2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

Applying to tax deductions is a fairly popular service. But what needs to be prepared for the implementation of the task? And who is eligible to file a fixed form petition? Below we will consider the necessary documents for a tax deduction, as well as get acquainted with the basic rules for calculating the corresponding funds to the population. Without the latter, the preparation of papers will be useless. Therefore, legal rules will have to be given due attention.

Characteristic

What is a tax deduction?

This is the name given to the process of recovering part of the expenses for certain services against remitted taxes on income. If a person pays personal income tax, he has the right to receive a service, although this is not always the case.

In fact, the state will reimburse a certain amount of funds to the applicant for specific expenses. But with some restrictions. They will be discussed later.

Types of returns

What documents are needed for a tax deduction? The main problem is the lack of a clear answer to the question posed. It all depends on the specific situation and the type of return.

To dateit is customary to allocate such deductions:

- standard ("for children");

- social (for treatment/education/drugs);

- property (for a mortgage or regular purchase of real estate);

- professional (issued mainly by individual entrepreneurs, we will not get acquainted with him).

Accordingly, then we will study each scenario. Only with proper preparation will it be possible to quickly recover part of the costs for certain operations.

Basic conditions

Thinking about what documents to get a tax deduction will come in handy in 2018? To begin with, you will have to study the basic rules for filing applications of the established forms. After all, not all citizens are en titled to reimbursement of expenses incurred.

Today, there are such rules for obtaining a deduction:

- The applicant must have Russian citizenship. Foreigners are not offered study law.

- A citizen must transfer personal income tax to the tax authorities in the amount of 13%, no more, no less. Accordingly, not every entrepreneur will be able to exercise their right to a refund.

- A person must have a formal job. Or he needs to register as an individual entrepreneur. Unofficial income is not taken into account by the tax authorities.

- The transaction for which the applicant pays must be registered to the person who requests reimbursement. All transactions are also carried out on behalf of the respective person.

Important: under certaincircumstances, you can return money for services rendered to a spouse, children, brothers and sisters.

Limits and restrictions

Documents for obtaining a tax deduction of one type or another must be prepared only when there is a right for the service. It disappears after the set limits for each type of return are exhausted.

Under current laws, the deduction is 13% of the expenses incurred. At the same time, it is impossible to recover more than a person transferred taxes in the form of personal income tax in a given year.

Moreover, each type of deduction has its own limits. Namely:

- for the purchase of property - 260,000 rubles;

- on a mortgage - 390,000 rubles;

- social deductions - 120,000 rubles (and no more than 50,000 rubles for the education of each child).

The standard deduction for a child is issued by the employer and it is fixed. We will not get acquainted with this scenario either.

Important: you cannot return more than 15,600 rubles in total for any social deduction per year. But a citizen can demand a refund immediately for 3 years that have passed since the conclusion of the transaction.

The above rules do not apply to expensive treatment. For it you can return exactly 13% of payments.

Where to apply

Many are interested in where to go with documents for a tax deduction. This is a pretty simple question. But everyone decides for himself what to do.

In Russia, requests of established forms are accepted:

- taxbodies;

- MFC;

- Single Window Services.

Certain types of returns can be issued by the employer. For example, a standard or social deduction.

Procedure of actions

It is important not only to understand the legal aspects of the issue under study and the list of required documents for a tax deduction, but also to understand how to act in this or that case.

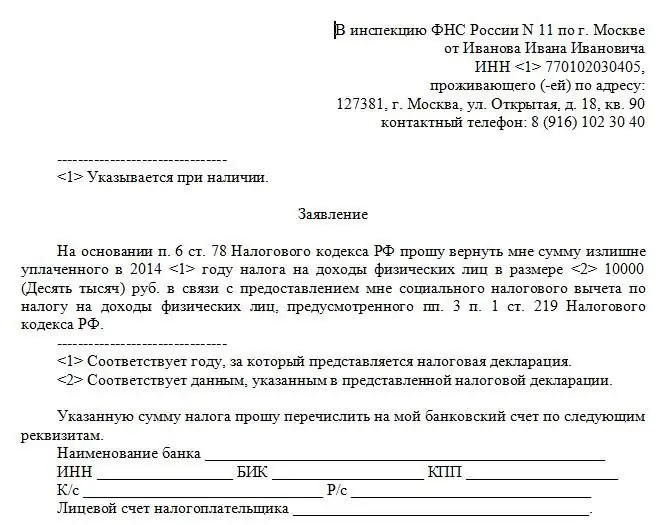

Let's consider the procedure for filing an application with the Federal Tax Service of the Russian Federation. Citizen will need:

- Create a package of papers required for a particular case.

- Fill out an application for a refund. The request must include the account details of the recipient of funds.

- Submit an application to the registration authority.

- Wait for a response from the Federal Tax Service. It usually arrives within 1.5-2 months.

- Receive money to the specified account. The process takes another 60 days.

There is nothing difficult or incomprehensible about this. The main thing is to find out what documents are needed to receive a tax deduction of one type or another.

Important: if the service is denied, the Federal Tax Service indicates the reason in its response. The person is given a month to correct the situation without resubmitting the request.

Main Package

What tax deduction documents do all potential applicants need to prepare? This is not such a difficult question. Especially if you divide it into several parts.

To begin with, let's get acquainted with the list of papers required under any circumstances. It is included regardless of the return type.

The applicant will be required to:

- income certificates (for example, in the form 2-personal income tax);

- tax return for a given period;

- identity card;

- statement;

- checks and receipts indicating the fact of certain expenses.

But that's not all. What documents may be needed for a tax deduction yet? Let's deal with this issue further!

Important: all payment documents must be issued to the applicant. Otherwise, the return will not be processed.

