2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

In modern economic terminology, you can find many beautiful, but incomprehensible words. For example, hedging. What's this? In simple words, not everyone can answer this question. However, upon closer examination, it turns out that such a term can be used to define market operations insurance, although a little specific.

Hedging - what is it in simple terms

So, let's figure it out. This word came to us from England (hedge) and in direct translation means a fence, a fence, and as a verb it is used in the meaning of “defend”, that is, try to reduce the likely losses or avoid them altogether. And what is hedging in the modern world? We can say that this is an agreement between the seller and the buyer that in the future the terms of the transaction will not change, and the goods will be sold at a certain (fixed) price. Thus, knowing in advance the exact price at which the goods will be purchased, the participants in the transaction insure their risks against possible fluctuations in exchange rates on the foreign exchange market and, as a result, changes in the market price of the goods. Participants in market relations who hedge transactions, that is, insure their risks,are called hedgers.

How it happens

If it's still not very clear, you can try to simplify even more. It is easiest to understand what hedging is with a small example. As you know, the price of agricultural products in any country depends, among other things, on weather conditions and how good the harvest will be. Therefore, when conducting a sowing campaign, it is very difficult to predict what the price of products will be in the fall. If the weather conditions are favorable, there will be a lot of grain, then the price will not be too high, but if there is a drought or, on the contrary, too frequent rains, then part of the crops may die, due to which the cost of grain will increase many times.

To protect themselves from the vagaries of nature, permanent partners can conclude a special agreement, fixing a certain price in it, guided by the market situation at the time of the conclusion of the contract. Based on the terms of the transaction, the farmer will be obliged to sell, and the client to buy the crop at the price that was prescribed in the contract, regardless of what price appears on the market at the moment.

Here comes the moment when it becomes most clear what hedging is. In this case, several scenarios are likely:

- the price of the crop on the market is more expensive than prescribed in the contract - in this case, the producer, of course, is unhappy, because he could get more benefits;

- the market price is less than that specified in the contract - in this case, the buyer is already the loser, because he bears additionalcosts;

- price indicated in the contract at the market level - in this situation, both are satisfied.

It turns out that hedging is an example of how you can profitably realize your assets even before they appear. However, such positioning still does not exclude the possibility of a loss.

Methods and purposes, currency hedge

On the other hand, we can say that risk hedging is insurance against various adverse changes in the foreign exchange market, minimizing losses associated with exchange rate fluctuations. That is, not only a specific product can be hedged, but also financial assets, both existing and planned for acquisition.

It should also be said that the correct currency hedging is not aimed at obtaining the maximum additional income, as it may seem at first. Its main task is to minimize risks, while many companies deliberately refuse an additional chance to quickly increase their capital: an exporter, for example, could play on a depreciation, and a manufacturer on an increase in the market value of goods. But common sense dictates that it is much better to lose excess profits than to lose everything at all.

There are 3 main ways to maintain your foreign exchange reserve:

- Application of contracts (terms) for the purchase of currency. In this case, fluctuations in the exchange rate will not affect your losses in any way, nor will they bring income. The purchase of currency will take place strictly according to the conditionscontract.

- Introduction of protective clauses into the contract. Such clauses are usually bilateral and mean that if the exchange rate changes at the time of the transaction, the likely losses, as well as benefits, are divided equally between the parties to the contract. Sometimes, however, it happens that protective clauses concern only one side, then the other remains unprotected, and currency hedging is recognized as one-sided.

- Variations with bank interest. For example, if after 3 months you need a currency for settlements, and at the same time there are assumptions that the rate will change upwards, it would be logical to exchange money at the current rate and put it on a deposit. Most likely, the bank interest on the deposit will help level fluctuations in the exchange rate, and if the forecast does not materialize, there will be a chance to even earn some money.

Thus, we can say that hedging is an example of how your deposits are protected from a likely fluctuation in interest rates.

Methods and tools

Most often, the same working methods are used by both hedgers and ordinary speculators, but these two concepts should not be confused.

Before talking about the various instruments, it should be noted that the understanding of the question "what is hedging" lies primarily in the goals of the operation, and not in the means used. Thus, a hedger conducts a transaction in order to reduce the probable risk from a change in the value of a commodity, while a speculator quite consciously takes such a risk, while expecting to receive only a favorable result.

