2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

Wages are the main source of income for the vast majority of people on earth. Its size varies from country to country, across industries and between speci alties. But the needs of a person, which are covered by a salary, can be reduced to a single denominator - a comfortable standard of living. Is it always real?

How to buy real estate with a salary?

The housing issue in Russia is acute. The government is taking a number of measures capable of, if not completely freeing citizens from the housing problem, then facilitating to a significant extent. From the outside, it may seem that these measures are like a drop in the ocean: the number of homeless families is not decreasing. There are many factors such as the demographic growth of the population, the differentiation of real estate prices in relation to regions, the social status of citizens and territorial laws.

Regardless of government measures, every citizen must take care of how to save money for an apartment under his individual starting conditions. From the very beginning, you should find out that ready-made univers althere are no instructions on this subject. There are a number of opportunities that can contribute to the purchase of treasured square meters. You should also highlight a number of factors on which the chance to use these opportunities depends.

Associated factors

The question of how to save money for an apartment can be asked by a family or a free citizen. The social status of a citizen is of great importance, since the state policy in solving housing issues is mainly aimed at family categories of citizens. But this is not the only factor. Other factors:

Type of employment. Manual workers, without qualifications and education, receive small salaries. A more substantial amount of income falls on the share of knowledge workers with appropriate qualifications: accountants, bankers, employees of insurance companies, representatives of the media business and other similar categories

If a citizen who is thinking about how to save up money for an apartment works in a low-skilled job, then it makes sense to decide to improve their skills and move to work with higher incomes. The qualification does not imply 5 years of university study. Short-term courses for training specialists, coupled with diligence for 1-2 years, bring personal financial performance to a new level. For example, women can become makeup artists or cosmetologists, men can also find a profession they like if they wish.

Official work. Despite the active work of the fiscal authorities,the shadow sector of the economy in Russia continues to exist. According to data for 2017, the share of the shadow sector is about 30%. Accordingly, a certain number of citizens work without an agreement with the employer and without official registration. Income received in this way is not recorded anywhere and is not taxed. If official proof of income is required, the shadow business employee cannot provide a certificate

The second step in the plan called "how to save money for an apartment" should be the legalization of work and wages. This promises a number of advantages, which will be discussed in other chapters of the material.

Marital status. As already mentioned, a family has more opportunities than a free bachelor. First, you can count on participation in government programs. Secondly, there is a chance to receive maternity capital. Third, the total return is better than one

Inevitable Factors

Now, briefly about what you have to put up with from the very beginning. The premise is this: real estate is the most expensive commodity of all time. It goes to those who know the following conditions of reality:

- Purchasing any property requires capital. Not small.

- The amount of capital depends on the standard of living of the city where you plan to buy housing.

- Then lies the banal paradox of life: where housing is cheaper, there are no opportunities; where there are many opportunities, prices are exorbitant. Examples: Moscow, London, Singapore and notonly.

- The next condition is the presence of a stable and solid income. It's about mortgages. But given the standard of living in big cities, usually not every citizen's income covers the mortgage.

- Continuing the question of where to get money for an apartment, we come to the conclusion that it is necessary to expand our own capabilities.

- This could be your own business or help from your parents.

Can I save from my salary?

Yes, you can. Recently, The Village considered such options for all major cities in the world. The results are impressive. For example, if a typical Muscovite earns more than $8,000 a year after taxes, then he needs to set aside his wages for 15 years so that he can afford about 50 square meters. m outside the center.

But the British will have to wait even longer: with annual incomes of $34,000, they need to save that amount for 19 years. There is good news for residents of St. Petersburg: with incomes of $6,600 or more a year, they can buy an apartment in 10 years.

The question of where to get money for an apartment in such volumes is an individual task for everyone. Fortunately, the initial conditions are the same for everyone: doing business is encouraged, everyone has access to information. In the same way, you can study new technologies and directions in business.

Given the question originally posed, we can say that it is possible to accumulate wages to buy an apartment, only theoretically. In practice, this ventureyou can put your whole life in which there will be no place for rest, entertainment, or even the most necessary components, like clothes and food. It is much nicer to consider options on how to earn money for an apartment after employment opportunities are slightly expanded.

Mortgage

Mortgage is a great chance for those who have a stable income and big plans for the future. The essence of the procedure is simple: the buyer chooses housing, the bank pays off with the seller, and the newly-made homeowner pays off with the bank. Moreover, the calculations will take into account his individual capabilities: the monthly repayment is calculated taking into account the consumer basket for each family member and income level.

