2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:25

When applying for various benefits and payments in Russia, citizens face significant paperwork. And therefore, it is far from always possible to cope with the tasks set in the shortest possible time. Want to claim a medical bill? What documents are needed to complete this task? We will try to understand all these issues and not only further. Ultimately, the design of this should not cause any significant trouble.

Description

What documents do I need to prepare for the treatment tax deduction? The answer to such a question depends on the life situation in which a citizen applies for the relevant service. Therefore, each case has to be considered separately.

First, you need to understand what the medical treatment tax deduction is. It refers to social tax "refunds", which allows you to reimburse a small amount of money spent on paid medicine or medicines.

Sizereturn

Want to get a tax deduction for medical treatment? Everyone should understand what documents are needed for this. But also, a potential applicant will have to figure out what to expect in this or that case.

All treatment can be conditionally divided into ordinary and expensive. In the first case, a person has the right to a refund of 13 percent of the amount spent, but not more than 120,000 rubles in total, 15,600 rubles come out a year. In the second, thirteen percent of the cost of expensive treatment is reimbursed, without any restrictions.

Important: a person cannot demand more money from the state than he transferred in the form of personal income tax to the state treasury.

Conditions for registration

Preparing documents for receiving a tax deduction for dental treatment in Russia does not make any sense if a person does not have the appropriate right. Not all residents of the country can apply for the "service" being studied. Before the implementation of the task, you will first have to understand whether a person has the right to implement it.

To have a real right to reimbursement of money spent on medicines, rehabilitation or other medical services, you must:

- be officially employed;

- have income subject to 13% personal income tax;

- be a Russian citizen (dual citizenship is allowed);

- to make expenses out of your own "pocket".

Accordingly, if a person payssomeone else's treatment, he, as a rule, cannot demand a refund of the money paid for the said service. But there are exceptions. For example, if we are talking about the treatment of close relatives.

For whom it is provided

It is necessary to collect documents for the deduction for treatment only after a thorough study of the legislative framework of the relevant issue. Otherwise, the potential applicant will simply be denied service.

Today, citizens can return part of the costs incurred for paying for medical services:

- to myself;

- children;

- Spouses.

But the rest of the relatives can not be treated, while receiving part of the money back. This is not provided for by the current legislation of the country.

Where to request

Do you want to get a deduction for treatment? What documents are needed for this task, it is important for everyone to know. But you should also understand where to turn for help when applying for the corresponding "service". It's not as hard as it first seems.

At the moment, the tax authorities are involved in the deductions. A person can go to the Federal Tax Service of the region directly or apply to the multifunctional center with an application in the established form.

For some time now in the Russian Federation it has become possible to issue a deduction (social, property) through the employer. This is far from the most common option, but it is also found in practice.

Statute of limitations

It is worth noting that tax-type deductions can be claimed notalways. Citizens should apply to the authorized bodies only within the time limits established by the state. Otherwise, the refund will be legally denied.

The statute of limitations for claims less a deduction for treatment or other medical services is three years. This means that during this period a person can reimburse himself for the cost of paid treatment or the purchase of medicines. It is also allowed to request funds immediately for all 36 months. It is very convenient if the applicant or his family are regularly treated in paid clinics.

Instruction - draw up a deduction

Documents for receiving a deduction for treatment, as already mentioned, will vary depending on the specific life case. Therefore, first of all, you need to deal with the features of its design. And only after that to clarify what certificates to prepare under certain circumstances. Interested in a medical bill? What documents are needed? And what to do to get it?

To request a share of the money spent on medical care from the tax authorities or the employer, you need to do the following:

- Study the documents for the deduction, and then prepare the necessary certificates. They, as emphasized earlier, will change in one case or another, albeit slightly.

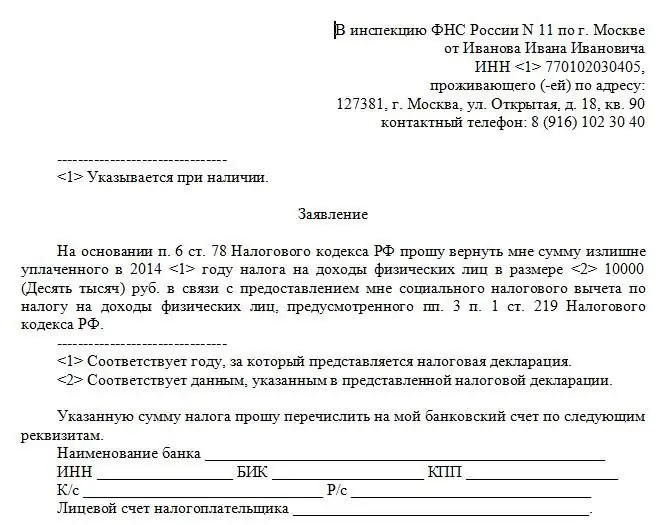

- Fill out the application of the established form.

- Apply for a medical bill to an authorized service.

