2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

The 70 account is designed to summarize all employee pay data. It takes into account various bonuses, benefits, reflects transactions for the issuance of pensions, as well as for the payment of profits from the company's securities. In this publication, the reader will learn a lot of interesting information about the account “Settlements with payroll employees”, its correspondence, balance, and examples will help to master the material.

What does a 70 loan account reflect

Credit 70 of the “Payment to employees” account records the following operations:

- payroll for employees;

- money accrued thanks to the formed reserve for vacation pay (D96 / K70);

- calculation of contributions through transfers to the social protection fund of citizens and other similar amounts (D69 / K70);

- profit arising from participation in the capital of the company (D84 / K70).

Debit account 70

70 The debit account reflects the funds paid out, which may include allowances, bonuses, wages, as well as profit from investments in the capital of the enterprise. This takes into account taxes, payments under the executivedocumentation and other retentions. The amounts of money accrued but not paid within a certain period due to the absence of the recipient are fixed (D70 / K76.3). Analytical accounting for the account in question is maintained for each employee of the organization.

Debit Correspondence

70 the account “Settlements with employees for wages” interacts by debit with the following accounts:

- "Cashier" (50);

- "Settlement accounts" (51);

- "Currency accounts" (52);

- "Special bank accounts" (55);

- "Calculations on taxes and fees" (68);

- "Social Security and Security Settlement" (69);

- "Settlements with accountable persons" (71);

- "Settlements with personnel for other operations" (73);

- "Settlements with different debtors and creditors" (76);

- "On-farm settlements" (79);

- "Shortages and losses from damage to valuables" (94).

Example of business transactions

To better understand what transactions can be made using account 70, you should read a few examples.

| D70/K50 | Payment of wages (cash) to staff according to relevant documentation |

| D70/K52 | Salary accrued to bank accounts of employees (based on statements) |

| D70/K55 | Transfer of salary from special bank accounts |

| D70/K73 | Repayment of the cost of workwear by the employee according to the application |

| D70/K10.9 | Issuance of branded clothing to staff |

| D70/K68 personal income tax | The operation of withholding income tax from the organization's staff |

| D70/K91.1 | Free transfer of workwear to the company's courier |

| D70/K72.2 | Reflection of deductions from the wages of guilty citizens |

| D70/K70 | No pay arrears and account closing |

Loan Correspondence

Account 70 interacts on a loan with the following accounts:

- "Investments in non-current assets" (08);

- "Main production" (20);

- "General production expenses" (25);

- "General expenses" (26);

- "Service industries and farms" (29);

- "Sales expenses" (44);

- "Social Security and Security Settlement" (69);

- "Settlements with different debtors and creditors" (76);

- "On-farm settlements" (79);

- "Marriage in production" (28);

- "Retained earnings (uncoveredloss)" (84);

- "Other income and expenses" (91);

- "Reserves for future expenses" (96);

- "Deferred expenses" (97);

- "Profit and Loss" (99).

Examples of loan business transactions

In accounting practice, the 70th account is used in different cases. Some of them are considered in the table.

| D23/K70 | Payroll operation for employees performing ongoing repairs |

| D08.3/K70 | Write-off of costs for investments in non-current assets |

| D08.4/K70 | Accounting for the company's own expenses related to the purchase of fixed assets |

| D29/K70 | Money was accrued to employees involved in servicing production and various types of farms |

| D97/K70 | Recognition of costs for the restoration of fixed assets as future expenses |

| D44/K70 | Money transferred to employees who ensure the sale of products |

| D91/K70 | Money has been accrued for the salaries of people involved in the dismantling of equipment |

| D08.1/K70 | Implementation of payroll costs |

Account balance

In most cases, the account balance of 70 is credit and means the company's debt to the staff. By structure, in the general case, the account is passive and is reflected in the appropriate section of the balance sheet. However, in practice there are situations when the advance payment is more than the accrued salary for the month. This may be the result of a combination of special circumstances or arithmetic errors (incorrect calculation and transfer of salaries), then the employee will have to return the money, and the balance is recorded in debit.

