2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

Most regions of our country cannot boast of high wages, despite the fact that prices are constantly rising, as is the cost of living.

In addition to monthly expenses for utility bills, groceries and other expenses, I want to save up money for a long-awaited vacation, buying real estate or educating children. Unfortunately, not everyone succeeds, and some are so obsessed with savings that they cross the line on the path to outright stinginess. So how to save money with a small salary, without infringing on the little things?

What can and cannot be saved on?

Before you start living economically, you need to clarify that this is not a road to poverty or complete limitation of your needs, but on the contrary - the correct arrangement of life positions, which, in turn, leads to rational spending of money.

Besides, learning how to spend money properly andto save them even with a small income, you can improve your financial situation, easily and quickly give up bad habits, be he althier and freer. For those who do not know how to save money with a small salary, but really want to, some meaningful goal will be a great motivator. It is she who will encourage the rational use of family income.

What can you save on from the first day of your goal:

- give up bad habits;

- from the "I want" shopping section;

- mobile communications;

- utility payments;

- products;

- garments;

- gifts;

- household chemicals.

What can't you save on? There are three points here:

- family he alth;

- security;

- education.

Reasons to start saving

Forming a goal is already a serious step towards saving. Otherwise, the result will not be achieved, and the money will be spent on all sorts of little things. If a person is striving for something, he will always weigh the need for expenses and choose what he can save on - buy new jeans or look like old ones, but go to the resort faster.

Targets can be:

- short-term, for example, buying household appliances;

- mid-term, for example, a trip abroad or repairs;

- long-term, for example, buying a property or renovating.

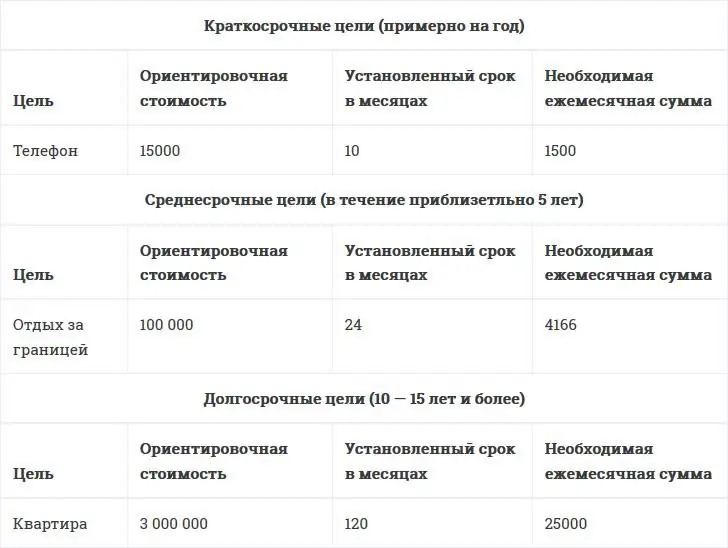

It will help you understand how to save money with a small salary, the table below. ATit presents the goals by period and the necessary means to achieve them.

How to determine the source of income?

In order to realistically assess their capabilities and determine whether a particular goal is feasible, a person needs to calculate their earnings and funds free from essential expenses.

For example, in a family there are several people with a stable monthly income, then the earnings of each are added up and mandatory expenses are deducted from them:

- payment of utility bills;

- money for travel;

- shopping for food;

- tuition fees;

- other payments.

These data are only approximate with allowable errors, so it is better to keep a notebook and write down all the primary expenses every month. As a result, you can calculate the average cost and adjust it as needed. In addition, this way you can determine how much can be set aside each month for the planned goal.

A small salary is not a reason to cut all ideas and plans in the bud. Of course, when thinking about how to save money with a small salary, you should not save for a chic mansion, but you can approach the goal from the other side and invest in education and personal growth, as a result, your earnings will increase and the goal will be more achievable.

Not everyone likes to live in economy mode, but if you approach things correctly, you can fulfill your dreams and improve your financial situation.

Building a reserve

After analyzing the feedback from people who have understood how a family can live economically on a small salary and save money, as well as those who are just mastering savings, we can conclude that the fundamental point is the mandatory formation of reserve funds.

Creating a reserve is a prerequisite, every month you need to set aside 5-10% of your salary in your own fund. This is a kind of "untouchable reserve", it will be a protective front in case of unforeseen circumstances. If the stock was not spent in the previous month, you should not attribute it to the income of the coming period. On the contrary, continue to add 5-10% of earnings to the reserve fund every month.

