund of personal income tax for real estate, in particular, for an apartment or house

Double Taxation Agreement with Cyprus: Definition, Application and Essence

Last modified: 2025-01-24 13:01

About the agreement on avoidance of double taxation between the Russian Federation and Cyprus. What taxes are covered by the treaty? Conditions regarding income from real estate, business, transportation, dividends, interest, roy alties, profit from the alienation of property, income from employment, capital. How is the problem regarding Russia and Cyprus resolved?

The main elements of personal income tax. General characteristics of personal income tax

Last modified: 2025-01-24 13:01

What is personal income tax? What are its main elements? Characteristics of taxpayers, objects of taxation, tax base, tax period, deductions (professional, standard, social, property), rates, calculation of personal income tax, its payment and reporting. What is meant by an invalid element of personal income tax?

Patent fee: concept, classification, features

Last modified: 2025-01-24 13:01

One of the most important actions from a legal point of view is the payment of fees as part of the process of registering a new mark or claiming profit from objects of intellectual property rights. Without timely payment of the fee, Rospatent will not start the formal examination procedure. In the article, we will consider the classification of patent fees, discuss what legal acts govern the process, what is the amount of fees, etc

Customs VAT: types, calculation of the amount and methods of return

Last modified: 2025-01-24 13:01

There are several types of customs payments that play a huge role in shaping the country's economy. All imports and exports go through customs, which means they are subject to certain payments. Today we will talk about customs VAT

Land tax: calculation example, rates, payment terms

Last modified: 2025-01-24 13:01

How the land tax is calculated should be known not only by legal entities, but also by citizens who own the land. Despite the fact that they receive a notification by mail, they can check the correctness of the accruals. An example of the calculation of land tax. On what basis is it calculated? What are the benefits

Excise tax on vodka: purpose, interest, rates

Last modified: 2025-01-24 13:01

What are excises? Pros and cons of the collection, its significance for the state. What are they charged for, who pays excises? What is the difference with VAT? Current excise rates for vodka and other alcohol. Varieties of rates, calculation formula. Forecasts regarding the increase in excises in 2020. What alcohol products are exempt from them?

The largest taxpayer is Concept and main criteria

Last modified: 2025-01-24 13:01

Criteria for determining KH. Conditions for the status of "largest taxpayer" at the federal and regional levels. The value of FED, interdependence, the presence of a license to operate. Responsibilities of CN. Which companies in Russia are recognized as the largest taxpayers?

Is financial assistance taxed: legal regulation and laws

Last modified: 2025-01-24 13:01

What is considered material assistance and personal income tax? To whom is it issued? Legislative regulation of the issue. What kind of support is not subject to income? In what cases should the state help? How to apply for financial assistance? How is the decision to appoint her made? What is the amount of the allowance? What kind of financial assistance can citizens of the Russian Federation count on?

Grounds and procedure for amending the tax code of the Russian Federation

Last modified: 2025-01-24 13:01

If the legislation is not changed, it will hopelessly become outdated. For this reason, laws are changed and punishment is adjusted. In the article, we examine the Tax Code, or rather, how the decision is made to change it. And also consider the most current editions

Retiree tax: types, tax benefits and expert advice

Last modified: 2025-01-24 13:01

Who is considered a pensioner, a federal beneficiary in the Russian Federation? What taxes are levied on them? What benefits and conditions have been introduced for obtaining preferences? Income, land, transport, property tax. What were the conditions before? In which regions are preferences applied? What tax deductions are working pensioners en titled to?

Tax benefits for people with disabilities: rules for granting, necessary documents, laws

Last modified: 2025-01-24 13:01

Disability tax credits are offered at the federal and state levels. The article describes all types of preferences that disabled people of different groups can count on. The rules for registration of these measures of state support are given

Ensuring the payment of customs duties: methods and calculation of the amount

Last modified: 2025-01-24 13:01

What are customs payments? What is paid by importers and exporters? Terms and procedure for making such payments. How to calculate their sum: algorithm, online calculator. What is a security for the payment of customs duties? Unconditional and exclusive categories. What is GTO? How is the amount of collateral calculated? Characteristics of its methods: guarantee, pledge and bank guarantee. What happens to the collateral when payment obligations occur?

