2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:29

In today's world there are enough rich people who do not know where to spend their money wisely. Someone just lives for their own pleasure, doing nothing, but there are those who invest their finances in the development of their own business. One of the most difficult, but profitable areas in business is the banking sector. To start working in it, in addition to impressive capital investments, you need extensive experience in the field of financial services and the availability of special knowledge. As practice shows, it is quite difficult to open a credit institution, and even more difficult to successfully manage it. According to statistics, many companies close a few years after opening. Nevertheless, successful entrepreneurs continue to wonder how to open their own bank in the Russian Federation from scratch. The step-by-step instructions given in this article will help you with this.

Classification of credit institutions

So, you have clearly decided for yourself that you want to do exactly thistype of activity, and also you have a large start-up capital. However, before we figure out how to open a bank in Russia from scratch, let's look at the main formats of this kind of business.

Lines of activity for today can be as follows:

- Market banks. They specialize in establishing and maintaining relationships between various financial institutions. The main part of the assets in this case is formed from the financial resources of other credit institutions. Earnings with this format of doing business consist in performing speculative transactions, for example, investing in stocks or bonds.

- Credit banks. As you might guess from the name, they provide consumer cash loans.

- Settlement financial institutions. Provide services to we althy clients and manage their funds.

- Retail banks. The most numerous group, combining a little from each organization discussed above. Their advantage lies in versatility and versatility.

Thus, if you want to have your own bank, you first need to decide on the format in which it will operate. Qualified financiers with extensive experience in the financial sector say retail organizations are the best option.

Legal

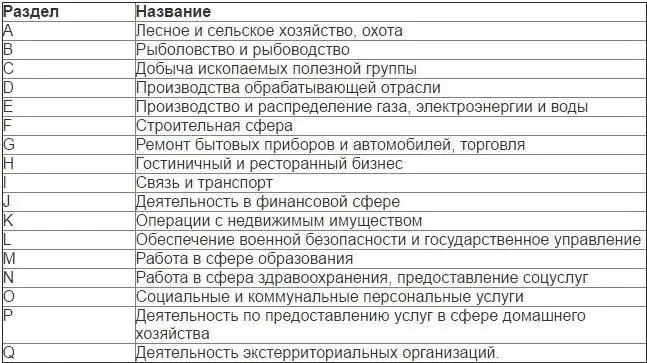

Let's take a closer look at this. As is the case with any other type of business, the implementation of a financial services project beginsfrom registration. This raises a completely logical question about what documents are needed to open a bank. It should be noted right away that for this kind of companies, the standard form is an open or closed joint stock company. As for the classifier of all-Russian products, you should select the type of activity "Financial services, except for insurance and pensions."

After all legal formalities are settled, you will need to submit information about the credit institution and its full name to the Main Territorial Administration of your region of residence. This is a very important step, because without a written agreement there is absolutely no point in obtaining a license to provide banking services.

Answering the question of how to open your own bank, a few words should be said about the authorized capital. To obtain a license, you must have at least 300 million rubles in free float at your disposal. When you have a written agreement in hand, you need to submit information to the Central Bank of the Russian Federation. It is he who decides whether to allow or prohibit the opening of a credit institution. If your project is approved, then information about the new company is transferred to the tax office, which will enter it into the credit register. Once this happens, you will only have 1 month to deposit funds into the share capital account.

As for the package of necessary documents, it includes:

- Statement.

- List of founding documents.

- Business planbank opening.

- Minutes of the constituent assembly.

- Receipt of payment of government fees.

- Copy of document certifying state registration.

- Questionnaires of employees holding managerial positions.

- An independent company's opinion on the conformity of financial statements with reality.

- A package of documents required to obtain an opinion on compliance with the basic rules when making cash transactions.

- Document issued by the Federal Antimonopoly Service.

- Written consent to open a new credit institution.

- Full list of all founders.

The package of documents is standard regardless of what bank format you open. To speed up the process of launching an institution, it is recommended that you take its preparation very seriously, as it requires a lot of time.

Possible list of services

You already know what documents are needed to open a bank, as well as the procedure for implementing the project. Now you must determine for yourself the main direction for the activity. The main goal of any financial organization is to increase income.

The following methods exist for its implementation:

- Increasing customer base.

- Expanding the range of services provided.

- Increase in market share.

The level of competition in the banking sector is very high, so it will be difficult to scale the business. Based on this, the onlythe way out is to provide as many services as possible.

Among the main ones are:

- Advice on any financial matters.

- Cash flow management.

- Broker service.

- Management of clients' investment portfolios.

- Insurance services.

- Completion of trust, leasing and factoring operations.

Having determined for yourself the main working points, you can start looking for an answer to the question of how to open your own bank. The step-by-step instructions that we consider in this article will help you do everything quickly, as efficiently as possible and without unnecessary problems.

Search for premises

Answering the question of how to open your own bank from scratch in Russia, it is worth talking separately about the optimal property in which it will be based. An ordinary office is not suitable for the successful operation of a financial institution, as they are responsible for the following functions:

- Customer service.

- Cash transactions.

- Storage of a large cash and material stock.

Based on this, it follows that the premises must meet a number of criteria that must be taken into account at the stage of building an object and performing repair work. Exterior and interior decoration should be designed in a corporate style, and the layout should be carefully thought out and divided into zones. In addition, the building should be technically strengthened, as well as equipped with all modern securitymeans and systems responsible for creating a high level of security.

If you have no idea how to open a bank, the requirements that must be met can be found on the website of such structures as the Central Bank of the Russian Federation, the Ministry of Internal Affairs, the fire inspectorate and Rospotrebnadzor. Each organization has its own criteria for assessing the suitability of the premises in which the credit institution will be located, therefore, it is necessary to carefully study all the regulatory documentation.

