2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:47

The Italian word "currency" came into Russian in the middle of the 18th century. At first it meant "payment on a bill", but already in the middle of the 19th century it acquired a new meaning - "the monetary system of the state, backed by gold." In this article, we will explain what a currency is.

General information

Banknotes, coins, treasury notes, which are legal tender and form the basis of the state's monetary system, are called currency. In everyday vocabulary, this term is most often used as banknotes of a foreign state. To distinguish between these two concepts, the following designations are used:

- closed currency operates within one state;

- reversible can be exchanged for the currency of another country.

Types of currencies

Each country has a national and foreign currency. Russian currency - rubles that are in circulation, withdrawn from circulation, funds on accounts in banks of the Russian Federation and abroad, which are recognized as a means of payment. The national currency is used for internal settlements, andforeign - for international. The second is money that is in free circulation or withdrawn from it, but is a means of payment in a foreign state or group of countries. To carry out international transactions, it is necessary to exchange currency based on the established exchange rate. This is the price of one currency, expressed in the monetary units of another state. The rate is set on the basis of supply and demand in the foreign exchange market. The goods on it are monetary units: rubles, dollars, yen, and so on. The exchange rates of national and foreign currencies change in different directions. The fall in the value of the domestic currency leads to cheaper exports and more expensive imports.

Stability of exchange rates

According to the degree of stability, rates are divided into strong and weak. A hard currency is backed by a gold reserve and is stable against the value of other monetary units. For strong ones, the excess of the market price over the face value is characteristic. A weak currency is less stable against the exchange rates of other countries' currencies. Its market rate is below par. The same monetary unit in practice is strong and weak in relation to the currencies of different countries.

Official rates of foreign currencies against the ruble are set by the Central Bank every working day. They come into force on the next working day after signing and are valid until the next order. These data are published on the website of the Bank of Russia. However, banks have no obligation to buy or sell currency at this rate. For legal entities and individuals, such information is for informational purposes only. To find outexact exchange rate, you will have to use a currency converter. It can be found on the website of any bank.

Characteristics of monetary units

Conditions and sales volumes largely depend on the restrictions that are set by the state and are characterized by the convertibility parameter. This is a certain financial regime that allows, in the course of foreign economic operations, to exchange the national currency for a foreign one. According to this indicator, the currency in banks is divided into three groups.

Types of convertibility

Freely convertible currency (CFC) is freely exchangeable for the currencies of other countries, as well as for means of payment that are used for settlements in international transactions. In world practice, the main characteristics of turnover are:

- absence of any restrictions on the exchange;

- flexible exchange rate.

CIS is used for transfers in the international payment system (CLS). This allows individuals and entrepreneurs to conduct transactions without exchanging the national currency for any convertible.

Having de alt with the issue of ICS, we turn to the question of what is a partially convertible and closed (non-convertible) currency.

The first is a currency with certain restrictions on turnover in a particular region, for certain persons or for several types of transactions. Non-convertible is a monetary unit, which, for economic or political reasons, the state has forbidden to exchange for monetarysigns of another country.

Within the framework of a partially convertible currency, external and internal turnover is distinguished. The first implies the possibility of foreign states to freely transfer their national currency abroad. Domestic implies the right of citizens and enterprises to buy foreign currency for transactions. In order to introduce convertibility, the state must adopt an appropriate law.

Benefits of ICS

Having de alt with the question of what is a currency that is freely convertible, we turn to the question of what benefits it gives the state. Today, free turnover is determined by the economic power of the country. ICS allows the state to create favorable conditions for improving the balance of payments, indicates economic freedom, promotes the development of international competition, as a result of which enterprises are forced to increase production efficiency.

Under such conditions, organizations can receive loans in banknotes of a foreign state. Foreign economic activity is stimulated: by reducing the currency risk, the export and import of goods increases. But at the same time, the rise in the price of imports leads to the devaluation of the national currency. The introduction of the ICS involves the state in the system of international division of labor, increases the inflow of foreign capital, and also simplifies the procedure for conducting transactions.

Conditions for the formation of turnover

These include:

- meeting demandsupply on the market;

- availability of the required amount of liquid assets;

- creating a reserve fund;

- presence of a balanced balance of payments;

- state budget deficit, if any, should not exceed 5% of GDP;

- carrying out a reasonable pricing policy without distortions, but taking into account the laws of value;

- pursuing a prudent credit policy with a reasonable interest rate and targeted funding;

- implement effective antitrust laws to demonopolize the economy.

