2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

Finishing a loan is the easiest way to acquire property that cannot be bought immediately and for cash. However, this is not always a good idea. Often long-term loans turn into real bondage, as the borrower is unable to repay them. In this case, the straw for a drowning person is refinancing at Sberbank. How is it carried out? And on what terms? We are talking about this further.

Brief essence of on-lending

Relending is a new loan that provides an opportunity to repay an old loan. At the same time, the previous loan must be reissued for a larger amount in another bank. And although such programs are not available in all credit institutions, they are in the Savings Bank of Russia. We will tell you more about how on-lending works at Sberbank.

Programs for refinancing loans at Sberbank

Currently, Sberbank has the following loan programs:

- for refinancing housing loans;

- on consumer lending for the purpose of refinancing.

What is this mortgage refinancing program?

If you have a large and unaffordable mortgage loan, it makes sense to choose a loan refinancing in Sberbank. At the same time, this program is designed not only for the full repayment of the “expensive” mortgage, but also for obtaining a new loan for the construction of a residential building or apartment at will (provided that you receive a permit for ownership). So, what are the terms of such lending?

Describing the terms of the loan, we will be extremely brief. Firstly, the loan is issued in the national currency and in the amount of at least 300,000 rubles. In turn, the maximum that you can count on is an amount not exceeding 80% of the total cost of a secondary or primary home - one, and not more than the balance of your debt on a previous loan - two. By the way, when securing collateral, the total loan amount will also not exceed 80% of the experts' estimate.

Secondly, on-lending at Sberbank involves taking a loan without the traditional issuance fee for up to 30 years.

What are mortgage refinancing rates?

The rate under the mortgage refinancing program at Sberbank directly depends on the expected maximum term for the loan, as well as on whether you are a payroll client of this financial institution. For example, with a term of up to 10 years, the loan rate for payroll clients will be 13.75%, up to 20 years - 14%, and up to 30 - 14.25% per annum. If you are not a client of Sberbank and apply for a loan here for the first time, feel free to add another 0.5% per annum to the above base rate.

What are the collateral requirements?

If you want to get a loan from Sberbank, be prepared to provide collateral. As it can be provided finished or under construction housing, for which a mortgage loan has already been issued. Or you can pledge any other valuable property equivalent to the loan amount issued. If you wish, instead of material security, you have the right to make a deposit in the amount of at least 3,000,000 rubles.

Insurance: do you need it or not?

When drawing up a loan refinancing agreement at Sberbank, be prepared for compulsory insurance. In particular, you will have to insure your collateral against possible damage, loss or complete destruction as a result of a natural disaster. The term of insurance directly depends on the terms of your loan agreement.

Is it possible to refinance at Sberbank and for whom?

Refinancing for Russians is possible, but on condition that they meet the established requirements of the bank. What are these rules? For example, at the time of applying for a loan, you must not be under 21 years old, but not older than 75 years old. You must also have six months of experience in the currentplace of work and total experience for the previous 5 years - from 1 year.

In addition, mortgage on-lending involves the involvement of at least three co-borrowers. These can be individuals, but with an income corresponding to the maximum amount of a bank loan. One of the co-borrowers can be your legal spouse or spouse.

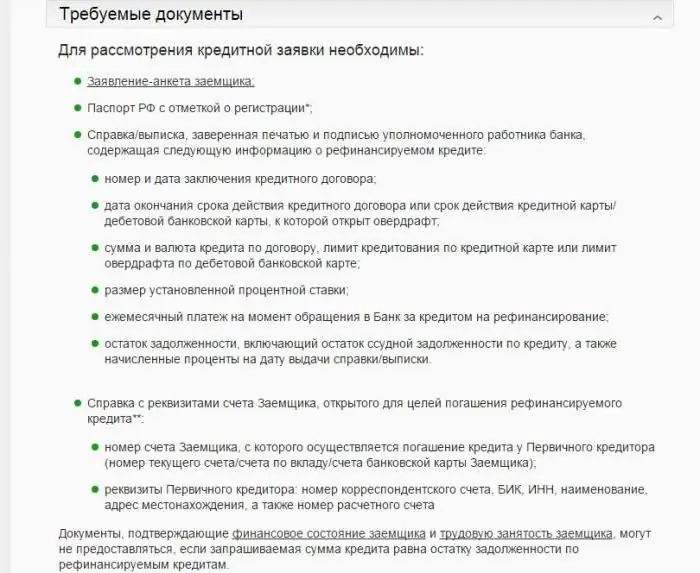

What documents are needed for registration?