Materials

If you are thinking about how to open your own bank, you should be aware that you will have to work with very large amounts of money every day. This will require specialized equipment and a powerful material and technical base. With it, you can quickly and accurately count cash, sort banknotes by face value, and also check their authenticity. There is a wide range of both individual devices and multifunctional devices on the market. In addition, you can not do without ATMs, which should be located in various areas of the city.

Staff

Above, it was described in detail how to open your bank from scratch. However, for its normal and uninterrupted functioning, as well as high-quality customer service, you need to create a team of qualified specialists. The provision of any financial services is a very responsible occupation that requires maximum concentration and responsibility from employees. Therefore, you must be very serious about hiring andstaff training, since even the slightest mistake can lead to large financial losses. Particular attention should be paid to the search for employees for leadership positions, since the effectiveness of the entire organization depends on them.

The organizational structure of the bank is determined by its charter, which should contain detailed information about the governing bodies. The highest level is the shareholders who meet at least once a year to resolve the most important issues and determine the company's further development policy. In addition, you will need to form a qualified staff of workers. How to open your own bank so that it works efficiently and consistently generates big profits? To do this, you need to form the following units:

- Credit and audit departments. The first is developing new products, and the second monitors the performance of the financial institution.

- Planning department. Commercial planning, economic performance studies, marketing campaign, public relations, and increasing the liquidity of the enterprise.

- Management of depositary operations. Work with clients who wish to open a bank deposit, manage securities transactions and issue money into circulation.

- Credit management. Issuance of short-term and long-term cash loans.

- Managing international operations. Placement of deposits in foreign currency.

- Accounting and operational management. Carrying out and recording transactions carried out throughcheckout.

In addition, the economic and administrative, accounting and legal departments, as well as the personnel service, are also mandatory. Now you have a detailed idea of how to open your bank in Russia. However, here every entrepreneur has a question about how much it will cost to develop and launch a project. The amount of initial investment required will be discussed below.

Starting capital

Let's look at this aspect in more detail. If you decide to open a bank, you should begin to draw up a business plan even before registering and obtaining all the necessary permits. This will make it possible to realistically assess the required financial resources and the feasibility of investments. As mentioned earlier, the minimum authorized capital is at least 300 million rubles. In addition, about two hundred more will be spent on the organization of offices, the creation of material and technical equipment, the development of a security system and the hiring of personnel. It is very difficult to name the exact amount, since it depends on the scale of the business, however, indicative figures are as follows:

- legal registration - 50,000,000 rubles;

- authorized capital - 300000000 rubles;

- rent and renovation of premises - 50,000,000 rubles;

- purchase of equipment and office furniture - 70,000,000 rubles;

- marketing - 500,000 rubles;

- associated costs - 30,000,000 rubles

In total, it turns out 500.5 million rubles. This is the minimum amount without which to talk aboutopening a bank just doesn't make sense. If you do not have these funds, then you can think about attracting additional sources of financing or organizing a credit union.

Timing to break even

Recoupment depends on many factors, the main ones being the financial situation in the city and the state of the country's economy. However, according to experts, with careful strategic planning and good advertising, the funds invested in opening a bank fully pay off in an average of 5-10 years. Such a long period is due to the high level of competition in this niche.

General tips and tricks

So you know how to open your own bank. Are there any ways to make it work as efficiently as possible? To compete with other financial institutions, you must do the following:

- Build a well-developed infrastructure.

- Develop several loan and depository products with favorable interest rates.

- Do not charge for service and extras.

- Build a large staff of skilled professionals to serve customers as quickly as possible.

- Create a convenient and highly secure online banking experience.

- Install enough ATMs.

In addition to all of the above, you must constantly work on the reliability of your financial institution, since this particularthe indicator is of most concern to depositors.

Conclusion

Undoubtedly, opening a bank is a very long and complicated process that requires large financial investments. However, as statistics show, credit institutions consistently earn, regardless of seasonality, the state of the economy and other factors, so this niche has always been and remains attractive for investment. If you have the required amount of money at your disposal, then feel free to open a bank, and you will not regret it.

Recommended:

How to open a summer cafe: step by step instructions. What do you need to open a cafe

The experience of seasonal entrepreneurship can be a good foundation for future business in this area. Even if you can’t make a lot of money in a short time, you can catch the main components of this business

How to open your own taxi from scratch: a business plan, the necessary package of documents, investments and profitability

Opening your own business, no matter what direction an entrepreneur chooses, is not an easy task. Organization of your business requires you to think through everything literally to the smallest detail, which will allow you to minimize risks in the future

How to open an IP in Moscow on your own: step by step instructions

Eleven stages of opening an IP: choosing a registration method, choosing the name of your business, determining the place of registration, choosing the necessary OKVED codes, filling out an application for registration, paying a receipt for state duty, choosing a tax regime, issuing a TIN, the composition of the necessary package of documents, the nuances of submitting documentation, obtaining ready-made copies of papers in the Federal Tax Service

How to sell an apartment on your own and through an agency: step by step instructions

Many people who want to sell real estate think about how to properly sell an apartment. The article describes how the process is implemented independently or with the help of an invited intermediary. Describes the nuances of selling an object in installments or using a mortgage loan by the buyer

Where and how to find out the amount of the funded part of the pension? Step by step instructions, required documents

The part of the pension that can be accumulated was first discussed in 2001. It was at this time that there were changes in the legislation regarding the pension business. Such concepts as basic, funded and insurance pensions appeared. At the same time, each separate part is financed separately from each other from different sources of cash receipts. Let's talk about how to find out the amount of the funded part of the pension