2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:32

Each entrepreneur wants to optimize taxation, so he chooses a regime that ideally matches the characteristics of his activity. Therefore, the question often arises, how to switch from UTII to the simplified tax system? The mode change may be due to a change in the direction of work or other reasons. The procedure can be performed at any time, but it is necessary to notify the tax service in a timely manner. Additionally, it is important to make sure in advance that the work of an individual entrepreneur or company meets the requirements of the simplified tax system.

Who can run the process?

Before switching from UTII to the simplified tax system, you need to make sure that the procedure can be performed by the entrepreneur. This right belongs to:

- firms and individual entrepreneurs who worked on UTII, but decided to engage in another type of activity for which it is impossible to use UTII, so they are switching to the simplified tax system;

- enterprises whose obligation to pay UTII ceases, as appropriate adjustments are made to the legislation of the region, therefore, work on this is prohibited in a particular citytax treatment;

- firms that violate the requirements for UTII payers during work, so entrepreneurs are forced to choose another system, with the USN considered the most relevant choice.

The transition procedure must be carried out exclusively with notification of the tax service. For this, two forms for the transition from UTII to the simplified tax system are used, since initially it is necessary to deregister for imputed tax, and then register as a payer under the simplified system.

What documents are required?

Before switching from UTII to the simplified tax system, it is necessary to prepare certain documentation for this process. To complete the procedure, the following list of papers is required:

- application for deregistration of an individual entrepreneur or company as a UTII payer, and the process must be completed within 5 days after the termination of work under this mode;

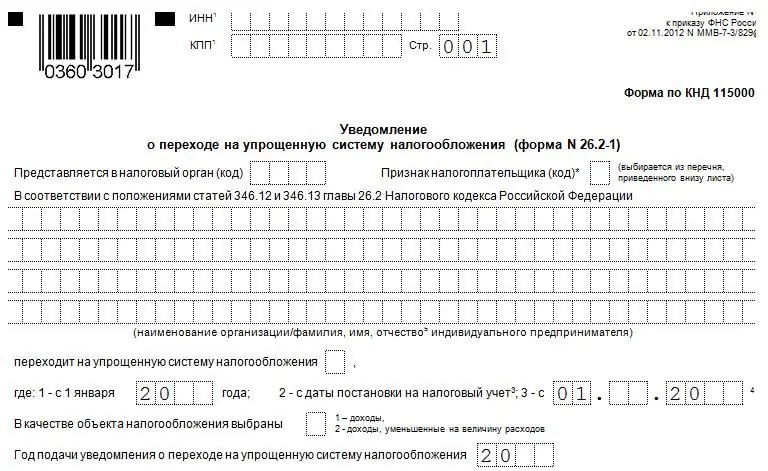

- notification of the transition to the simplified tax system, drawn up in a special form enshrined in legislation.

Documents can be personally handed over to the tax inspector when visiting the branch of the Federal Tax Service, and they can also be sent to the institution electronically. A sample notice of deregistration of a businessman as a UTII payer can be studied below.

Differences between the simplified tax system and UTII

When switching to any mode, an entrepreneur must carefully evaluate all its features. The nuances of using the simplified tax system or UTII include:

- when applying UTIIimputed income tax is paid, which depends on the chosen line of business;

- the imputed system is not accepted in many regions of the country;

- to use UTII, you need to work only in strictly limited areas of activity;

- when using the simplified tax system, you can choose two ways to calculate the tax, since 6% of all income or 15% of profit can be charged, for which you have to calculate the difference between income and expenses;

- only when switching from UTII to the simplified tax system, it is allowed to perform the procedure in the middle of the year;

- necessary documents must be submitted to the Federal Tax Service within 5 days after the change in the features of the entrepreneur's work.

The procedure for switching from UTII to the simplified tax system is enshrined at the legislative level, so if the head of the company or individual entrepreneur violates this procedure, the entrepreneur may be held liable or automatically transferred to the OSNO, from which it will be possible to leave only from the beginning of next year.

