2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

All financial transactions are reflected in the accounts. This publication will discuss what account 76 “Settlements with various creditors and debtors” is intended for, into which categories it is divided. The article will provide examples to help you better understand the topic.

Destination of account 76

76 the account is an active-passive settlement. It is necessary in order to summarize information on financial transactions with debtors and creditors not included in accounts 60-75:

- property insurance;

- claims;

- Funds deducted from employees' wages for third parties as ordered by the courts or executive acts.

In the new chart of accounts, the functions of the account in question, through which the main financial flow is carried out, have significantly expanded. In this regard, it became advisable to open different categories intended for certain types of calculation.

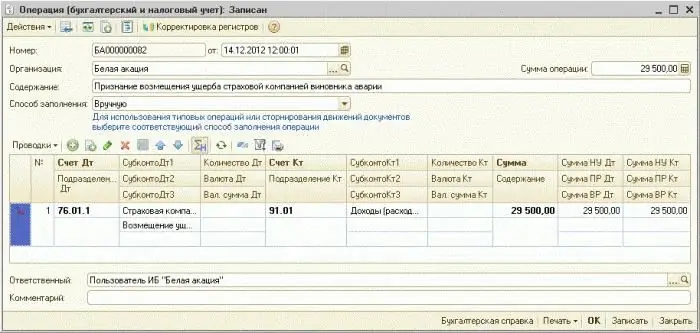

Account 76: sub-accounts 1 and 2

Because cash transactions can be different, accounts payable and accounts receivableusually divided into several categories. The first (76.1) includes insurance of property and personnel, with the exception of payments for medical and social insurance.

The transfer of money amounts of the organization is reflected in the debit, and the write-off of funds - in the credit. For example, D76 K73 is the insurance compensation due to the employee of the organization in accordance with the contract. D51 K76 - receipt by the organization of funds in accordance with regulations. D99 K76 - writing off uncompensated insurance claims or damage from a force majeure event.

Sub-account 76.2 reflects the settlement of claims that may be made:

- to suppliers, transport agencies and contractors for price discrepancies found, when calculating errors are detected after the accounts are completed, as well as when there is a shortage of cargo (D76 K60);

- to organizations for violating quality standards, non-compliance with specifications (D76 K60);

- to credit institutions for erroneously written off or transferred amounts on the organization's accounts;

- for downtime or marriage caused by suppliers, contractors (correspondence with section III of the chart of accounts);

- for fines and pen alties for non-compliance with obligations in the contract (correspondence with invoice 91).

Credit sub-account 76.2 reflects payments received. If cash is found to be non-collectible, it is treated as a debit.

Account 76: sub-accounts 3 and 4

Clause 76.3 controls dividends due to the firm and other types of income that do not contradictpartnership agreement. D76 K91 - profit to be received (distributed). D51 K76 - funds received by the organization from debtors.

The fourth sub-account is designed to take into account the amounts accrued to the employees of the enterprise, but not paid within a certain period due to the absence of the recipients. In such cases, the following posting is performed: D70 K76. When a worker receives money, an entry is made in the debit of account 76.

Use of sub-account 76/3 in practice

Oasis LLC has a receivable in the amount of 1,350,000 rubles. on account 62 "Settlements with customers and buyers". For certain reasons, before the due date of payment, she transferred for 750,000 rubles. their rights to the enterprise Iceberg LLC, which was able to recover 900,000 rubles on account of the debt due. In this situation, several questions arise:

- Is accounts receivable a purchase of property or a financial investment in assets?

- The buyer's asset is 1,350,000 rubles. or 750,000 rubles?

- Is the debt of debtors considered income in this case, and 750,000 rubles. - the expense of the enterprise Iceberg LLC?

In such a situation, Oasis LLC must, from a legal point of view, make the following entries:

Debit 91.2 Credit 62 RUB 1,350,000 - writing off the right of claim from buyers.

Debit 51 Credit 91.1 RUB 750,000 - compensation received.

Such transactions allow you to record "Other income and expenses" on the accountsloss of the Oasis enterprise arising from the assignment of the right to claim. Accountants of the Iceberg company must make a debit entry to account 76.3 in order to fix the debt from counterparties. The difference between the rights received and the costs for them is shown on the credit of accounts 98/1, 83 or 90/1.

