2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:39

Expense report is a document that confirms the expenditure of funds issued to accountable employees. It is drawn up by the recipient of the money and submitted to the accounting department for verification. After that, the advance report is submitted to the manager for approval. The expenses reflected in the document are subject to write-off in the manner established by the PBU. Let us further consider the features and sample of filling out the advance report.

Disbursements

Receipt of cash by an accountable employee is carried out at the cash desk of the enterprise. The basis for this is the expense order. It should indicate the purpose of the funds.

The head of the enterprise issues an order in which he fixes the list of employees en titled to receive funds for household needs. The same local act establishes the terms for which amounts can be issued.

Filing an advance report

This document is submitted to the accounting department within three days from the end of the period for which the funds were issued. The form is submitted along with papers confirming the spending of money. At the same time, the employee calculates the costs andbalance.

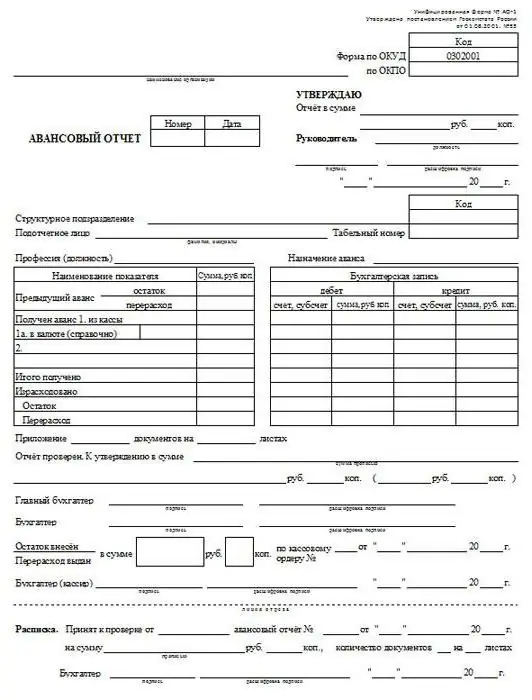

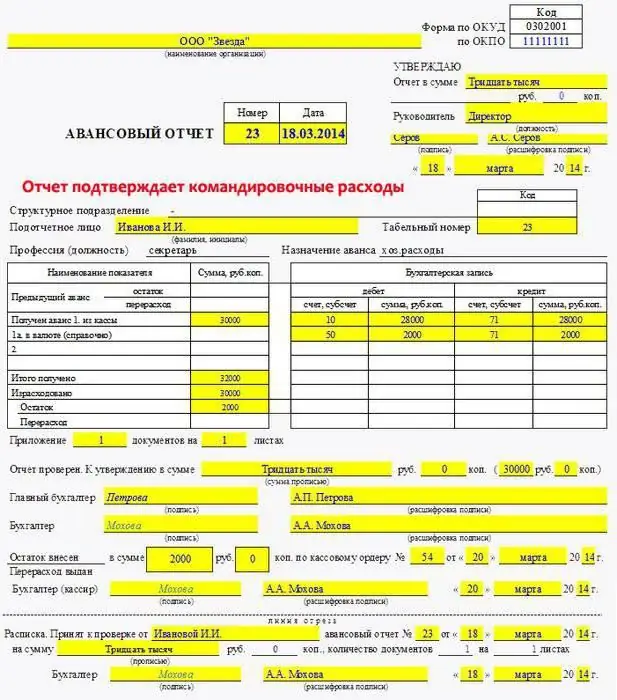

Expense report template: front side

The document is provided in one copy.

If you take any sample expense report, you can see that it is filled out on both sides. On the front of the accountable employee indicates:

- Document number.

- Date of completion of the expense report.

- F. I. O., position and department in which he works.

- Personnel number (if available).

- Assignment of the advance.

On the left side on the same side you need to fill in the table. It lists the previous advance, funds currently received, spending, overspending, and balance.

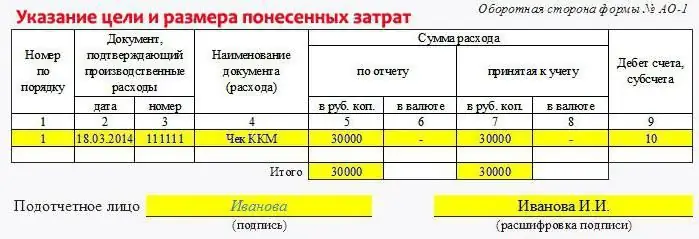

Reverse side

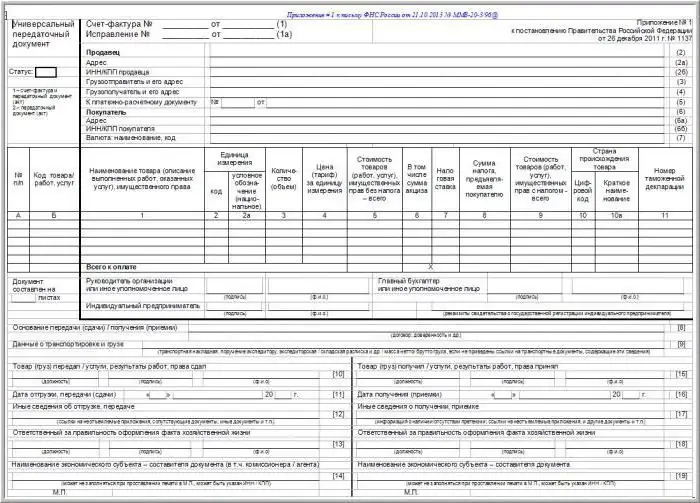

The reverse part of the expense report sample is intended to indicate the list of documents confirming the costs. They can be:

- Travel ID.