World currencies

Due to liquidity and influence on the financial market, it is customary to refer seven monetary units to world currencies:

- euro;

- US dollar;

- Canadian, Austrian and Swiss dollars;

- Japanese yen;

- Swiss franc.

These currencies are the largest number of contracts, they are most often traded on the Forex market.

Main signs of world banknotes:

- high liquidity;

- solvency;

- rate stability.

They are used to create foreign exchange reserves. The rates of world currencies are interconnected. When the price of one falls, the value of the other increases. And vice versa.

Most European countries have their own currencies and central banks that regulate monetary policy. In 1996, a monetary union was formed, which by 2014 already unites 18 countries. Within the Eurozonecontrol is exercised by the European Central Bank. The currency in force in this territory is the euro. Since 1999, the euro has been used for non-cash payments. Since 2002 - for cash payments. Today, the euro competes with the dollar in terms of turnover and shares in the creation of gold and foreign exchange reserves.

Another very popular world currency is the US dollar. It is a means of payment in more than twenty countries of the world. For the last half century, the dollar has been one of the sources for creating a reserve currency. Immediately after the Second World War, he supplanted the British pound.

Yen is used for transactions in Asian countries. There are more settlements in the national currency of Japan than in the dollar or the euro.

Approximately 5% of foreign exchange reserves are formed in pounds sterling. The national currency of Great Britain is one of the most stable in the world.

The Australian dollar is very popular on the Sydney Stock Exchange.

The Canadian dollar is most often used for settlements on commodity exchanges when trading sand, metals and energy resources.

Currency of Russia - SVK

In order for the ruble to become fully convertible, it must be backed by a material equivalent. In theory, the Russian economy, assessed by independent experts at a high level, could become such an equivalent. But in practice, a more realistic option is the provision of the ruble by the state. The launch of a convertible currency that is not backed by government obligations, as was the case with the dollar, will no longer work. The euro as a world currency still holds a conditional state status.

Ensuring the status of the SVK by the state implies that Russia, upon demand, will have to pay with material resources. That is, the ruble mass in the world should not exceed the material support of the country. Given the corruption at all levels of government, it is quite difficult to guarantee this.

However, the Russian government is taking every step to give the ruble the status of ICS. Recently, the Bank of Russia announced its intention to completely switch to the ruble. Other credit institutions, including Sberbank, also "thought" about this. The currency of the Russian Federation may soon be included in the list of Continuous Linked Settlement Bank. It uses ICS for calculations. The Bank of Russia has already filed a corresponding application with CLS, but there is no response yet.

CV

Banknotes issued by one country, but used as a means of payment in other countries, indicate a high level of development of the state. Ideally, banknotes and coins should be supported by the legal status of the country or its national we alth, freely exchanged for banknotes of other countries. This is what a currency that is freely convertible around the world is.

Recommended:

Currency borrowers. All-Russian movement of foreign currency borrowers

At the end of last year, an all-Russian movement of foreign currency mortgage borrowers was formed. This was due to the sharp devaluation of the ruble, which made it almost impossible to service loans of this type

Organizational structure of Russian Railways. Scheme of the management structure of Russian Railways. Structure of Russian Railways and its divisions

The structure of Russian Railways, in addition to the management apparatus, includes various dependent divisions, representative offices in other countries, as well as branches and subsidiaries. The head office of the company is located at: Moscow, st. New Basmannaya d 2

How much was the dollar in the USSR? How did the dollar change during the Soviet era?

During the entire second half of the twentieth century, the dollar in the USSR cost less than one ruble, and only a few citizens had it, and then in a limited amount, necessary for traveling abroad or in other exceptional cases

The currency of the Russian Federation is the Russian ruble. How is its course formed, and what affects it

Article about the currency of the Russian Federation - the Russian ruble. Briefly disclosed are the main characteristics of currencies, types of rates, features of the formation by the Central Bank of the Russian Federation of foreign exchange rates against the ruble, as well as factors affecting the value of the ruble against other currencies

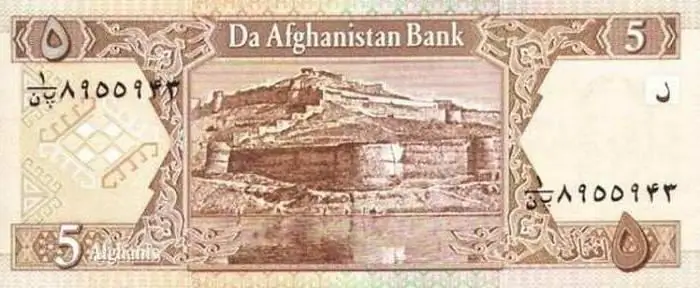

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material