Even partial collection of payment leads to mutual agreement of both parties and full repayment of debts. The unpaid part is reflected in the debit of 51 accounts, and the debited part is reflected in 98.1. In this example, it turns out:

Debit RUB 51,900,000

Debit 98.1 RUB 765,000

Credit account 76 RUB 1,350,000

The Iceberg company spent 750,000 rubles. to acquire rights and returned 900,000 rubles, that is, the profit is 150,000 rubles. The wiring is:

Debit 98.1 Credit 91.1 RUB 150,000

The real amount of profit from the operation is reflected in account 98/1, intended for fixing deferred income.

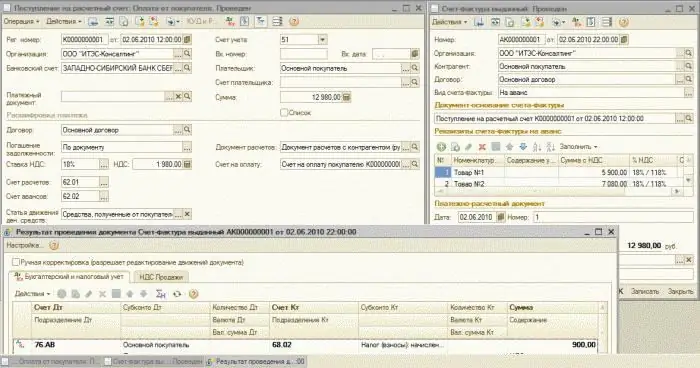

Sub-account 76. AB "Value added tax on advances and payments"

Summarize information about the calculations for the payment of VAT from advance payments allows account 76. AB. Accounting is maintained with those customers and buyers from whom money was received in advance for the planned shipment of goods or for the provision of various types of services.

Business transactions can be different. For example: D68.02 K76. AV - accounting for value added tax on payment received from the client in advance. D 76. AB K68.02 - accrual of VAT on funds received in advance from buyers. Check76. AB has the following subcontos (analytical characteristics): “Counterparties”, “Invoices”.

Debit Correspondence

The account under consideration (76) by debit can correspond with the following: “Fixed assets” (01), “Equipment for installation” (07), “Profitable investments in the MC” (03), “Investments in non-current assets” (08), "Intangible Assets" (04). From the second section of the chart of accounts, it interacts with the items "Materials" (10), "Animals for growing and fattening" (11), "Procurement and acquisition of MC".

76 the account can correspond in debit with all items of the section "Costs of production", as well as with accounts 44 41, 45 and 43, the category "Finished products and goods". Postings are often made with cash accounts: 52, 50, 58, 51, 55, as well as with settlement accounts: 60, 67, 66, 62, 73, 70, 76, 71, 79. In addition, correspondence with the following accounts is carried out by debit: 99 (reflects profits and losses), 91 (fixes miscellaneous income and expenses), 90 "Sales", 97 "Deferred expenses", 86 "Target financing".

Examples of business transactions (by debit)

Some examples from the table will help you understand the material presented in the article.

| Correspondence | Content of business transaction |

| D76 K20 | The cost of unfinished main production decreased due to debtors and creditors. This may be the accrual of the debt of the insurance company foroccasion (state of emergency or force majeure). |

| D76 K28 | Losses from marriage are charged to accounts payable and accounts receivable. |

| D76 K60 | Receipt of debts to suppliers, according to documents confirming consent to the transfer of funds. |

| D76 K50 | Paying funds to creditors in cash (from the cash desk). |

| D76 K68-VAT | Identification of budget arrears (for VAT) during the determination of revenue for taxation. |

| D76 K26 | General business expenses are offset by various debtors and creditors. |

| D76 K43 | Accounting for debts from different debtors for finished products. |

| D76 K29 | The cost of maintenance work in progress decreased due to the transfer of funds to the organization from debtors. |

Loan Correspondence

Accounting account 76 can interact with the following categories of the chart of accounts: "Investments in non-current assets", "Fixed assets", "Intangible assets", "Equipment for installation", "Profitable investments in the MC". In the "Inventory" section, correspondence is carried out with the accounts "Materials", "Procurement and purchase of MC", "Animals for growing and fattening", "VAT on acquired values".

76 bill can alsointeract on a loan with all calculated (except for 68, 69, 75, 77) and the category "Production costs". From the section "Finished products and goods" - with accounts 52, 50, 51, 44, 55, 41, 57, 45, and 58. In addition, correspondence is carried out with most settlement accounts and, of course, with those that reflect monetary transactions (91, 97, 94, 96, 99).

