2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:38

Today we will study the types of taxation for legal entities and entrepreneurs. What are they like? And what is better to choose in this or that case? Each individual entrepreneur should know the pros and cons of existing tax payment systems. Otherwise, the business may fail. All this and more will be discussed below. In the end, everyone will understand how to choose one or another system of taxation. This is not as difficult as it might seem at first glance.

Taxation is…

First, let's figure out what, in principle, we have to deal with. Taxation for individual entrepreneurs and LLCs is an extremely important component. It's a tax system. Thanks to it, income is declared and part of the profit is returned to the state.

According to the Tax Code of the Russian Federation (Article 17), tax payment systems determine:

- objects of taxation;

- tax base;

- period for which you need to pay;

- tax rate;

- payment calculation procedure;

- terms and methods of money transfer;

- benefits and other features of taxes.

At the moment, a legal entity may face different types of taxation. Next, we will look at each possible option with pros and cons.

Types of systems

Let's start with a short list. It will help you understand from which in general you can choose the type of transfer of part of the profits for doing business.

Currently, there are the following types of taxation in Russia:

- BAS;

- USN (simplification);

- UTII (imputation);

- ESKhN;

- PSN.

ECHN is almost never used in practice. Therefore, it should not be heavily focused on. We will deal with other types of taxation and their characteristics. Understanding all this is not difficult.

BASIC & BUSINESS

The most common scenario is the use of a common taxation system. It is selected by LLC or IP by default. The alignment is not always profitable, especially at the very beginning of the business.

It provides for serious paperwork and very large taxes. Therefore, OSNO is often abandoned by many entrepreneurs. For some, this option is suitable.

If you briefly describe the tax payment system, then in this case you will have to transfer funds for the property of the organization and for income. There is also VAT. It is this component that allows you to choose or refuse BASIC.

Cons of the overall system

We have listed the main types of taxation in Russia. Now it is worth considering each option morein detail.

At the moment OSNO has the following weaknesses:

- high taxes;

- variety of payments;

- serious tax reporting.

That's it. No more flaws.

It is worth paying attention to the fact that LLC (company) under OSNO pays income tax of 20%, and IP - 13%. Reporting quarterly. And so it gives firms a lot of trouble.

Pros BASIC

Now for the positives. They play an important role. Especially if a person does not know what type of tax payment to stop at.

The general system of taxation in Russia today has the following advantages:

- applies everywhere and to any type of activity;

- you can not contact the Federal Tax Service additionally to select it;

- allows you to reduce VAT on VAT that is transferred to suppliers;

- tax base is profit minus expenses;

- in some cases, personal income tax can be equal to from 0 to 30%.

However, this option is not always used. What type of taxation to choose in this or that case? To do this, you should pay attention to other offers. Only then will the entrepreneur be able to figure out how best to transfer taxes to the state treasury.

USN in Russia

The next tax payment system is the simplified tax system. They call it "simplistic". This is the alignment used by entrepreneurs most often.

Already by the name of the system it is clear that this mode of paymenttaxes implies a simplified procedure. So it is - paperwork with him is minimal, especially if a citizen works without employees.

USN has 2 varieties. More precisely, then:

- income - expenses;

- income.

Depending on the selected type, the tax base will change. In the first case, net profit is implied (after deducting expenses), in the second, all income received.

"Simplified" provides for the payment of personal income tax. They pay either from 5 to 15% (income - expenses), or from 0 to 6% (income). The exact amount of tax depends on the region in which the entrepreneur lives, as well as on the type of activity.

Disadvantages of the USN

A few words about why individuals refuse to "simplify". This alignment is far from suitable for everyone.

For example, due to such shortcomings:

- not all activities allow the use of the simplified tax system;

- you have to additionally write an application for the transition to "simplified";

- the company can employ no more than 100 people;

- you need to receive no more than 60 million rubles a year (from 2017 - 120,000,000) to be eligible for the simplified tax system.

Accordingly, this type of taxation for an individual entrepreneur working for himself without employees is quite often suitable. But what are the advantages of this system?

