2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:25

The birth of a child is not only a joyful event, it is usually accompanied by paperwork. For example, when registering children's documents and benefits. Employed citizens are en titled to a tax deduction at the birth of a child. But not everyone knows how to arrange it. Fortunately, to cope with the task will not be difficult. It is enough to have a good understanding of the current legislation.

Description

The 2019 birth tax credit is called the standard child tax credit. But what is it?

With the help of this deduction, a citizen will be able to reduce the tax base when calculating personal income tax levied on wages. True, for a fixed amount. It directly depends on how many children a person has.

Who has the opportunity

A tax deduction at the birth of a child can be issued by legal representatives of a minor. Usually they are able to request:

- mom and dad;

- single parent of a minor;

- guardians;

- adoptive parents.

At the same time, if both parents work in the family, one of them may receive an increased tax deduction. To do this, the second spouse will have to waive the corresponding right in favor of the husband/wife.

Basic conditions for obtaining

How to get a tax deduction for the birth of a child? The thing is that the right to it arises after the appearance of a minor in the family. And it disappears when the child reaches 18 years of age. Occasionally - 16 or 23 years. But not every parent can apply for one. You will have to make sure that the conditions established by law are observed.

For example, only a citizen with Russian citizenship can issue a tax deduction. Eligible person must have formal employment and income taxable income.

A tax deduction at the birth of a child is issued for working citizens who receive up to three hundred and fifty thousand rubles in the form of a salary a year. Otherwise, you cannot count on it. The corresponding opportunities are simply not provided.

It is worth paying attention to the fact that if one of the parents does not have a minor official employment, the second of them will not be en titled to an increased deduction.

For one

The tax deduction for the birth of the first child raises many questions for parents. For example, how much can you get in one case or another.

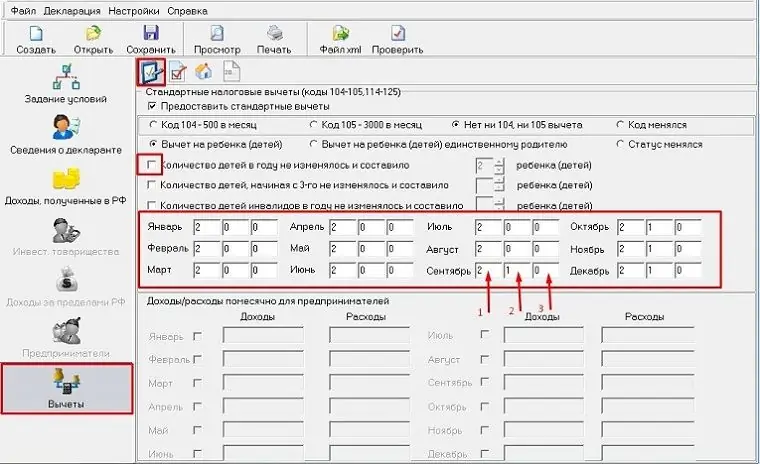

As already mentioned, the size of the standard tax deduction in Russia for children depends on the number of minors. For one baby, a deduction of 1,400 rubles is put. Is it possible to count on a large amount? No, but there are exceptions. For example, if the child is disabled. More on that later.

For two

But what if there are two children in the family? It doesn’t matter whether they are from the same marriage or from different ones - the main thing is that minors are “registered” according to the documents for one or another parent or adoptive parent.

The standard tax deduction for the birth of a child is 1,400 rubles. The same is due for the second minor in the family. That is, a person will be able to receive a total deduction of 2,800 rubles.

Three or more

Not all families are limited to one or two children. It also happens that citizens give birth to many children - three or more. And such cells of society, as a rule, are considered to have many children. The state also supports them. Such cells of society can count on tax-type deductions.

For the presence of a third and subsequent children, a working person is offered a standard "return" in the amount of three thousand rubles. The corresponding amount is issued for the third, fourth and subsequent adopted or born children. So, if there are 3 children in a family, a citizen will be able to receive 1,400 + 1,400 + 3,000=5,800 rubles in the form of a standard deduction.

If there is a disabled person

Tax deduction at birthwe considered the second child. It also happens that children are born or become disabled. Under such circumstances, families in the Russian Federation are trying to support the peculiar benefits. And in the tax sphere as well. For example, parents in this case will be en titled to an increased deduction.

It is only 12,000 rubles. This is how much one legal representative of a disabled child is paid until he or she comes of age. An exception is if the child is studying at the "point". Under such circumstances, the parent may count on the deduction until the disabled person reaches the age of 24 or graduates. How much will the family get? In this case, the final deduction will be 1,400 (or 3,000) + 12,000 rubles. It follows that the "turn" of the child by birth is also taken into account.