Answering the main question "is it possible to make on-lending at Sberbank", let's say: "Yes. You can." If the bank meets the requirements and the following documents are available:

- passports;

- original birth certificate of children (if any);

- original marriage certificate (if you are a member);

- passports and documents that indicate kinship with you (if your relatives act as co-borrowers), etc.

This is a general list of documents. However, it may vary and be supplemented by the decision of the bank.

How to pay off a mortgage refinancing loan?

A similar loan is repaid in monthly annuity (in other words, equal) amounts. Repayment is made in the following ways:

- at the cash desks of bank branches;

- at self-service terminals;

- at ATMs;

- using internet banking;

- through mobile banking.

Is it possible to refinance a car loan at Sberbank, we will tell further.

Consumer Loan Program

In addition to the mortgage, many borrowers may have problems with car loans. That's just creditno such loans. However, Sberbank has another consumer loan program for these purposes with the aim of further on-lending. What are the features of this banking product?

The main feature of this program is that it can be used to repay up to five current loans received from other lenders. For example, it can be consumer loans, car loans, as well as current debt on a current overdraft or plastic card.

In addition, if the bank meets the requirements, each borrower has the opportunity to receive the required amount without submitting a work book and income statement. In addition, this program does not imply a commission fee for issuing a loan amount and does not require the provision of collateral.

What are the conditions for lending under the consumer program?

You can apply for this loan online or during a personal visit to one of the existing branches of the organization. It is usually provided in national currency, the loan period is at least 3 months, maximum - 5 years. In this case, the allowable amount should not exceed 1,000,000 rubles, and the base interest rate starts from 17.5%.

What are the loan requirements for refinancing?

This program is characterized by a selective attitude towards loans subject to refinancing in Sberbank. So, for example, the current term on the loan should not be less than six months, and until the end of its repayment - not less than threemonths. In addition, your problem loan must not be past due. At least within six months, you must regularly repay it and avoid delays.

What are the requirements for borrowers?

Unlike the previous program, persons aged 21 to 65 can apply for this loan. All other requirements, including general and current work experience, are identical. This is how refinancing works in Sberbank. Customer reviews will help you get a general idea of the programs.

What do they say about Sberbank's refinancing programs?

In order to understand how profitable refinancing programs at Sberbank are, let's turn to the reviews. For example, some citizens like mortgage on-lending, as it allowed them to relieve themselves of the burden of excessive credit. Others consider the terms of a consumer loan for the purpose of further refinancing to be the most attractive, since they allow covering up to five large loans. Still others are not satisfied with the involvement of co-borrowers. The fourth likes an acceptable percentage and no commission.

Recommended:

How to return car loan insurance? Is life insurance required for a car loan?

When applying for a car loan, banks require borrowers to obtain life insurance and comprehensive insurance. But there are several options that allow you to refuse such policies by receiving the required amount of funds from the insurance company

Car loan or consumer loan: what is more profitable? Which loan to choose: reviews

According to statistics, the average cost of a car in Russia reaches 800,000 rubles. It is worth emphasizing that this figure may vary depending on the region. At first glance, it is clear that it is impossible for a simple layman to earn such money even in a year. As always, credit organizations come to the rescue. Often the population asks the question: "Car loan or consumer loan, which is more profitable?"

The most profitable car loans: conditions, banks. What is more profitable - a car loan or a consumer loan?

When there is a desire to buy a car, but there is no money for it, you can use a loan. Each bank offers its own conditions: terms, interest rates and amounts of payments. The borrower needs to find out about all this in advance by examining advantageous offers for car loans

Car loan for a used car without a down payment - features, conditions and reviews

Now loans are gaining more and more popularity. People buy everything on credit: from household appliances to real estate. According to the latest data, a car loan and the conditions for obtaining it for used cars are of the greatest interest

How to repay a loan with a loan? Take a loan from a bank. Is it possible to pay off the loan early

This article helps to deal with the refinancing agreement, which is one of the most successful loan repayment options