Pluses of the simplified tax system

"Simplicity" is a favorite direction in which entrepreneurs work. Small companies also often stop atthis scenario, but over time it has to be abandoned due to the large staff and high profits.

The advantages of the simplified tax system include:

- minimal paperwork;

- low tax rates;

- opportunity to reduce taxes by the amount of deductions to the Pension Fund;

- the right to choose the method of calculating the tax base.

In practice, if it is possible to use "simplified", citizens try to stop at this option.

Annual reporting (until May 31 for companies and until April 30 for individual entrepreneurs), but personal income tax will have to be paid once a quarter. Additionally, you will have to keep a book of expenses and income.

Reduction of the tax base is carried out at the expense of the cost of maintaining the company, deductions for employees in the Pension Fund (no more than 50% of transfers) and for themselves (100% of the amounts given to the Pension Fund).

UTII, or "imputation"

And there is such a thing as UTII. This is a single imputed tax. People call him "imputed".

UTII - a type of taxation that is not used in Moscow. But in other regions of the Russian Federation, you can actively work with him. It provides for the absence of any taxes that depend on the income of the enterprise.

Types of taxation for LLCs of all previously listed are not as interesting to businessmen as UTII. "Vmenenka" is ideal for cafes, taxis and a number of other types of activities.

As in the case of the simplified tax system, UTII can be reduced by the amount of fixed deductions. Reporting and payment of taxes in this mode are quarterly. taxespaid depending on the potential profit of an individual entrepreneur or LLC. The corresponding estimated income is set by the state and depends on the region of registration, as well as on the activities of the enterprise.

On the shortcomings of UTII

What are the disadvantages of "imputation"? After all, all types of taxation have strengths and weaknesses. Every businessman should remember them.

At the moment, UTII has the following disadvantages:

- not available in all regions;

- can only be used for certain types of activities;

- in some cases, working with UTII is not entirely profitable;

- paperwork from quarter to quarter paying taxes;

- you cannot work with UTII if the company has more than 100 subordinates.

In addition, as in the case of the simplified tax system, with the "imputation" of another company, the share in the business should not be more than 25%. Otherwise, the right to the considered type of tax payment is abolished.

On the advantages of UTII

Types of taxation for LLCs and entrepreneurs necessarily include "imputation". This is not the worst option. Especially if the company's real profit is greater than the state suggests.

The following strengths of "imputation" can be noted:

- tax base does not depend on the company's income;

- no additional expenses are needed except for fixed deductions to the FIU;

- there is an opportunity to reduce taxes on contributions made to off-budget funds;

- you can not use cash registers.

Important: the tax rate is determined by 15% of the potential annual profit of the company.

PSN is…

Not so long ago, patent taxation appeared in Russia. The types of activities in this case are also limited, as with the simplified tax system or UTII. Nevertheless, PSN is actively used in practice. Especially if a person wants to open an individual entrepreneur and "see" how he can conduct business.

In general, PSN resembles the USN or "imputation", but with its pluses and minuses. For example, this option is available only to IP. And the amount of tax does not depend on the real profit of the entrepreneur.

Flaws of patents

Now consider the disadvantages of this option. As already mentioned, PSN is available only to entrepreneurs. LLC will not be able to work with her under any circumstances.

Currently, the patent system has the following weaknesses:

- can be used for some types of activities;

- not always profitable;

- the company should not have more than 15 employees;

- cannot reduce taxes on mandatory contributions to the Pension Fund;

- annual profit cannot exceed 60,000,000 rubles;

- the cost of a patent is different in all regions of the Russian Federation.

Nevertheless, this alignment seems very attractive to some. In order to decide on the choice of tax payment system, you need to evaluate all the pros and cons of each proposal. Only in this way will a person make the right decision.

Pros of a patent

Types of taxation for LLCs do not provide for PST. But entrepreneurs may face this situation.

Patents are convenient. But why? It is customary to single out the following positive aspects of the regime:

- there is no dependence of the amount of tax on real profits;

- minimal paperwork;

- no need to use cash register;

- you can buy a patent for a period of 1 to 12 months;

- taxes are paid either before the expiration of the patent (if it is purchased for up to six months), or 33% of the amount is transferred no more than 90 days after the acquisition, and the rest - until the end of the validity of the PSN from the IP;

- multiple patents allowed.