- KKM checks.

- Receipts.

- Commodity, waybills.

- Invoices, etc.

The accountable employee also indicates the amount of expenses on documents. The numbering of the papers attached to the report is carried out in the order they are indicated in the form.

Nuance

On the front side there is line 1a, and on the back - 6 and 8. In the advance report, these fields are filled in if the funds were issued to the accountable person in foreign currency. For example, an employee was sent on a business trip abroad.

Recommendations for an accountant

Specialist fills in firstfront side of the form. First of all, in the table "Accounting record" it is necessary to enter information about the numbers of the corresponding accounts and the amounts.

The reverse side of the form reflects the expenses accepted for accounting. In the advance report, this information is entered in columns 7 and 8. In addition, the accounts (sub-accounts) are indicated, on the debit of which the costs are posted (column 9).

After that, supporting documents are drawn up, the correctness of the form and the targeted spending of funds are checked. After completing all the procedures, the accountant puts a mark on the report. It indicates that the document has been checked and the amount of expenses has been approved (it is written in numbers and in words).

On the front side, a receipt is also filled out, which is transferred to the accountable employee.

The form must be signed by the employee who checked the document and Ch. accountant with transcripts.

If necessary, information on the amounts of the balance or overspending, details of the documents (orders) for which the final settlement will be carried out are entered into the report form.

Approval by manager and write-off of amounts

A verified report is submitted to the director of the organization. He must sign it. For this, there is a corresponding column in the upper part on the front side of the document. The form can be signed not only by the head, but also by another employee with authority. After approval, the report is accepted for accounting for debiting funds.

The balance of the advance is credited to the cash desk of the enterprise.

Prohibitions

If the accountable personhas a debt on previously provided advances, the issuance of funds is not allowed. In addition, it is forbidden to transfer money received by employees to third parties.

Shelf life

They are established by law. Different documents have their own retention periods. As a rule, enterprises choose the maximum period.

Based on sub. 8 1 of paragraph 23 of Article TC, tax and accounting papers and other certificates must be kept for at least 4 years. Paragraph 4,283 of the norm of the Code provides for a 10-year period for documents confirming losses. It is worth saying that information about expenses is used by organizations to reduce the tax base.

FZ No. 402 establishes that primary documentation must be stored for at least 5 years from the end of the reporting period.

Work in "1C"

The advance report is drawn up, as a rule, on a computer. To do this, you can use the program Excel or "1C". The latter is used in most enterprises. Consider briefly the design scheme in "1C".

To work, you need to open the document "Advance report". It is created from the "Production" or "Cash Desk" tab. Select the desired item in the menu.

This will open the documentation log. This is where all report data is stored. To create a new document, click on the "Add" button. Next, you need to select "Individual".

After that, the required document type is selected. For example, "Issuance of funds at the box office for settlements". Next, the order log will open. The desired document is selected here.

The tabular section reflects information contained in orders.

After that, the second tab is filled. Here you need to specify the products purchased by the accountable employee. For example, it can be forms. By clicking on the "+", you can add a new position.

If returnable packaging was used during the purchase, this information must be reflected in the appropriate column.

When posting materials and goods using the account. 631 the "Payment" tab is used. The column "Other" reflects information about additional costs. For example, it can be the cost of fuels and lubricants, Internet use, etc.

To print the document on paper, you need to click on the "Print" button.

Recommended:

Filling out TORG-12: rules for filling out a consignment note

This article discusses the primary documents, the TORG-12 consignment note, the rules for filling out, the form and the form, its purpose and the requirements of the inspection inspections

Samples of filling out a consignment note. Rules for filling out a consignment note

In order for the company's activities to fully comply with the requirements of the law, when filling out the documents, you must follow the established instructions. This article discusses samples of filling out a consignment note and other accompanying documents, their purpose, structure and meaning in the activities of organizations

Advance report: postings in 1C. Advance report: accounting entries

Article on the rules for compiling advance reports, accounting entries reflecting transactions for the purchase of goods and services for cash, as well as travel expenses in the accounting of the enterprise

How to draw up an advance report? Pattern and rules

Expense report is the primary document in accounting workflow. Its main purpose is to confirm the amount spent by the accountable person

Advance report on a business trip. Advance report form

To account for funds that are issued to employees of the organization for travel or other needs, a special form is used. It's called a travel expense report. This document is proof of the use of money. The basis for the issuance of funds is the order of the head