2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

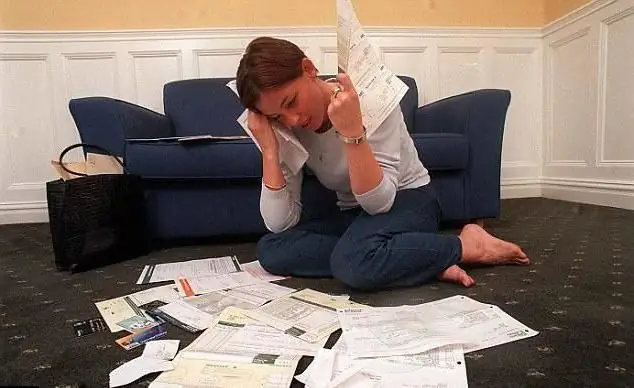

Knowing how to find out your bank debt on loans by last name in the coming year, you can eliminate the likelihood of not only falling into debt pits, but also the occurrence of other undesirable consequences. Surely, many Russians at least once in their lives turned to banking institutions for help to get money on credit. Along with this, not everyone managed to pay off their obligations within the specified period. We will learn how to view the loan debt below.

What prevents you from repaying your loan on time?

This largely depends on the current difficult economic situation that has developed in the country in recent years. Numerous sanctions significantly cut the income of the population, because of this, many in the first place is not debt repayment, but the desire to stay afloat. At the same time, it should be remembered that the presence of a delay in a loan may entailnumerous consequences, which makes it advisable to check the presence or absence of debts to the financial structure on a regular basis in order to eliminate further misunderstandings.

General points

The presence of credit debt for Russian citizens can lead to a large number of consequences, the main ones are considered to be:

- Measure for accrual of fines and pen alties.

- Implementing the arrest of collateral.

- Appeal to the court to enforce the recovery of funds on the loan.

It is necessary to pay attention to the fact that such consequences may be caused by the presence of a delay in making monthly mandatory payments. In order to prevent the possibility of falling into a debt hole with the ensuing legal consequences, it is very important to check the existence of obligations to certain creditors on a regular basis.

How can I find out if there is a debt on a loan by last name, for free?

Many borrowers are interested in the question of how to view loan debt by last name and date of birth online. If only such information is available, citizens cannot obtain the relevant information, unless the bank has applied to the judicial authority for the purpose of enforcement. This is due to the fact that such information is classified as confidential and is not publicly available.

Where to go

Simultaneously see the debtfor online loans, you can use your last name if you contact:

- To the Credit Bureau.

- On the website of federal bailiffs.

In the latter case, you can find out the data only if there is a running office work. Below are several options for where to view loan debt.

Credit Bureau

It is necessary to pay attention to the fact that the BKI provides information regarding:

- promissory note on a loan, in particular the amount, dates of registration and the like;

- credit lines for financial institutions in general.

Such information is subject to automatic verification. How to view loan debt using the BKI service? Citizens residing in Russia reserve the right to make an official request:

- via registered mail;

- by completing an online application.

Additionally, they provide for the possibility of personal contact at the address of the position of the type of institution in question. In any case, official requests must include the following information:

- email address;

- mobile number;

- passport data in the form of full initials, series and number of the identity card, as well as when and by whom the corresponding document was issued.

It is necessary to pay attention to the fact that information on the amount of debt obligations in the BCI is free of charge once a year. Registration on the siteconsidered mandatory. Along with this, today there are several varieties in the country, namely: the national one, which is referred to as "NKBI", the joint organization ("OKI") and "Ekvifans".

It is necessary to pay attention to the fact that, as part of obtaining a detailed picture of the circumstances, it is recommended to form appropriate requests simultaneously to all organizations under consideration. In case of any misunderstanding, you can ask the support service on the official portal of the department with your questions.

Bailiffs

This federal body provides Russian citizens with the opportunity to find out information about the availability of obligations assumed in accordance with signed loan agreements. Where can I see the debt on loans with the help of the bailiff service? You can initiate a check using a specially designed service, which is located on the official portal. This type of verification, as a rule, takes no more than a few minutes, as a result, you can find out specific information. In 2019, the mechanism of action through this body is as follows:

- Initially sent to the official portal at fssprus. en.

- Go to the main page of the corresponding site. Here you need to select a specialized subsection called "Learn about personal debt."

In the window that opens, indicate the full initials of the applicant along with the structural unit of the service and the region of residence. After that, you need to click on the "Find" option. Based on the generated request, the user is provided with a created table in which you can view the debt on the loan, which details the year of birth of the debtor along with the place of his permanent or temporary residence and a specific description of the existing debt, including outstanding loans.

It is required to pay attention to the fact that when identifying personal information in the list provided, it is possible, if there is a desire, to pay money instantly online. To do this, it is enough to click on the button called "Pay".

