2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:27

What do we know about the overdraft? This is one of the forms of lending to the population, which is distinguished by its simplicity, ease of execution and use. It can also be said that an overdraft is an excellent option for those who do not want to depend on anyone, even if at some time they urgently need money. One of the best options for the consumer is an overdraft. Sberbank provides such a service.

Terms of Service

The first thing that can be immediately seen upon closer acquaintance with the conditions is the interest rate. It cannot be said that it is very high, but it is alarming that it can change over time, and unilaterally, that is, without prior agreement with the client. The Borrower is only given two months' notice before the new terms come into effect and must either accept them or repay in fulloverdraft. Sberbank will also not work at a loss during inflation, like any other bank - payments will increase, rates will increase or additional commissions will be introduced.

Amount of monthly payments

When applying for an overdraft, it is imperative to pay attention to the amount of the monthly payment. Even if the loan is paid every month, but in an amount insufficient to repay the minimum payment, the loan will be overdue. Pen alties and pen alties will apply. But that's not the worst. If you run an overdraft, Sberbank may fix a bad credit history, which in the future may lead to problems obtaining a loan.

What happens if you still don't pay?

If you do not pay an overdraft to Sberbank for a long time, then fines, pen alties and commissions may become more than the amount of the delay itself. And even if payments are resumed, the loan amount itself will not be repaid until all the pen alties are paid. There are cases when the client does not repay the overdraft for several months, and then he begins to make the minimum payments, and the amount of debt only increases. The client is surprised, he does not understand how this

maybe. Everything is very simple - in a few months such a debt has run up that when making an old payment, the client does not cover it, and the debt grows. In this case, you must first pay the fine in full, and then pay the overdraft.

Sberbank takes a commission forservice?

We must not forget that the amount for servicing the loan is debited annually, which can be an unpleasant surprise if the client does not know about it. The annual service will depend on which card the client has on which the overdraft is set. Every bank has such annual commissions. For some it may be more or less. At the same time, small commissions may be accompanied by high interest rates for using the loan or a short grace period. To avoid misunderstandings, you can calculate a loan at Sberbank, the calculator can be found on the official website.

Before you draw final conclusions about which bank has the most profitable overdraft, you need to take into account all the nuances. And always carefully read the loan agreement, especially the part that is written in small letters.

Recommended:

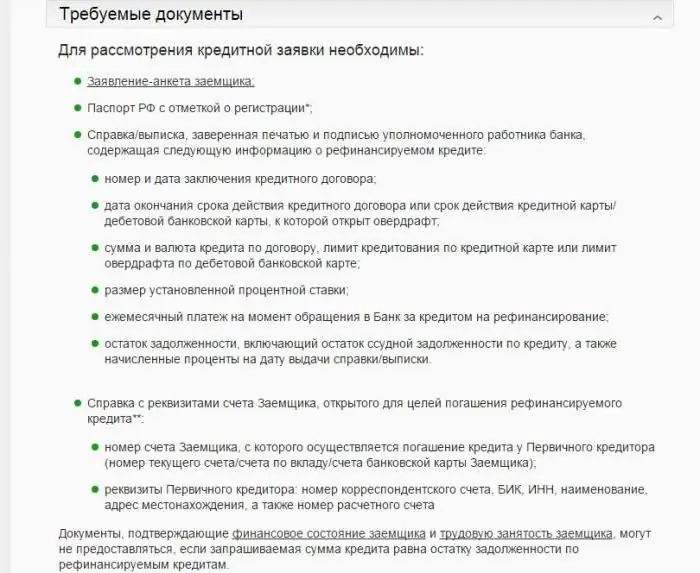

On-lending consumer loans. On-lending consumer loans with arrears

Unfortunately, there are often situations when, having issued a mortgage or other loan for consumer purposes, the client after some time realizes that he cannot cope with his obligations. There can be several ways out of this situation - from trying to arrange credit holidays to selling collateral. But there is another way out of the situation, perhaps the least painful - this is the on-lending of consumer loans (it is also refinancing)

Types of mortgage lending. Mortgage Lending Programs

Mortgage lending is now very common. Many people see this as almost the only hope for acquiring their own housing. There are many types of mortgage lending, each of which has its own characteristics

On-lending in Sberbank loan, car loan: reviews. Is it possible to make on-lending at Sberbank?

Refinancing at Sberbank is a great opportunity to get rid of an "expensive" loan. What are the programs for on-lending at Sberbank today? Who can borrow and under what conditions? Read more about it

Sberbank: lending conditions for individuals, types of loans and interest rates

The article describes the conditions for lending to individuals in Sberbank. Various types of loans considered

Overdraft lending to legal entities and individuals

Overdraft lending is a profitable financial instrument for both the borrower and the banking organization. It allows you to receive the missing funds at the right time, while giving a constant, albeit not too significant income to the lender