2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:39

Many of us, without having enough information, are very distrustful of taxes and everything connected with them, completely relying on our employers in matters of their payment. Meanwhile, in some cases, some of them can be returned in the form of social deductions.

There is an opinion among the people that it is almost impossible to get them because of the large number of necessary documents and bureaucratic red tape. But for those who once figured out the procedure, filing a declaration no longer looks like such an intimidating event.

The tuition tax deduction is one of the ways to return part of the funds paid to the treasury. Next, let's figure out the order in which you get it.

Tuition deduction - who is en titled to it? What size?

Those who can count on a tax refund in this case can be divided into those who pay for tuition on their own and those for whom the next of kin do it.

In the first case, everything is quite simple: it is possible to receive a tax deduction for studies forstudying in a preschool, secondary or higher educational institution, studying a foreign language or taking courses in a driving school. Thus, there are no restrictions on the type of institution. The institution, however, must be licensed to conduct educational activities. In the absence of a license, the deduction cannot be received.

The maximum amount to be returned is 15,600 rubles per year (13% of 120,000 rubles). It is this upper limit of the cost of education adopted by the state. The specified amount can be received only if the amount of income tax paid to the treasury is not less than this amount, and the tuition fee is 120 thousand rubles.

If parents, brothers or sisters pay for education for children (their age should not be more than 24 years old), the tax deduction for studies can only be obtained by studying at the faculties of the full-time (full-time) department.

The maximum amount of funds that the state is ready to return, in this case, is 5,600 rubles a year (13% of 50,000 rubles). The specified amount can be received for one child, i.e. if there are several children, compensation can be received for each.

You can apply for a deduction no earlier than the year following the tuition fee (if the tuition was paid in 2012, a refund of a part of personal income tax can be received in 2013, 2014 and 2015). Thus, the pupil / student or his relatives have 3 years to apply.

Refund of personal income tax for education - required documents

In addition to the passport and application to the inspectionwill need to provide:

- completed declaration;

- confirmation of income in the form of 2-personal income tax;

- copy of school license;

- copy of contract for educational services;

- Tuition payment confirmation.

If you receive a tax deduction for the education of a child/children, you will additionally have to request a certificate from the educational institution (the form of education is required) and a birth certificate of the student and his brother/sister, if they pay for his education.

In conclusion, it is worth noting that the tax refund period is four months from the date of filing the declaration.

Recommended:

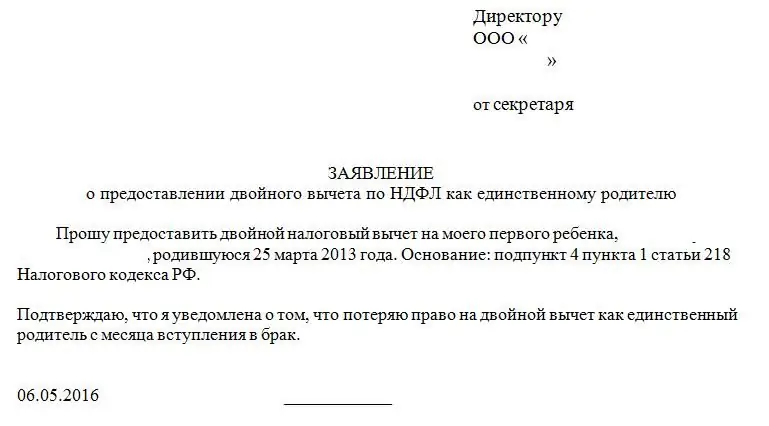

Tax deduction at birth of a child: application, who is en titled to a deduction, how to get

The birth of a child in Russia is an event that is accompanied by a certain amount of paperwork. Parents acquire special rights when replenishing the family. For example, for a tax deduction. How to get it? And how is it expressed? Look for the answer in this article

Tax deduction for mortgage interest. property tax deduction

Today, not every citizen has enough free cash to buy an apartment. Many have to use loans. Targeted loans give the right to claim a tax deduction for mortgage interest, provided that the documents are executed in the territory of the Russian Federation

Do you also not know how to get a tuition tax deduction?

Not everyone is financially literate enough to know how to claim a tuition tax deduction. But this is a real opportunity to recover at least part of the funds spent on education

Deduction of taxes when buying a car. How to get a tax deduction when buying a car

Tax deductions are quite an interesting question that interests many. Of course, because you can get back 13% of the transaction! But is there such an opportunity when buying a car? And what is required for this deduction?

What can I get tax deductions for? Where to get a tax deduction

The legislation of the Russian Federation allows citizens to apply for various tax deductions. They may be related to the acquisition or sale of property, the implementation of social protection mechanisms, professional activities, training, medical treatment, the birth of children