2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:43

Expense report is the primary document in accounting workflow. Its main purpose is to confirm the amount spent by the accountable person.

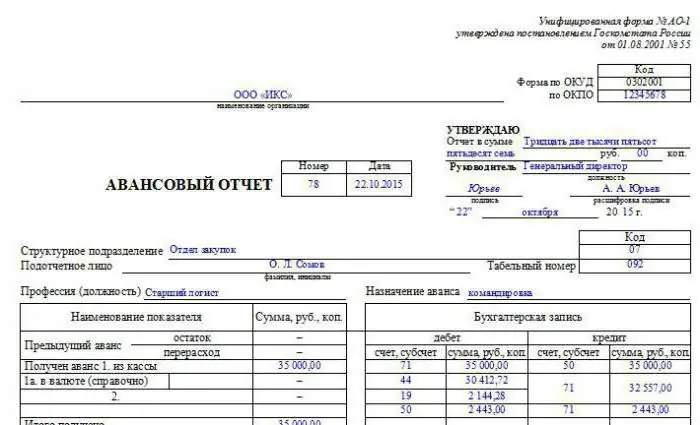

Bilateral unified form No. AO-1 - a single form for each legal entity of any form of ownership. The only exceptions are state employees who have been using a special form “0504049” since 2002.

An expense report is the responsibility of every employee who receives funds for a business trip or purchase of any material or goods (such as office supplies or food).

Expense report of traveler

How to properly draw up an advance report if an employee was sent by an organization to perform some task in another city?

A business trip is a trip of an employee in order to perform their job duties outside the location of the company. It is never without expenses, which are subject to compensation to the employee in accordance with the currentlegislation.

Travel expenses include:

- Round trip, but only if the worker has tickets.

- Rental housing (checks or receipts are required).

- Additional expenses included in per diems.

- Telephone calls, mail, currency exchange, transit and commission fee, baggage ticket and any other event, without which the main purpose of the trip will not be achieved.

All of the above expenses must be documented. If we talk about daily allowances, then their size is usually specified in the order or in the position on a business trip issued by each enterprise. The amount may differ depending on where the employee went: within the region, to another subject of the Russian Federation or abroad.

The legislation does not establish a maximum per diem, but if their value within the country exceeds 700 rubles, and outside it - 2500 rubles, then they should be subject to personal income tax. Problems with how to properly draw up an advance report after returning from a business trip should not arise. Deadline for delivery of the document - no more than three days from the date of arrival. If the accountable amount was not spent in full, then the difference must be returned to the cashier by means of an incoming cash order, and if, on the contrary, there was an overrun, then the employee is compensated for everything using an outgoing cash order.

What are the consequences of an incorrect advance report?

Correctly draw up an advance report onthe employee must travel on a business trip within three days, otherwise the supervisory authority may consider this amount as income, on which personal income tax and insurance premiums must be accrued.

By the way, the adoption of the new version of Law No. 290-FZ of July 03, 2016 introduces some adjustments, for example, a serious fine for providing an improper check. It is also planned to start using special bank cards that comply with the international standard Visa and MasterCard to pay for travel expenses.

General rules

How to draw up an advance report? You just need to follow each of the following points:

1. The report must be drawn up no later than three working days from the moment:

- the period indicated by the employees in the application for the issuance of funds has expired;

- an employee went to work if the expiration of the period for which the money was issued fell on vacation or illness;

- employee returned from business trip.

2. To draw up a report, use the unified form No. AO-1 or the form adopted by the enterprise.

3. An employee, together with an accountant who knows how to properly draw up advance reports (an example is clearly available in the program used), must fill out the document.

4. The manager is responsible for approving the reporting paper.

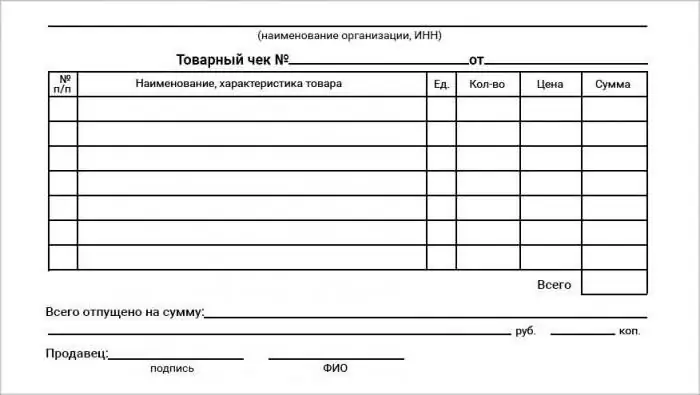

5. Any advance document must be accompanied by checks, invoices,tickets and other papers that confirm that the person actually spent the accountable funds.

Filling order

How to draw up an advance report?

