2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-06-01 07:12:56

Many traders use good indicators in their work. Forex is very changeable, and to find the optimal entry point, you need to use all available tools. With the help of signals given by indicators, market participants decide to buy or sell an asset. As practice has shown, there is no single indicator that would always give accurate signals for entering the market. On the other hand, using the best Forex trend indicators, you can see very interesting moments in the market. Eliminating each other's false signals, automatic analysis tools allow you to objectively assess the situation.

Why do we need indicators besides defining entry points?

Good Forex indicators are indispensable tools for currency market participants. If specialists can see the market and anticipate price movements without auxiliary programs, then beginners simply need them. The very first thing to do when analyzing the situation before making a deal is to determine the trend. It will indicate the direction of entry: buy or sell. Further, having found the most attractive entry points, you can already take active steps. Good Forex indicators allow you to determine the trend, the direction of price movement as accurately as possible. The instruments can be used in different time frames, which will give grounds to study both long-term and short-term trends. Indicators also provide assistance in the presence of open positions. By analyzing their data, you can determine at what point the momentum of the price movement has already been exhausted and it is worth waiting for the reverse movement.

Moving Averages, or Moving Averages

The simplest and most versatile trading tool in the market is moving averages, or Moving Averages. Two indicators, two lines on the price chart can give very accurate signals. Tools are used by many traders and underpin numerous strategies. For example, an automatic instrument with parameters of 200 and 50 can indicate a trend. It is generally accepted that when the 50th line goes above the 200th, the trend is up. When the situation is reversed, the trend is down. Many, experimenting with the parameters of the instrument, achieve decent results in trading. For maximum efficiency of moving averages, you need to set your own parameters for each time period. The best Forex indicators are undoubtedly moving averages.

MACD is a reliable trading assistant

In the 60s of the 20th century, Gerard Apparel developed an indicator called MACD, which helps confirm the trend. With the help of a computer program, it is possible to clearly fix the phenomenaconvergence and divergence. When the price on the chart goes up, and the indicator falls down, this indicates a change in the current trend. This is also indicated by the mirror situation. With positive readings of the instrument, we can talk about the north direction of the price, with negative readings - about the south. Based on the information provided by the tool, you can make effective trading decisions. In combination with moving averages, MACD will help to show excellent trading results.

RSI - help in identifying overbought and oversold zones

When studying good Forex indicators, one should not ignore RSI. This analysis tool shows when the price reaches the overbought zone and the oversold zone in the market. If the indicator waves are closer to the zero level, then the number of sales has already reached its critical zone. When the indicator waves reach the level of 100, this indicates that buyers have already run out of strength, and the trend is running out. Stochastic helps to filter false signals. This is another tool from the "Best Forex indicators" category. Stochastic is more sensitive to price movement. When the signals of two instruments overlap each other, this indicates that it is worth looking for entry points.

Bollinger Bands

If we are describing the best Forex trend indicators, we should also consider Bollinger Bands. The tool draws a moving average, parameterswhich are set by the trader. A certain corridor is formed that determines the average statistical deviation of the price in a certain period of time. On the chart, the indicator looks like a corridor, within which the price “walks”. Signals to buy or sell come when one of the boundaries of the corridor breaks through. This tool is more helpful for beginners to see the market. There is another strategy, according to which, after a significant narrowing of the corridor, a strong movement begins.

Arrow indicators and their analogues without drawing

Many traders find it convenient to use the best Forex arrow indicator in trading, which everyone chooses on their own. The advantage of this automatic tool is that it does not overload the price chart. It is formed on the price chart in the form of arrows that determine the expected market movement, taking into account a number of parameters. Visually, this trading tool is perceived easily, which simplifies trading for the trader. The best indicators (“Forex”) without redrawing are very effective in trading, the readings of which do not contradict the price movement in the market. One example of drawing is different readings of indicators at different time intervals, which show different values. This makes it difficult to make trading decisions. That is why it is extremely important to check the instruments for drawing before using them in trading.

