2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

In Russia, many citizens can get tax deductions. For treatment, for example. This is a fairly common phenomenon, but not everyone knows about it. In addition, not everyone understands how to act in a particular case. Next, we will consider all the features of the return of funds for medical services. What should be remembered about them? How to use the service? Who is en titled to it? Understanding all this and more is not difficult. The main thing is to follow the simplest instructions. They are listed below.

Definition

What is the treatment tax deduction?

This is the name of the process of returning part of the money for medical services of a paid nature on account of the paid personal income tax. Accordingly, if a citizen does not pay personal income tax, he does not have the right to demand funds for treatment.

Deduction for treatment is a social service. Relies on any paid medical care. You can return the money for yourself or for close relatives. For example, for children or spouses.

Who is eligible

How to get a tax deduction for treatment? Here you needmention that not everyone is eligible.

It is allowed to return part of the expenses incurred for medical services if:

- a person is a citizen of the Russian Federation;

- applicant transfers 13% personal income tax to the state treasury (no more, no less);

- the recipient has a permanent income taxed on income;

- citizen has reached the age of majority (or emancipated).

In reality, everything is much simpler than it seems. And if you competently approach the solution of the task, there will be no trouble along the way. Preparation for the return begins in advance, namely at the time of payment for certain services.

For what the funds are returned

Tax deduction for treatment in which area of medical services can I get? It is worth focusing on some conditions prescribed in the law.

For example, a refund is due for medical services:

- provided in Russia (to the applicant and his close relatives);

- which are included in the corresponding list (about it later);

- the medical institution where the services were provided has a license to operate.

In addition, you can return funds for medicines, dental treatment and he alth insurance VHI. The principle of action in all cases is extremely simple. It remains to be seen further.

Sizes

But first, let's find out exactly how much they are allowed to return for medical care. The maximum tax deduction for treatment in Russia is 120,000 rubles. This is the total amount thatcan count on every applicant for a lifetime.

You cannot return more than 13% of expenses per year. At the same time, the maximum amount of return for 12 months is 15,600 rubles. The rule applies to all social deductions. For example, for education.

When it comes to expensive treatment, the tax deduction has no limit of 15,600 rubles. Under such circumstances, a citizen can be returned 13% of the expenses incurred.

The basic rule that everyone should remember: you can not demand more money than in a given year in the form of personal income tax was paid by the applicant.

When the Right Arises

The tax deduction for treatment also has a "validity" period. However, like any return in Russia.

The right to reimbursement of funds from the applicant appears from the moment of payment for medical services or medicines. But it is allowed to apply with a request only for the next calendar year. That is, in 2015 a person will receive funds for medical care for 2014, and so on. You can claim money no later than 3 years after the expenses incurred.

Moreover, a citizen has the right to draw up a deduction immediately for 36 months. This is very convenient, especially if the potential recipient often uses paid medicine.

Where to go for help

We have already studied the amount of the tax deduction for treatment. Where are the applications sent? And how can you even get back some of the expenses incurred?

At the moment, returns are made through:

- companies-intermediaries (for a fee);

- FTS;

- MFC.

Where exactly to go? Everyone gives an answer to this question for himself. Most often, citizens apply for tax deductions for treatment (and not only) directly to the tax authorities. This is due to the fact that in this case the process of considering the request will be slightly accelerated.

Applying Methods

The tax deduction for dental treatment and other medical services is proposed to be requested in different ways. But the algorithm of actions in all cases will be approximately the same. Only the waiting time for a response from the tax service changes.

Currently, an application for a tax deduction (for treatment, training, and so on) is proposed to be submitted:

- personally;

- by mail;

- via the Internet.

The last option is almost never used in practice. If you act through postal services, you will have to certify some documents and wait a long time for an answer. That is why it is best to submit refund requests in person. It's not as hard as it looks.

Quick Guide

Filing a tax deduction for treatment is a very simple process. Problems with the implementation of the task can only arise during the preparation of the relevant documentation. But more on that later.

If you briefly imagine the algorithm of actions preceding the receipt of money for paid medical care, then the instruction will look like this:

- Pay for medical services or medicines.

- Collect a certain package of papers. It will change intodepending on the situation.

- Apply to the registration authority with a request for a deduction.

- Wait for a response from the Federal Tax Service.

- Receive the right amount of money.

That's it. Nothing else is needed. A tax deduction for dental treatment or other medical services is issued very quickly and without much difficulty.

Main papers

Now a few words about what certificates may be useful to citizens for the implementation of the task.

As already mentioned, the package of papers varies depending on the situation. Therefore, we consider all possible layouts. There is a general list of documents required for processing returns.

These include:

- identity card;

- income certificates;

- declaration in the form of 3-personal income tax;

- completed refund application;

- checks and receipts confirming payment for medical services or medicines.

But this is only the beginning. It is not too difficult to request a tax deduction for treatment if you correctly form a package of documentation for the implementation of the task. What else is useful in this or that case?