Control function of taxes: description and examples

Last modified: 2025-01-24 13:01

What are taxes? Characteristics and examples of their functions: control, social (redistributive), regulatory, fiscal. What sub-functions stand out here? What is the additional incentive function? What are the control and other functions of the Federal Tax Service?

Registration after receiving the TRP: list of documents, procedure for the procedure, terms

Last modified: 2025-01-24 13:01

After receiving the TRP, registration in any real estate is a mandatory process for every foreigner. The article describes the time frame for registration, as well as what documents are needed for this

When can I switch to UTII: procedure, terms, features

Last modified: 2025-01-24 13:01

Features of the UTII regime, the possibility of switching to it. On UTII with OSNO: when is it possible, what are the conditions? On UTII with the simplified tax system: when is it possible, what are the difficulties? Features of the transition to "imputation" when registering a business. What documents are required for LLC and IP? Is a partial transfer possible? in what cases it will not be possible to switch to "imputation"?

Customs fees and customs duties: types, description, calculation and accounting procedure

Last modified: 2025-01-24 13:01

What is this? Import and export groups. Classification by purpose of collection, objects of taxation, method of calculation, nature and state of origin. What is special duty? How are these payments calculated?

How does an individual entrepreneur report to the tax office? Tax reporting of an individual entrepreneur

Last modified: 2025-01-24 13:01

The article describes how an individual entrepreneur reports to the tax office, which taxation regimes are selected, and which declarations are drawn up. Provides documents that have to be submitted to the Federal Tax Service and other funds for employees

Filing out the results of tax audits: types, procedures and requirements

Last modified: 2025-01-24 13:01

How long does it take to process the results of tax audits? Who signs the documents? Rules for drawing up an act. Who sets the requirements for its design? What documents are attached to the act? Delivery of the act, exceptional cases: refusal, departure of a foreign organization. Objections of the verified person

How to get back 13 percent of buying a car on credit: the main options and ways to save

Last modified: 2025-01-24 13:01

It is impossible to issue a tax deduction for the purchase of a car purchased on credit. The only benefit that is possible in this case is the receipt of funds in debt, intended for the purchase of a car under the state program. The law does not provide for a tax refund, since deductions to the state budget, if a credit car is purchased, are not made. You can only get a deduction when you sell a vehicle

Types of taxes and tax benefits: concept, classification and conditions for obtaining

Last modified: 2025-01-24 13:01

In a broad sense, taxes also include duties and fees, that is, obligatory payments by firms and households to the state for granting permits, rights and performing other legally significant actions (for example, licensing, customs, fees, state fees for notarial actions, for consideration of cases in courts, registration of acts of civil status, etc.)

Who can apply UTII: tax calculation, example

Last modified: 2025-06-01 07:06

Representatives of small businesses are in constant expectation of a more profitable and convenient taxation system. Someone uses a simplified system, but for someone it is quite suitable to pay a single tax on imputed income. Who can apply UTII? What you need to know about this tax regime?

Land tax: calculation formula, payment terms, benefits

Last modified: 2025-06-01 07:06

Owners of a piece of land, whether private or legal persons, must pay land tax. If for some (individuals) the tax authorities make the calculation, then others (legal entities) must make the necessary calculations themselves. For details on how land tax is applied in different cases, read the article

Until what age are child tax deductions? Article 218 of the Tax Code of the Russian Federation. Standard tax deductions

Last modified: 2025-01-24 13:01

Tax deductions in Russia - a unique opportunity not to pay personal income tax on wages or to reimburse part of the costs for some transactions and services. For example, you can get a refund for children. But until when? And in what sizes?