Mortgage is one of the main services of almost all banks in the country. And there are about 650 of them. This means potentially 650 financing options for each citizen, where he can borrow money for an apartment and return it with interest. And here the role of legalization of income and labor activity becomes clear: banks work only according to documents.

Interesting mortgage offers can always be found in the list of services of Sberbank, Renaissance Credit, VTB-24. Interest rates usually vary slightly - by 2-4%. The requirements are standard everywhere: the availability of initial capital - from 10% of the cost of housing, the availability of permanent sources of income and the ability to officially confirm these facts.

Government programs

Government programs provide financial assistance to certaincategories of citizens. If a citizen is wondering how to earn money for an apartment, then he should first of all enter the number of categories eligible to use government programs.

Today, there are several large-scale programs of federal significance. A vivid example is "Young Family" and "Housing". The Young Family conditions are as follows:

- The fact of marriage registration not earlier than 1 year.

- The age of the spouses is up to 35 years.

- Having children.

- Need for housing or better housing.

The same rules apply to the Housing Program. Assistance can be provided in the form of benefits and loans. The maximum amount in 2018 can reach 2.2 million rubles. You should also look closely at regional programs. Local programs may differ slightly from federal programs in terms of conditions.

For example, residents of St. Petersburg can count on the following types of assistance:

- It is customary to pay approximately 30,000 rubles for each square meter of housing.

- If the applicant participates in the federal program, he can count on support of up to 70%, 30% of which are allocated from the federal budget, the rest from local budgets.

- +5% per child.

- Any family will receive at least 40% of the cost of housing.

There are also joint programs implemented between government agencies and private banks. The leader in this industry, as well as in other types of financial services, is Sberbank. Money for an apartment in Sberbank is issued inan average of 7-8% rate. The participant must submit the certificate to the bank within 3 months from the date of receipt. On its basis, an account is opened in the name of the applicant. At the request of the bank, funds will be transferred to this account.

This account gives the right to attach own funds or maternity capital to this amount. The funds can be used to purchase housing or non-residential premises that meet the bank's technical and legal requirements.

To build or expand

Studying how to save money for an apartment in Moscow, you should not discount other housing options: building a private house or expanding existing housing.

In the first case, funds are allocated in the same volumes as when buying an apartment. The applicant has two options for receiving:

- Upon completion of construction, presenting all checks and receipts for the purchase of construction services and materials.

- Before construction begins, based on permits for the site and a service agreement with the contractor.

Money for an apartment from the state can be used to improve living conditions. For each region of the country there is an established norm of housing per person. The national average is at least 18 square meters per person.

If we are talking about a young family, then the living space should be at least 42 square meters. There are also criteria for living conditions: housing must have a utility area, communicationnetwork and should not be in an emergency state.

The applicant must notify the local municipal authorities of these facts. The representative must inspect the housing, draw up a technical specification and issue an opinion on the need to improve conditions. A complete list of documents is specified in local governments. The money received for an apartment for a young family should be used to repair an old one or to buy a more spacious home.

You should also look at the programs of private banks. For example, Sberbank is an active partner of the state in the implementation of the Housing program. According to the Decree of the Government of the Russian Federation, this program will be valid until 2020.

Banking programs involve issuing a loan for an apartment with lower interest rates. You can also achieve even lower rates if you become a corporate client of the selected bank, if you use salary projects, conclude an insurance contract or open a deposit in a bank.

It should be borne in mind that the programs apply not only to complete families, but also to families where there is only one parent. The child may be his own or adopted. The recipient parent in single-parent families can be either the father or the mother.

Where to get the initial capital?

To get a loan for an apartment or government assistance, you must fully meet the requirements. One of the important conditions for private banks is that the applicant has a down payment. Usually this amount starts from 10%. For example, if the property being purchased costs 6.5 million rubles, then the down payment must be at least 650,000 rubles.

There are several options for solving this issue:

- Participants of government programs can contribute a certificate for a subsidy.

- Certificate for maternity capital can also be used towards the purchase of housing. It is only necessary to check with the bank in advance whether it has accreditation for operations with government agencies.

- To borrow. At the same time, you need to remember that in the near future you will have to repay this debt in parallel with mortgage payments.

Purchase and lease option

Talks about how to save money for an apartment, and advice of this nature is often accompanied by offers to participate in dubious projects with a payback of 1 day and even with esoteric tricks like closing your eyes and constantly imagining that the apartment has already been bought. A plan with possible options is needed in order not to go far from the goal and not be drawn into dubious proposals. Real estate fraud is very common.