Rules for calculating tax under the simplified regime

It is important to understand not only how to switch from UTII to the simplified tax system, but also what difficulties you will face during the calculation of the tax under the new regime. Key features include:

- with the simplified tax system, it is important to maintain KUDiR in order to take into account all expenses and income from activities;

- if during the transition the entrepreneur has a receivable, then it should not be taken into account when calculating the single tax;

- expenses that had to be incurred when using UTII cannot reduce the tax base forsimplified mode.

A sample application for the transition to the simplified tax system can be studied below.

Terms and order of transition

Many entrepreneurs, for various reasons, are forced to switch from imputed income to the simplified tax system. Applications and notifications for the transition from UTII can be submitted at any time, so this does not require waiting for the start of the new year.

Notification of the removal of an entrepreneur from imputed income must be submitted within 5 days after the change in working conditions. Application for the use of the simplified system must be submitted within 30 consecutive days.

Entrepreneurs should be well versed in when it is possible to switch from UTII to the simplified tax system, so as not to violate tax laws with their rash actions.

Nuances when combining

Some entrepreneurs work in several directions at once. It is even allowed to work LLC on UTII. The transition to the simplified tax system in this case is carried out in the same way as for private entrepreneurs.

If a firm operates in several activities, it is allowed to combine several modes. The procedure is allowed both for individual entrepreneurs and for different organizations. But for this you need to be well versed in the rules of separate accounting. Difficulties usually arise when using a simplified system, when 15% is charged on profits. In this case, it is difficult to determine which expenses are imputed tax and which are included in the simplified regime.

Reporting rules forcombination

For each system, declarations are submitted to the Federal Tax Service separately within the time limits established by law.

Under the imputed regime, it is required to pay tax quarterly, and the declaration is submitted every three months.

Advance payments are transferred quarterly under the simplified regime. Declarations are submitted to the Federal Tax Service only once a year.

Is the reverse transition allowed?

The conditions for the transition from UTII to the simplified tax system are considered quite simple, but often entrepreneurs think about the reverse transition. The procedure can be performed subject to the following rules:

- The transition to an imputed tax is allowed only from the beginning of the next calendar year. In this case, the correct deadlines must be observed. Until January 15 of the next year, it is necessary to send a notice of refusal to use the simplified system during operation to the Federal Tax Service department. Within the next 5 days, you must send a notification of the use of UTII.

- If a company loses the right to use the simplified tax system in the middle of the year, then it will not be able to switch to an imputed tax. As soon as the right is lost, the taxpayer is obliged to notify the tax office. After that, it is automatically transferred to OSNO. You will have to work according to this regime until the end of this year.

Before the direct transition, the entrepreneur must understand well what the simplified tax system is, so as not to encounter various difficulties during work. This is due to the fact that the reverse transition is possible only from the beginning of the new year.

What are the challenges?

STS for individual entrepreneurs without employees is an ideal choice, since it is possible to reduce the tax base by the amount of insurance premiums. If the entrepreneur has hired specialists, then the base can be reduced only by 50% of the contributions paid.

When switching to the simplified tax system from an imputed tax, some difficulties may arise. These include:

- accounting becomes more complicated, and this especially applies to the situation when the “Income minus expenses” system is chosen;

- it is important to figure out how to report for the month, part of which the entrepreneur works on imputed income, and the simplified system is applied on the remaining days;

- different restrictions apply to individual entrepreneurs and firms using the simplified regime, so before going directly, you should make sure that it is allowed to use the simplified tax system for the selected line of work.

Practice shows that tax officials often conduct unscheduled inspections of entrepreneurs who regularly change tax regimes or combine several systems at the same time. Therefore, it is important to initially understand what the simplified tax system and UTII are, how the transition between these modes is carried out, and also how to properly keep records for each system.

