2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

When cash is taken in business for goods and services, a cash register is usually required. In some cases, you can do without it. The new requirements require registration of cash registers. To do this correctly, you need to familiarize yourself with some of the nuances.

Who doesn't need a procedure?

Entrepreneurs who make payments in cash and bank cards use cash registers. But they are not needed in the following cases:

- work takes place on UTII or PSN;

- lottery tickets are sold;

- non-alcoholic products for sale;

- catering for people studying and working at school;

- selling kerosene, milk, fish, vegetables;

- sale of goods at an exhibition, fair, market;

- reception of glass containers;

- for small retail sales;

- sale of postage stamps;

- sale of goods of a religious nature.

Where does registration take place?

The procedure is performed at the tax authority at the place of residence. Legal entities should apply at the location of the organization. If theyhave divisions in which KKM is applied, then the procedure is considered mandatory in the tax authorities at the location. For example, if an LLC has several stores in different cities, then registration of cash registers in each city is required.

Individual entrepreneurs register a cash register at the tax office at the place of residence. Is there any liability if the application is not registered? A fine is imposed on individual entrepreneurs and LLCs.

Required documents

First you need to write an application for registering a cash register. Its form is approved by the Order of the Federal Tax Service of Russia. It is also necessary to attach documents for registering a cash register:

- device passport issued upon purchase of cash register;

- maintenance contract.

The agreement is concluded with the KKM supplier or with the technical service center. Documents must be submitted to the tax office in originals. If they are not, registration cannot be completed.

You also need to provide an IP document proving the identity of the IP. A legal entity must provide confirmation of the ability to act on behalf of the organization. If the documents are submitted by a representative, then he must have a power of attorney. The tax office is not en titled to demand documents for the premises in which the device will be used.

In practice, there are situations when they ask about such documents as a certificate of registration,registration. In order not to delay the procedure, it is advisable to find out in advance what documents are required.

Registration Features

Registration of cash registers must be completed within 5 days of submission to tax documentation. Employees must notify the applicant of its receipt.

If defects are found in the documents, for example, something is missing, then it can be done within 1 day after notification. If you miss this period, then registration will be denied.

Inspect equipment

There is a generally accepted procedure for registering a cash register. This is established by law, and in case of non-compliance with the rules, liability is provided.

The device is inspected before registration. A specific time is assigned for this procedure. If it is not carried out, then registration will be denied. Inspection of KKM is carried out by a specialist supply or central heating.

Registration rules

If the equipment and documents have no comments, then the cash registers are registered. Information about the device is entered in the CCP accounting book, which is controlled by the tax authority.

The entrepreneur must provide a device passport, where a special mark is placed. After that, an equipment registration card is issued, an accounting coupon and documents. Employees certify the journal of the cashier - teller. No service fee.

Requirements for cash registers

You only need to register the equipment thatis in the public register. The device must show details on the receipt, which may differ in each type of activity. Therefore, it should be considered in which industry the CCM will be used.

To use the equipment, you will need to conclude an agreement with a special company that will provide technical support for the equipment. Without this document, the device cannot be registered. A cash register without registration cannot be used.

Choice of equipment

The device must be chosen correctly. If the model is not in the state register, then it is forbidden to use such a technique. The device must have a hologram "State Register" with the designation of the year, number and name of the device.

Cash register receipt must have information such as:

- document name with number;

- date;

- Name of entrepreneur;

- TIN;

- name and quantity of goods;

- amount;

- position and full name of the employee.

There is a check printer that does not have an ECLZ memory block. Such a device is not considered a CCP, so it will not be possible to register it. NIM is used by UTII and PSN payers.

Refusal to register KKM

The registration procedure may be denied if there are not enough documents, the entrepreneur does not appear to inspect the equipment. Other reasons include:

- applying to the wrong tax office;

- false information in the application;

- finding KKM inwanted;

- equipment malfunctions or missing signs, seals;

- no access to device.

Refusal to register may follow in the case of presentation of a device that is not included in the state register. This applies to the expiration of the KKM depreciation period. The main requirement, due to which registration occurs, is the inclusion of the device in the registry.

Exceptions are situations when the device has dropped out of this document. If such a device is registered, then it can be used until the end of the depreciation period (up to 7 years). But if KKM was bought from someone, then it will not be possible to register it.

Used device can be registered at:

- changing the name of the organization;

- reorganization of a legal entity;

- changing the location of the company;

- IP recovery;

- introducing CCP into the authorized capital;

- registration of a legal entity by the founder of an IP.

Responsibility is provided for the use of the device in violation. Large fines are imposed on individual entrepreneurs and legal entities.

Operation of the equipment is equal to 7 years, after which deregistration is required. For sale, cash registers are in a non-fiscal state, so the meter is turned off. The process of fiscalization is considered mandatory. When registering a supported device, you need to reset the fiscal memory.

When registering with a tax inspector, the serial number, TIN and name are entered into the memoryorganizations. Then a password is approved, which serves as protection against illegal entry into the device. Then the seal is installed, and the procedure is completed by the introduction of the amount. This is necessary to check the correctness of the details. The FTS inspector and the applicant sign the registration document. The cash register will have its own number, after which it is considered registered.

Recommended:

Quik: setup, installation, step-by-step instructions, features of work

The trading platform plays a very important role in trading. All transactions are made on it. In trading on financial markets, there are different terminals that have their own characteristics and characteristics. This article will talk in detail about the Quick trading platform. The reader will receive information about the correct Quik settings for different trading assets and its installation

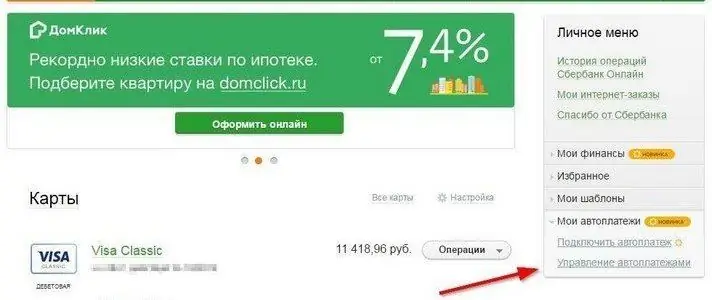

How to remove auto payment from a Sberbank card: step by step instructions

Sberbank has a wide variety of services that make life much easier. Some of them are provided free of charge, while others require payment. The "Auto Pay" option can be very useful, but it needs to be turned off from time to time. But how to do that? Look for the answer in this article

All about the cash discipline of IP: cash register, cash book, Z-report

It is not uncommon for newly registered IPs to experience difficulties associated with a huge number of responsibilities that have suddenly fallen on them. One of these difficulties is a cash register and a lot of documents that need to be drawn up with its appearance. Everything is much simpler than it might seem at first glance! The article in an accessible form will tell about the conduct of cash transactions

Cash registers "Mercury": instructions and reviews

Cash registers "Mercury" enjoy well-deserved popularity not only in Russia, but also in many neighboring countries. Price and quality - that's what distinguishes them from the models of other companies. What else attracts buyers in these devices?

Cash registers for individual entrepreneurs: price and registration. Is a cash register required for sole proprietorship?

Let's talk about the activities of individual entrepreneurs. Who are IP (individual entrepreneurs)? These are individuals registered as entrepreneurs. They are not legal entities, but they have many similar rights. After registering, individual entrepreneurs ask themselves if they need a CCP to carry out their activities