Examples of business transactions (loan)

To visually familiarize yourself with what account 76 transactions have, the table below will help with several examples.

| Correspondence | Content of business transaction |

| D01 K76 | Write-off of purchased fixed assets (FA) in the accounts payable section. |

| D03 K76 | Return of leased property to the balance of the enterprise (occurs in cases where there was no change of ownership on the basis of an agreement). |

| D10 K76 | Write-off of materials in terms of accounts payable. |

| D51 K76 | Receiving money from the client to the current account. |

| D62 K76 | Receiving debt from buyers on the basis of an agreement. |

| D25 K76 | Debt to various creditors and debtors for general production costs. |

| D76 K76 | Fixation of the current accounts payable to the lessor (for lease payments) to reduce long-term liabilities. |

Account balance 76

Beginning accountants often ask what account 76 really is: active or passive? In practice, situations are different, but since it takes into account receivables and payables, the balance can be of two types:

- one-way (debit or credit);

- two-way (simultaneously debit and credit).

This means that the account in question is active-passive. In order to determine the debit balance, all debts from counterparties are summed up. The balance 76 of the loan account reflects all the money that the company is obliged to pay.

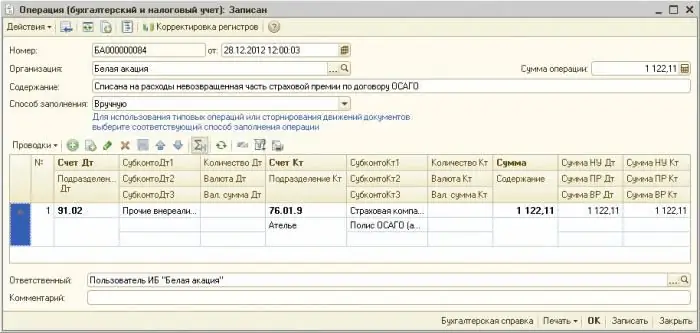

Reports on payables and receivables in the system 1 С

A company using the "1C: Enterprise 8" system must keep a report on the amount of receivables of counterparties. You can get acquainted with the information if, after starting the program, enter the section "Counterparties". In the field that opens, there is a list of organizations and individual entrepreneurs. Among them are debtors and creditors. Contact details, invoices and contracts, work schedule - all this can always be viewed. It is from this menu that you can register a new organization that is part of the holding.

Find out the exact debt of enterprises is not difficult. To do this, enter the section "Debts under contracts", on the panel“Display debt” select “Accounts receivable” and set the required date. The user will see a list of all counterparties, among which you can select specific enterprises (with large debts). If there are many organizations and the entire list does not fit on one page, the information can be presented in a visual form. To do this, you need to go to the "Diagram" section. Similarly, work with accounts payable is carried out.

That's all you need to know about account 76, which reflects settlement transactions with debtors (creditors). Since the legislation of the Russian Federation is systematically changing, you should regularly use legal reference systems, which always have an up-to-date chart of accounts and PBU. Then specialists will always be aware of any changes regarding their professional activities, and will be able to make the right decisions when doing accounting.

Recommended:

Accounting documents are The concept, rules for registration and storage of accounting documents. 402-FZ "On Accounting". Article 9. Primary accounting documents

Proper execution of accounting documentation is very important for the process of generating accounting information and determining tax liabilities. Therefore, it is necessary to treat documents with special care. Specialists of accounting services, representatives of small businesses who keep independent records should know the main requirements for the creation, design, movement, storage of papers

44 accounting account is Analytical accounting for account 44

44 accounting account is an article designed to summarize information about the costs arising from the sale of goods, services, works. In the plan, it is, in fact, called "Sales Expenses"

What is a debit? Accounting debit. What does account debit mean?

Without knowing it, we are exposed daily, even at a basic level, to the basics of accounting. At the same time, the main concepts with which a person deals are the terms "debit" and "credit". Our compatriots are more or less familiar with the last definition. But what is a debit, not everyone represents. Let's try to understand this term in more detail

Accounting for beginners: from postings to balance. Accounting

Accounting is quite complex, but at the same time necessary. What does he represent? Why should this be studied? What are the nuances? Let's look at accounting for beginners from postings to balance

A settlement account is Opening a settlement account. IP account. Closing a current account

Settlement account - what is it? Why is it needed? How to get a savings bank account? What documents need to be submitted to the bank? What are the features of opening, servicing and closing accounts for individual entrepreneurs and LLCs? How to decrypt bank account number?