Pros of transition

The transition from an imputed tax to a simplified system has many advantages for entrepreneurs. These include:

- on the simplified tax system, as well as on UTII, notit is required to pay personal income tax, VAT or other types of taxes, although there are exceptions when paying property tax, since if an object for which the cadastral value is calculated is used in business, then tax will have to be paid for it annually;

- "simplifiers" are required to transfer 20% to the PF in the form of insurance premiums, and not 30%, which is considered an undoubted advantage, since the financial burden is significantly reduced;

- businessmen independently choose the subject of taxation, represented by income or profit, and this choice determines what rate will be applied to calculate the exact amount of tax;

- the cash limit has been canceled for entrepreneurs on the simplified tax system, and they can also enjoy various privileges in relation to ongoing operations, so at the end of the working day any amount of cash can be in the cash register;

- no accounting required;

- on the simplified system, you need to submit only one declaration per year, but when using an imputed tax, you have to draw up 4 declarations per year, since they are submitted to the Federal Tax Service quarterly;

- it is allowed to combine the simplified tax system with other taxation systems, which allows you to significantly save money on taxes;

- regional authorities can significantly reduce the rate on the simplified tax system, and often to support small businesses it is 0%.

Although UTII and STS are similar taxation systems, the use of each regime has certain advantages. Often, entrepreneursknow about what profit they will receive, so it is advisable to work on the simplified tax system. Submission of notifications for the transition from UTII to the simplified tax system must be carried out on time, otherwise the entrepreneur will be forcibly transferred to the OSNO.

Cons of transition

Rejection of UTII in favor of a simplified system has some disadvantages. These include:

- not all individual entrepreneurs and firms can use the simplified tax system, as some restrictions are taken into account related to the amount of annual revenue and the number of employees;

- if at least one requirement for the use of this system is violated during the work process, the entrepreneur will automatically be transferred to OSNO;

- not all company expenses can be accepted to reduce the tax base;

- accounting becomes more complicated, because if a system is chosen that charges 15% of profits, then all expenses will have to be correctly taken into account, which must be documented and justified;

- if for various reasons the right to apply the simplified tax system is lost, then it will be possible to switch to this regime again only after a year.

Therefore, before filing a notice and application, you should make sure that such a transition is appropriate.

Court practice

Often the transition procedure is carried out by entrepreneurs with numerous violations of various requirements. Under such conditions, businessmen are forcibly transferred to OSNO. They can challenge this decision of the tax service in court.

Practice shows that the mostoften judges take the side of tax inspectors. But there are precedents when the decision was made in the direction of the taxpayer. In any case, when switching to a new tax regime, entrepreneurs must take into account the rules for implementing this process. Otherwise, you will face unpleasant tax consequences.

Conclusion

UTII and STS are simplified special regimes that allow you to pay only one tax to the budget. They have many differences, so it often becomes necessary to switch from an imputed tax to a simplified system. The procedure can be performed at any time.

The transition must be official, so it must be notified to tax officials. To do this, a notification of deregistration as a UTII payer is sent in a timely manner, as well as an application for switching to a simplified regime.

Recommended:

Using the simplified tax system: system features, application procedure

This article explores the characteristics of the most popular taxation system - simplified. The advantages and disadvantages of the system, conditions of application, transition and cancellation are presented. Different rates are considered for different objects of taxation

When can I switch to UTII: procedure, terms, features

Features of the UTII regime, the possibility of switching to it. On UTII with OSNO: when is it possible, what are the conditions? On UTII with the simplified tax system: when is it possible, what are the difficulties? Features of the transition to "imputation" when registering a business. What documents are required for LLC and IP? Is a partial transfer possible? in what cases it will not be possible to switch to "imputation"?

How to make the transition to the simplified tax system: step by step instructions. Transition to the simplified tax system: VAT recovery

The transition of IP to the simplified tax system is carried out in the manner prescribed by law. Entrepreneurs need to apply to the tax authority at the place of residence

Minimum tax under the simplified taxation system (simplified taxation system)

All start-up entrepreneurs who have chosen a simplified taxation system are faced with such a concept as the minimum tax. And not everyone knows what lies behind it. Therefore, now this topic will be considered in detail, and there will be answers to all relevant questions that concern entrepreneurs

Do I need a cash register for individual entrepreneurs with the simplified tax system? How to register and use a cash register for individual entrepreneurs under the simplified tax

The article describes the options for processing funds without the participation of cash registers (CCP)