2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:32

Obligation is a legal relationship of a civil type, connecting certain persons who intend to carry out the action envisaged by the obligation in relation to each other. This may be the transfer of property or payment of its value, the performance of a specific type of work, or the reimbursement of expenses as a result of damage caused.

Scope of commitments

Commitment is one of the formats of relationships that can be applied in a variety of industries and areas. Here we can talk about the relationship between different kinds of organizations and citizens. The concept mediates interaction in the manufacturing industry, in distribution and exchange, in entrepreneurship.

Obligation relations are formed on the basis of contracts of sale, delivery, as well as during transportation, in capital construction and in many other areas. Within the framework of market relations, the services listed above can be provided not only by enterprises, but also by private entrepreneurs. This partnership format is relevant in connection with donations, loans and when issuing powers of attorney. Commitment isrelationships that may arise not only from contracts, but also arise on the basis of other aspects provided for by law. Here we can talk about unilateral transactions, about administrative acts, about causing harm, about other points that form certain rights and obligations.

Participants of commitments

As part of the obligations, there is a debtor or an obligated person and a creditor who has the right to claim. The composition of obligations relations provides for the existence of both rights and obligations of their participants. So, in accordance with the loan agreement, the creditor has all the rights to demand the return of the loan from the debtor upon expiration of the agreement. When each of the parties, in accordance with the contract, assumes obligations in relation to the opponent, it is considered the debtor of the other party and undertakes to do certain actions. In parallel, the party also acts as a creditor, as it has the right to demand.

Let's take a situation as an example. The tenant in the form of a debtor must maintain the leased property in optimal condition. The landlord, who acts as a creditor, has every right to demand the fulfillment of this moment from his tenant. Obligations may include not only the existence of claims, but also the existence of creditor obligations.

Share relationships

Commitment is a universal format of legal relations, in which both a couple of persons and more can take part. With a plurality of persons, legal relations can bepresented in equity and solidarity format. Equity legal relationship is a format of partnership in which each of its private owners fulfills a certain debt stipulated by the contract, or requires the part of the promised part that is due to him. In the absence of a clear distribution of the size of shares, either by law or on the basis of an agreement, all obligations and rights are distributed evenly.

Solidarity legal relations

Solidary obligations are also very common. What is it, let's try to figure it out gradually. This format of cooperation provides that the creditor has the full right to demand from each of the joint and several debtors the fulfillment of obligations in full. Alternatively, each solidary creditor has similar rights. When one of the joint debtors fully fulfills all obligations, all the others are released from liability. Claims can be made both against an individual debtor and against all debtors at the same time.

How are obligations enforced?

Debt obligations are a format of relationships that provides for the conscientious fulfillment of all tasks that only one of the parties can undertake. Contractual discipline is strengthened by the exact execution of all agreed points. In order to avoid breach of agreement, it is customary to use collateral.

Note:

- Forfeits. This is a certain amount of funds that the debtor will be required to payto the borrower in the event that he improperly or untimely fulfills his part of the agreement.

- Bail. This is a certain valuable property that is transferred to the creditor as a guarantee that the debtor will fulfill all his obligations within a clearly defined time frame.

- Guarantee. This is when a third party vouches for the fulfillment of his obligations by the debtor, who is ready to take full responsibility if the latter refuses to fulfill his part of the agreement.

- Bank guarantee. It is similar to a guarantee, only in this situation the financial institution itself acts as a third party.

- Retention provides for the presence of the debtor's property with the creditor until such time as he fulfills all his monetary obligations. This right is not written into the contract.

- Deposit. This is a certain amount of material resources that is transferred to the lender as confirmation that the borrower will fulfill all its obligations.

Full responsibility

Obligation is such a legal relationship between the parties, which provides for full liability for failure to comply with a certain part of the contract. Liability provides for unfavorable circumstances of the property type. This is a decrease in a property benefit as a result of the recovery of damages or the payment of a pen alty. An example is petty liabilities on the balance sheet. This is a statutory necessity for the employer to accrue on the main amount of wagesadditional funds in case of late payment or in a situation where the employee works more hours than stipulated in the contract.

What is a debt obligation?