The following advice may be useful for those who still have a place to live, but do not have enough money for an apartment. Successfully implemented in large cities. The bottom line is that the buyer purchases a liquid property with the help of a bank, then rents it out for approximately the price that is close to the monthly mortgage payments. As a result, the apartment will be bought, and tenants pay for it. In this decision, the liquidity of housing is not in vain mentioned. She should be firstturn liquid for rent: convenient siding, interior and infrastructure.

There are risks associated with the cost of maintaining an apartment, the period of change of tenants, ongoing repairs and, most importantly, living somewhere during this period. But keep in mind that no financial transaction is risk-free.

Shared construction

Shared construction is widespread among persons belonging to one organization or one structure. The bottom line is that an apartment building is being built with common funds, which will eventually be provided for housing by all participants in shared construction.

Several persons can organize this option on their own initiative. The collected funds are used to purchase a plot and hire a contractor. Even construction companies can be the initiator. But reality knows too many cases when construction was not completed, and people could not return the money. Against such outcomes, a number of changes have been introduced into the legislation. Now contractors are required to have at least 10% of the total cost of the project in their authorized capital and insure personal risks.

In any case, you should carefully approach participation in shared construction.

Purchase by installments

The question of how to raise money for an apartment is relevant for millions of citizens of the country. In solving this issue, all legal methods are good. The help and support of loved ones can be a good help. If they can collect for the initial payment -that's great. If one of them can even help with advice or moral support, it is also worth a lot.

But it's best if someone from your circle agrees to sell housing in installments, because strangers very rarely agree to such a deal. And it's completely legal. The Civil Code spells out the procedure for processing such transactions.

The pitfall is that the cost of housing is set at the time of the transaction and must remain unchanged until the end. But the market is unstable. If prices rise, the seller may withdraw from the deal. If they fall, the buyer may regret. But in any case, the initiator of the termination of the contract will have to pay a pen alty if the transaction was carried out in accordance with all the rules of the law. From this point of view, the reliability of the parties is important in this matter.

Recommended:

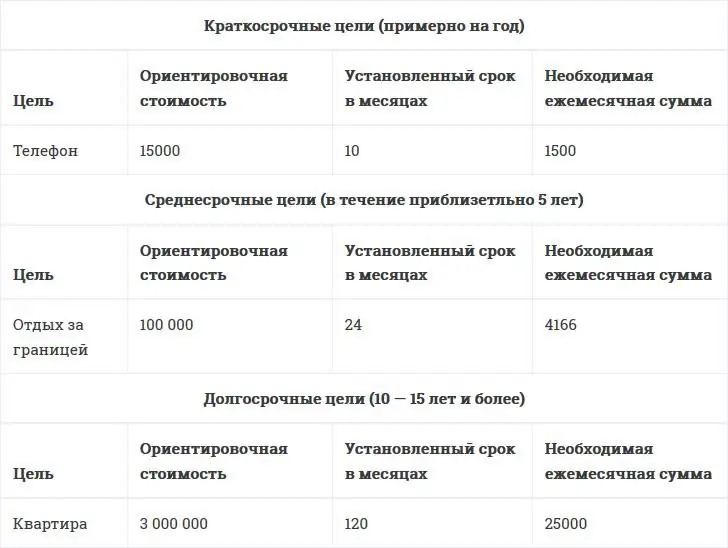

How to save money with a small salary? How to save correctly?

In addition to monthly expenses for utility bills, groceries and other expenses, I want to save up money for a long-awaited vacation, buying real estate or educating children. Unfortunately, not everyone succeeds, and some are so obsessed with savings that they cross the line on the path to outright stinginess. So how to save money with a small salary, while not infringing on the little things?

Small business problems. Small business loans. Starting a Small Business

Small business in our country is practically not developed. Despite all the efforts of the state, he still does not receive proper support

How to attract money: useful tips and signs

Every person who experienced certain material difficulties inevitably thought about how to attract money. But, as a rule, the matter did not go beyond lengthy reflections. Meanwhile, there are special monetary signs and rituals aimed at attracting capital. They will be discussed in our article

What is the difference between an apartment and an apartment? The difference between an apartment and an apartment

The residential and commercial real estate market is incredibly vast. When offering housing, re altors often refer to an apartment as an apartment. This term becomes a kind of symbol of success, luxury, independence and we alth. But are these concepts the same - an apartment and an apartment? Even the most superficial glance will determine that these are completely different things. Consider how apartments differ from apartments, how significant these differences are, and why these concepts should be clearly distinguished

Deposit "Save" (Sberbank): interest and conditions. What is the interest rate of the "Save" pension deposit in Sberbank of Russia?

Deposit "Save" is one of the most profitable deposit programs of Sberbank. There are higher interest rates for pensioners. Flexible partnership terms available