For medical services

For example, consider the case of a refund for your own treatment. Medical services are meant.

Under such circumstances, it is worth knowing in advance what documents are needed. The tax deduction for treatment requires (in addition to the previously listed papers):

- doctor and medical facility license;

- contract forprovision of paid services.

All documentation is provided not only in originals, but also in copies. There is no need to certify them additionally.

For medicines

As already mentioned, in Russia, refunds are allowed for the cost of medicines. For this, drugs must be included in a special list. It is determined by the government of the Russian Federation.

In any case, in order to claim money for expenses incurred, a citizen will need:

- certificate from a doctor (preferably with a diagnosis);

- contract with a medical organization;

- licenses (doctors and medical facilities);

- prescription from a doctor.

The listed components must be attached to the main package of papers. Otherwise, no deduction will be given.

For loved ones

You will have to act somewhat differently if a citizen has paid for other people's medical services or medicines. The thing is that such a step is accompanied by even more paperwork.

The applicant will additionally be required to provide certificates confirming kinship with the recipient of medical care. For example:

- marriage certificate;

- certificates of adoption/guardianship/guardianship;

- birth certificates.

These are the most common options. In reality, everything is not as difficult as it seems. But for someone else's treatment to return the funds will not work. This is not required by law.

Timing times

How long to wait for the verdict of the Federal Tax Service? The answer to this question worries many citizens. Especially those who receive a refund for medicalservice is vital.

The fact is that preparing documents for applying is a quick and not the most difficult process. But it will take a long time to wait for a response from the Federal Tax Service. In general, processing any tax deduction type is a long process. It takes an average of 4-6 months to receive the service.

Of these, most of the time is spent on checking the attached package of documents. Already after 1, 5-2 months, if you're lucky, the person will receive a response from the Federal Tax Service with a decision regarding the provision of a refund. The rest of the time is spent directly conducting the transaction through the bank.

Accordingly, it will not work to return money for treatment or education immediately and as soon as possible. Will have to wait. There are no ways to speed up the operation. The only thing a citizen can do is to carefully consider the preparation of a package of papers for a petition.

Rejections

Can a tax deduction for treatment be denied? Yes, but only under certain circumstances. Just like that, the return of funds from the Federal Tax Service is not denied. This is a direct violation of existing laws.

After the documents with the application for a tax deduction for treatment are considered, the Federal Tax Service will make one or another decision. Can refuse if:

- applicant brought an incomplete package of papers;

- documentation used is invalid or counterfeit;

- citizen does not transfer personal income tax in the established amounts;

- recipient has already exhausted statutory refund limits;

- medical care/medication not includedto special lists;

- applicant did not pay for treatment himself;

- a person is trying to return money for medical services and medicines of third parties (not relatives).

Just like it was already said, they can't refuse. This is illegal.

If a citizen was denied a deduction, within 30 days he can correct the situation and re-apply for a refund without re-submitting a request. The difference is that in this case, the countdown of the application processing time will start from the very beginning.

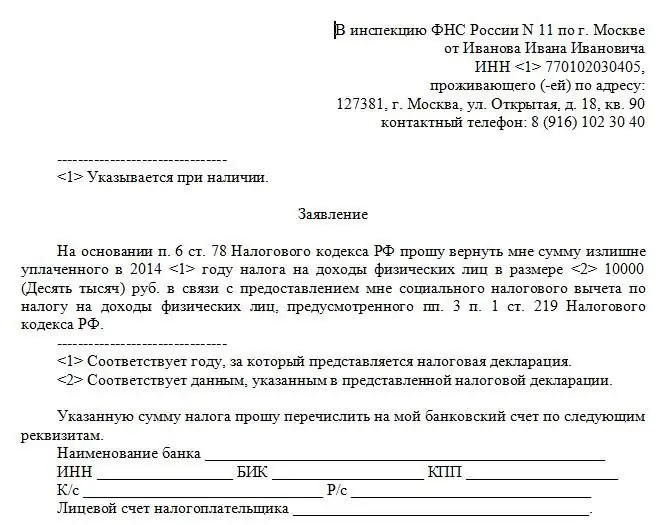

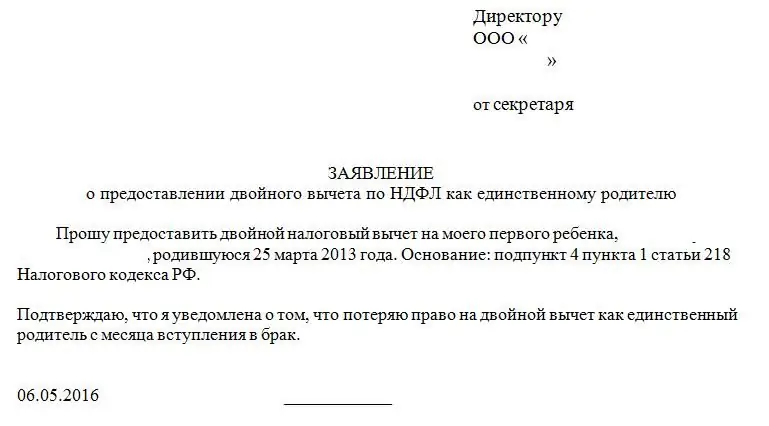

About the statement

Some people have questions about the content of the application for a refund of money in the personal income tax account. What does the relevant petition indicate?

