2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:28

Despite the periodic economic and financial crises that come to Russia or to the entire world economy, most people still manage to save their excess income. This is greatly helped by a stable source of money, for example, wages. At the same time, when accumulating a certain amount, another question arises. How to save savings, and even better to increase them? In this article, we will analyze in which currency it is more profitable to keep money. But first, let's talk about ways to save savings.

Ways to save money

It should be noted that there are many options for saving and increasing the accumulated funds. But there are several main ones. The choice of how to save your money largely depends on the intended purpose of savings. In addition, it is of great importance whether you just want to protect your savings (against inflation, devaluation, etc.) or invest them profitably and increase them. Among the most popular tools for saving and increasing funds are deposits in banks, the acquisition of real estate, investmentmoney into business, buying antiques. In what currency is better to keep money, you will find out by reading the material to the end.

In addition, when choosing a way to save your own savings, you need to pay attention and analyze the terms of storage that certain tools can offer. The risks must also be taken into account. As you know, the risks increase with the increase in profitability. In other words, the higher the profit derived from your own investments, the higher the risk of losing them. In addition, external factors, as well as the global economic situation, play an important role in the preservation of savings. But still today, the currency remains the most relevant and reliable way to save your own money savings.

Choice of monetary units to save savings

When choosing a currency for holding deferred funds, the purpose of these savings should be taken into account. If the owner of the excess amount of money does not plan to use the savings to form the family budget or for an early large purchase (real estate, car), then they can be converted into gold. This precious metal has been used as a certain standard for centuries, it has permanent liquidity and is guaranteed not to lose its relevance for many years to come. But what currency should you keep your money in?

If you buy real estate or a car soon, it is better to save savings in the currency in which the purchase will be made. Most often we are talking about the national monetaryunit. You can use popular and reliable foreign currencies when there is a need for long-term storage of funds. If you want to receive income from the possession of the accumulated amount, you should choose a foreign currency, taking into account the situation in the world economy, as well as in those countries where these monetary units are issued. What is the best currency to keep money in Russia?

Keeping money in Russian rubles

For Russians, this issue is as relevant as for citizens of other states. What currency should you keep your money in? Russia is among the 15 leading countries in the world in terms of nominal GDP. Nevertheless, the Russian ruble as an instrument of savings is suitable primarily for those who receive income in this particular currency. In this case, there are no costs that accompany banknote exchange operations. In addition, during the exchange of the purchased currency back to Russian rubles, losses are also inevitable due to the difference in the exchange rate for buying and selling monetary units in banking institutions.

The stability of the domestic currency inspires some optimism, despite the stagnation or slight growth of the Russian economy over the past few years. The liquidity of the ruble is provided by the export of energy resources, and the relevance of oil and natural gas for the world economy in the coming decades is beyond doubt. And in what currency to keep money in Kazakhstan? Citizens of states that have close economic and industrial ties with the Russian Federation can be advised as one ofthe same Russian ruble.

He has another advantage, namely high interest rates on deposits, which can be obtained in many banks. These rates compare favorably with those offered by financial institutions to their clients for foreign currency deposits. It is especially profitable to use the Russian ruble for short-term storage or investment, since in a short period, as a rule, there are no significant economic events that could affect the profitability of ruble investments. In what currency to keep money in Belarus?

The economy of this republic is also closely connected with the Russian one. When choosing a currency for savings, residents of Belarus should keep in mind several denominations of their national currency. But you should not stop your choice only on the Russian ruble. Next, we will look at other options.

US dollar savings

The US dollar is the main reserve currency in the world. In addition, this currency is the most common and popular. The US dollar is especially suitable for saving their savings for those who receive income in this particular currency. Despite the fact that many experts consider the US economy to be bloated and showing signs of a soap bubble, the US ranks first in the world in terms of nominal GDP and is not going to lose its positions yet.

In addition, the dollar is backed by the most powerful American industry, the production of high-tech, and in some cases uniquegoods. It should be noted that it is more profitable to place US dollars on bank deposits, provided that in the near future it will not be necessary to carry out exchange operations. It is for long periods that the safety and profitability of dollar deposits will be the highest. What currency to keep money in, other than the US dollar?