Accordingly, today many entrepreneurs pay attention to PSN. In particular, if this mode is applicable to a particular type of activity.

ECHN

When switching to a new tax payment regime, a citizen is required to write an application within the prescribed time limits (usually from 10 to 30 days from the beginning of the tax period) and submit it to the Federal Tax Service. You will have to specify the type of taxation code and the type of activity of the company. All this can be viewed in the databases of tax services.

And what is ESHN? A tax that is only suitable for those who independently conduct agricultural activities. Almost never occurs in real life. Accordingly, we will not consider such a regime. It is enough to know that it exists. For more detailed information, it is better to check with the Federal Tax Service.

Conclusion

We found out what types of taxation for individual entrepreneurs and companies exist in Russia. But where is the best place to stop?

Based on the foregoing, we can conclude that the simplified tax system, UTII and PSN are similar to each other. Therefore, they need to be compared for a specific type of activity in a particular region.

With certainty, we can only say that it is better not to agree to the OSNO at first. For inexperienced businessmen, this is a huge tax and reporting burden that can ruin their business.

Recommended:

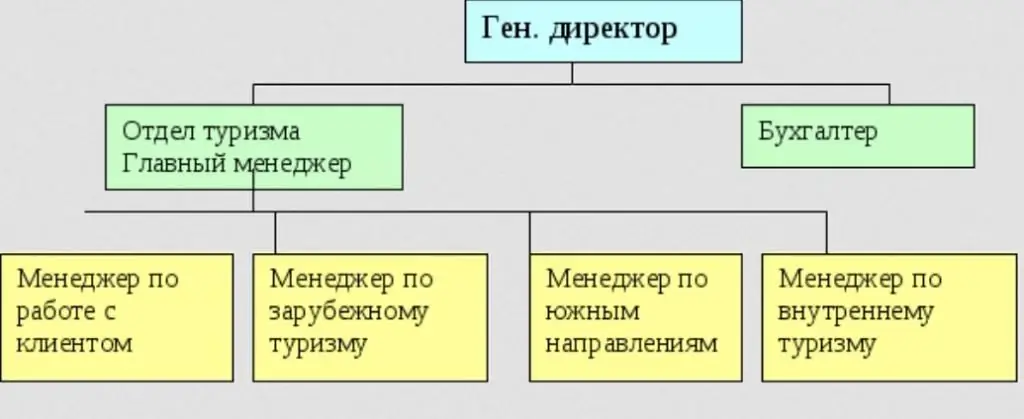

Types of tour operators and their characteristics. Functions and features of the activities of tour operators

The tour operator provides a wide range of travel services and simplifies the reservation of services in other cities and countries, taking on these tasks. In the field of tourism services, it occupies a special niche. In the article we will consider the types of activities of tour operators

Non-ferrous, precious and ferrous types of metals and their characteristics

Metals are a large group of simple elements with characteristic features such as high thermal and electrical conductivity, positive temperature coefficient and more. To properly classify and understand what's what, you need to deal with all the nuances. Let's try with you to consider such basic types of metals as ferrous, non-ferrous, precious, as well as alloys. This is quite an extensive and complex topic, but we will try to put everything on the shelves

Reserves of banks and their formation. Required bank reserves and their norm

Bank reserves ensure the availability of funds for the uninterrupted fulfillment of payment obligations regarding the return of deposits to depositors and settlements with other financial institutions. In other words, they act as a guarantee

Main types and types of business plans, their classification, structure and application in practice

Each business plan is unique, because it is developed for certain specific conditions. But you need to familiarize yourself with the features of various types of business plans in order to understand their key features. Experts recommend doing this before compiling your own similar document

What are the premium taxes? Types of premiums, features of their taxation

Bonuses are presented by the encouragement of employees who achieve high performance in the company. The article tells what taxes the premium is subject to, what are its varieties, and also how it is correctly assigned by the management of various enterprises. The rules for paying not only taxes, but also insurance premiums are listed