2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

Mortgage has already firmly entered our lives, and this is not a secret. Many families, especially young ones, resort to this service, which allows them to purchase real estate on favorable terms. The main advantage of a mortgage is that the cost of an apartment, together with interest for a kind of loan, is divided over 15-20 years, which allows you to pay an acceptable amount every month.

Today in Russia there are various types of mortgage lending, which differ in their conditions. First you need to consider the concept of "mortgage": what does it mean and where did this word come from?

What is a mortgage?

This term has its roots in the VI century BC. e. At this time, the concept of hypotheca appeared on the territory of Greece, meaning the debtor's liability to the creditor associated with landed property. In Roman law, a mortgage was a pledge of real estate.

In our country, this term first appeared at the end of the 19th century and was borrowed from Europe. Mortgage at that time was synonymous with the word "collateral". into the SovietAt the time, there was no law on mortgage lending, since no one needed it.

In 1998, the President of the Russian Federation signed and put into effect the Law "On Mortgage", which is the first to regulate mortgage activity. Currently, the term "mortgage" means a contract of pledge of property.

Objects and subjects of mortgage

As already noted, mortgage lending implies that the purchased property will be pledged for the duration of the loan repayment. A mortgage is a contract, the parties to which are the object and the subject of legal relations. Below are the possible objects of mortgage lending:

- apartments, houses and private rooms;

- a land plot that does not belong to the state and does not belong to municipal property, and also exceeds the minimum allowable area;

- garages, cottages, as well as other buildings and buildings intended for consumer use;

- enterprises that find application in entrepreneurship;

- ships.

The lender plays an important role in obtaining a mortgage. This may be a bank or other legal entity that will keep records of loan repayment. Mortgage lending to individuals is carried out only after making the down payment.

In addition to creditors, an investor who buys securities secured by mortgage loans can also act as a subject of the agreement.

Mortgage Lending Device

To implement a mortgage loan, they issuespecial securities called collateral. The sale of these securities by the bank provides the funds necessary for the issuance of mortgage loans. This is a very reliable type of securities that brings solid interest. The pledge paper notes the property that relates to it.

Mortgage lending in Russia is becoming more and more popular, and people who decide to take this step should clearly know how the mortgage system works. The pledge paper must contain a coupon book, which reflects the amounts and dates of payment of mortgage interest. People who have taken advantage of this kind of loan pay interest first, and then the principal.

The fact that the mortgage is taken for a long time makes it much easier to repay the loan. However, if the loan debt is not fully paid, the property will become the property of the mortgage bank. This is how the mortgage lending mechanism currently works.

Government assistance

Since 2009, a state mortgage support program has been in place, aimed at people who are unable to improve their living conditions due to low incomes. However, only in 2015 this program became popular. About 250 billion rubles were allocated to improve the living conditions of citizens.

State support for mortgage lending is that the state takes over the payment of a certain part of the debt. However, it is not easy to get a loan under such a program, since not all banks agree to such conditions. You can use such a program only in the largest banks in the country.

The essence of state support is an agreement between the bank and the state. The bank cuts its interest rate to 11%, no matter what it was originally. The difference between the initial rate and the final rate (11%) is paid by the state. To become a participant in this program, it is not necessary to belong to the social category of the population. Anyone can take out a loan under these conditions.

Types of mortgage lending

Currently, due to the fact that the number of such loans is growing, there are many different types of mortgages. Mostly, commercial banks are engaged in issuing loans, the main purpose of which is to make a profit.

All types differ from each other in terms of lending, features of their receipt. At the moment, mortgage lending to individuals can be divided into two segments:

- acquisition in the primary real estate market;

- buying on the secondary real estate market.

The whole variety of types and types of mortgages will be discussed below.

Apartment in a new building on credit

This species is especially popular at the moment. However, despite all the visible advantages (a new apartment, no one has lived before), there are a number of disadvantages. Very often a situation arises when a house is not rented out on time or is not registered with a certain state body for a long time.