For adoptive parents

The tax deduction at the birth of a child, as already mentioned, is due not only to natural parents, but also to adoptive parents. In the case of he althy minors, its amount will be established according to the principles indicated above. The exception is if the child has a disability.

The point is that adoptive parents in the described situation will receive a smaller deduction. They are legally en titled to the amount of six thousand rubles. No more, no less. More precisely, as in the previous case, the standard deduction for a he althy child will be taken into account, and there will also be a "surcharge" for disability.

Request Locations

Tax deduction at the birth of a child must be properly processed. And not everyone knows how to cope with this task. Actually it's not like thatdifficult as it may seem at first.

It is proposed to issue a deduction through:

- multifunctional center;

- one stop shop service;

- Regional Tax Service;

- employer.

The last option is the most common. The Federal Tax Service and other authorized bodies apply for deductions if the employer has not issued one or to collect taxes that are overpaid.

Instructions on request

How can I claim a tax deduction after having a baby? To cope with this task, you will have to prepare. And, as a rule, if you contact the employer, you will need to face less paperwork. But in general, the actions will be similar in both cases.

So, in order to apply for a standard tax deduction for a child, you must:

- Clarify what certificates to prepare, and then put them together.

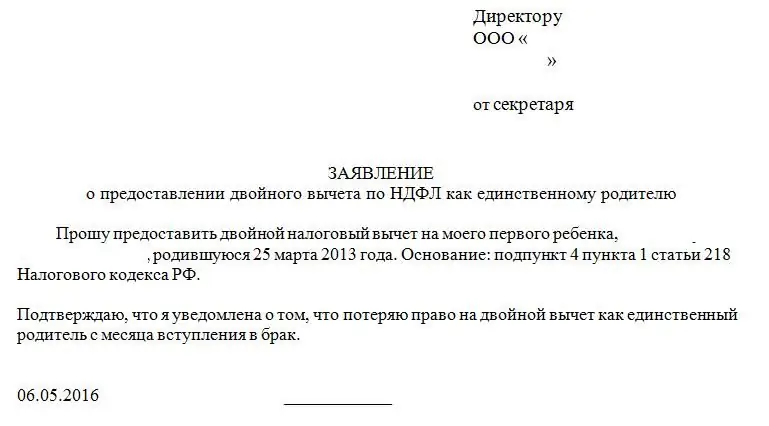

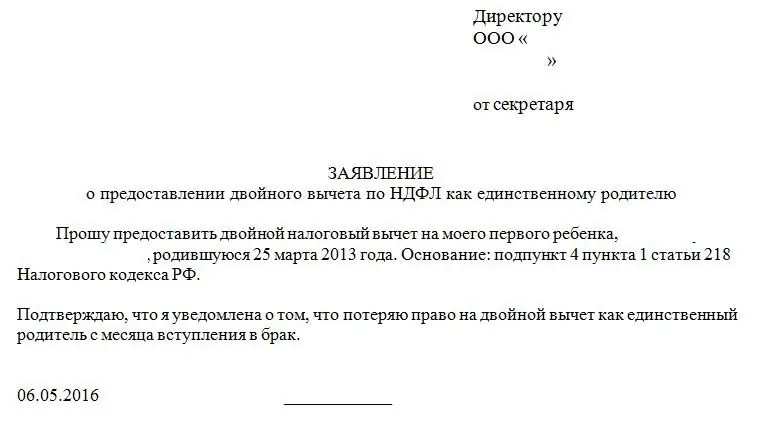

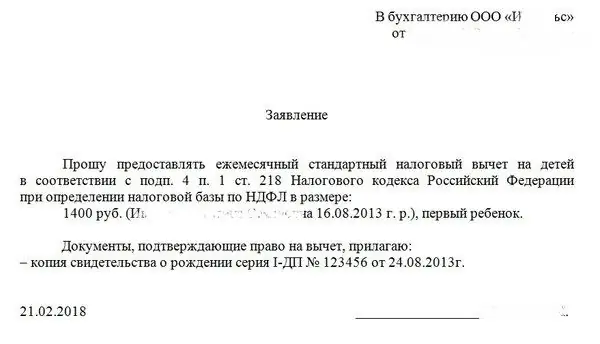

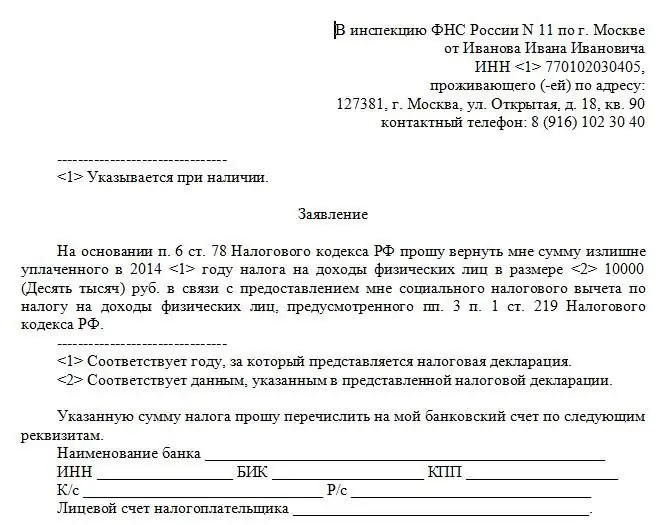

- Fill out an application for a tax deduction. You can take the form of the established form at the MFC, on the website of the Federal Tax Service or directly at the tax authority.

