2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

Today we will talk about how to apply for a personal income tax refund for training. Every citizen should know about this feature. After all, under certain circumstances, you can recover part of the money spent on educating a child or yourself. The first option is more common in practice. In fact, there is nothing difficult or special about it. It is enough to know about some rules for filing an application of the established form. What information should every taxpayer know? What to pay attention to those who want to get back part of the money spent on their studies?

When the deduction is due

First of all, it is worth figuring out when you can apply for a personal income tax refund for training. Not always and not everyone has such an opportunity.

The fact is that a return of part of the money for education is offered to all citizens who are taxpayers-residents of the Russian Federation, and also study full-time at a university. That is, a citizen has the right to receive money both for his studies and for the education of his child. When it comes to your own studies, the formgetting an education is not important.

But in the case of children, the deduction is due only when the student is under 23 years old. And subject to the full provision of the child's life at the expense of the parents. The student should not have a formal job. At the same time, parents are required to work officially. At least one of them. Or receive any profit subject to income tax.

How much to return

And how much money can be returned? Are there any restrictions? Yes, they do exist. Fortunately, not too serious. But it is worth considering whose training we are talking about. This is an extremely important point.

In general, they return, as a rule, no more than 13% of the total expenses. However, there are still some limits. The fact is that if an application for a refund of personal income tax for training is submitted for oneself, then for the entire period of study one cannot get back more than 15,600 rubles.

But for children this amount is higher. For each child, no more than 50 thousand rubles are deducted. That is, if parents pay for the education of 3 students, then they can receive a maximum of 150,000 rubles. These are the rules currently in force in Russia.

For what period is returned

The next question is how long can the deduction take? Many note that a refund is not required for the entire time of training. And it really is.

According to the laws established in Russia, you can request deductions from the tax authorities only for the last 3 years. That is why you should not rush. After all, deductions are made only once.

However,if a citizen decides to return part of the money for a particular year and he has a "balance" (for example, only 10,000 out of 50,000 are returned), he can get it by filing another declaration for the tuition deduction, but in a different tax period. This extra paperwork is highly discouraged by the tax authorities.

Features of serving

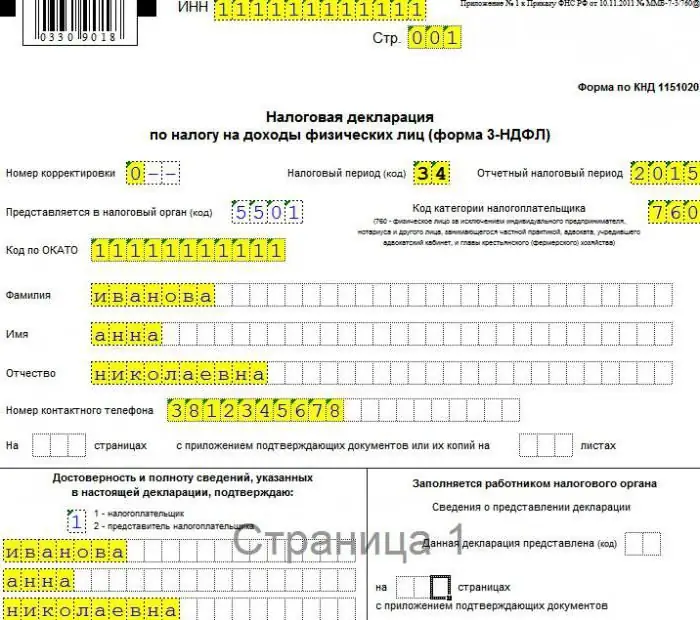

Filing a declaration has its own peculiarities. Each citizen must fill out the 3-NDFL form to make a deduction. This is the so-called income statement. Without it, no one will issue a deduction. This factor must be taken into account.

Therefore, an application for a refund of tuition is usually submitted along with the declaration of income for the year. Then you won't have to fill out the 3-personal income tax form several times.

Until when do I need to file income tax returns? At the moment, all taxpayers - individuals report to the state before April 30 of the year following the reporting period. That is, if a citizen makes a deduction for 2016, then you need to submit a certificate of income before 2017-30-04. In this case, you can return the money for 2014-2016 inclusive.

An application for a refund of personal income tax for training requires a certain list of documents. Without them, the return will be denied. What do you need to bring with you to the tax office at the place of registration along with the declaration of the established form?

Documents for deduction

The list of papers will depend on who the refund is for. But it doesn't differ too much. That's why,to apply for a refund of personal income tax for education, a citizen must bring with him:

- certificate of income (form 2-personal income tax);

- statements indicating stable income;

- university license;

- accreditation of an educational institution;

- student certificate;

- training contract;

- citizen's identity card;

- application for deduction;

- filled out form 3-personal income tax (taken at the tax office or filled out at home in advance);

- documents indicating kinship (if return for study of a relative);

- details for the accrual of funds;

- SNILS (desirable);

- receipts for tuition fees.

After submission

What to do after applying? Nothing else is needed. As soon as the 3-NDFL declaration (tuition refund) is submitted to the tax office, you can wait for an answer. Approximately in 2 months, the citizen will receive a notification in which the decision on the assignment of payments will be announced. If all the documents are true and presented in full, then within 1, 5-2 months the money will be credited to the account. Otherwise, the notice will write the reason for the refusal.

You can eliminate it and get a deduction in 30 days. Otherwise, you will have to deal with the design from the very beginning. That's all you need to know about how useful the 3-NDFL certificate is. The return of tuition is issued without any problems if the citizen is familiar with all the previously listed information.

Recommended:

For what you need an application for a personal income tax refund

Every citizen receiving income must pay income tax to the budget. Tax legislation provides for benefits that give the right to return part of the transferred tax in connection with certain expenses

How to get back the tax overpayment? Settlement or refund of overpayment. Tax refund letter

Entrepreneurs pay taxes in carrying out their activities. Often there are situations of overpayment. Making a larger payment also occurs for individuals. This is due to various reasons. You need to know how to get a tax refund

Refund of tax deduction when buying an apartment: documents. Deadline for tax refund when buying an apartment

So, today we will be interested in the deadline for the return of the tax deduction when buying an apartment, as well as the list of documents that will be required to provide to the appropriate authorities. In fact, this question is interesting and useful to many. After all, when paying taxes and making certain transactions, you can simply return the “nth” amount to your account. A nice bonus from the state, which attracts many. But such a process has its own deadlines and rules for registration

Is it possible to get income tax refund when buying a car? Documents for income tax refund for education, treatment, purchase of housing

Any officially employed person knows that every month the employer transfers income tax from his salary to the Federal Tax Service. It makes up 13% of income. This is a necessity, and we have to put up with it. However, it is worth knowing that there are a number of cases when you can return the paid income tax, or at least part of it

What can I get tax deductions for? Where to get a tax deduction

The legislation of the Russian Federation allows citizens to apply for various tax deductions. They may be related to the acquisition or sale of property, the implementation of social protection mechanisms, professional activities, training, medical treatment, the birth of children