Alsoone of the main disadvantages of a new building is the lengthy registration of ownership. In addition, it is quite difficult to get a loan for the purchase of a new building, since not all banks do this. If the bank nevertheless accepted the application, each case is considered separately. A lot of factors influence the final decision, among them finding out who is the developer, investor, what is the deadline for the completion of the house, etc. Apartments in new buildings can be purchased quite inexpensively, and a mortgage becomes a good option in such conditions. When choosing an apartment, a young family almost always prefers a new house.

Apartment on the secondary real estate market

Features of this type of mortgage lending include fairly quick processing and relative ease of obtaining. In this matter, you need to contact several banks, even in case of refusal. After all, the reason why there was a refusal in one bank, in another will not be sufficiently solid.

As already mentioned, such a loan is easier to get than in a new building, in particular due to the fact that there are few reasons for refusal. Among them:

- the seller made a redevelopment of the apartment and did not register this fact;

- legal cleanliness of the house, perhaps someone lived there with an unfavorable history.

Social type of mortgage

This type of mortgage lending is intended for socially unprotected segments of the population, as well as those on the waiting list who are unable to buy real estate under normal conditions. There are two types of socialmortgages:

- for those on the waiting list when the down payment is provided by the city as a subsidy;

- loan is provided at construction cost prices; in six months, the recipient of this loan can repay the debt without any interest.

In the future, it is planned to purchase real estate under a social program from the developers themselves at market prices. But those on the waiting list will also be able to take advantage of this by paying subsidies for an apartment. The longer you wait in line, the greater the amount of subsidies. Also, people on the waiting list are able to buy real estate that was built not only by the city.

Type of mortgage for young families

The problem of acquiring real estate for newly-married spouses is particularly acute. Banks do not want to take risks, and the interest is quite high, since the future of young professionals is unpredictable. However, recently some banks have been meeting the needs of young people and creating new programs.

Mostly, mortgage lending programs of this type are aimed at reducing the down payment and at the maximum term for issuing a loan. If one of the spouses is under 30 years old and there is a child in the family, the initial contribution may be 10%. If young specialists are already employed in promising jobs, the down payment becomes even 5%, and the mortgage is issued for 25-30 years.

Of course, in modern conditions, one of the most realistic options for buying a home is a mortgage. A young family is looking for different ways to improveloan terms. The main problem is to prove to the bank the seriousness of intentions. If this can be done, the bank will not refuse.

Building Together Program

Types of mortgage lending are very diverse, and certain programs are created in each of them. The essence of "Building Together" is a long installment plan, which is repaid at the expense of the population.

The task of a person who is going to buy a home is to accumulate about 40-50% of the cost of the apartment, and the cooperative adds the rest. As soon as real estate is acquired, it becomes the property of that person, but on security. The part given by the cooperative must be repaid within a maximum of 20 years. Then the deposit is removed, and the person becomes the full owner.

Military Mortgage Program

All mortgage lending programs are aimed at improving credit conditions, and this one is no exception. This is a funded system for providing housing for military personnel.

Features of mortgage lending of this program are that the military, who concludes the first contract, has the right to a certain kind of deductions. Every year, on average, about 250 thousand rubles are credited to the account of a serviceman. He can use this amount after the expiration of the old contract and when signing a new one. The amount that has accumulated over several years is used as a down payment.

The rest of the loan is paid by the state while the military is under contract in the army. As soon as he ceases to be military, the state ceases to pay, and the restthe loan must be repaid by yourself.

Project "Affordable and comfortable housing for citizens of the Russian Federation"

The purpose of this project is to increase the availability of mortgages for residents of Russia. Everyone knows that for many people almost the only chance to purchase a home is a mortgage. Young families are no exception. They are mostly denied mortgages.

The project participants have no problems with this. In addition, the percentage of mortgages is reduced. This project was developed as part of the social type of mortgage lending. Its main difference from the commercial one is the special (preferential) cost per square meter. As part of the social mortgage, the bank undertakes to insure the borrower and the housing area itself, as well as maintain a certain rate until the end of the loan.

The development of mortgage lending is possible thanks to such types and programs that are aimed at improving housing conditions, both for young families and for socially vulnerable segments of the population.