The first or front part must be completed by an accountant. It is impossible to do without specifying the details of the document (number and date), information about the enterprise and accountable persons, the amount of the advance payment issued, summary information: funds spent and accounting accounts, on the basis of which one can judge the movement and write-off. In addition, an overspending or a refunded unused advance should be indicated here.

The second part is a tear-off receipt stating that the advance report has been accepted for verification. After filling out, the accountant must cut it off and give it to the accountable employee.

The third part (back side of Form AO-1) must be completed collectively. The task of the accountable employee is to reflect the details and attach each correctly executed sales receipt for the advance report. The accountant will have to fill in the amount and the account, which will reflect the money spent.

The document must be signed by the employee, accountant and chief accountant. Only after that it can be approved by the head.

Reasonable overspending

How to file overspending on expense report? First you need to make sure it is justified:

- spending is higherallocated was required to complete the task on behalf of the authorities;

- employee has supporting papers.

If at least one condition is not met, then the amount of money is not refundable.

Procedure for compensating overspending at the checkout

In case of overspending, the accountant faces the question: how to draw up an expense report correctly. A sample of an account cash warrant form No. KO-2 can be easily found on the vast expanses of the Internet. The details of this document must be indicated in the report - the line "Overrun issued by cash order".

The term for compensation of overspent funds by an employee is not established by law. Therefore, if the accountant did not immediately indicate information about the issue order in the advance report, this will not entail any pen alties.

Conditions for compensation for overspending on a salary card

Currently, almost all organizations transfer salaries to employees on a bank card. Is it possible to return the amount overspent according to the expense report to the employee in the same way?

The legislation does not have a clear answer. The document itself suggests only one form of reimbursement of the overspent accountable amount - cash.

The Central Bank of Russia shared the same opinion in 2006 in its letter No. 36-3/2408. At the same time, his letter, but dated December 24, 2008 No. 14-27 / 513, contains information about the question: is it possible to use a bank card to pay foraccountable amount is not within the competence of the Central Bank. That network enterprise should independently deal with its problems in this case. And so that the controlling agency does not have unnecessary questions, it is recommended to use the cash desk.

How to compensate an employee's personal money?

An employee of an organization can himself go to purchase the necessary goods (works, services) at his own expense. In this case, there is no need to fill out an advance report. How to arrange the above steps?

An application and documents confirming the purchase (cash receipts, invoices, strict reporting forms, travel documents, etc.) will be quite enough.

Issuing an advance report in 1С

Every accountant should be familiar with such a document as an expense report. How to arrange in 1C? The location of the document in the program is the "Bank and cash desk" section.

In the created window, you must first specify information about the organization and accountable persons. The "Add" button will make available a table in which you need to reflect all the information about the funds issued.

There are three types of advance payment:

- Money documents. This takes into account air and railway tickets, vouchers, postage stamps, etc.

- Cash. The main purpose of the document is to write off cash.

- Settlement account. The document is necessary in order to take into account the write-off of a non-cash amount from the settlementcompany accounts.

To generate cash withdrawal information, you need to start by creating a new outgoing cash order. After filling out, the document should be printed and handed over to the accountable person, so that the latter fills out the line on receipt of funds and signs. Only then can you save and post the document.

In the tabular section of the cash receipt, information about the goods and materials purchased by the accountable person should be indicated. If the purchase of goods was accompanied by the issuance of an invoice, then it is necessary to put the SF flag, select the Supplier and fill in his details.

The "Returnable packaging" section requires filling in information about the packaging that the Supplier is waiting for back.

The "Payment" section records the amounts paid to the supplier for previously purchased goods. The advance payment is reflected in the posting D 60.02 K 71.01.

The “Other” tab is designed to account for other expenses of an accountable person (business trip, travel, fuel expenses, etc.).

Recommended:

How the advance is calculated: calculation procedure, rules and features of registration, accrual and payment

The correctness and timeliness of payroll is a matter of interest not only to the accounting department, but also to the employee himself. There are different types of payments such as advance payment, vacation pay, compensation payments, and each of them has its own rules and approved benchmarks

The flag pattern in technical analysis. How to use the flag pattern in Forex

Technical analysis has incorporated a large number of repetitive patterns of price movement. Some of them have proven themselves better than others as a source of forecast. One of these models is the flag or pennant. A correct understanding of this pattern can be the basis for many profitable strategies

Advance report: postings in 1C. Advance report: accounting entries

Article on the rules for compiling advance reports, accounting entries reflecting transactions for the purchase of goods and services for cash, as well as travel expenses in the accounting of the enterprise

Advance report is Advance report: sample filling

Expense report is a document that confirms the expenditure of funds issued to accountable employees. It is drawn up by the recipient of money and submitted to the accounting department for verification

Advance report on a business trip. Advance report form

To account for funds that are issued to employees of the organization for travel or other needs, a special form is used. It's called a travel expense report. This document is proof of the use of money. The basis for the issuance of funds is the order of the head