2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:27

Mortgage loans are characterized by the presence of collateral in the form of real estate. This type of transaction requires official confirmation using a special document, because a real estate loan is a loan of a fairly large amount of money. In addition, here we are talking about a certain pledge, the role of which is played by the purchased house, apartment or other housing.

In this regard, Russian banks have introduced the practice of issuing a mortgage along with a mortgage agreement.

What is a mortgage

A mortgage is a security that regulates the relationship between a lender and a borrower.

Thanks to her, the owner becomes the owner of two rights at once:

- The right to fulfill monetary obligations under a mortgage loan without providing other evidence for its existence.

- The right to use mortgaged property as collateral.

To define more precisely what a mortgage is and how it differs from a mortgage agreement, see the following table:

| Conditions | Mortgage | Mortgage agreement |

| Status | A mortgage is a security that can be a participant in transactions in a bank and between banks | Official document with legal force |

| Ability to make changes | No opportunity, for this you need to draw up a new mortgage | Maybe, but if both parties agree |

| Who signs | Borrower and pledger | Lender and Borrower |

| Place of registration | Registration Service | Notary |

| Deposit information | The collateral object is described in detail | Collateral is only mentioned |

| Contents | Guarantee of performance of the obligations of the parties | Description of legal relations for the issuance and repayment of a housing loan |

General information

A mortgage is a debt security, the effect of which expires only after the full repayment of all obligations of the borrower to the creditor. As long as its validity has not expired, the right holder bank may re-pledge or sell the mortgage to other financial and credit organizations. Of course, only with the personal consent of the borrower. However, this does not have any significant effect on the security itself.renders: the terms of the mortgage agreement, as well as the terms of the mortgage, are unchanged.

Russian credit practice does not provide for the mandatory execution of this paper. Large banks, for example, do not consider it necessary to oblige the borrower to sign a mortgage, because they have impressive financial assets in their reserves, that is, they do not risk losing any significant amount for themselves. But not so large participants in the credit and financial market insist on a mortgage in order to protect themselves.

An important feature of the mortgage is that its conditions are superior in priority to the mortgage agreement. It turns out that in case of non-compliance, the obligations will be fulfilled according to the provisions of the mortgage.

The mortgage loan agreement is the main document of this transaction, it certifies the mortgage, and the mortgage is its guarantee. The original mortgage is kept by the bank that granted the loan, while the borrower receives a copy certified by a notary.

A mortgage is a security whose nominal ownership does not allow a financial institution to transfer it to third parties without the written permission of the borrower.

The essence of mortgages

Mortgage is the link between the real estate and securities markets. The essence of mortgages is refinancing, that is, mortgage debt can be sold or mortgaged. The institution of mortgages was introduced quite recently, which undoubtedly means progress in the development of the debt securities market. Thus, banks will be able to sell debt on the secondary market, thus providing themselves with an extensive cash base for long-term lending.

In mortgages, the most important thing is the massive lending by banks to housing under construction and ready. Long-term housing loans cannot be based solely on deposits and other savings accounts. Mass and long-term lending for construction and the purchase of private real estate require the possibility of refinancing, including on the stock market. World financial history has proved the impossibility of normal development of the home loan market without mortgages.

Conditions for issuing a mortgage bond

This security can be issued subject to three conditions:

- main obligation is monetary;

- when concluding a mortgage agreement, the amount of debt on it or the criteria by which it can be determined is indicated;

- the mortgage agreement must contain a clause on the issue of a mortgage.

This does not mean that the mortgage or the main contract is no longer valid. They both continue to be valid. But it must be remembered that a mortgage is a security, the obligations of which are secured by collateral. The holder may recover the subject of the mortgage loan or obtain execution under the main contract precisely on the basis of the mortgage, and not on the basis of a mortgage or main agreement. In addition, one of the features of the mortgage should include the mandatory state registration of this valuablepaper.

The mortgagor issues a document. Mortgage is a pledge agreement, which is issued in a single copy, in writing, on a special standard form. State registration of a mortgage bond requires an individual registration number and seal, without which this security is considered invalid.

Object categories

A mortgage is a security secured by one of the objects of the following categories:

- apartments, residential buildings and their parts;

- unfinished objects;

- land plots;

- garages, garden houses, dachas and other consumer buildings;

- inland navigation vessels, ships and aircraft, space objects.

A mortgage cannot be issued if the subject of the contract is an immovable object with specific properties, such as:

- plot of land;

- an enterprise as a single and indivisible property complex;

- forest, etc.

In a mortgage agreement, the right to lease may be indicated as an object.

What is a mortgage in the securities market

A mortgage is a secured debt obligation. A company that owns a portfolio of such mortgages has the right to start issuing its own bonds in order to attract additional finance. They are repaid by paying interest on mortgages owned by the company that issued the bonds.

