2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

Changes in the field of banking due to technological progress have long been noticeable. One of the innovations is getting a credit card. Thus, it is easier for the bank to control the financial condition of the borrower.

And it is much more convenient for you to repay the loan and enjoy other benefits of this service. The postal card, reviews of which are often positive, is a significant change in the lending system. It's pretty easy to get it. Same as use.

Bank "Russian Standard". Postcard. How to get?

Suppose you have just turned 18 and need money urgently. You can contact the bank and go through the process of registration and verification of your candidacy in order to get a loan on the card. This can be done both online, without leaving home, or by visiting Russian Standard Bank. To do this, you will first have to contact the dean's office or the accounting department of your educational institution in order to provide the organization with the necessary information about your solvency. A student mail card, which is rather controversial (depending on the narrator), will come to your dean's office after verificationall personal data.

Student card: advantages

The student postal card ("Russian Standard"), reviews of which can be read on the Internet, is very profitable. She has a grace period when the withdrawn funds can be repaid without paying interest. The only restriction for its receipt is age. If you are in your first year, you will have to wait until you move on to the next, because no one will issue a card for you. It seems that you are very well versed on the Internet, so after receiving a credit card, you will be able to track your payments and terms on the loan in the bank's online service. Moreover, having another account (scholarship, deposit) in the same organization, you will be able to transfer funds between your cards, thus repaying the debt (this service is not valid if your credit card and deposit / scholarship card are from different banks). Agree, the loan repayment becomes quite convenient, you don’t even need to leave the house. In the absence of another Russian Standard card, you can pay off the debt at a bank branch or, by paying a commission, use the services of other organizations that will transfer money to your account.

Another advantage of the "Russian Standard" credit card is the payment service in shops / catering establishments without interest.

Student credit postal card: reviews and disadvantages in use

The disadvantage of this type of loan is the impossibility of withdrawing funds without commission. However, if you have already paid off all the debt, personal money is withdrawn without any interest. Another unpleasant moment when concluding an agreement with Russian Standard Bank is the card maintenance fee, which is 200 rubles. True, it is charged only one year. In addition, it should be noted that the postal card, reviews of which are quite numerous, is subject to a serious commission for the use of funds. Therefore, before using this service, it is recommended to familiarize yourself with the interest rates.

Recommended:

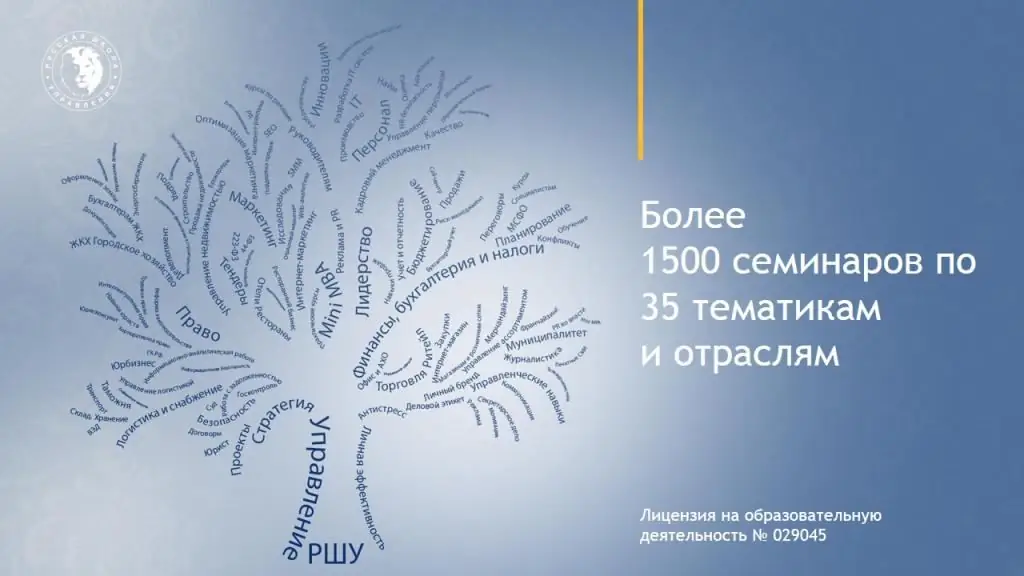

Russian School of Management: student reviews, areas of training and advanced training, branches

Russian School of Management is a modern, world-class advanced training center. The main difference can be called a unique teaching staff. How RSU teachers differ and what clients say about the training center will be discussed in this article

Student loan at Sberbank from the age of 18: design features, conditions and reviews

Money is needed to get an education in many institutions. Often the amount is so high that such money may not exist. Then you can take a student loan offered by Sberbank. It is provided for a long period and allows you to cover all training

"2 shores": reviews on the quality of dishes and service, conditions for ordering food and delivery. "Two Shores": employee reviews

Food delivery is a great way to save time and do something that makes you happy instead of cooking. But not all establishments are ready to provide gourmet cuisine, and sometimes the food is so mediocre that the buyer regrets that he did not cook it himself. In today's article we will talk about such a company as "Two Shores". Reviews written on the Internet about her are quite contradictory

Home Credit installment credit card: customer reviews on conditions

Recently, not just credit cards, but installment payment cards have begun to gain more and more popularity. And this is no accident. Such cards have a number of advantages. Not so long ago, Home Credit Bank also issued its installment card

Credit card "Corn" - reviews. "Corn" (credit card) - conditions

A credit card is an analogue of a bank loan, one of the ways to attract borrowed funds. It has a lot of advantages. The client gets access to a revolving line of credit, provided that he repays the debt on time. Five years ago, such a means of payment could only be issued at a bank. Today it is actively offered by large companies and networks. In this article you will find out what is a credit card "Corn"