Probably the most difficult task is choosing the right hedging instrument, which can be roughly divided into 2 broad categories:

- OTC represented by swaps and forward contracts; such transactions are concluded between the parties directly or through the mediation of a specialist dealer;

- exchange hedging instruments, which include options and futures; in this case, trading takes place on special sites - exchanges, and any transaction concluded there, as a result, turns out to be tripartite; the third party is the Clearing House of a particular exchange, which is a guarantor of the fulfillment by the parties of the contract of their obligations;

Both methods of risk hedging have their advantages and disadvantages. Let's talk about them in more detail.

Exchanges

The main requirement for goods on the stock exchange is the ability to standardize them. These can be both food group goods: sugar, meat, cocoa, cereals, etc., and industrial goods - gas, precious metals, oil, and others.

The main advantages of stock trading are:

- maximum accessibility - in our age of advanced technology, trading on the stock exchange can be conducted from almost any corner of the planet;

- significant liquidity - you can open and close trading positions at any time at your discretion;

- reliability - it is ensured by the presence in each transaction of the interests of the clearing house of the exchange, which acts as a guarantor;

- fairly low transaction costs.

Of course, it has not been without drawbacks - perhaps the most basic can be called quite severe restrictions on the terms of trade: the type of product, its quantity, delivery time, and so on - everything is under control.

OTC

Such requirements are almost completely absent if you trade on your own or with the participation of a dealer. Over-the-counter trading takes into account the wishes of the client as much as possible, you yourself can control the volume of the lot and the delivery time - perhaps this is the biggest, but practically the only plus.

Now for the downsides. As you understand, there are much more of them:

- difficulties with the selection of a counterparty - now you will have to deal with this issue yourself;

- high risk of non-fulfillment by any of the parties of their obligations - in this case there is no guarantee in the form of the administration of the exchange;

- low liquidity - if you terminate a previously concluded deal, you face significant financial costs;

- considerable overhead;

- long term - some hedging methods may span multiple years as variation margin requirements do not apply.

In order not to make a mistake with the choice of a hedging instrument, it is necessary to conduct the most complete analysis of the likely prospects and features of a particular method. At the same time, it is necessary to take into account the economic features and prospects of the industry, as well as many other factors. Now let's take a closer look at the mostpopular hedging instruments.

Forward

This concept refers to a transaction that has a definite term, in which the parties agree on the delivery of a specific commodity (financial asset) at a certain agreed date in the future, while the price of the commodity is fixed at the time of the transaction. What does this mean in practice?

For example, a certain company intends to purchase Eurocurrency for dollars from a bank, but not on the day of signing the contract, but, say, in 2 months. At the same time, it is immediately fixed that the rate is $1.2 per euro. If in two months the dollar/euro exchange rate is 1.3, then the company will get tangible savings - 10 cents on the dollar, which, with a contract value of, for example, a million, will help save $100,000. If during this time the rate falls to 1, 1, the same amount will be at a loss to the enterprise, and it is no longer possible to cancel the transaction, since the forward contract is an obligation.

Moreover, there are a few more unpleasant moments:

- since such an agreement is not secured by the clearing house of the exchange, one of the parties can simply refuse to execute it if conditions unfavorable for it occur;

- such a contract is based on mutual trust, which significantly narrows the circle of potential partners;

- if a forward contract is concluded with the participation of a certain intermediary (dealer), then costs, overheads and commissions increase significantly.

Future

Such a deal means that the investor takes onan obligation to buy (sell) a certain amount of goods or financial assets - shares, other securities - at a fixed base price after some time. Simply put, this is a contract for future delivery, but the futures is an exchange product, which means that its parameters are standardized.

Hedging with futures contracts freezes the price of the future delivery of an asset (commodity), while if the spot price (the price of selling a commodity on the real market, for real money and subject to immediate delivery) decreases, then the lost profit is compensated by the profit from the sale of futures contracts. On the other hand, there is no way to use the growth of spot prices, the additional profit in this case will be leveled by losses from the sale of futures.

Another disadvantage of futures hedging is the need to introduce a variation margin, which maintains open urgent positions in working condition, so to speak, is a kind of guarantee. In the event of a rapid increase in the spot price, you may need additional financial injections.

In a sense, hedging futures is very similar to ordinary speculation, but there is a difference, and a very fundamental one.

Hedger, using futures transactions, insures with them those operations that he conducts on the market of this (real) product. For a speculator, a futures contract is just an opportunity to earn income. Here there is a game on the difference in prices, and not on buying and selling an asset, because there is no real productexists in nature. Therefore, all losses or gains of a speculator in the futures market are nothing but the end result of his operations.