It is not for nothing that the reserves of entire states are formed in this way. Continuing in the same spirit, in a few months you can afford to buy an expensive thing, and having collected a little more, save up for a holiday with a small salary or make cosmetic repairs in the apartment.

How to start saving?

As soon as a person thinks about changing something and starting to live more economically, obstacles immediately appear in the form of apartment bills, the need to replenish food supplies, paying for circles for children and other household expenses. As a result, the goal is postponed indefinitely.

To master the principles of economy, it is necessary to discard all doubts and set aside at least a minimum of funds. Despite the utility bills, empty fridge and stuff. It is important to remember that the rational use of funds is practiced infirst of all for yourself, and savings are no less important than spending on groceries and bills.

The optimal amount for the formation of the stock will be the amount of 10% of monthly earnings. Despite the fact that this is not so much, it is quite problematic to postpone them. Often it's not about the money issue, but the relationship, why people are so disrespectful of themselves that they do not consider it possible to set aside 10% for personal needs. Or they don’t believe in the ability to save up for something significant, depositing such small amounts, however, more often than not, having set aside money a couple of times, a person slowly draws out of the reserve for current needs.

You need to set yourself a goal: under no circumstances spend money on secondary goals, willpower is the key to success. You should constantly keep a record of money, how much was received and was spent. At first, it is recommended to have a notebook and indicate in it all daily expenses down to the smallest detail. At the end of the month, an analysis is carried out in order to determine which of them were superfluous, which ones can be saved on next month.

Home bookkeeping for Android will help you save. This is an application that keeps track of expenses and income of a person or an entire family. Using the program, you can analyze several periods. Also, the functionality allows you to transfer data to a computer. Security is provided by entering a password.

Savings during a loan

Repayment of loans, mortgages and collateral obligations is a hot topic for most of the country's population. Stretching out a large payout over years, peopleindulge in small whims: a trip on vacation, buying new equipment, updating the wardrobe. What can we say about going to the cinema or attending a theatrical premiere.

In terms of savings, “pleasant expenses” are immediately deleted from the planned budget, which is absolutely wrong. If a person approaches cost planning with all seriousness, these costs must be included in the plan, otherwise the lesson will seem completely gray and unpromising. It would be good if at least once a month there will be an opportunity to go to the theater or buy a new thing.

As already mentioned, 10% must be set aside in the reserve fund, but if funds are taken from the family budget to pay for the loan, then this amount can be divided in half, for example, 5% to save for yourself and 5% for early loan repayment. Since payments to the bank are not a rational, but a forced waste of money, which it is desirable to remove from the balance as soon as possible.

Of course, any financier will advise you to manage on your own and not take loans at all, but the realities of life are often put in a strict framework, and a loan becomes a necessary measure. In this case, it is better to limit yourself to smaller payments for a long time, rather than give away almost all earnings in a short period of time.

Many are wondering how to save up for a car with a small salary. In this case, the main thing is not to break at the last moment. If a person does not work all day, then you can look for additional work or create something with your own hands.

Whatevertemptation to spend what you have accumulated, you need to create a system of accumulation. The following methods will help with this:

- Envelopes in which money will be deposited. They are sealed, so taking funds from there will be more problematic than from a box or jewelry box.

- You can also open a bank account and make donations.

- Get a savings or cashback card.

- Open a deposit with the possibility of making an additional monthly payment.

Savings on groceries

Most shoppers are familiar with the situation when they went into the store for bread, and left with a full cart of groceries, and not essentials. Saving on food is quite real, and it is not necessary to switch to low-quality food or starve, a reasonable approach to business is important.

How to live on a small salary by buying groceries:

- Proper nutrition. Avoiding processed foods will not only save money, but also keep you he althy, the same can be said about fast food. Purchased buns and donuts can be replaced with dairy products or baked on your own, an alternative to meat and sausage semi-finished products is boiled or baked beef roll, and dried fruits for sweets.

- Menu for the week. A planned menu for the week eliminates the option when you need to run to the store for only one ingredient and come home with a full package of products. In addition, excess products will not spoil, therefore, the money is spent correctly.

- Product list. Writing a list of necessary things is a very useful habit. In-firstly, it will save you from impulsive spending, and secondly, there will be no need to return for this or that product, and how it ends is already known.

- Cash or card. Numerous surveys have revealed that people part with funds more easily when paying with a card, because they do not have visual and tactile contact with money. However, paying by card provides many advantages in the form of discounts and bonuses, so you should not completely exclude it. How would you not have to pay, you need to keep receipts and keep records.

