2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:33

Today, insurance plays an important role in all spheres of life of citizens. The concept, essence, types of such relations are diverse, since the conditions and content of the contract directly depend on its object and parties. The key element of insurance is risk. This word refers to situations in which the object of the agreement is damaged. There are many risks that determine the variety that distinguishes the concept of insurance and types of insurance. The persons entering into the contract have a significant material interest - to protect themselves from losses associated with causing significant damage to their he alth, life or property.

Concept

The concept of insurance and types of insurance in general terms are known to everyone. It is a system of economic relations designed to reduce property losses in the event of adverse circumstances. In other words, such an agreement helps to protect yourself from the risk of losing a large amount due to an accident. Participants make contributions, from whicha reserve fund is formed. If the object of insurance (property, he alth, etc.) was damaged, the organization pays the amount necessary to compensate for the losses.

However, the subject receives compensation not just in case of various damages, but only in those situations that are previously specified in the contract. An event that leads to compensation for damage is called an insured event. This concept means a random situation that can lead to significant material losses.

Legal entities providing such services are called insurers. To carry out their activities, they must meet state requirements and obtain a license. The concept of insurance, its functions and types are specified in the relevant law of the Russian Federation. Thus, persons who decide to sign an agreement with an official company may not be afraid that their rights will be violated. The activities of organizations pay off at the expense of a bonus - a remuneration provided for by the terms of the contract.

Functions

In a primitive form, the concept of insurance and types of insurance appeared in ancient times, when people stocked up on grain and building materials in case of bad weather and natural disasters. Today, this type of agreement is the basis of the economy, guaranteeing financial stability to individuals and legal entities. The modern concept of insurance and types of insurance have developed in stages, supplemented with the advent of new forms of economic relations. At the moment it's beforefirst of all, the opportunity for entrepreneurs to secure their business, and for citizens to provide for themselves in the event of a temporary or final loss of working capacity. This type of relationship performs important functions, among which are the following.

Function |

Essence |

|

Compensation |

Providing the insured with an amount sufficient to compensate for losses due to the occurrence of certain circumstances |

| Preventive | Large organizations allocate part of their income to reduce the risk of adverse situations |

| Savings | Cumulative life insurance not only performs a compensatory function, but also brings profit to an individual |

| Indicator | Companies collect large-scale statistical information about certain risks, the likelihood of their occurrence |

Classification

Insurance is divided into many types, which, in turn, are grouped into two forms: mandatory and voluntary. The main criterion for classification is the subject of the contract. Today, insurance covers almost all spheres of public life: material values, human he alth, labor activity. Different types of relationships are combined into three industries, presented in the table.

Property |

Private |

Liability insurance |

| Real estate, vehicles, risk of fire and natural disasters | Life, he alth, the likelihood of an accident, the conclusion of a contract when traveling abroad | Civilian, professional, manufacturer, employer, car owner |

Property insurance is important for both entrepreneurs and individuals. Damage to property due to fire, accident and other unforeseen circumstances can result in high costs that business owners are often unable to cope with on their own. For this reason, the conclusion of an insurance contract is a normal practice for entrepreneurs. In states that do not guarantee free medical care, personal insurance has become widespread. The concept and types of such an agreement are directly related to human life and he alth. There are also combined types of insurance, which can be attributed to several types at once.

Life and he alth

In Western countries and among we althy citizens of the CIS countries, personal insurance is widespread. The concept and types of this type of contract are difficult to cover in a general formulation: different companies around the world provide a wide range of services that cover a wide variety of areas of activity. We can say that this is a type of relationship where the object of insurance is a property interest,relating to man and his activities. The subject of the contract may be:

- life;

- he alth;

- accident risks.

He alth is the most common subject of this type of contract, since serious diseases can entail significant costs. The concept and types of he alth insurance differ depending on the spectrum and, accordingly, the cost of the services provided in the clinic. The most unusual object of the contract is human life. This type of insurance provides for the accumulation of money that is paid to an individual after a certain period of time (for example, upon retirement) or to heirs after his death. Thus, the contract helps to secure the family and ensure a comfortable old age. Accident insurance is valid for a short period. Compensation is paid when, due to an external cause, a person died or lost his ability to work. Such an agreement is often concluded by passengers, employees of an enterprise or tourists.

Treatment

Different types of agreements related to human he alth are common, but it is possible to single out the concept and types of he alth insurance that are common. First of all, it is the social protection of citizens, which manifests itself in payment for medical services in the event of various diseases. There are two main types of such insurance:

- mandatory (CMI);

- additional (VHI).

The latter also includes contracts thatconcluded by citizens when traveling abroad. In most countries, including the Russian Federation, there is compulsory he alth insurance. With its help, all citizens of the state have equal opportunities for treatment and receiving medicines. The territorial MHI fund transfers money to the account of MHI insurers, depending on the number of insured persons in a particular area.

