2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-06-01 07:12:56

The evolution of the world's monetary systems is driven by reproductive performance. It is determined by the main stages of development of not only the world, but also the national economy. At times, the principles of the world monetary system begin to contradict the structure of the world economy, do not correspond to the distribution of resources between the main centers. This leads to the emergence of the MVS crisis. Currency contradictions arise as a result of the discrepancy between the structural principles of the world mechanism and the changing conditions of production, trade and the distribution of world forces. The evolution of world monetary systems, which will be briefly described below, is determined by the needs of the national and world economies, the need to change the alignment of forces. Only flexibility and variability, the ability to adapt to the situation of financial instruments and provided the basis for the existence and development of modern society.

Key elements: the evolution of the global monetary system

MVS has overcome the thorny path of its formation before adopting a modern format. For the entireIn its long history of development, the principles of the system have changed 4 times, which was accompanied by the decision of the relevant international conference. The name of the structure itself was also changed, which began to correspond to the name of the city where the conference was held.

Let's consider the stages of evolution of the world monetary system:

- The 1867 Paris system, known as the "gold standard". Each national currency was characterized by a gold content, starting from which an exchange was made for other currencies or gold. There was a floating exchange rate.

- Genoese system of 1922, known as the "gold standard". In addition to the gold reserves, every currency in the world was backed by the currency of the leading economic country, mainly the British pound sterling.

- The 1944 Bretton Woods system, known as the "dollar standard". A prerequisite for the formation of the system was the active development of America in the postwar period. Gold was used in limited quantities.

- The Jamaican system of 1976-78, known as the "Special Credit Measures Standard". SDR acted in the format of assets (specialized entries in the accounts of the IMF). The introduction of the SDR is explained by the desire of all countries of the world to ensure stability in the aspect of international mutual settlements.

Gold Standard

The evolution of world currency systems began with the "gold standard", which operated from 1867 to the 20s of the 20th century. The formation of the financial structure was spontaneous. The main impetus for the Parisian MVSserved as the industrial revolution of the 19th century and the expansion of international trade on the gold coin standard. The main characteristics of the financial system were the following provisions:

- Fixed gold backing of national currencies.

- Gold played the role of universal means of payment and world money.

- Banknotes issued by the Central Bank were exchanged for gold without restrictions. The exchange was based on gold parities. The deviation of the exchange rate was allowed within the limits of monetary parities, which formed a fixed rate.

- In international circulation, along with gold, the pound sterling was recognized.

- Internal money supply corresponded to the gold reserves of the state, which automatically regulated the balance of payments of the states.

- The deficit in the balance of payments was covered by gold.

- Gold was free to move between states.

This stage of development is not the most efficient, not the pinnacle that the evolution of the world monetary system eventually reached. The Parisian monetary system suffered from non-compliance with the rules of the participants in the global financial market. The flow of gold between states did not always take place. England held the position of the main financial state, regulated not only bank interest, but also gold flows. The main reason for the successful development of the "gold standard" was not its effectiveness as a system, but the calm development of the world economy in the pre-war periods.

Gold exchange standard

The stages of the evolution of the world monetary system include the dominance of the "gold standard", which took place from 1922 to the 30s. After the First World War had exhausted itself and all foreign economic relations between the countries were restored, it became necessary to form a new MVS. At the conference in Genoa, the question was raised that the capitalist countries do not have enough gold to settle relations in the segment of foreign trade settlements and other operations. In addition to gold and the British pound, it was decided to introduce the American dollar into circulation. Two currencies assumed the role of an international payment instrument and received the title of motto. The system was adopted by Germany and Australia, Denmark and Norway. In terms of its principles, the system almost completely corresponded to its predecessor, the Paris system. Gold parities were maintained, and the role of world money was still entrusted to gold. At the same time, the evolution of world currency systems led to the fact that certain national banknotes were exchanged not for gold, but for other currencies, called mottos, which were later exchanged for gold bars.

Formation of the first dependencies

World currency systems and their evolution, in particular the adoption of the "gold-device standard", led to the formation of the first dependence of some countries on others. There were only two formats for exchanging the national currency for gold. This is direct, intended for pounds and dollars, which played the role of mottos, and indirect, for other currencies within this system. This AIM used a consolidated floating currencywell. Through the use of foreign exchange interventions, the states of the world were obliged to support any deviations of the national currency. It was the distribution of gold and foreign exchange reserves between states that formed the basis for the formation of relationships.

The gold exchange standard was not the main MVS for a long time. After the liquidation of the crisis of 1929-1922, the system was completely destroyed. Already in 1931, Great Britain completely abandoned the gold standard and devalued the pound sterling. As a result, a number of European states, including India, Egypt and Malaysia, experienced the collapse of national currencies due to the strong relationship with England in economic terms. In 1936, Japan and France abandoned the gold standard. In 1933, in America, in parallel with the refusal to exchange banknotes for gold, the export of the latter abroad was prohibited and the dollar devalued by about 41%. This period, which the evolution of world monetary systems will remember for a long time, became the moment of transition to the currency circulation of money that cannot be exchanged for gold, in other words, credit funds.