- Payday shopping. Most people, having received an advance or salary, tend to make purchases on the same day. It is better to wait with this in order to cool down a bit and plan the costs for the upcoming period.

- Who should go shopping? Some argue that men are more rational when shopping, but many women might argue with that. Not all men study the price tags and often take goods without checking the price, or buy the wrong products that their wife needs in the kitchen. Therefore, it is still better to go to the store for that family member who does not give in to spontaneous purchases and takes more deliberate actions.

Below is a table on how to save money with a small salary. With it, you can analyze which purchases were superfluous.

Save on other purchases

In addition to food, people make a lot of other purchases every day: clothes, cosmetics, toys, shoes, not to mention larger purchases. With the right approach, you can save here too. When wondering how to save up for repairs with a small salary, it is also necessary to apply the envelope system. To do this, you need to analyze the cost of repairs and calculate the amount of deferred funds.

Consider other costs:

- Cosmetics and hygiene products are not something you can save on. Cheap and low-quality products often lead to allergic reactions, deterioration of the skin and hair. Cosmetic products should consist of natural ingredients, which, by the way, are not cheap at all. Alternatively, you can save money by buying goods in the same network and accumulating bonuses using a discount card.

- Clothes. We are not talking about second-hand stores here, although, according to many people, you can find good things there at an affordable price. It is recommended to buy clothes in online stores, joint purchases or in stocks of last year's collections - this will save up to 25% of the market value. The main advice is not to make spontaneous purchases, all things in the wardrobe should be in perfect harmony. Thus, you do not have to pick up clothes for a long time and you can save a lot on unnecessary things.

- Technique. The most popular brands of phones, TVs and other gadgets add a huge percentage to the cost of production through advertising and earned name. You can always buy an analogue that meets the basic requirements at a lower price.

Utility payments

With the rightconsumption of resources, you can save on monthly utility bills. For example, if the house has an electric kettle, you can refuse it and boil water on the stove in an ordinary kettle or pour the strictly necessary amount of water, and not waste electricity on constantly heating a full container.

How to save money with a small salary, saving on utility bills:

- It is better to make tea or coffee with water from a thermos.

- The refrigerator should be kept as far away from heating appliances and direct sunlight as possible.

- It is better to cook on an electric stove using dishes with a thick bottom. This keeps the heat longer, and cooking some dishes is allowed, just a little before they are fully cooked.

- When buying household appliances, you should pay attention to the energy class.

- LED and energy-saving light bulbs significantly save electricity.

- If the family is used to taking a bath, then it is worth getting into the habit of bathing in the shower.

Travel, communications, Internet costs

If we talk about trips, then the principle applies here, there is a car - it is better to walk more often for short distances or try to use public transport at least occasionally. So it will turn out to learn how to save money with a small salary.

For regular travel, you need to buy a travel card. You have a long trip ahead, you can use the application that allows you to find fellow travelers and save a lot on travel expenses.

In the modern worldjust to keep abreast of events, you need to use the Internet and cellular communications. How to save money with a small salary, given these costs? Most subscribers do not use the paid tariff at 100%. In order to cut costs, it is recommended to switch to a cheaper tariff or choose one where only the services that have been used are paid for. Another tip is to sometimes check your tariff package and control the connected paid services that can be imposed by the mobile operator.

Recommended:

Criteria for small and medium businesses. Which business is considered small and which is medium

The state creates special conditions for the work of small and medium enterprises. They get fewer inspections, pay reduced taxes, and can keep more simplified accounting records. However, not every firm can be considered small, even if it occupies a small area. There are special criteria for small and medium-sized businesses, according to which they are determined by the tax office

Small business problems. Small business loans. Starting a Small Business

Small business in our country is practically not developed. Despite all the efforts of the state, he still does not receive proper support

Government assistance to small businesses. How to get government assistance for small businesses?

Today, many people are not satisfied with being hired, they want to be independent and get the maximum profit. One acceptable option is to open a small business. Of course, any business requires initial capital, and not always a novice businessman has the necessary amount on hand. In this case, help from the state to small businesses is useful. How to get it and how realistic it is, read in the article

Interesting small business ideas in a small town

Small cities, unlike large ones, are usually characterized by lower wages and very limited opportunities for self-realization. But still, do not despair, there are very interesting small business ideas in a small town. Read more about it

How to save money for an apartment with a small salary: useful tips

Buying your own home is the cherished dream of every modern person. What is stopping you from realizing this dream? Between the dream and its realization lies a detailed plan, which describes every step, every option and the time frame during which they need to be completed. No one can give guarantees, but it's worth trying