2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:30

Technical analysis of financial markets includes many models that can predict future price movements. The Head and Shoulders pattern is one of those. Despite its more than three hundred years of history, it is still a reliable tool.

Building a graphical model “Head and Shoulders”

The Head and Shoulders pattern came from Japanese candlestick analysis. It works regardless of the type of chart display. This pattern can be either bullish or bearish. In the case of a bullish pattern, it is called the “Inverse Head and Shoulders”. Japanese analysis calls the “Three Buddha Heads” pattern “bearish” and the “Three Rivers” pattern “bullish”.

Technical analysis answers the question: what is happening in the market at a particular moment in time, will the price reverse or will it continue to move? This model belongs to the first variant. There are several more similar reversal structures: “Three Peaks”, “Two Peaks”. They are also oftenmeet and form at the end of the trend.

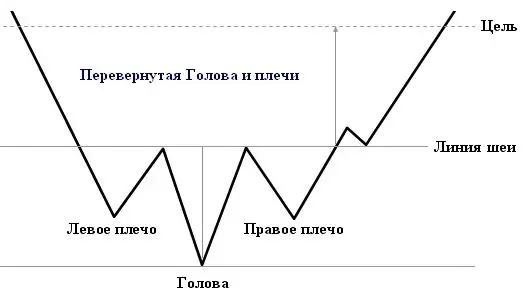

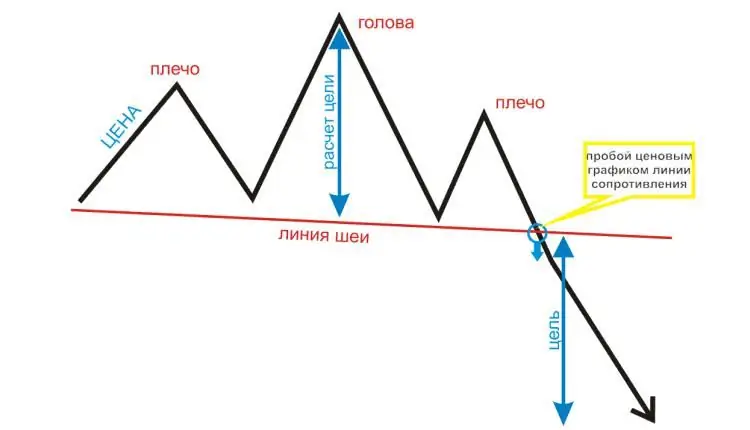

The “Head and Shoulders” consists of three dome-like price formations. Moreover, the middle one will be the highest - it is the head. The two vertices on the sides will be the shoulders. They are much smaller in size.

If you draw a straight line from the bottom of the first vertex to the bottom of the third, then this line will be called the "neck". It plays an important role in the rules of trade.

The ideal figure is when the shoulders are symmetrical, but in practice one of them is higher and wider than the other, and the neck may have a slope.

The “Head and Shoulders” technical analysis figure is considered formed if a straight line can be drawn on the chart.

Inverted pattern

The inverted “Head and Shoulders” is somewhat less common. It is also formed by three peaks, but directed downwards. This construction occurs after a long downtrend. Its construction is completely identical to the non-inverted model.

Pattern Features

When a Head and Shoulders pattern appears on the technical analysis chart, you need to pay attention to several points:

- There must be a long previous trend. Ascending for bearish and descending for bullish.

- The more pronounced the parts of the pattern, the more likely it is to work.

- Symmetry both in height and duration in time is also a good indicator.

- Model can beuse in trading only after the price breaks through the neck level.

- The higher the time frame, the more hope for this pattern. Cases below H1 should not be considered.

- Confirmation for this model will be a divergence, that is, a divergence between two lines: a trend line, drawn along the tops of the figure, and the second, drawn along the peaks of the histogram of MACD indicators or volumes.

The target that can be counted on when practicing the “Head and Shoulders” pattern is equal to the distance from the top point of the head to the base of the shoulders

Reasons for the pattern

The emergence of this model is due to the psychology of bidders. What does the Head and Shoulders pattern mean?

First, the price moves in a certain corridor, which forms a trend. This movement is long enough. And the longer, the more market participants begin to expect a reversal. When it approaches a strong resistance level, traders try to close long positions. The decrease in volume causes the price to pull back to support, which was resistance before. This forms the left shoulder.

However, not all market participants are ready to sell at the formed price. Seeing that it is not moving down further, traders re-open buy trades, forcing it to go up again. Seeing that the movement has begun again, latecomers jump into the “leaving train”. They do this at the moment when large players, on the contrary, begin to close long positions. The price stops rising and gradually decreases. Latecomersclose at a loss, panic sets in.

Here, at the biggest peak, there are no more volumes to buy, and since the level that has arisen is very attractive for sales, more short positions are opened. The price drops to the resistance line formed by the base of the left shoulder. It is not possible to immediately break through it, so the movement stops again. Head shaped.

A small group of players, encouraged by the stoppage, start opening buy positions again. But a small number of them cannot push the indicator above the level of the left shoulder.

When the price falls again to the resistance level, the sellers already understand that the market has rejected it, and it will fall. The right shoulder has formed, and a large number of players are entering the market who want to sell. With the arrival of large volumes, the price begins to fall rapidly, giving the opportunity to earn.

