2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

A rather interesting issue for many citizens is the return of 13 percent from treatment. And it doesn't matter what kind of medical care we are talking about. The main thing is that you can get the so-called tax deduction for it.

This topic is of interest to many. Especially when it comes to dental treatment, because they are usually repaired for a fee. Few agree to a free service. And every citizen who has one or another income can receive a refund of 13 percent from dental treatment. And medical treatment in general. How to do it? What deadlines should be met? We will tell about all this further.

Who is eligible

First of all, who is eligible for the social tax deduction in our case? It is also called the medical bill. Not all citizens apply for it, but only some. However, most often this option is available to the majority of the population.

Why? The thing is that a return of 13 percent from treatment is possible only when it comes to a person who is officially employed. That is, such a payment is possible withpayment of income tax. And nothing more.

But the unemployed and officially unemployed people do not have the right to receive it. But the return of 13 percent of the treatment to pensioners, in accordance with the current legislation, will be made. But ordinary unemployed citizens - no.

Passport

Well, now a little about what documents we need to get the deduction. This question is really important. After all, if you provide an incomplete list, then you will simply be denied a refund. And you have to start all over again.

The first thing you need is an identity card. In our case, this is a passport. A refund of 13 percent from treatment without this document (or rather, without a copy of it, it can be uncertified) does not take place. You can try to present any other identification document, but most likely you will be refused. Consider this!

Declaration and Statement

Do you need a 13 percent refund on your dental treatment? The documents that will be required to receive this payment, as practice shows, are not so difficult to obtain. For example, you need a tax return. It is submitted to the tax authorities by April 30 of each year and reflects your income and expenses. This is an important reporting document.

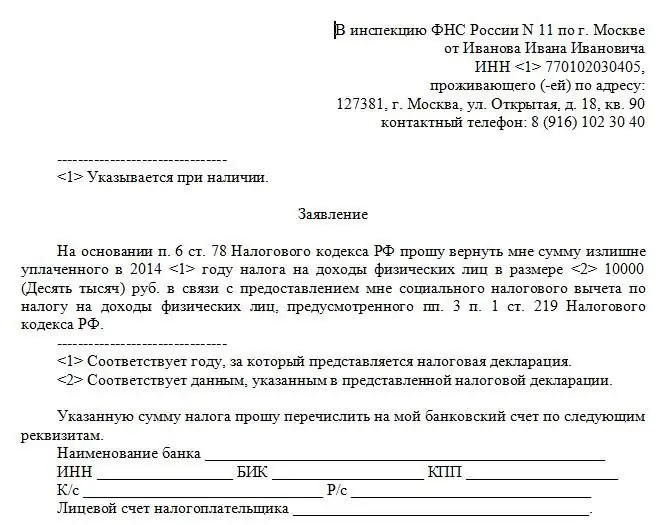

You also need to write a free-form application. Without it, there is no point in contacting the tax authorities. Granting a deduction is possible only upon the application of a citizen. The original document is required. It must contain information about the medical institution, as well as about you and aboutthe treatment carried out. Do not forget to write down the reason for the appeal.

Important: the application will have to indicate bank details, which will be used to return 13 percent of the treatment. In the absence of them, you will either be refused, or you will have to convey the missing documents.

About the facility

What else? The above list of all the essentials does not end there. In addition to the proposed documents, you will have to worry about informing the tax authorities about providing data on the place of your treatment. In fact, you should not be afraid of this feature.

Want to get a 13 percent refund on your treatment? What documents are required for this type of deduction? You, it turns out, will also need a license from the visited medical institution. You will have to take a certified copy of it. As a rule, there are no problems with this moment.

In the case of dentistry, a license will suffice. In some situations, accreditation of a medical worker may also be required. But this is not such a common case. So don't worry about him.

Payments

Next, you will need to confirm that you have paid for the treatment. For this, any payment checks are suitable - receipts, statements, as well as a service agreement. By the way, without the latter, a return of 13 percent from the treatment is impossible in any case. If the check can be replaced by some other evidence, then the contract is not.

Also note that you will have to take a certificate from the employer (your)2-personal income tax. It serves as proof of your income. If you work for yourself, fill it out yourself. Only the original is required, copies are not acceptable. But checks and receipts can and should be photocopied and then presented (even without certification).

Other documents

What else would a 13 percent refund on dental treatment require? In principle, with the list of documents already listed, you can apply to the tax authorities for a deduction. But, as practice shows, most often taxpayers are asked for additional and not the most important papers. What can be attributed to them?

Firstly, these are marriage/divorce/birth certificates. Such a requirement is rare, but people are used to playing it safe once again. Uncertified copies are enough, originals are not needed.

Secondly, pensioners will need a pension certificate. It is it that serves as proof of receipt of compensation for paid treatment in a particular case. A normal copy is also sufficient. Usually all paperwork ends here.

Timing

How long does it take to apply for a tax deduction? Here, citizens have an alternative to resolve the issue. The thing is that most often deductions can be made for the last 3 years. But here the return of money for treatment is recommended to be carried out as soon as possible, within a year. And even better - by the end of the tax reporting period.

The application is being considered along with all the documents for about a month, a maximum of one and a half. After you receive a responsefrom the tax authorities. Your request is either granted or denied, with reasons. You can try to correct the situation and try again.

The transfer of funds to the account indicated in the application takes about 2 more months. In total, the whole process takes about 120 days. Therefore, try to start preparing as soon as possible.

The faster you finish this task, the less headache you will have in the future. As you can see, the return of 13 percent from the treatment requires different documents. But if you start preparing correctly and in a timely manner, you will not have any problems!

Recommended:

What documents are needed for deduction for treatment: list, rules of registration

In Russia, many citizens can apply for a so-called tax deduction. For example, social type. People are able to recover part of the cost of medical services. But how to do that? This article will talk about the tax deduction for treatment in the Russian Federation

How to get back 13 percent of buying a car on credit: the main options and ways to save

It is impossible to issue a tax deduction for the purchase of a car purchased on credit. The only benefit that is possible in this case is the receipt of funds in debt, intended for the purchase of a car under the state program. The law does not provide for a tax refund, since deductions to the state budget, if a credit car is purchased, are not made. You can only get a deduction when you sell a vehicle

Sewerage: cleaning, removing blockages. Wastewater treatment plant, biological wastewater treatment

The article is devoted to sewer systems and wastewater treatment facilities. Methods for cleaning sewer pipes, biological treatment plants and drainage systems are considered

Definition of front-, middle- and back-office terms. What is working in the back office of a bank?

The back office is the gray cardinal. Clients and customers cannot appreciate the work of its specialists, although they put a lot of effort into the prosperity of the business. Such divisions are in banks, investment companies, organizations that make transactions in the securities markets

Tax deduction for treatment: who is en titled, how to get it, what documents are needed, rules for registration

This article will tell you how to get a tax deduction for treatment. What is it and what are the rules for issuing a return?