2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

Tax deductions are a kind of benefit that the state provides to parents. Depending on the number of dependents, the employee may pay a smaller amount to the tax office, keeping "cash" for himself. Each deduction has its own number, a kind of code. It is he who is reflected in the certificate in the form 2-NDFL, and is also taken into account when filing a tax return. Also, this code is indicated in the tax return. One of the most common is the 114th deduction.

What is the essence of the tax deduction?

A tax deduction is a specific figure that, as the name suggests, is deducted from an employee's total salary. That is, it is the amount of money that is not taxed. These amounts vary and depend on a number of factors. For example, the number of children, as well as the degree of relationship. That is, for adopted children, provided that they are disabled, the amount may be different. Also, increased deductions apply to those who have the status of a widow or single mother.

In a particular case, a parent gets 182 rubles of benefit per child. That is, it is this amount that goes into the pocket of the employee, and not the tax service. However, it makes sense to consider each case separately, since it is possible to identify any fundamentalnuances.

What relies on the first child? Deduction code - 114

The first child is en titled to a deduction in the amount of 1400 rubles. Of course, if the child is not brought up by a widow or a single mother. By the way, a document in form 25, which single mothers receive at the registry office, may also be present in the father, who is raising the child himself. However, this is an isolated case that many employers forget about.

Thus, if the employee has provided all the necessary documents, the accountant is obliged to designate the required deduction code -114 in the 1C “Salary and Human Resources” program. Thanks to this, the employee will receive this benefit every month. It is worth noting that the deduction is provided from the month when all documents are submitted. By the way, they stop if the employee's total income for the year exceeded three hundred and fifty thousand rubles.

What documents do accounting departments need?

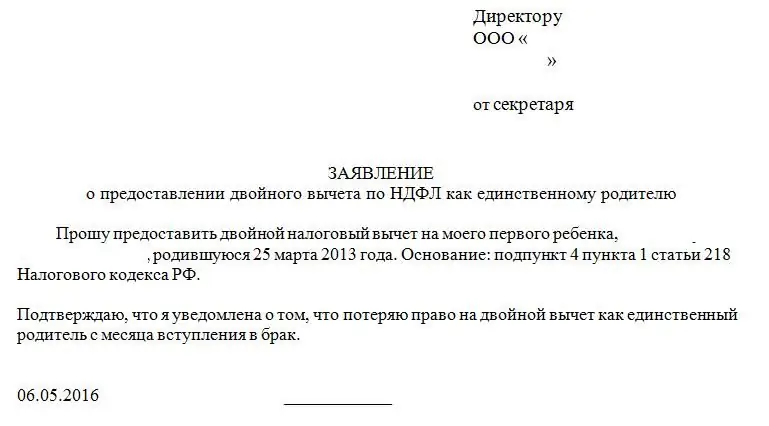

To receive a deduction for code 114, the employee must provide the accountant with the following documentation:

- Application in the form established by the enterprise or in free form if there is no regulated sample. Here you need to specify your data, last name, first name and patronymic of the child, as well as his date of birth. It also makes sense to write exactly what documents are provided.

- Copy of the child's birth certificate. It is a mistake to provide a copy of the passport. Even if the child is already 14 years old and has an identity document, in order to receive a deduction for 114 orto another code, it is the birth certificate that should be provided. This is because it specifies who the parent is.

- Certificate from an educational institution. This document is provided if the child is already 18 years old and is studying full-time. For "part-time students" the personal income tax deduction (code 114) is not provided.

- Help in the form of 2-personal income tax, if the employee gets a new job. This helps keep track of the total amount of income for the year, and also prevents the employee from receiving the deduction for the same month twice, but from different employers.

Change history

It is worth noting that in the personal income tax deduction code 114 has changed its name more than once. For example, the described number was assigned to him only in 2012, when it was decided to separate the first and second child with different codes, despite the fact that the amount for them is the same.

So since the end of 2016, there have been new changes. In 2-personal income tax, the deduction code 114 changed its number to 126. This is how the code provided for the first child to parents now looks like.

Not always in the pay slip provided by the employer, you can see the deduction code and its amount. Therefore, the employee has the right to independently calculate the amount of tax. To do this, you need to subtract the amount of the deduction from the total payroll. In the case of code 114, this is one thousand four hundred rubles. And the result must be multiplied by thirteen percent. This is how much the employee must pay the tax service.

Deduction codes in certificates and declarations

In the help form 2-NDFL, which is accepted by the tax office and most credit organizations, a lot is built on codes. Here you can find the digital designation of the employee's income, and, of course, all deductions for children. Code 114 is located immediately below the columns with the employee's income. It is worth noting that this certificate does not indicate in which month the deduction was provided, only the amount is cumulative from the beginning of the calendar year or from the moment you start working at the enterprise.

In the tax return, which is also called 3-personal income tax, you can also indicate these codes used by the employee. However, a program that can be downloaded from the official website of the tax service will help to do this correctly.

Recommended:

List of documents for a tax deduction for an apartment. Property deduction when buying an apartment

Fixing a tax deduction when buying real estate in Russia is accompanied by significant paperwork. This article will tell you how to get a deduction when purchasing a home. What documents will need to be prepared?

Tax deduction at birth of a child: application, who is en titled to a deduction, how to get

The birth of a child in Russia is an event that is accompanied by a certain amount of paperwork. Parents acquire special rights when replenishing the family. For example, for a tax deduction. How to get it? And how is it expressed? Look for the answer in this article

Tax deduction for mortgage interest. property tax deduction

Today, not every citizen has enough free cash to buy an apartment. Many have to use loans. Targeted loans give the right to claim a tax deduction for mortgage interest, provided that the documents are executed in the territory of the Russian Federation

Deduction of taxes when buying a car. How to get a tax deduction when buying a car

Tax deductions are quite an interesting question that interests many. Of course, because you can get back 13% of the transaction! But is there such an opportunity when buying a car? And what is required for this deduction?

What can I get tax deductions for? Where to get a tax deduction

The legislation of the Russian Federation allows citizens to apply for various tax deductions. They may be related to the acquisition or sale of property, the implementation of social protection mechanisms, professional activities, training, medical treatment, the birth of children