Currently indicated in the document:

- name of registration authority;

- data about the applicant;

- refundable services and medicines;

- data on who received medical care with the degree of relationship;

- return size (desirable);

- details of a bank account or card to transfer money to;

- list of documents attached to the paper.

As practice shows, filling out the application of the established form does not cause any difficulties. The petition is written by hand when contacting the Federal Tax Service or printed out in advance on a computer.

Results

We found out how to get a tax deduction for medical treatment. After the described actions, a person will be able to claim a refund of part of the expenses incurred.

BRussia has recently been allowed to ask for social deductions from the employer. Then the citizen's income will be exempted from personal income tax in the amount of the due return. But this is not the most common scenario.

However, if the applicant decides to act through the employer, he will need similar packages of papers. Only the petition is submitted to the authorities. It is considered much faster.

List of expensive medical services

Special attention is paid to the tax deduction for expensive treatment. These include the following services:

-

- Surgical treatment of congenital anomalies (malformations).

-

- Surgical treatment of severe forms of diseases of the circulatory system, including operations using heart-lung machines, laser technology and coronary angiography.

-

- Surgical treatment of severe respiratory diseases.

-

- Surgical treatment of severe forms of diseases and combined pathology of the eye and its adnexa, including using endolaser technologies.

-

- Surgical treatment of severe forms of diseases of the nervous system, including microneurosurgical and endovasal interventions.

-

- Surgical treatment of complicated forms of diseases of the digestive system.

-

- Arthroplasty and reconstructive joint operations.

-

- Transplantation of organs (a complex of organs), tissues and bone marrow.

-

- Replantation, implantation of prostheses, metal structures, pacemakers and electrodes.

-

- Reconstructive, plastic and reconstructive plastic surgery.

-

- Therapeutic treatment of chromosomal disorders and hereditary diseases.

-

- Therapeutic treatment of malignant neoplasms of the thyroid gland and other endocrine glands, including using proton therapy.

-

- Therapeutic treatment of acute inflammatory polyneuropathies and complications of myasthenia gravis.

-

- Therapeutic treatment of systemic connective tissue lesions.

-

- Therapeutic treatment of severe forms of diseases of the circulatory, respiratory and digestive organs in children.

-

- Combined treatment of pancreatic diseases.

-

- Combined treatment of malignant neoplasms.

-

- Combined treatment of hereditary bleeding disorders and aplastic anemia.

-

- Combined treatment of osteomyelitis.

-

- Combined treatment of conditions associated with complicated pregnancy, childbirth and the postpartum period.

-

- Combined treatment of complicated forms of diabetes.

-

- Combined treatment of hereditary diseases.

-

- Combined treatment of severe forms of diseases and combined pathology of the eye and adnexa.

-

- Complex treatment of burns with an area of damage to the body surface of 30percent or more.

-

- Treatments associated with the use of hemo- and peritoneal dialysis.

-

- Nursing premature babies weighing up to 1.5 kg.

Treatment of infertility by in vitro fertilization, cultivation and intrauterine introduction of the embryo.

For all this, according to the law, you can get a refund of 13% without restrictions. There is only one rule - you cannot demand more money from the Federal Tax Service than a citizen transferred in the form of taxes.

Recommended:

What is a property deduction, who is en titled to it and how to calculate it? Article 220 of the Tax Code of the Russian Federation. property tax deductions

Russia is a state in which citizens have a lot of rights and opportunities. For example, almost every citizen of the Russian Federation has the right to receive a property deduction. What it is? Under what conditions can it be issued? Where to go for help?

What documents are needed for deduction for treatment: list, rules of registration

In Russia, many citizens can apply for a so-called tax deduction. For example, social type. People are able to recover part of the cost of medical services. But how to do that? This article will talk about the tax deduction for treatment in the Russian Federation

Tax deduction at birth of a child: application, who is en titled to a deduction, how to get

The birth of a child in Russia is an event that is accompanied by a certain amount of paperwork. Parents acquire special rights when replenishing the family. For example, for a tax deduction. How to get it? And how is it expressed? Look for the answer in this article

Application for a refund of personal income tax for education: when you can get it, the rules for applying for a tax deduction

Getting tax deductions in Russia is a very simple process. This article will tell you all about how to get a tuition deduction and apply for a refund of the money spent

What documents are needed for a tax deduction: a list of papers for registration

Tax deduction - the right to a refund of part of the costs for certain services. This article will explain how to request this service