- Apply to the authorized body with a statement.

- Wait a while. If we are talking about applying to the Federal Tax Service - about one and a half to two months, if the application was submitted to the employer - before the first salary.

If a citizen did everything right, he will be given a tax deduction at the birth of a child. Or rather, the standard deduction for children in the prescribed sizes. Otherwise, the person must be informed of the denial ofservice.

Important: when refunding the overpaid tax, the money will be transferred to the applicant to the account specified in the application. Otherwise, the base for calculating personal income tax from earnings will be reduced.

Key Documents

Interested in the tax deduction for the birth of a child? An application without documents will not be accepted by the authorized bodies. Therefore, special attention will have to be paid to the certificates required for a standard tax deduction.

In our case, it is mandatory to prepare:

- statement of the established form;

- tax return;

- birth or adoption certificate for minor children;

- stamped marriage certificate (if any);

- identity card.

This should be enough if a citizen applies for a deduction to his employer. All references must be submitted in original. You can also make copies of them and then notarize them.

Other references

And what else can be useful for the implementation of the task? In order not to be mistaken, it is better to clarify the corresponding list with the Federal Tax Service or with the head. They will definitely tell you what to take with you for a particular case. In addition to the previously indicated documents, in practice, a potential applicant may need additional information.

Among them are:

- copy of the spouse's passport with the refusal of the deduction (it is advisable to indicate in the document in whose favorperson);

- certificates of disability for minors;

- statements showing the applicant's salary.

Practice shows that there is nothing difficult or incomprehensible in the preparation. If the other parent is deceased, the spouse must attach a certificate of death or declaration of death. The person concerned would then be en titled to an increased deduction, but only until they remarry.

Can they refuse

How to get a tax deduction for the birth of a child is now clear. Can a citizen be denied an application?

Yes, but this is far from the most common case. However, it does occasionally occur in practice. Refusal to grant a tax-type deduction must be justified.

This situation usually occurs when:

- not all necessary documents were provided to the authorities;

- the references used are invalid;

- applicant has no official income;

- children have been emancipated or come of age;

- the annual income of a citizen exceeds the maximum deductible value.

If a disabled child is studying, it is additionally recommended to prepare also:

- contract for educational services;

- student certificate.

In this case, as a rule, the employer can simply refuse to deduct the employee, reporting the reasons orally. And the tax authorities must give a refusal in writing.

Conclusion

Standard tax deduction for a child can now be issued by everyone. More precisely, citizens will know when and how to act to achieve the task.

In reality, everything is not as difficult as it seems at first. If you know how to proceed, you can pretty quickly draw up any tax type deduction. And not only at birth or adoption of minors.

It is recommended to issue a deduction immediately after the production of children's documents. This way you will be able to get the maximum benefit legally. A reduction in personal income tax, albeit by a small amount, is not superfluous for families with children.

Recommended:

What is a property deduction, who is en titled to it and how to calculate it? Article 220 of the Tax Code of the Russian Federation. property tax deductions

Russia is a state in which citizens have a lot of rights and opportunities. For example, almost every citizen of the Russian Federation has the right to receive a property deduction. What it is? Under what conditions can it be issued? Where to go for help?

Tax deduction for a child: what is it and who is en titled to it?

Tax deductions are different. And they are provided to citizens on different conditions. For example, there is a deduction for a child. What's this? How and where to apply? This article will tell you all about claiming deductions for children in Russia

Application for a refund of personal income tax for education: when you can get it, the rules for applying for a tax deduction

Getting tax deductions in Russia is a very simple process. This article will tell you all about how to get a tuition deduction and apply for a refund of the money spent

Tax deduction for treatment: who is en titled, how to get it, what documents are needed, rules for registration

This article will tell you how to get a tax deduction for treatment. What is it and what are the rules for issuing a return?

What can I get tax deductions for? Where to get a tax deduction

The legislation of the Russian Federation allows citizens to apply for various tax deductions. They may be related to the acquisition or sale of property, the implementation of social protection mechanisms, professional activities, training, medical treatment, the birth of children