Pattern trading options

Trading the Head and Shoulders pattern can be conditionally divided into three options:

- classic;

- aggressive;

- conservative.

They have different approaches. Therefore, the degree of risk will also be different. Here we mean not the probability associated with the conclusion of the transaction, but whether this pattern will be worked out.

Aggressive trading

The aggressive method is to open a trade before the pattern completes its formation. At a time when it is still impossible to say for sure that there is a Head and Shoulders pattern on the Forex chart. As you know, shefinishes its formation only after breaking through the price level, which forms the neckline.

In the case of an aggressive approach, the deal is opened at the moment of the end of the growth of the right shoulder. The advantage of this method is a much larger amount of profit than in classical trading. The downside is a large stop loss. It will need to be installed behind the top, which is the head. That's quite a lot. The ratio of risk to possible profit decreases. In addition, since the figure is not fully formed, a reversal and continuation of the trend are possible.

Classic trading

Standard trade entry occurs when the price breaks the bottom of the Head and Shoulders pattern. In this case, stop loss is set above the upper level of the right shoulder, and take profit is placed at a distance equal to the height of the model pending down.

But there is another way to enter the trade. This method has the most minimal risks. Its essence is to enter not during the breakdown of the leverage, but on a retest. In this case, after breaking through, you need to wait for the price to return to the neck level. Then wait for it to push off, and then open a sell position. Although this method minimizes risks, there is a chance that the price will not retest the level, but will immediately start moving down.

Indicator for automatically finding the Head and Shoulders pattern

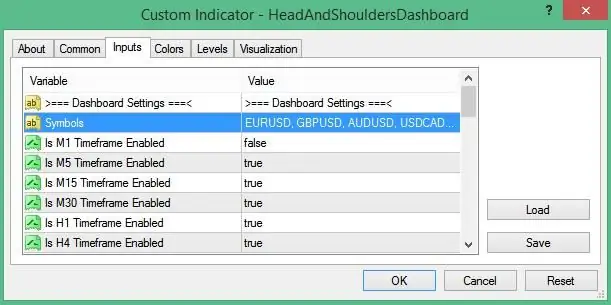

If at the initial stage it is difficult to identify such a technical analysis figure as “Head and Shoulders”, the Head & Shoulders Dashboard indicator will help you find it. He shows her on any temporarychart.

After installing the indicator in the trading terminal, it will display a table with the "Head and Shoulders" patterns on all instruments that are specified in the settings. That is, you can automatically track different currency pairs. By clicking on the selected instrument, the user will see a chart with the found pattern.

In the Metatrader 4 terminal, the indicator is installed as standard. In the "File" menu, you need to open the data directory. Select the MQL 4 folder in it. Find the Indicators folder in it. You need to unpack the indicator files there.

Indicator settings

After restarting the terminal, select the Head & Shoulders Dashboard in the navigator menu and drag it to the chart window. This will open the indicator settings dialog box:

- Symbols - list of available instruments;

- Is … Timeframe Enabled - a function that enables search on a given timeframe;

- Sort By - what criteria to sort by;

- Sort Type - distribution type;

- Price Proximity Percent - search accuracy setting;

- Fill Patterns with Color - how to display the pattern on the chart: with or without color filling;

- Display Head and Shoulder - Head and Shoulder display setting;

- Display Reverse Head and Shoulder - enable the display of the inverted model;

- Depth, Deviation, Backstep - setting related to the ZigZag indicator;

- Alert Title - alert title;

- Popup Alerts - a signal given when a new popup is foundpattern.

After the notification appears in the trading terminal, the trader's task is to determine where the indicator found the Head and Shoulders pattern. According to technical analysis, it can occur after a long trend. The movement must be at least 100 candles, regardless of the timeframe on which the figure is found. If the pattern originated in a price consolidation, then there is no reversal here. Accordingly, this situation is not considered as a trading signal.

Conclusion

The “Head and Shoulders” pattern is quite common in trading. But not every one of them should be considered as a source of a profitable trade. Any graphic design needs to be confirmed, as well as reinforced with additional signals. Then the risks associated with losing trades can be minimized.

Recommended:

Trading strategy: development, example, analysis of trading strategies. The Best Forex Trading Strategies

For successful and profitable trading on the Forex currency market, each trader uses a trading strategy. What is it and how to create your own trading strategy, you can learn from this article

Fundamental market analysis. Technical and fundamental analysis

Fundamental analysis is a set of methods that allow predicting events in the market or in its segments under the influence of external factors and events

The flag pattern in technical analysis. How to use the flag pattern in Forex

Technical analysis has incorporated a large number of repetitive patterns of price movement. Some of them have proven themselves better than others as a source of forecast. One of these models is the flag or pennant. A correct understanding of this pattern can be the basis for many profitable strategies

Technical analysis of "Forex" (market). What is the summary technical analysis "Forex"

The Forex market has become very famous in Russia in a short time. What kind of exchange is this, how does it work, what mechanisms and tools does it have? The article reveals and describes the basic concepts of the Forex market

Real-time technical analysis of the foreign exchange market: basics and tools

Technical analysis of the currency market is the basis from which you should start your acquaintance with trading. It is the analysis of the situation based on past price fluctuations that will make it possible to determine the priority movement of quotations