Euro savings

Euro is one of the youngest world currencies. At the same time, it has already managed to become a reserve and take its place in the gold and foreign exchange reserves of many countries. Despite the fact that the economic situation in some countries of the European Union leaves much to be desired, its economy shows, albeit small, but steady growth. It is advisable to transfer your savings into euros if you make short-term deposits or when you are planning a trip to one of the Eurozone countries.

Other types of savings in foreign currency

Other popular currencies, in addition to the already mentioned Russian ruble, US dollar and euro, are the Swiss franc, the British pound sterling and the Chinese yuan. It is advantageous to use these monetary units primarily to protect your savings. But in some cases, they can provide a good income. So what is the best currency to keep money in?

For example, the Swiss franc. This currency has remained stable for more than a decade. In addition, in recent years, many banking institutions offer their customers very attractive conditions for placing deposits in Swiss francs. So, the rate on deposits in thiscurrency reaches 6% per year. Such figures are much higher than those shown by deposits in US dollars or euros.

The British pound sterling is also a convenient and reliable tool for savings. Despite the recent events in the UK, which ended with the country's exit from the European Union, the pound still remains one of the main reserve currencies of the world. In addition, it is traditionally stable and stable. Rates on deposits in this monetary unit range from 0.5 to 4.5% per annum. What currency to keep money in 2018?

Chinese yuan savings

Another alternative to the most popular currencies is the Chinese yuan. China's economy has been growing at a gigantic pace in recent years, which has allowed the country to create huge gold and foreign exchange reserves. Even the world's financial and economic leader, the United States, has a huge debt to China. And, despite the slowdown in the Chinese economy, international investment in the production of goods in China is growing.

In addition, there are optimistic forecasts regarding the trade balance. All these factors make it possible to attribute the Chinese yuan to the category of the most stable and reliable world currencies. The yield on such deposits will be in the region of 2-3% per annum. The Chinese Yuan is an excellent tool for long-term investment.

In closing

It is necessary to emphasize a few more factors,which were not touched upon in the main part of the article. Any, even the most reliable currency, is subject to certain risks. An eloquent example of this is the global economic crisis of 2008. That is why, when answering the question for yourself in which currency it is profitable to keep money, it is advisable to take the advice of many financial experts and analysts. They recommend diversifying your investments. In other words, it is advisable to keep your own savings in several currencies at once. Thus, it is possible to ensure a constant profitability of savings, as well as their safety in different time periods.

Recommended:

The best deposit in the best bank in Moscow

Financers who have a serious approach to economic strategies are guided by the rule: money can multiply when it works

How to make money without money? Ways to make money. How to earn real money in the game

Today everyone can make good money. To do this, you need to have free time, desire, and also a little patience, because not everything will work out the first time. Many are interested in the question: "How to make money without money?" It's a perfectly natural desire. After all, not everyone wants to invest their money, if any, in, say, the Internet. This is a risk, and quite a big one. Let's deal with this issue and consider the main ways to make money online without vlo

Investing in gold. Is it profitable to keep money in gold or not?

Investing is a rather complicated and risky process, but there are types of investments that almost always remain win-win. This is what the article tells about - about investing in gold

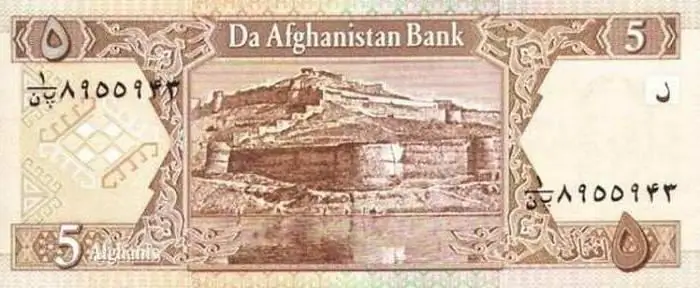

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article