Tax deduction for medical services: list of services, procedure for registration, documents

Last modified: 2025-01-24 13:01

The tax deduction for medical services is a right that many citizens of the Russian Federation can use. This article will talk about who and for what can receive a refund in the field of medicine. How to do it?

How IP is checked: features, types, who carries out

Last modified: 2025-01-24 13:01

Just two years ago, each individual entrepreneur was under strict state control, and the sanctions imposed in the form of fines on this type of business did not differ significantly from the amounts paid by large organizations. This alignment caused strong unrest among entrepreneurs. In this article we will talk about how IP is checked today

UTII system: application procedure, reporting, pros and cons

Last modified: 2025-01-24 13:01

The UTII system is represented by a kind of simplified tax regime. The article describes how the tax is calculated and paid. The pros and cons of the system are given, as well as the risks and rules for switching to the system

Individual property tax: rate, benefits, terms of payment

Last modified: 2025-01-24 13:01

Every citizen should know how the tax on the property of individuals is calculated and paid. The article describes the rules for applying different tax rates, as well as the process for calculating the fee. It tells about the consequences of violations and the possibilities of changing the cadastral price of objects

A tax audit is Definition, procedure, types, requirements, terms and rules for conducting

Last modified: 2025-01-24 13:01

The number of forms of tax control, which are listed in Article 82 of the Tax Code, primarily includes tax audits. These are procedural actions of the tax structure related to control over the correctness of the calculation, completeness and timeliness of the transfer (payment) of taxes and fees. In our article we will talk about the types, requirements, timing and rules for conducting such checks

What is KBK in details? BCC (field 104)

Last modified: 2025-06-01 07:06

The first experience of processing a payment order for the transfer of honestly earned funds to the bins of the Motherland will make you figure out what KBK is in the details so that the money goes to its destination

Notification of the application of the simplified tax system: a sample letter. Notification of the transition to USN

Last modified: 2025-01-24 13:01

The result is formed by the supply market. If a product, service or work is in demand, then the notification form on the application of the simplified tax system in the contract package will not turn into an obstacle to business relations

How to get a tax refund on a purchase? Legal advice

Last modified: 2025-01-24 13:01

Refunds from purchases are quite common in Russia. Just like any other tax deduction. But how to arrange it? What is needed for this?

How to make the transition to the simplified tax system: step by step instructions. Transition to the simplified tax system: VAT recovery

Last modified: 2025-01-24 13:01

The transition of IP to the simplified tax system is carried out in the manner prescribed by law. Entrepreneurs need to apply to the tax authority at the place of residence

St. 346 of the Tax Code of the Russian Federation: simplified taxation system

Last modified: 2025-01-24 13:01

The simplified taxation system is considered to be a demanded regime for many entrepreneurs and companies. The article describes what types of simplified tax system are available, how the tax is correctly calculated, what reports are submitted, and also describes the rules for combining this system with other modes

Accrual and cash basis

Last modified: 2025-06-01 07:06

The accounting policy of an enterprise is the basis of the activities of the accounting service at business entities. Therefore, it is extremely important to make the right choice regarding one or another method of allocating income and costs, so that later there will be no misunderstandings with the fiscal authorities. In the article below, we will talk about how the results of the enterprise's operating activities can be reflected in accounting

Property tax: rate, declaration, payment deadlines

Last modified: 2025-01-24 13:01

Every person and company must pay property tax if they own certain real estate. The article tells how this fee is calculated for individuals and businesses. The rules for reporting by legal entities are given

What is the validity period of the 2-NDFL certificate

Last modified: 2025-01-24 13:01

All working citizens of Russia are familiar with the situation when it becomes necessary to submit a 2-personal income tax certificate to various authorities. This document confirms the income of the bearer. Quite logical questions immediately arise: what is the validity period of the 2-NDFL certificate and is it possible to prepare it in advance for submission at the place of demand?

