2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:39

Checks are different! Green and red…

This is not poetry. The check is generally the prose of life. If we exclude the meaning of the word "check" as a plot of cultivated field for growing rice, then the remaining meanings

of this English word the check means, strictly speaking, paper. Only papers called checks are different.

In dictionaries, for example, by Ozhegov, a check is, firstly, a security with an order from the owner of the money stored in the bank to give the bearer of the check an amount determined by the depositor. And secondly, a check is a receipt or coupon, which contains the amount received by the seller in payment for the goods by the buyer. That is, strictly speaking, a check is a document confirming the performance of any operation related to the circulation of funds.

About the memorable privatization checks in this article will not be discussed.

So what is a bank check? The English verb to checker is translated into Russian as “graph, graph”. If anyone remembers, there was such an instrument for counting - an abacus, which is a graphed board. This tool gave its name to what is now called a bank check. A bank check is a payment document.

Actually, we have a certain idea of what a bank check is. At least according to Hollywood films, where brutal handsome men, smiling white-toothed, take out an oblong book from the inside pocket of their jacket, write something on it, then tear off a piece of paper and give it to some store clerk. And he, smiling gallantly, presents a box with some kind of jewelry to the coquettish companion of the check drawer.

In Russia, such forms of settlements between individuals and legal entities are not common. But many organizations have checkbooks for getting cash from the bank. They are kept under the key of the chief accountant and filled in by one person.

And what is a cash receipt like a receipt? And why are they sometimes called

fiscal? Actually, everything is simple: you buy a product, pay money for it, and in confirmation that this product, which was the property of the store until the moment of purchase, has now become your property, you receive paper in your hands - a cash receipt. This paper is all covered with numbers and letters, some of which are mandatory properties for a cash receipt, and some are optional details. A fiscal check is a cash receipt with signs of a fiscal regime. Signs of the fiscal regime - this is a mandatory attribute of a cash receipt.

The word is - fiscal - put into useRussian inhabitants still Peter the Great. There was an institution of fiscals under him, whose duties included the implementation of secret administrative-financial and judicial supervision. It is clear that Peter did not come up with a good life to follow the treasury in this way, but we have what we have: he himself did not keep track, and he left this practice to us as a legacy. Fiscal mode when using cash registers ensures the registration of fiscal data in a special device - the fiscal memory of the cash register. That is, for the correct taxation of the organization selling the goods to us, it is necessary to carefully record the volume of its sales. This is what the cash tape is designed for, on which cash receipts with fiscal data are printed.

Recommended:

How to check an account with Sberbank: hotline, Internet, SMS and other ways to check an account and bonuses

Cash is slowly but surely becoming a thing of the past, becoming part of history. Today, payments in almost all spheres of life are made using bank cards. The benefits of such changes are clear. One of the most important is a convenient service that allows you to receive information about the status of your account at any time. Let's consider this possibility in more detail on the example of the largest participant in the Russian banking system. So, how to check an account with Sberbank?

How to check an organization: ways to check firms

Why is it necessary to check the activities of the organization? Firstly, it allows you to identify unscrupulous partners or customers, cooperation with which can cause financial damage to the company. Secondly, the risks of participation in court proceedings both as a plaintiff and as a defendant are reduced. Thirdly, claims from the tax authorities in the absence of due diligence are prevented. This eliminates the possibility of additional taxes

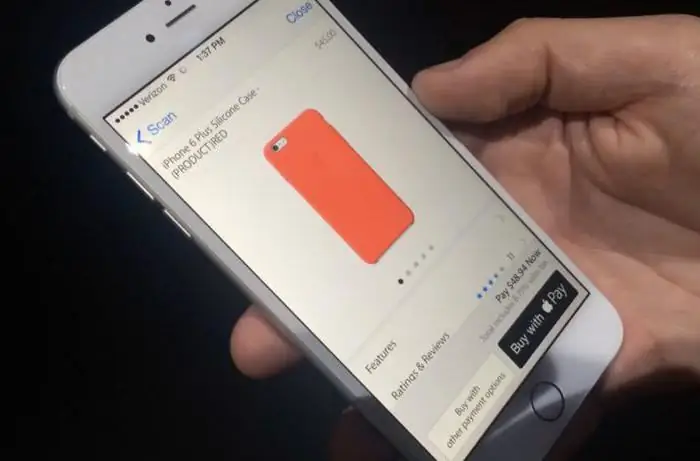

How to pay by phone in a store? Pay for purchases by phone instead of a bank card

Modern technologies do not stand still. They develop so fast that many people simply do not have time to understand them

How to check a Sberbank card: by number, phone, SMS and other ways to check the balance and the number of bonuses on the card

More than 80% of Sberbank customers have plastic cards. It is easy and convenient to use them, besides, they allow you to save time when performing transactions. To always be aware of the amount of funds on a credit card, you need to know how to check a Sberbank card

Financial educational program: credit operations of commercial banks

Today more and more commercial banks are making themselves known. The lending operation is in demand and in demand. There is nothing surprising in this, because this system is beneficial for both financial institutions and customers. What is meant by credit transactions? This will be discussed in the article