A mortgage on the securities market is a document that meets a number of requirements. In particular, it must be literal, that is, certain details must be present on paper. Having not all of them will automatically invalidate its value.

In addition to the points and data established by law, the mortgage may contain information designated by the pledgee and the pledgor. For example, these may be certain sanctions applicable to the borrower in the event of late payment of the next payment, or some additional opportunities involving the preservation of the pledged property. The Bank has the right to independently, without the participation of the debtor, set these additional conditions.

Transfer of mortgage and its legal implications

The transfer of a mortgage in a legal sense is divided into two stages:

- drawing up an endorsement in favor of the endorser (any third party);

- actual transmission of the original.

The endorser (the one who transfers the security) is obliged to provide the debtor with a written notice of the fact of the transfer of the mortgage. Having received the document, the endorser becomes the owner of all the rights of the mortgagee under the mortgage and main agreements. The endorser is responsible to him for the degree of reliability of the information contained in the transferred security. In addition, the transfer of a mortgage means confirmation by the endorser of the conscientious performance of all obligations of the debtor under the contract. Aftertransfer of paper, the pledgor disclaims all responsibility to the endorser for the failure of the debtor to fulfill any obligations.

However, there is a clause in the Mortgage Law that provides for the designation of liability conditions. Thus, the buyer of the mortgage increases his own comfort and the security of his investment.

Refinancing with mortgages

The Mortgage Law provides for several ways to refinance with mortgages:

- mortgage sale;

- her bail;

- sale of this document with the obligatory condition of its repurchase;

- Issue of mortgage-backed securities.

A very important nuance in this matter is that you can refinance the mortgage only until the debtor fulfills all obligations on the loan.

Advantages and disadvantages of mortgage-backed securities

The benefits of issuing mortgage bonds and certificates are:

- getting the mortgage market financial resources to expand the scale of mortgage lending;

- Investors receive securities with high returns and guarantees.

The disadvantage of mortgage bonds and certificates for the owner is the possibility of repayment of the loan by the debtor ahead of schedule. The risk of returning the face value of the certificate is high, as a result of which the holder of the mortgage-backed security will be deprived of long-term profit in the form of interest.

Recommended:

Which bank gives a mortgage on a room: lists of banks, mortgage conditions, a package of documents, terms of consideration, payment and the amount of the mortgage loan rate

Your own housing is a necessity, but not everyone has it. Since apartment prices are high, when choosing a prestigious area, a large area and the cost increases markedly. Sometimes it is better to buy a room, which will be somewhat cheaper. This procedure has its own characteristics. Which banks give a mortgage on a room, is described in the article

Mortgage in Germany: choice of real estate, conditions for obtaining a mortgage, necessary documents, conclusion of an agreement with a bank, mortgage rate, terms of consideration

Many people are thinking about buying a home abroad. Someone might think that this is unrealistic, because prices for apartments and houses abroad are too high, by our standards. It's a delusion! Take, for example, a mortgage in Germany. This country has one of the lowest interest rates in all of Europe. And since the topic is interesting, you should consider it in more detail, as well as consider in detail the process of obtaining a home loan

Pitfalls of a mortgage: the nuances of a mortgage loan, the risks, the intricacies of concluding an agreement, advice and recommendations from lawyers

Mortgage credit as a long-term loan for real estate every year is becoming more accessible to the working population of our country. With the help of various social programs, the state supports young families in terms of improving their own households. There are conditions that allow you to take a mortgage on the most favorable terms. But there are pitfalls in mortgage loan agreements that are useful to know about before contacting a bank

Bank account agreement is The concept, terms and conditions of the agreement

Regardless of the rating of a credit institution, its level and popularity in the banking services market, the procedure for opening bank account agreements is the same everywhere, from a package of documents to the termination of such an agreement

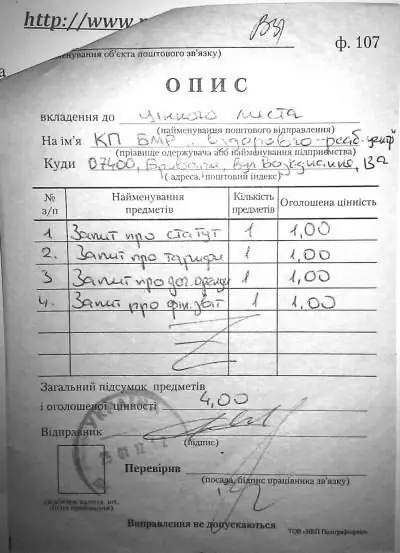

Registered letter with attachment description. The procedure for sending a registered letter with a description of the attachment

In the age of computer technology, people write paper letters to each other less and less. It may seem that in the near future such an organization as the post office will become obsolete altogether. But in reality this is far from the case. Quite often, it is simply impossible to do without mail forwarding. In this article, we will consider the procedure for sending a registered letter with an attachment description. Let's also talk about how long the letter will take, and how much such a service costs