2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:32

What is such a financial instrument of enrichment as a deposit-backed currency option? What features exist here? What should you focus on when making deals?

General information

Let's get some terminology out of the way. What is an option? This is a kind of contract that allows you to exchange one currency for another if the deal is winning, and abandon it if it is not profitable. In this case, you can act according to two schemes: "call" (call) and "put" (put). In the first case, it is possible to purchase a predetermined amount of currency on a specific day and at a predetermined price. "Put" provides for the sale on the same terms. Deposit-backed currency options are offered by banks to their clients. They represent a carefully organized financial and investment product. It includes such instruments as a currency option and a deposit. Why is such a product offered at all? Thus, banks give their customers the opportunity to earn a higher percentage than is offered by conventional deposits. But along with thisyou need to understand that savings are also subject to currency risk.

About the benefits

A standard currency option has the following advantages:

- The opportunity to receive more significant income than under the terms of a simple deposit.

- Flexible choice of term, currency pairs, rate and profitability.

- Short placement period, typically up to three months.

- Possibility of remote registration.

Who is this good for?

Holders of cash savings, assets and liabilities, who have their own vision of how rates will develop, can try options on currency pairs. Of course, if they are not afraid of risks. When choosing this type of investment, it is necessary to give preference to the base and alternative currency pairs, a carefully chosen placement period, as well as the exchange rate. What should be invested in? The base currency is used for this purpose. But it can be converted into alternative funds according to the previously set rate. The income received from this transaction is an option premium. It is formed from the difference in exchange rates. The market for currency options is quite developed, so if you want to find a niche that suits you, it is not difficult.

What do you need to do to make money?

Suppose the reader is interested in a currency option transaction. What do you need to do to participate in it? On the day of registration of the option follows:

- Place a certain amount inpre-selected base currency. As such, the Russian ruble, euro, US dollar, British pound sterling, Chinese yuan or Swiss franc are most often used. Options may vary slightly between financial institutions.

- Second currency is selected.

- The placement period is set. Typically, a range of seven to ninety days is available.

- The exchange rate is negotiated, as well as the premium for the currency option. Remember that the larger the amount you claim, the higher the risks.

When the day of defining the option comes, then there are several options for further action:

- If the exchange rate is less profitable or equal to the one determined at the time of the conclusion of the contract, then on the day of return the person claims to receive the amount of his investments, interest on the deposit, as well as an option premium in the base currency. Alas, this is a failure.

- If the rate is more profitable than the one determined by the person, then he receives all the amounts of money due to him in an alternative currency.

Let's say a word about the award

Probably, now many readers are interested in one question. How is the option premium determined? The task of paying out cash is entrusted to the trader who purchases the option. Such an option of investing money together with the interest accrued on the deposit will allow you to get a high income. Of course, if there were corresponding movements in the market. Let's look at a small example to explain how this system works. Suppose a person has an assumption that the value of the euro will increase from 90 to 95 rubles in a week. Since it assumes the growth of the currency, the choice is made in favor of call options. Then they are bought from a broker, and often accompanied by certain surcharges. But let's not talk about them for now. If the rate really rose, the value of the option also increases with it. At the same time, no additional investments are required from a person. The option itself can be kept until the end of its term, or it can be exercised at any convenient time before the end of the agreements.

About some moments and development

The tool considered in the article is constantly changing and improving. There is even something that was not there before. One of the latest developments is binary currency options. This is such an amazing transformation of securities that one can hardly see their ancestors in them. What is their feature? Initially, any asset is completely thrown out of circulation. The main object here is the price. Traders are interested in its behavior over a certain period of time, and that is what they bet on. If they think that the price will rise, then they take a “call”, if they think it will fall, they take a “put”. You see, even these words have lost their original meaning. At the same time, the price of an asset does not depend on its behavior. In this case, the most interesting is the percentage of the value at the time of the agreed day to the amount of the rate. This is what the premium is based on. The more delivered, the moregain, as well as the risk of losing money. If the investor's bet has not played, then the premium remains with the broker. As you can see, binary currency options provide that only one side will win.

How to make a profit?