Consider voluntary he alth insurance, the concept, types, the forms of which do not differ much from the state. The difference lies in the fact that with this type of relationship, additional services are provided to clients in individual medical and preventive institutions. The contract operates on a commercial basis and allows you to get better treatment from narrow specialists. A he alth insurance contract is also drawn up when traveling abroad. For some countries, this procedure is mandatory.

Property insurance

This type of contract is designed to protect material values - things, vehicles, real estate. Both individuals and legal entities can take out property insurance. The concept and types of the contract are similar to the previous type of agreement, only the object of the contract is material risks, and not human life. Property insurance is the protection of interest associated with the possession, disposal and use of things. In case of damage to the material values specified in the contract, the client is paid compensation. As with a personal contract, an agreement has two forms:mandatory and voluntary.

View |

Essence |

| Fire | Compensation for damage in case of fire, explosion, lightning strike, aircraft crash |

| Techniques | Coverage for the purchase of non-working, defective or unsuitable equipment for production |

| Commercial risks | Reimbursement for bad trading conditions |

| Losses due to production interruptions | Compensation for lost profits in case of business downtime |

| Transport risks | Insurance of vehicles or goods carried by them |

| Other species | Compensation for damage caused by storm, collision with a car, robbery, accident |

If the property was destroyed and cannot be restored, its owner is paid its full value. In case of damage to things, not the entire amount is reimbursed, but only the part necessary for their repair.

Liability insurance

Sometimes this type of contract is not allocated to a separate position during classification, but is considered a component of a property agreement. However, it has some distinctive features. The object of insurance for this type is the responsibility of a person to third parties for causing harm to them or their property. According to the legislation of the Russian Federation, in such situations it is necessary to compensate for the damage caused. The company with which the client has entered into an agreement allocates the amount necessary to pay compensation, thus satisfying the property interest. In addition, the concept and types of compulsory insurance also include contracts the subject of which is liability, for example, for car owners.

Object |

Essence |

| Vehicle Owner | In the event of an accident, the company pays the client all costs, if they do not exceed the amount specified in the contract. It doesn't matter who was driving his car |

| Producers | Compensation for damages that buyers received when using or using the manufacturer's goods |

| Businesses | Compensation for damage caused by the insured to human he alth, property of individuals and legal entities and the environment in the course of business activities |

| Professional responsibility | Compensation for losses associated with the performance of a specialist's work (errors, negligence) |

| Other species | Responsibility of owners of animals, houses and land, hunters, developers, etc. |

Accidents during production

Agreements relating to the risk of pollution are called"environmental insurance". The concept and types of contract include the provisions of the positions of the previous classification. Such an agreement is aimed at compensating for damage caused by environmental pollution. In some accidents, the use of land and water bodies may become impossible, and the presence of people in a certain area may become unsafe for he alth. Such situations entail high costs. Types of environmental insurance:

- personal (life of citizens living or working in a high-risk area);

- property (real estate that may be damaged during an environmental disaster or accident);

- responsibility (enterprises whose activities can harm the environment).

In some states, environmental insurance is mandatory. This mainly concerns enterprises where production failures can occur that can cause severe environmental damage (for example, oil spills).

Reinsurance

Sometimes companies enter into an agreement with customers with too much risk. To protect themselves, firms draw up an agreement with another reinsurer. Part of the responsibility and remuneration remains with them, while the rest is transferred to the second company. Thus, insurers achieve financial balance. The process of shifting risks is called cession. Such a chain can consist of any number of positions, for example, a secondary insurer has the right to transfer parttertiary responsibility. There are different forms of this type of agreement.

Compulsory classification of reinsurance:

- negotiable (the company or person chooses whether he wants to transfer part of the responsibility to another person, as well as the size of this share);

- automatic (some firms enter into a contract with reinsurers, as a result of which all transactions that fall under certain criteria are transferred to them).

The share to be transferred can be set in two ways. Proportional insurance provides for a commensurate distribution of liability, compensation and premiums. Thus, the benefits and costs of the primary and secondary insurers are the same. Another way of determining the parts is disproportionate, since the interests of the parties to the contract are not proportionate, in particular, one of them may suffer large losses. These are the concept and main types of insurance, where responsibility and remuneration are distributed among several persons.

State binding agreement

There are two forms of contract, depending on the insurer with whom it is concluded. When the organization is owned by the country, these agreements are called state, and if it is owned by legal entities - private. At the same time, the first type of agreement, according to the legislation of the Russian Federation, is mandatory. The amount at the expense of which contracts are concluded is allocated by the state specifically for these purposes.