A debt obligation - in simple terms, a receipt - is a free-form document that a lender receives from a borrower when applying for a loan or loan. The paper in accordance with which the fulfillment of obligations will take place is a document within which the size of the loan is described and the terms of its repayment are indicated. The document gives the lender the legal right to recover the full amount of the debt from the borrower at the end of the partnership. A debt obligation is mandatory if the amount of the loan exceeds 10 times the minimum wage.

Some technical points

An IOU, or promissory note, has no clearly defined form. The paper can be presented both in simple written form and certified by a notary. Both formats of the document have identical legal force, however, if there is a seal and signature of a specialist in the event of litigation, the debtor does not have the slightest chance to evade liability. Written commitments must contain all identification data, including registration and address of actual residence. The IOU is returned to the borrower after the fulfillment of all obligations in full. When a party evades its obligations, litigation begins. Atignoring a court decision, various pen alties are imposed on the borrower.

Recommended:

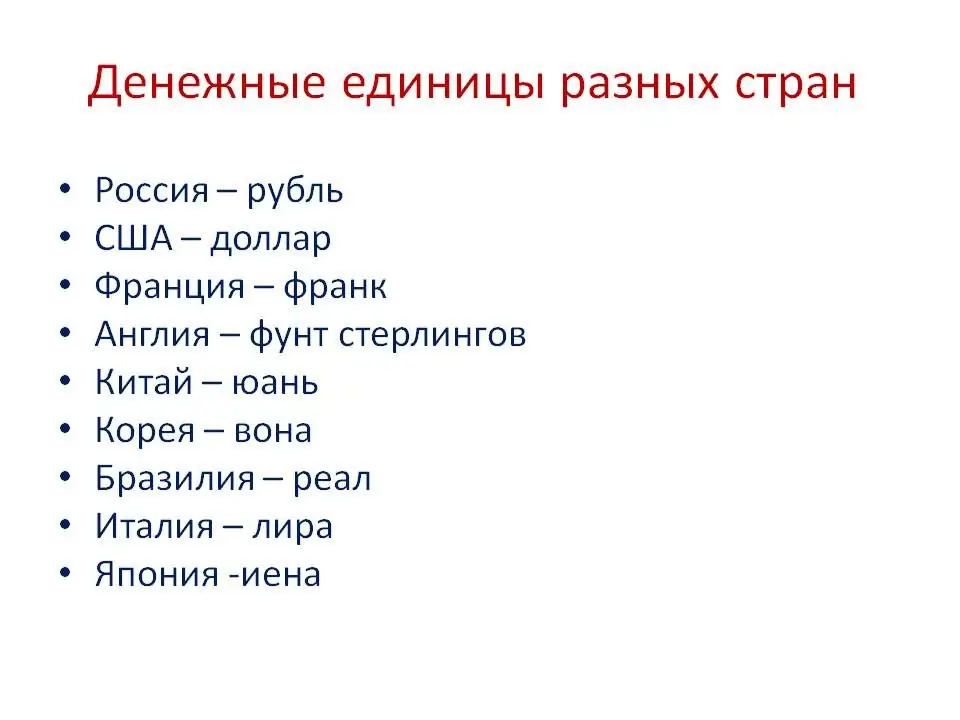

Monetary unit - what is it? Definition of the monetary unit and its types

The monetary unit serves as a measure for expressing the value of goods, services, labor. On the other hand, each monetary unit in different countries has its own measure of measurement. Historically, each state sets its own unit of money

Purchase of debt from individuals and legal entities. Buying property with debt

What is buying and selling debt? Features of the purchase of debt under the writ of execution. Cooperation with collectors. Purchase of debt from individuals and legal entities. What to do if you bought an apartment with debts?

Debt sold to collectors: does the bank have the right to do so? What to do if the debt is sold to collectors?

Collectors are a huge problem for many. What to do if the bank has contacted similar companies for debts? Does he have the right to do so? What will be the consequences? What to prepare for?

Legal obligation is Legal rights and obligations

Legal obligation is a measure of proper behavior, which depends not only on the norm of the law, but also on the situation in which the citizen finds himself

Evolution of world monetary systems briefly. Stages of evolution of the world monetary system

The evolution of world currency systems includes 4 stages of development. The gradual and systematic transition from the "gold standard" to monetary relations became the basis for the development of the modern world economy