Dollar Standard

In the city of Bretton Woods in 1944, 44 countries of the world gathered at an international conference. An agreement was reached on the formation of a regulated structure of correlated exchange rates. The system lasted from 1944 to 1976. Her main characteristics were:

- The role of world money went to gold. In parallel, currencies such as the dollar and the pound were used.

- Formedfinancial institutions of international type: the International Monetary Fund (IMF) and the World Bank for Reconstruction and Development (IBRD). The main task of the organizations was to regulate financial relations in the world between the member countries of the system. All member states of the IMF were automatically members of the World Bank.

- A system of adjustable rates was introduced, which made it possible to either keep the rate at the same level or adjust it upon prior agreement with the IMF. It was planned to set rates at a level that would allow states to effectively develop due to the advantages of international trade and the flow of capital. In the absence of the opportunity to implement this program, the courses were revised.

- Peg dollar to gold. The evolution of the world monetary system (briefly discussed in this article) has led to the fact that all countries have sought to have a dollar reserve. Only America had the right to exchange currency for the precious metal at a price of $35 per ounce. The rest of the states announced the rates of their currencies in gold or dollars, supporting them by buying or selling those same dollars in the currency market.

- Formation of the fund of international reserves. The reserve contribution of each state was determined by the volume of international trade and corresponded to 1/4 of gold or dollars and 3/4 of the national currency. It was the share in the fund that directly affected the allowable amount of a foreign currency loan from the IMF.

The situation in the world during the "Dollar Standard" period

The evolution of world currency systems, which can be briefly considered on the example of the standards prevailing in time, has led to the fact that during the period of the "dollar standard" the direction of the development of the world's economy began to be set by the states of the "big seven". They accounted for about 44.8% of the vote. America owned 18% and Russia 2.8%. This formed the peculiarity that America and other states of the "seven" could directly influence the adoption or rejection of any decisions. Since the appearance of this structure, a sufficiently large amount of material resources has been allocated for the development of a significant number of countries.

Evolution of the world monetary system: a table of the structure of loans during the "dollar standard" period

| Country | Loan size (billion dollars) |

| Russia | 13, 8 |

| South Korea | 15, 2 |

| Mexico | 9, 1 |

| Argentina | 4, 1 |

| Indonesia | 2, 2 |

Despite the prospects of the system, it did not last long due to the fundamental differences between the national economy and the world economy. The beginning of the fall of the system was given by the deficit of the American payment system, which transferred dollars in the form of a world reserve currency. By 1986, the US external deficit was $1 billion. Despite the tolerance of the situation, the phenomenon hadits consequences. In 1971, President Nixon refuses to link the national currency to gold, as society expects a devaluation of the currency and begins to actively buy up gold, which America, in accordance with its obligations, is forced to sell. The dollar is set free to float, the era of the "dollar standard" has completely exhausted itself.

Special Credit Measures Standard

The evolution of the world monetary system, which is briefly discussed in the article, did not stand still, and the "standard of special lending measures" replaced the "dollar standard". It was adopted between 1976 and 1978 and is in active use today. The main characteristics of the Jamaican currency system can be considered the following provisions:

- Major abandonment of the gold standard.

- Demonetization of gold officially accepted. The role of the precious metal as a global means of payment has been cancelled.

- Gold parities are banned.

- Central banks have retained the right to buy and sell gold as a common commodity at a price set in the free market.

- Adoption of the SDR standard, which could be used as world money, and also used as a base for calculating the exchange rate, official assets. The SDR is actively used for international settlements at the expense of account entries and as the unit of account of the IMF.

- The role of reserve currencies was given to the US dollar and the German mark, the pound sterling and the Swiss franc, the Japanese yen and the French franc.

- The exchange rate is floating, formed onforeign exchange market through supply and demand.

- States have the right to independently set the regime for the exchange rate of the national currency.

- Frequency fluctuations are out of control.

- The formation of closed currency format blocks, which are considered to be IMF participants, has become legal. A striking example of this category of education is the European Monetary System (EUR).

The world monetary system: its non-linear evolution

World monetary systems in the order of their occurrence led to the formation of the European monetary system, which acts as a set of economic relations related to the functioning of national currencies within European economic integration. The EMU is an important component of the entire MMU. The structure includes three main components:

- ECU A standard adopted in 1979 that defined a new form of ECU reserve that acts as a tandem of 12 European currencies.

- Free floating exchange rate with a range of deviations within 15%, both upward and downward. A mechanism for exchange rates and interventions has been formed.