Tax deductions for individual entrepreneurs: how to get, where to apply, main types, necessary documents, rules for filing and conditions for obtaining

Last modified: 2025-06-01 07:06

Russian legislation provides for a real possibility of obtaining a tax deduction for an individual entrepreneur. But often, entrepreneurs either do not know about such an opportunity at all, or do not have sufficient information about how it can be obtained. Can an individual entrepreneur receive a tax deduction, what kind of benefits are provided for by Russian law, and what are the conditions for their registration? These and other questions will be discussed in the article

Tax accounting is The purpose of tax accounting. Tax accounting in the organization

Last modified: 2025-01-24 13:01

Tax accounting is the activity of summarizing information from primary documentation. The grouping of information is carried out in accordance with the provisions of the Tax Code. Payers independently develop a system by which tax records will be kept

Form 2-TP (waste): filling out procedure, deadlines

Last modified: 2025-06-01 07:06

The 2-TP form (waste) was approved by the Decree of the Federal State Statistics Service. Rosprirodnadzor with its help collects and processes data related to the formation, use, disposal, transportation and placement of recyclable materials. This form has been in circulation since 2004

Characteristics of taxes: functions, methods and principles

Last modified: 2025-01-24 13:01

The tax system is a set of taxes and fees levied on payers in the manner and under the conditions specified by law. The need to characterize the tax system follows from the functional tasks of the country. The historical features of the evolution of the state predetermine each stage of the development of the taxation system. The structure, organization, general characteristics of the tax system of the state indicate the level of its economic development

Tax revenues of local budgets: revenue analysis

Last modified: 2025-01-24 13:01

The solution of territorial development problems is the responsibility of local authorities. It is this echelon of power that solves the pressing problems of people living on its territory, understands their problems. The population, as a rule, judges the success or failure of state policy as a whole based on the results of the work of local authorities. It is very important to strengthen the financial base of the regions, increase their interest in collecting local taxes that go to the budgetary regional system

Accounting policy for the purposes of tax accounting: the formation of an enterprise accounting policy

Last modified: 2025-01-24 13:01

A document that defines an accounting policy for tax accounting purposes is similar to a document drawn up according to accounting rules in accounting. It is used for tax purposes. It is much more difficult to draw up it due to the fact that there are no clear instructions and recommendations for its development in the law

Unified social contribution: accrual and rates

Last modified: 2025-01-24 13:01

The issue of unified social insurance does not bother, perhaps, only the lazy. After all, every self-respecting citizen should know how much and why we pay the state from our honestly earned money. We will consider this issue in the article below, based on the current regulatory legal acts

Can IP work with VAT? Taxes in Russia

Last modified: 2025-01-24 13:01

VAT is one of the most complex and ambiguous taxes in Russia. It is especially difficult for individual entrepreneurs to use it. This situation is aggravated by the fact that often an entrepreneur keeps tax and accounting records of his activities on his own, without the help of a professional accountant. Whether an individual entrepreneur is obliged to pay VAT, whether this can be avoided and what nuances such taxation has - will be discussed in detail in the article

Tax increase: reasons, laws, effective date, list of taxes, rates and benefits

Last modified: 2025-01-24 13:01

The tax system is an important source of funds for the state budget, from which many institutions and social services are paid. In 2018, major changes took place in Russia: a number of tax rates increased, and new taxes also appeared. You can read more about raising taxes and how it will affect the well-being of ordinary people in this article

Inheritance tax. What taxes are paid upon entering into an inheritance under a will and under the law

Last modified: 2025-01-24 13:01

Entering by law or by will into an inheritance involves some expenses. How much will citizens have to pay? How to do it?

Taxpayers are a special category of branches of law

Last modified: 2025-01-24 13:01

The modern world presents every person with many different ways to earn money. However, we should not forget that for each unit of profit received, a certain percentage must be paid to the state. This amount is called a tax. The article below will discuss the rights and obligations of persons who must make payments