Advantages and disadvantages of mortgages

Types of mortgage lending, regardless of each other, have their pros and cons. This is typical not only for mortgages, but also for any loans. So the benefits are:

- mortgage is the only chance for a lot of people to buy their own home;

- mortgages are issued for a long period, and people have the opportunity to pay small amounts;

- you can register your relatives in the apartment,and also make repairs to your taste, in general, give money for potentially your housing.

Disadvantages include:

- formally, an apartment taken on a mortgage belongs to the bank, and a person cannot sell or donate it;

- during the time of the loan, a person pays the cost of 2 or even 3 of these apartments, since the term is too long;

- if a person stops paying, the bank takes the apartment and puts it up for sale to cover their expenses, the rest of the amount is returned.

Most people at one stage or another in their lives wonder whether to take an apartment on credit. Mortgage lending in Russia has many disadvantages, but still in the modern world it is one of the few chances to buy your own living space. The main thing is stable work, which will help to gain the trust of the bank, as well as improve credit conditions. The state has recently created many programs that are designed to facilitate payments and help people purchase housing.

Recommended:

Which bank gives a mortgage on a room: lists of banks, mortgage conditions, a package of documents, terms of consideration, payment and the amount of the mortgage loan rate

Your own housing is a necessity, but not everyone has it. Since apartment prices are high, when choosing a prestigious area, a large area and the cost increases markedly. Sometimes it is better to buy a room, which will be somewhat cheaper. This procedure has its own characteristics. Which banks give a mortgage on a room, is described in the article

State mortgage programs in Russia: conditions, package of documents

Everyone wants to arrange their life and do it as soon as possible. The state is trying to help citizens solve this problem with the help of concessional lending programs. Today in Russia you can get a social mortgage, take a loan from a bank or participate in a social project

How to get a mortgage for a young family: conditions and description of programs from banks

After the registration of marriage, the family begins to solve pressing problems, one of which is the acquisition of housing. The state encourages families and is ready to support in various ways. They have a special system of mortgage lending

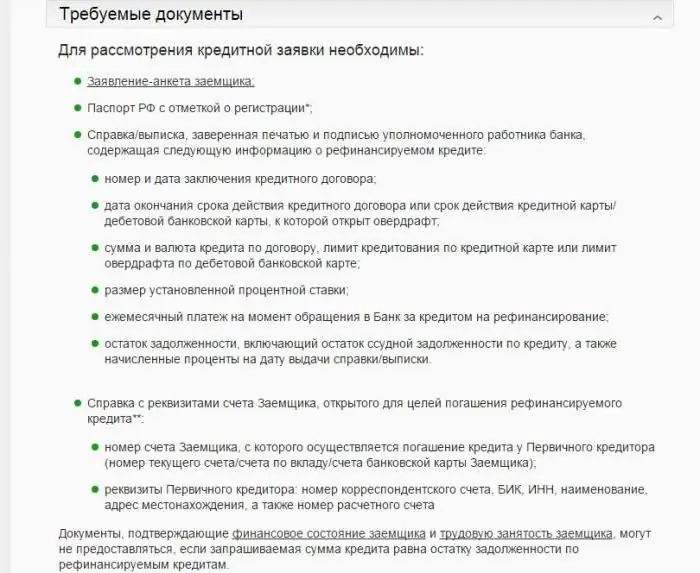

On-lending consumer loans. On-lending consumer loans with arrears

Unfortunately, there are often situations when, having issued a mortgage or other loan for consumer purposes, the client after some time realizes that he cannot cope with his obligations. There can be several ways out of this situation - from trying to arrange credit holidays to selling collateral. But there is another way out of the situation, perhaps the least painful - this is the on-lending of consumer loans (it is also refinancing)

On-lending in Sberbank loan, car loan: reviews. Is it possible to make on-lending at Sberbank?

Refinancing at Sberbank is a great opportunity to get rid of an "expensive" loan. What are the programs for on-lending at Sberbank today? Who can borrow and under what conditions? Read more about it