2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

Now we have to figure out how to pay the transport tax. And in general, we will discuss everything related to this payment. After all, every citizen should know not only what a particular pen alty is, but also have an idea about the calculations, as well as the procedures for paying payments. Don't forget about beneficiaries. After all, not everyone pays the tax on transport. Either someone is exempt from it, or has a pay benefit. All this should be taken into account. And only then think about how to pay the transport tax.

What is

What do you have to deal with? What is a transport tax? It is necessary to know. After all, not every citizen pays such contributions to the state treasury. But only those who own this or that vehicle.

So, the transport tax is an annual contribution to the tax authorities for registering a vehicle (with an engine) in the traffic police. This payment does not apply to those who have bicycles, skateboards, snowboards and so on. The transport tax has a regional character. And, as you might guess, it is installed in every region inindividually. The tax code is not regulated. Benefits are also determined for the transport tax in each specific subject. But there are also general rules. Both regarding settlements (rates), and regarding beneficiaries.

Who doesn't pay

Should I pay transport tax? The answer to this question is unequivocal: yes. But there is no need to rush. First you have to understand who is exempt from it. And only then, classifying yourself in one or another category of citizens, deal with this issue.

Veterans and the disabled are among the beneficiaries. The military who took or are taking part in hostilities can also be classified as special citizens. Heroes of the Soviet Union should not be forgotten. These categories of citizens are completely exempt from paying transport tax. They don't have to think about how to pay for it at all.

In addition, large families are also exempted in most cases from this pen alty. Only people must have at least 3 minor children. Learn it. All other citizens can think about how to pay the transport tax.

Pensioners

A separate item in our today's question is pensioners. The thing is that in Russia, older people are among the beneficiaries. Therefore, they often wonder if they need to pay a fee for the vehicles they own.

This question is not so simple. First, pensioners are rarely completely exempted from paying. Instead, they are given an exemption. For example, if inthe property has 2 or more vehicles, the elderly person only has to pay 10% of the total.

In addition, in some cases, the transport tax is not applied to people who have gone on a well-deserved rest. Citizens of retirement age who own low-powered cars and other means of transportation are completely exempted from paying this contribution. The exact data should be found in your region. Typically, engine power varies from 70 to 150 horsepower.

For settlements

Transport tax for individuals is always different. It depends on many factors. It has already been said that this payment belongs to the regional ones. Therefore, when calculating the amount, the city of residence will be taken into account. What will help you figure out how much the transport tax will be in a particular place?

First, you need to know the tax rate. It is determined by the characteristics of your vehicle in each region. The role is played by engine size, year of manufacture and ecology of the class.

Secondly, you need a tax base. It is also called horsepower. The more of them the transport has, the higher the tax will be. The data is indicated in the TCP.

Thirdly, the transport tax rate is calculated based on the time of car ownership. It is important. After all, for some calculations it is required to select certain formulas. About them - a little later.

The last thing that might come in handy is a multiplier. Has room forexpensive vehicles. Appears only when the cost of the car exceeds 3 million rubles. You need to find out the coefficient in each region.

Formulas

How can I pay the vehicle tax? Before addressing this issue, it is worth having an idea about the calculations thereof. After all, no one wants to pay. Just like underpaying. Both in the first and in the second case there are problems with the law. And, as you might guess, no one needs them.

How much will the transport tax be in this or that case? You will have to turn to special formulas for calculations. Just keep in mind: first you need to get all the data on tax rates and other components for your region. After all, as already mentioned, our today's tax depends entirely on the area of residence. In fact, not everything is as difficult as it seems.

The standard formula for determining the exact amount is when the vehicle tax rate is multiplied by the number of horsepower. It is from these data that we will have to build on.

But for cars owned less than a year, there are rules. To get the exact amount you have to deposit, the standard calculation formula is multiplied by the months of ownership divided by 12.

Luxury cars also have their own formulas. More precisely, one. The standard formula is simply multiplied by the multiplying factor. And it turns out the amount that the taxpayer must pay. When it comes to luxurya car that has been owned for less than a year, you will have to slightly change the settlement system. How exactly? Take the vehicle tax formula if you've owned it for less than a year and then multiply by the multiplier. Nothing difficult or special.

Terms and Orders

So we figured out how to calculate the transport tax. The terms of payment, as well as the order of this process, should not be surprising. After all, there is one rule for all taxes - you are limited by the reporting period.