The state compulsory insurance plays a big role in the economy. Concept, types, rules andthe tariffs of this form of agreement are clearly defined. Under the state compulsory insurance refers to the relationship that arises between the parties to the contract by virtue of law. It covers the entire population of the country or large groups of people. There are such types of compulsory insurance:

- medical;

- social;

- military personnel;

- passengers;

- responsibility of vehicle owners (OSAGO);

- owners of hazardous facilities.

Voluntary insurance

This type of contract is optional and is concluded at the initiative of the subject. Unlike the already described form of relations, the rules by which voluntary insurance is carried out, the concept and types of such an agreement are established by law only in general terms. Specific tariffs and conditions are determined by the parties to the agreement. Its types include insurance:

- life;

- he alth (continuous and in case of illness);

- from accidents;

- vehicles;

- cargo;

- from natural phenomena;

- responsibility of vehicle owners;

- financial risks, etc.

This type of relationship is characterized by selective customer coverage, that is, the company may refuse the policyholder if he does not meet its requirements. At the same time, a voluntary agreement always has its own terms. Upon completion, the contract can be re-executed by paying the fee again.

The concept and types of social insurance

This type of agreement means a system of social protection, which is designed to financially provide citizens with disability, in case of illness, unemployment or loss of a breadwinner. The concept and types of social insurance may differ, depending on the form of the agreement, which are distinguished by three:

- collective (trade unions);

- government;

- mixed.

In the first case, the conclusion of the contract is voluntary and is carried out in situations where the state does not provide appropriate material protection. Relations are built on the principle of democracy, partnership and self-government. The amount of payments is not fixed and depends directly on the level of income of employees.

The concept and types of compulsory social insurance are clearly regulated by the legislation of the Russian Federation. It is part of the state social protection system, aimed at providing workers with a deterioration in their financial situation. There are such types of compulsory social insurance:

- medical;

- pension;

- temporary disability;

- from accidents;

- maternity;

- due to the death of a family member.

Conclusion of the contract

Before drawing up the document, an underwriting procedure takes place - the risk of an insured event is assessed. The size of the premium directly depends on this, and therefore the process requires careful calculations. Misjudged Riskcan lead to significant waste and bankruptcy of the company.

The basis for the conclusion of the contract is the application of the client, which can be both written and oral. In this document, the policyholder must list in detail the facts that will help to give the most accurate risk assessment. The agreement is drawn up in any of two forms: in the form of a contract or a policy. In the first case, the document is signed by both parties, and in the second case, only the insurer.

Recommended:

Job description of a social work specialist. Social protection and social assistance

What are the requirements for a social worker, what are his functions, rights and obligations as a professional in social protection and social assistance to citizens - a complete description of a representative of one of the most humane professions

Classification of management functions: definition of the concept, essence and functions

Management is a complex and multifaceted process. Why is it needed and what is its essence? Let's talk about the concept and classification of control functions, consider approaches to this problem and characterize the main functions

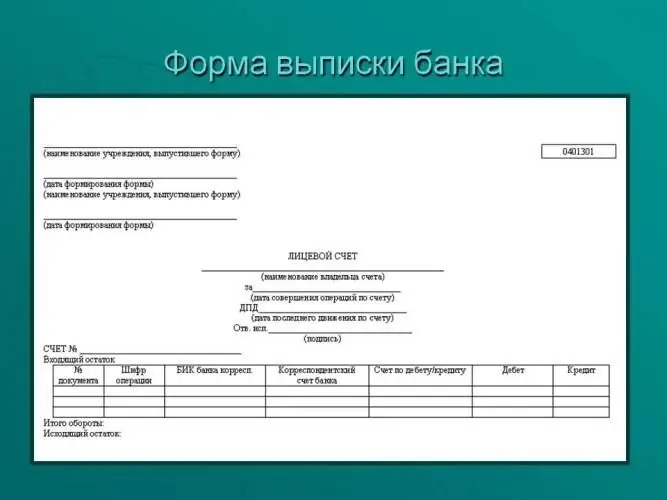

A bank statement is The concept, necessary forms and forms, design examples

When purchasing any banking product, any client, sometimes without knowing it, becomes the owner of an account with which you can carry out income and debit transactions. At the same time, there must certainly be a certain tool that allows any client to exercise control over the movement of their own funds. This is a bank statement. This is a document that is usually issued upon request to the client. However, not everyone is aware of this possibility

Entrepreneurship, its types and forms. Concept, essence and signs of entrepreneurship

This article discusses in detail the concept of "entrepreneurship", given its concepts, essence, features, forms and types, and analyzed the personality of the entrepreneur. The main features of small, medium and large types of entrepreneurship are highlighted

Legal bases of insurance: essence, functions and forms

Insurance is a way to distribute possible losses from current income. It is used to protect the property interests of legal entities and individuals in the event of the occurrence of certain events thanks to the monetary funds that were formed from the contributions paid