Handling the passport to the bank

Another convenient solution, which is quite simple, is considered to be a personal visit to a financial institution in which a loan agreement was previously signed in order to confirm or refute existing debt obligations.

As part of the implementation of the task, it is required to provide an all-Russian passport or another document that identifies the person is suitable. After that, they make a request for a credit rating. Next, we will figure out how to view the loan debt in the most popular financial institutions today.

How to find out debts via the Internet on a loan from Sberbank?

The fastest way to find out debts on your own loans is offered on the official website of a financial institution. It is not at all necessary to remember the portal address and the path tothe necessary item, any search engine, upon request, will provide the necessary link to the instruction on loans of this institution. In order to view the loan debt at Sberbank, you will need to log into your personal account of the Sberbank-online service.

For those who have not yet mastered the benefits of remote access, the site has a detailed step-by-step guide. In fact, access through a personal account provides tech-savvy customers with the greatest freedom of access to credit personal information.

At Home Credit Bank

When you need to find out the credit debt in this organization, you can contact a bank employee by coming to the nearest branch with a passport. But the easiest way is to call the call center and ask the operator all your questions. By phone, you will be able to independently find out the amount using the special “mobile bank” service by dialing the card number and a special TPIN code. You can get it by calling the toll-free hotline.

You can view the debt to the Home Credit Bank through your personal account using online banking. But for this, a person must connect to the corresponding service by filling out an application, in addition, by signing the required agreement at the office of a financial institution. Only under this condition will the client have access to a function called "online assistant" on the site. Thanks to her, you can find out the debt on credit loans.

OTP bank

In the event that the borrower has activated the service undercalled Internet banking, then he will be able to see the loan debt in OTP Bank directly in his personal online account. To do this, you need to go to the section called "Credit" and select the "Detailed information on the loan" option, where the account balance will be indicated.

Borrowers can find out the debt by contacting the call center. In the event that a consumer loan was issued in this organization, then you need to call the numbers listed on the company's website. Customers can use the interactive menu (by pressing the appropriate key and following the prompt to enter the card or contract number), or wait for the operator. Another way to clarify the balance of the loan debt is to visit the OTP bank branch. Borrowers need to bring their passport with them.

At Tinkoff Bank

In order to view the loan debt in Tinkoff, find out the amount for the next payment along with the amount of the debt and the date, you need to go to your personal account directly in the Internet banking system. To do this, you need to log in, then go to the section called "Accounts", and then click on the page "Credit cards". Then the desired product is selected, after which they click on the "Account Details" option. Now requires the "Currently" mode. As a result of all the manipulations performed, relevant information will open. Among other things, you can always call the support service.

Can I find out if a deceased person has debts?

Potential heirs reserve the right to check the credit rating and can find out information about the loan debt of the deceased debtor. How to see the loan debt in this case? To do this, you must have:

- passport of a potential applicant;

- official confirmation of the death of a relative;

- a will, which must be properly drawn up, or a court decision regarding inheritance.

Why initiate a debt check of deceased persons? Accrued interest with pen alties and pen alties after the death of the borrowers still continue to accrue. Before accepting the inheritance mass, it is necessary to clarify what debt the deceased citizen has in financial institutions.

During the period when the representative of the notary service will read the will, according to Russian law, it is possible to make a decision on the rejection of the problematic estate. In this case, the bailiff service has no legal force to force the heir to repay the debt.

Recommended:

Purchase of debt from individuals and legal entities. Buying property with debt

What is buying and selling debt? Features of the purchase of debt under the writ of execution. Cooperation with collectors. Purchase of debt from individuals and legal entities. What to do if you bought an apartment with debts?

Debt sold to collectors: does the bank have the right to do so? What to do if the debt is sold to collectors?

Collectors are a huge problem for many. What to do if the bank has contacted similar companies for debts? Does he have the right to do so? What will be the consequences? What to prepare for?

Loan repayment methods: types, definition, loan repayment methods and loan payment calculations

Making a loan in a bank is documented - drawing up an agreement. It indicates the amount of the loan, the period during which the debt must be repaid, as well as the schedule for making payments. The methods of repayment of the loan are not specified in the agreement. Therefore, the client can choose the most convenient option for himself, but without violating the terms of the agreement with the bank. In addition, a financial institution can offer its customers various ways to issue and repay a loan

Car loan or consumer loan: what is more profitable? Which loan to choose: reviews

According to statistics, the average cost of a car in Russia reaches 800,000 rubles. It is worth emphasizing that this figure may vary depending on the region. At first glance, it is clear that it is impossible for a simple layman to earn such money even in a year. As always, credit organizations come to the rescue. Often the population asks the question: "Car loan or consumer loan, which is more profitable?"

How to repay a loan with a loan? Take a loan from a bank. Is it possible to pay off the loan early

This article helps to deal with the refinancing agreement, which is one of the most successful loan repayment options