Option insurance

One of the most popular tools for influencing the risk component of contracts is option hedging, let's talk about them in more detail:

Option of type put:

- The holder of an American put option has the full right (but not the obligation) to exercise the futures contract at any time at a fixed strike price;

- by purchasing such an option, the seller of a commodity asset fixes the minimum selling price, while retaining the right to take advantage of a favorable price change;

- when the futures price falls below the strike price of the option, the owner sells it (executes), thereby compensating for losses in the real market;

- when the price increases, he may refuse to exercise the option and sell the goods at the most favorable price.

The main difference from futures is the fact that when buying an option, a certain premium is provided, which burns out in case of refusal to exercise. Thus, the put option can be compared with the traditional insurance we are used to - in case of an unfavorable development of events (insurable event), the option holder receives a premium, and under normal conditions it disappears.

Call type option:

- the holder of such an option has the right (but is not obliged) to purchase futures at any timecontract at a fixed strike price, that is, if the futures price is higher than the fixed price, the option can be exercised;

- for the seller, the opposite is true - for the premium received when selling the option, he undertakes to sell the futures contract at the first request of the buyer at the strike price.

At the same time, there is a certain security deposit, similar to that used in futures transactions (futures sale). A feature of a call option is that it compensates for a decrease in the value of a commodity asset by an amount not exceeding the premium received by the seller.

Hedging types and strategies

Speaking of this type of risk insurance, it should be understood that, since there are at least two parties to any trading operation, the types of hedging can be divided into:

- hedge investor (buyer);

- hedge supplier (seller).

The first is necessary to reduce the investor's risks associated with a likely increase in the cost of the proposed purchase. In this case, the best hedging options for price fluctuations would be:

- selling a put option;

- buying a futures contract or a call option.

In the second case, the situation is diametrically opposite - the seller needs to protect himself from falling market prices for goods. Accordingly, the hedging methods will be reversed here:

- sell futures;

- buying a put option;

- selling a call option.

A strategy should be understood as a certain set of certain tools andthe correctness of their application to achieve the desired result. As a rule, all hedging strategies are based on the fact that both the futures and spot prices of a commodity change almost in parallel. This makes it possible to compensate on the futures market the losses incurred from the sale of real goods.

The difference between the price determined by the counterparty for the real commodity and the price of the futures contract is taken as the "basis". Its real value is determined by such parameters as the difference in the quality of goods, the real level of interest rates, the cost and storage conditions of goods. If storage is associated with additional costs, the basis will be positive (oil, gas, non-ferrous metals), and in cases where possession of the goods before it is transferred to the buyer brings additional income (for example, precious metals), it will become negative. It should be understood that its value is not constant and most often decreases as the term of the futures contract approaches. However, if an increased (rush) demand suddenly arises for a real product, the market may move to a state where real prices become much higher than futures prices.

Thus, in practice, even the best strategy does not always work - there are real risks associated with sudden changes in the "basis", which are almost impossible to level with the help of hedging.

Recommended:

Land tax: calculation example, rates, payment terms

How the land tax is calculated should be known not only by legal entities, but also by citizens who own the land. Despite the fact that they receive a notification by mail, they can check the correctness of the accruals. An example of the calculation of land tax. On what basis is it calculated? What are the benefits

Why is a simple pencil called "simple"? How is the hardness of a pencil marked in different countries?

From early childhood and throughout our lives, we constantly use pencils, both simple and colored. For some professionals, the hardness of a pencil is an important part of their profession. How to find out the hardness of a pencil by marking, and also for what purposes they can be used, is described in this article

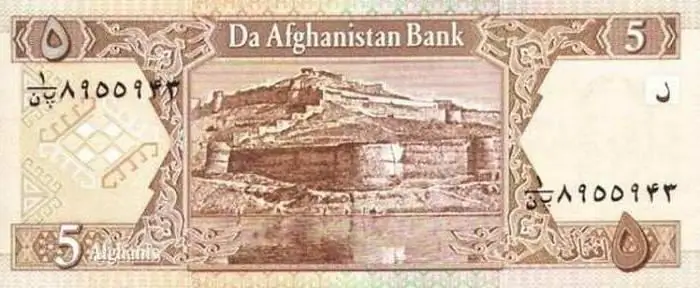

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article

The dual-currency basket in simple words is The rate of the dual-currency basket

The dual-currency basket is a benchmark that the Central Bank uses to set the direction of its policy to maintain the real ruble exchange rate within the necessary limits