- Wait for a response from the relevant organization, and then receive the funds in the prescribed amount.

Sounds like there won't be any design issues. But in practice, paperwork when requesting the studied "service" in Russia causes a lot of trouble. And therefore it is better to prepare for it in advance.

Basic information

Documents for a tax deduction for dental treatment or any other paid medical service have to be prepared in advance. Otherwise, the person may be legally denied service.

Without fail, a citizen will have to take with him to the authorized body:

- applicant's ID;

- statement of the established form;

- income certificate (available from employer);

- tax declaration for a particular tax period;

- checks for medical expenses;

- contract with a medical institution for the services provided;

- license of the selected place of treatment of a person;

- Physician accreditation and license, if required by law.

But this is usually not enough. Especially when it comes to documents for obtaining a tax deduction for the treatment of relatives. Under such circumstances, a person will have to face more paperwork. Fortunately, achieving the desired result is much easier than it seems.

Important: When it comes to reimbursement of funds for drugs and medicines, you will need to attach a doctor's opinion and a prescription issued by a specialist.

For the children

There was a need forbilling for treatment? What documents are needed in order to achieve the desired result?

Usually it depends on the situation. We have de alt with the main package of references. But they are usually not enough when it comes to reimbursement of funds "for medicine" received by close relatives of the taxpayer.

Quite often in Russia paid treatment is given to children. In this case, you will have to supplement the previously specified list:

- birth certificate of a minor;

- child's passport if he is fourteen years old;

- Adoption statements;

- certificates about changing the child's personal data (if any).

This list ends. As in the previous case, when reimbursing funds for medicines, you need to get a doctor's opinion and a prescribed prescription.

For spouses

Interested in the dental tax deduction? What documents to prepare under certain circumstances?

It also happens that a person pays for the treatment or rehabilitation of his spouse. By law, a working taxpayer may be reimbursed for a portion of the costs incurred for eligible services.

You need a marriage certificate to receive your spouse's treatment deduction. It is also recommended to attach certificates proving that the husband/wife does not have an official place of work.

For insurance

In Russia, as in many developed countries, people use paid medicalinsurance. And for it, too, you can return some money. The main thing is to know how to act to achieve the desired goal.

Implies treatment deduction. What documents are needed to reimburse the costs of paid he alth insurance? All of the above, but in addition to them, you will have to attach an insurance contract and a VHI policy. We must not forget about the license of the insurance organization. Otherwise, the taxpayer will simply be refused.

Through employer

Documents for receiving a deduction for treatment must be prepared in advance. This is the only way to protect yourself from failures from authorized services. What if a person decides to request a deduction through the employer?

In this case, you will have to prepare for the fact that the funds will not be issued on hand. Instead, a person will not pay personal income tax on wages in the amount of the deduction.

To cope with the initial task, the citizen will have to prepare all the previously listed documents. True, you can not prepare a 3-personal income tax form, as well as income statements. Sometimes it makes life a lot easier.

Private companies

Documents for obtaining a tax deduction for treatment in the Russian Federation can be collected and submitted to the authorized body by private intermediary companies. They issue tax returns for a fee, and also request certain certificates for citizens. If necessary, apply for deductions.

You can contact any relevantcompany. The intermediary will send an application with prepared certificates to the local tax office. True, such a scenario is not in demand. It is much easier and cheaper to contact the Federal Tax Service or the MFC on your own.

Tax transfer

Are you planning to make a deduction for dental treatment? We found out what documents to prepare under certain circumstances. It's hard to believe, but even pensioners and non-working citizens can count on an appropriate refund. True, not for long.

We are talking about the use of the so-called transfer of personal income tax. When applying for a tax deduction for medical services, income taxes paid to the state treasury for three years will be taken into account. Accordingly, in the event of the loss of an official place of work, a person’s right to a tax deduction will disappear only after thirty-six months.

Recommended:

Accounting documents are The concept, rules for registration and storage of accounting documents. 402-FZ "On Accounting". Article 9. Primary accounting documents

Proper execution of accounting documentation is very important for the process of generating accounting information and determining tax liabilities. Therefore, it is necessary to treat documents with special care. Specialists of accounting services, representatives of small businesses who keep independent records should know the main requirements for the creation, design, movement, storage of papers

Tax deduction for medical services: list of services, procedure for registration, documents

The tax deduction for medical services is a right that many citizens of the Russian Federation can use. This article will talk about who and for what can receive a refund in the field of medicine. How to do it?

What documents are needed for registration of SNILS: list, procedure for registration, terms

SNILS is an important document that every resident of the Russian Federation should have. This article will show you how to arrange it. What is useful for obtaining SNILS? And what are the most common challenges people face?

What documents are needed for a tax deduction: a list of papers for registration

Tax deduction - the right to a refund of part of the costs for certain services. This article will explain how to request this service

Tax deduction for treatment: who is en titled, how to get it, what documents are needed, rules for registration

This article will tell you how to get a tax deduction for treatment. What is it and what are the rules for issuing a return?