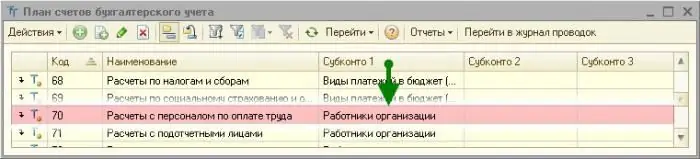

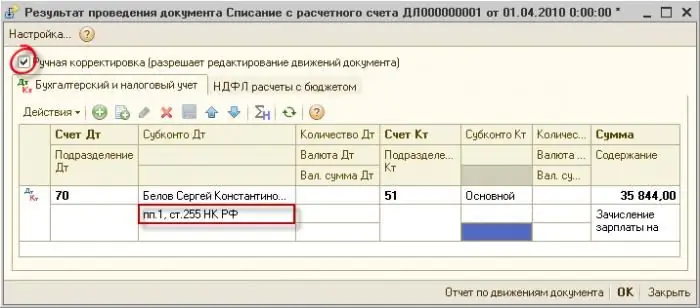

Calculation of remuneration for personnel in the 1С system

It is possible to calculate the correct salary in the program "1C: Salary and Personnel", subject to a certain sequence of arrangement of all the required data in the infobase. The results of the calculations are entered into the payroll. Some organizations pay out wages on account cash warrants, which are issued for each worker. To avoid mistakes, users of the 1C system are advised to calculate all the numbers in the payroll, and issue money according to the required documents.

To compile a payroll in the 1C program, you need to open the "Reports" menu and select the appropriate item. The document can be compiled as a whole for the enterprise or for a specific unit, as well as for a group of employees. The order of reflection of data in the payroll:

- The serial number of the record is put in column No. 1.

- In columns 2-5, information about the employee is entered. It can be viewed from the "References" section.(personnel number, surname and initials, position or profession, tariff rate or salary).

- Based on the time sheet, column 6 contains data on the number of days actually worked in the period, and number 7 - days worked on holidays and weekends.

- Displays information on accruals for the current month by type of payment (sections 8-12), as well as the calculation of deductions from the amount.

- Column 13 sets the amount of tax payable this month.

- Data are entered on other deductions from the worker's salary (column No. 14): loan repayment, alimony, union membership dues, etc.

- Column 15 summarizes.

- Column 16 shows the company's debt (employee's debt) based on the results of previous calculations.

- If there is a difference between the results of columns No. 12 and No. 15, it is shown in column No. 18 "Amount to be paid".

The article examined in detail the 70th account “Settlements with employees for wages”. Knowing its features, young professionals will be able to correctly perform the required financial transactions.

Recommended:

Accounting documents are The concept, rules for registration and storage of accounting documents. 402-FZ "On Accounting". Article 9. Primary accounting documents

Proper execution of accounting documentation is very important for the process of generating accounting information and determining tax liabilities. Therefore, it is necessary to treat documents with special care. Specialists of accounting services, representatives of small businesses who keep independent records should know the main requirements for the creation, design, movement, storage of papers

Accounting 76 account: balance, credit, debit, postings

All financial transactions are reflected in the accounts. This publication will discuss what account 76 “Settlements with various creditors and debtors” is intended for, into which categories it is divided. The article will provide examples to help you better understand the topic under consideration

Accounting for working hours in the summary accounting. Summarized accounting of the working time of drivers with a shift schedule. Overtime hours with summarized accounting of wor

The Labor Code provides for work with a summarized accounting of working hours. In practice, not all enterprises use this assumption. As a rule, this is due to certain difficulties in the calculation

44 accounting account is Analytical accounting for account 44

44 accounting account is an article designed to summarize information about the costs arising from the sale of goods, services, works. In the plan, it is, in fact, called "Sales Expenses"

A settlement account is Opening a settlement account. IP account. Closing a current account

Settlement account - what is it? Why is it needed? How to get a savings bank account? What documents need to be submitted to the bank? What are the features of opening, servicing and closing accounts for individual entrepreneurs and LLCs? How to decrypt bank account number?