Artificially created units of account such as SDR and ECU cannot be used as a real currency arising as a result of the integration of a number of states. Since 1999, 11 states out of 15 have agreed to the introduction of a single monetary unit - the euro. Already in 2002, the countries that agreed to the adoption of the new currency were fully integrated intothe European zone and completely abandoned their currency.

What criteria must members of the Eurozone meet?

The evolution of the world monetary system, in chronological order, which is discussed above, has not only a linear structure. An offshoot was the EBU, which can be joined by any country in the world that meets a number of criteria:

- Inflation growth in the country should not exceed by more than 1.5% the value of an identical indicator on the territory of three states with a minimum increase in the cost of goods and services.

- The budget deficit in the country should be less than 3% of GDP.

- Public debt should be within 60% of GDP.

- The exchange rate of the national currency within 2 years should not cross the corridor established by the EMU standards (+/- 15%).

The currency system, characteristic of industrialized countries, controls not only monetary transactions, but also internal cash flows. This is the most practical solution in today's world. At the same time, the evolution of world currency systems and modern currency problems are tightly interconnected, as they originate from the same source.

Linking the IFS and national financial systems

The evolution of world currency systems, which is briefly discussed in this article, began with a spontaneously functioning structure based on goldstock, and gradually modernized into a focused and regulated structure, which is based on paper-credit material resources. The development of the IAM goes step by step, with a range of 10 years, with the dominant stages in the formation of national monetary structures. In the domestic economy, monetary structures gradually transformed from a gold coin standard to a gold bullion standard, then to a gold exchange standard, and finally came to a paper-credit system, where the main role belongs to credit funds.

| Features |

Paris System (1967) |

Genoese system (1922) |

Bretton Woods (1944) |

Jamaican system (1976-1078) |

European Monetary System (since 1979) |

| Basis | Gold is the coin standard | Gold Coin Standard | Gold Coin Standard | SDR Standard | Standard: ECU (1979 - 1988), Euro (since 1999) |

| Application of gold as a world currency |

Conversion of currencies into gold. Gold parities. Gold as a reserve and means of payment. |

Conversion of currencies into gold. Gold parities. Gold as a reserve and means of payment. |

Currencies are converted into gold. Goldparities and gold remains as the main means of payment. | Demonetization of gold officially announced | More than 20% of gold-dollar reserves combined. Gold is used for the ECU and emission provision. Gold reserves are overvalued at market value. |

| Course Mode | Currency rates fluctuate within the "gold dots" | Currency rates fluctuate without reference to "gold dots" | Exchange rate and parities fixed (0.7 - 1%) | Governments of states independently choose the exchange rate regime | Floating exchange rate in the range (2, 25 - 15%) applies to countries that have not joined the euro. |

| Institutional policy | Conference | Conference, meeting | The IMF is the body of interstate currency regulation | Meetings, IMF | EFS, EMI, ECB |

Let's sum up what the world currency systems were like. The table above will allow you to track the main stages of evolution.

Recommended:

Monetary unit - what is it? Definition of the monetary unit and its types

The monetary unit serves as a measure for expressing the value of goods, services, labor. On the other hand, each monetary unit in different countries has its own measure of measurement. Historically, each state sets its own unit of money

Hydraulic system: calculation, scheme, device. Types of hydraulic systems. Repair. Hydraulic and pneumatic systems

The hydraulic system is a special device that works on the principle of a liquid lever. Such units are used in the braking systems of cars, in loading and unloading, agricultural machinery and even in the aircraft industry

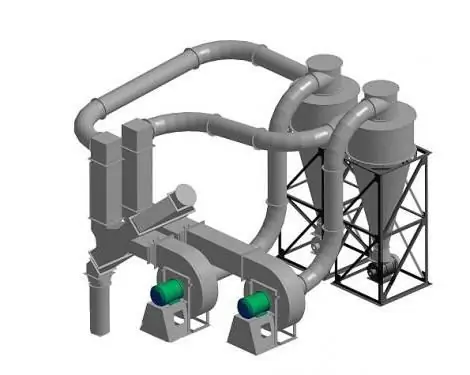

Aspiration systems: calculation, installation. Production of aspiration systems

Aspiration systems are systems that are designed to purify the air. The use of these installations is mandatory at all industrial enterprises that are characterized by harmful emissions into the atmosphere

Visa and Mastercard systems in Russia. Description of Visa and Mastercard payment systems

Payment system - a commonality of methods and tools used for money transfers, settlements and regulation of debt obligations between participants in economic turnover. In many countries, they differ significantly from each other due to the diverse provisions in the levels of economic development and the characteristics of banking legislation

Who invented the dollar: history, stages and evolution

The dollar is almost the most popular and desired currency in the world. Recently, the market has been gradually flooded with the euro, which claims to world domination. However, the old "green" dollar is not losing ground yet. Perhaps the one who invented the dollar did not count on such a stunning reputation for his offspring