Summing up

Each trader has his own best Forex indicator, which is more convenient for himjust use. This does not mean at all that the tool used by a particular trader is the most effective. Most likely, the information that it conveys is easiest for a certain person to perceive. Experts say that in order to build a profitable trade, it is not necessary to install all available instruments in the terminal. The optimal number of indicators is 2-3. Let's pay attention to the fact that almost all tools for automatic trading are built on the basis of technical analysis and on the basis of the average price value in a certain period of time. Moreover, they all show almost the same signals. The only question is which tool is more convenient for each person to work with. Please note that it is impossible to use only indicators for trading, since they tend to give false signals. Their implementation in a trading strategy is much more efficient and profitable.

Recommended:

A good is an economic good

A commodity is an economic good produced for exchange. A commodity has two features: exchange value and use value

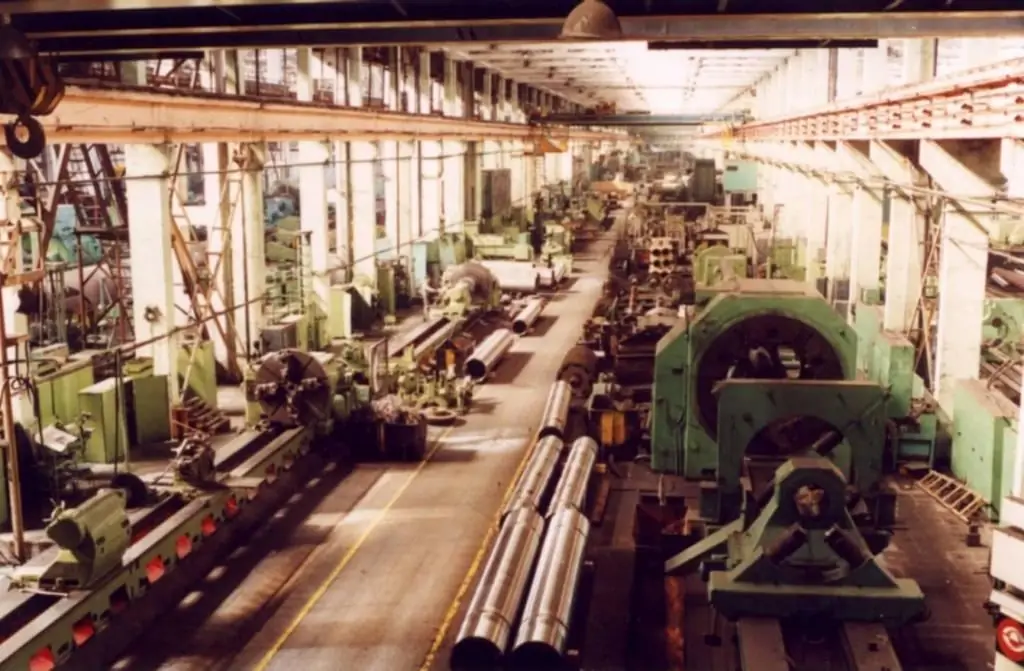

Product manufacturability indicators: types of indicators and evaluation methods

Product manufacturability indicators are the most important component of assessing the quality characteristics of products, designs, parts, and so on. They make it possible to compile a comprehensive description of the effectiveness of technological products in relation to the adaptability of the design to its application in specific conditions, for example, in production

Trend is the trend and direction of development

A trend is a direction, a trend in the development of a process or phenomenon. A fashion trend is a trend in the style and design of clothing or other accessories. A sideways trend in the foreign exchange market is when price fluctuations occur in the same range

A good hookah in Moscow: a list of places for a good holiday, addresses, descriptions, photos and reviews

Moscow is not only a beautiful, but also a modern city, where a huge variety of restaurants and cafes, banquet halls, cafeterias operate. However, there are also many different hookahs in the capital of Russia, where anyone who has reached the age of 18 has the right to order a hookah and smoke it, relax, and have a good rest. Today we will tell you about the most popular restaurants, as well as bars and cafes where you can order a good hookah, their menu, review

The most accurate indicators for MT4: rating. The best indicators for MT4

Are you a trader? Do you need the best indicators for MT4? We will talk about them in the article. In Forex trading, traders use an impressive number of various indicators with which they can accurately enter the market