It lasts until April 30th. Of course, the sooner you pay, the better. It is not worth delaying this process. As soon as you receive the appropriate payment, try to make the payment as soon as possible. Make it easy. Especially with modern features. How to pay transport tax? Let's try to figure it out.

Bank

The first option is the simplest and most familiar. But it is not very convenient for most modern people. It's about paying with a bank. You will need to take the details of the tax authorities, just in case, documents for the car, without fail a passport. TIN and SNILS will not be superfluous either.

Next, with the payment received, go to any bank, hand over your identity card and account for payment. Deposit cash into the cashier, receive a check and keep it. The process is over. Only, as already mentioned, not all citizens recognize it. Moreover, now the Internet and cashless payments are in great demand. And it's a sin not to use it.

Public services

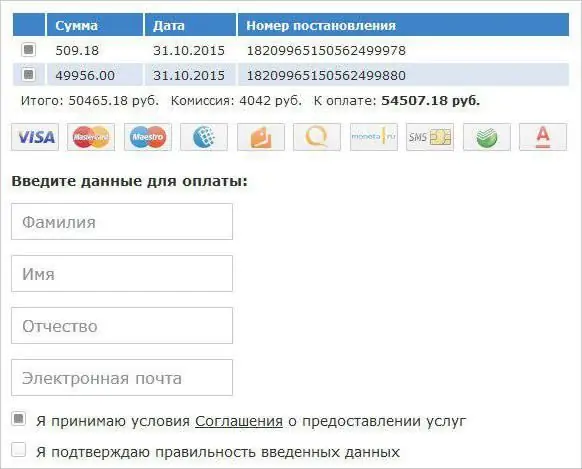

For example, if you are thinking about how to pay the transport tax, the "Payment for public services" service is suitable. Here you need to find the "Taxes" section. Next, you will be able to search for possible payments. The main feature of this service is that you can immediately see what debts you have.

Enter your TIN in the appropriate field, then select "Transport Tax". If you've already paid a fee, it shouldn't be there. Now it remains to fill in the data about yourself and about the transport, if there are empty fields. And enter the payment amount (sometimes it is entered automatically).

Everything is almost ready. It remains to choose a calculation method. Suitable "Bank card". After clicking on the appropriate button, new fields will be available for you to fill out. They are directly related to your bank card. Enter whatever is required and confirm the operation. You can print a check. By the way, payment is made in the same way using Internet services such as Sberbank Online.

In the tax office

Another option that will help answer how to pay the vehicle tax is nothing more than filing all documents with the tax office in your area. Now there are separate cash desks where everyone has the right to pay.

The process is no different from the actions in the bank. Unless you, most likely, will be asked for the title and data about the car. This practice is very common. That'sall. Now it is clear how to pay the transport tax.

In addition to the above methods, you can use ATMs and payment terminals. Insert bank "plastic" into them, select "Payments and transfers", "Search for a recipient by TIN". Next, enter the details of the tax office, select "Transport tax", print the required data (your TIN may not be written, but it is better to indicate it), and then confirm the payment. That's it.

Recommended:

Transport taxes in Kazakhstan. How to check transport tax in Kazakhstan? Deadlines for paying transport tax in Kazakhstan

Tax liability is a huge problem for many citizens. And they are not always resolved quickly. What can be said about the transport tax in Kazakhstan? What it is? What is the procedure for paying it?

Transport tax in Bashkiria. Vehicle tax rate in 2014

Transport tax is everywhere. And in Bashkiria too. How much and how will drivers have to pay in 2014? Is it possible to evade this tax?

Tax rate for transport tax. How to find the tax rate for the transport tax?

Today we are interested in the tax rate for transport tax. And not only it, but in general taxes that are paid for the fact that you have this or that means of transportation. What are the features here? How to make calculations? What is the due date for paying transport tax?

How to pay taxes online. How to find out and pay transport, land and road tax via the Internet

Federal Tax Service, in order to save time and create convenience for taxpayers, has implemented such a service as paying taxes online. Now you can go through all the stages - from the formation of a payment order to the direct transfer of money in favor of the Federal Tax Service - while sitting at home at your computer. And then we will take a closer look at how to pay taxes online easily and quickly

How to pay transport tax through "Gosuslugi"? Pay taxes online, through a bank

How to pay transport tax through "Gosuslugi"? In truth, this issue worries many modern citizens. After all, you don’t always want to stand in line at the bank for a long time in order to pay off the state. Sometimes online payment is much faster and more convenient. Fortunately, this possibility officially takes place. Now we will try to understand how to pay the transport tax through the "Gosuslugi" or in any other way