Buying property

To begin with, let's study the most common scenario. We are talking about the return of expenses for the purchase of property. In particular, real estate.

Let's consider the process of forming a package of papers using the example of buying an apartment. In this case, the applicant is required to:

- USRN statement;

- property purchase agreement;

- statements and receipts of the seller receiving money for the operation.

These components report to the previously listed papers. Sometimes you have to try hard to achieve the right to return. Especially when requesting services in marriage.

For family people

Documents for a tax deduction for an apartment can be supplemented. For example, if we are talking about getting a refund by a family person. Then it is better to prepare for the process in full.

The thing is that family applicants are often asked to:

- marriage/divorce certificates;

- adoption certificates;

- Birth certificates of all children (especially if they own the apartment being refunded).

In some cases, you need to take an extract from the personal account of the apartment and from the BTI. As a rule, such documentation is not required from citizens. But it will come in handy when buying property.

Mortgage and return

What documents for a tax deduction when buying property on a mortgage are useful? This question is starting to worry many modern families.

So far, the Federal Tax Service, when making a return for the main loan, asks:

- mortgage agreement;

- payment schedule;

- receipts for payment of due bills;

- certificate of ownership of the apartment.

That's it. It is advisable to attach the listed references in originals. Copies of them will also not be superfluous. There is no need to certify documentation.

Mortgage interest

What documents to prepare for a tax deduction if you want to return funds for mortgage interest? In this case, the package of papers will not be too large. It resembles statements for the return of money under the main mortgage agreement.

In addition, applicants will need to bring:

- interest checks;

- loan repayment schedule.

Nothing else needed. In fact, everything is much simpler than it seems. And if a citizen prepares in advance for the operation, he will be able to request money without much hassle.

Own treatment

Nowconsider social returns. For example, for treatment. This is a fairly common scenario. Especially when it comes to paid childbirth or dental treatment.

In modern Russia, such necessary documents are allocated for a tax deduction for their own treatment (or the purchase of medicines):

- contract with a medical institution;

- payment documents;

- medical report with a prescription for medicines;

- medical facility license;

- doctor's license (in some cases).

To prepare the basic documentation for the return of money for the services rendered, a citizen must contact the registry of the selected hospital. They will quickly form a package from the listed references. The main thing is to take receipts confirming expenses with you.

Child treatment

The next option is to apply for a child care deduction. Usually meant minors and disabled.

Under such circumstances, you need to additionally take a birth or adoption certificate from the Federal Tax Service. In addition, it will be necessary to prove that it was the applicant who paid for the medical services. This is easy to do.

As in all of the above cases, you need to attach these documents for a tax deduction to the main package of papers. You can submit a request for consideration and wait for a response from the tax authorities.

Own study

Another scenario is an appeal to the Federal Tax Service to receive money for tuition. For example, a brother or sisteryour own child or yourself. Exercising the right is much easier than it looks.

Let's study additional certificates for reimbursement of expenses for our studies. They include:

- student certificate;

- agreement with an educational institution;

- organization license;

- accreditation of speci alty/chosen area of study.

The last two papers must be submitted as certified copies by a notary. You can take them in the accounting department of an educational institution.

Important: a person is en titled to a tuition deduction "for himself", regardless of the form of study. You can also return the expenses for the "refund" card.

Teaching relatives

More difficult is the situation in which there is a return of money for the study of relatives. For example, a sister or her own child. In the first case, you will have to try hard.

The thing is that a citizen needs to find and prepare:

- statements confirming kinship with the student;

- agreement for the provision of educational services;

- certificate of education (taken at school/kindergarten/university/technical school);

- license and accreditation of the organization.

The main problem is to prove the relationship between the applicant and his brother/sister. Moreover, sometimes the Federal Tax Service may be asked to point out the fact that no one else can pay for educational services.

In the case of teaching children, everything is much simpler. The previously listed package of references is supplemented by an act onadoption or birth certificate.

Important: a return of this type is allowed only if the relative does not have official employment and before he reaches 23 years of age. Usually, only full-time tuition fees can be refunded.

Conclusion

We found out what documents are needed for a tax deduction in Russia in 2018. Now there should not be any problems with the preparation of certificates. And including getting a refund. The main thing is to follow the instructions listed earlier.

In fact, obtaining a deduction for certain transactions is a rather long and laborious operation. It takes about 4-6 months, taking into account the preparation of all the documentation listed above.

As we have already said, a person may be denied a deduction. However, the refusal does not affect the right to re-apply. A person can claim a refund if he meets the listed conditions. And until the set limits on deductions are exhausted.

Recommended:

List of documents for a tax deduction for an apartment. Property deduction when buying an apartment

Fixing a tax deduction when buying real estate in Russia is accompanied by significant paperwork. This article will tell you how to get a deduction when purchasing a home. What documents will need to be prepared?

What documents are needed for deduction for treatment: list, rules of registration

In Russia, many citizens can apply for a so-called tax deduction. For example, social type. People are able to recover part of the cost of medical services. But how to do that? This article will talk about the tax deduction for treatment in the Russian Federation

Tax deduction for medical services: list of services, procedure for registration, documents

The tax deduction for medical services is a right that many citizens of the Russian Federation can use. This article will talk about who and for what can receive a refund in the field of medicine. How to do it?

What documents are needed for registration of SNILS: list, procedure for registration, terms

SNILS is an important document that every resident of the Russian Federation should have. This article will show you how to arrange it. What is useful for obtaining SNILS? And what are the most common challenges people face?

Tax deduction for treatment: who is en titled, how to get it, what documents are needed, rules for registration

This article will tell you how to get a tax deduction for treatment. What is it and what are the rules for issuing a return?