The considered financial instrument attracts a large number of speculators of all stripes. Well, this is not surprising, because it allows you to get huge incomes. And at the same time, the probable losses are clearly recorded. But if this is such a profitable business, then why are there those who are ready to sell currency options? And the answer is simple: the amount of premium that the seller of the option receives is commensurate with the risk of unlimited losses. Does it make sense to get involved in this whole story? Theoretically, it is quite possible to become a successful bidder. To do this, you only need to be the first to know about all fluctuations in the exchange rate, be able to predict its changes and have information that others do not know about. Otherwise, it will be very difficult to compete. It should be understood that financial activity has significant risks. Here are some examples:

- The price of transactions is inflated compared to other types of investments.

- Requires deep financial knowledge and experience. Currency options are difficult to implement and it is impossible for anyone to succeed in this area.

- Be aware that this type of investment is extremely time bound. Therefore, many contracts remain unfulfilled.

As you can see, making money in this case is not so easy as it might seem at first glance. Whether it is worth risking your money, time and nerves - everyone decides for himself. The main points have already been covered, let's pay attention to additional points.

Administrative difference

Initially currency options started to be used in Europe. But over time, they gained great popularity in America. Now they are also widely used in Asia. At the same time, depending on the geopolitical attachment, their own characteristic features appeared. The most popular now is the American model of interaction. Its feature is the possibility of early execution of rights. The European model is aimed at obtaining medium incomes with minimal risks. Asians perceive an option as a specific commodity, which should have its own price. Exchanges are widely used for this.

What to play?

People who have decided, but have not yet begun to act, are for the most part interested in the question: what are the best currency pairs for binary options? Unfortunately, there is no 100% correct answer here. To do this, you need to be aware of the many different trends, specific moments and other elements of successful investing.

Let's look at a small example. Here we have the euro, US dollars and yuan. What can be said in this case? The most predictable pair is the dollar and the yuan. The Chinese government supportsexport economy. And for this you need a cheap own currency. Therefore, they constantly depreciate the yuan against the US dollar. But this is not all possible field of activity. Other interesting currency pairs for binary options are euros and dollars, as well as the money of the European Union and the yuan. True, it is impossible to accurately predict here. So, now the euro exchange rate against the dollar is growing, although just a year ago it was steadily falling. And it was seriously believed that the euro would become cheaper than the dollar.

Conclusion

You need to be aware that financial activities involve enormous risks. There are always losers and winners in it. And if you do not have the necessary knowledge, experience, acumen, then there is a very high probability of falling into the first category, the losers. This topic is quite broad and requires considerable preparation. One could also talk about barrier and range currency options and other financial instruments. But to fully cover this topic, even speaking in passing, the size of the article is not enough. Even one book will not be enough. For people who want to conduct successful financial activities, there is the possibility of obtaining a full-fledged higher education, which now takes four years. Yes, not all the information that is taught is useful, but consider whether it is worth competing with those who have studied well and have a good understanding of financial processes.

Recommended:

A put option is Definition, features, conditions and examples

Option trading is one of the types of trading in the financial markets. According to statistics, the most popular type of options for traders is the Put option, which will be discussed in this article. The reader will learn what a put option is in simple words, about its features, tasks in trading and characteristics, and examples will be given in the article

Deposit deposit: conditions, rates and interest on deposits

For those who have just begun to master financial instruments, first of all, a deposit is opened. It allows you to minimize the impact of inflation and ensure the safety of funds. What is this tool? What is it used for? What benefits does it provide us?

Deposit "Seasonal" in VTB 24: deposit reviews for individuals, conditions

How to choose the most profitable deposit and what to look for? Deposit "Seasonal" bank "VTB 24": conditions and customer reviews

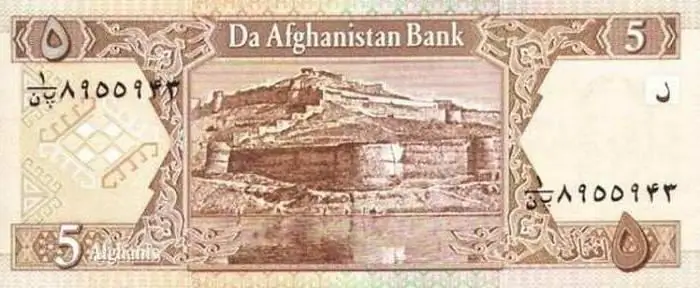

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article