2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

With the advent of the Federal Law "On Funded Pension" dated December 28, 2013 No. 424-FZ, Russians have the opportunity to increase their pension savings through a co-financing program. More than 12 million people have chosen to transfer to private pension companies - NPFs. But not all clients are satisfied with the conditions offered by non-state funds. Many regret their choice and are now worried about how to switch from NPF back to PFR.

What is a funded pension?

The new pension reform in 2013 allowed citizens to choose whether they are going to invest their pension savings in NPFs or leave them in the insurance part. In the first case, 6% of the employer's transfers will go to the account of a non-state financial institution that the client chooses.

In the second option, citizens' funds willbe spent according to the needs of the state regarding the policy of the Pension Fund of Russia. The savings will be distributed to payments to existing pensioners, social benefits and benefits.

To transfer funds from the funded part of the pension, a citizen must contact any NPF office and write an application. For registration, a passport and SNILS are required. The transfer of a pension from the NPF to the PFR is the reverse procedure.

Why do Russians transfer savings to non-state funds?

Before switching from NPF to PFR, clients of non-state funds asked themselves: "Why sign an agreement with a non-state pension organization?"

The transition to a non-state fund has a number of advantages:

- Investment of pension savings at the NPF rate.

- The transfer of funds by inheritance.

- Possibility of combining a mandatory pension insurance contract (OPI) with another pension co-financing program.

After the conclusion of the OPS agreement, the citizen becomes a client of the NPF. He can control the investment and transfer of funds in his account (online).

But not all companies guarantee high interest rates and are reliable. Market leaders, for example, NPF Sberbank, do not have the highest interest rates (the fund's return for 2017 was 8.34 per annum). And those companies whose profitability in 2017 exceeded 10% are bankrupt in 75% of cases.

Which is better: PFR or NPF?

When choosing the future, Russians inFirst of all, think about your pension. They are interested in what to choose: large commercial companies (NPF Sberbank, Gazfond, Almaznaya Osen and others) or a state fund?

This choice is provided to citizens by the state. Everyone, aged 18 to 60, has the right to decide where to send the funded part of the pension.

Do not be afraid: clients of non-state funds always have the opportunity to change companies or transfer funds from NPFs to PFRs. By law, customers can change their mind no more than once a year. However, it is not recommended to change companies more often than once every 5 years, since when changing one NPF to another, all accrued interest is burned out if less than 5 years have passed since the transition.

If a citizen changes his mind and wants to transfer money to the state fund, he should take care of how to return to the FIU from the NPF. The operation is carried out with the same frequency: no more than 1 time per year.

Reasons for terminating the OPS agreement

The most common reasons for leaving the non-state pension insurance program are:

- Low percentage of return (less than 8% per annum).

- Unreliability of the fund (debts on payments to existing pensioners, delay in the return of depositors' funds).

- Negative customer reviews.

- Choosing an alternative pension plan.

Methods of returning funds from a non-state pension fund

Those who decided to return funds tothe insurance part of the pension, they want to know how to switch from NPF to PFR. The return scheme consists of several stages and can be carried out in 2 ways.

- Return to the Pension Fund of Russia upon termination of the contract with the NPF.

- Transfer from FIU office.

In any of the ways, the citizen is guaranteed to return the funds to the insurance part. They differ only in the speed of the service and the order of actions.

How to return funds to the insurance part of the pension through the branch of the NPF?

One of the options, how to switch from NPF to PFR, is a return at a private insurer's branch. This is possible if the company has the technical ability, that is, managers can send a notification to the Pension Fund of the Russian Federation.

To return funds to a government organization, you must:

- Come to the NPF office with a passport, SNILS and an agreement on compulsory pension insurance.

- Fill out an application for the return of part of the pension to the FIU.

- Get a copy of the application or receipt of documents.

Due date - 1 year. The application is processed within a month. Upon successful processing, the client receives a notification that his funded part of the pension will be transferred to the Pension Fund.

By law, the final transfer of funds is made at the end of the 1st quarter of the year following the date of writing the application.

What should I do if the funds have not been transferred?

Sometimes when trying to return funds to the Pension Fund of the Russian Federation, citizensface problems. For example, they receive an SMS notification that the NPF or PFR refused to transfer.

This may be due to some reasons:

- Invalid data. When drawing up an application, it is recommended to clarify all the questions that arise with the manager of the pension organization in order to send documents for processing.

- Information discrepancy. This occurs when the client's documents have changed at the time of the refund. New information, if it has not been entered before, must be reported to the operator. Otherwise, the system will generate an error or it will be impossible to complete the application.

- Technical failure. If the money was not transferred during a refund due to an error in the program, the client will receive a notification on his mobile phone or a call from a company employee.

For any of these reasons, the client needs to re-apply to the company's office to re-fill the application. If the operation was not performed due to outdated client data (document change), then the service execution time will be increased by 30-60 days (depending on the speed of replacing information in the NPF database.

Not all organizations deal with the return of client funds. Before deciding to visit a branch, it is recommended to clarify whether it is possible to transfer cash through a branch of a non-state pension fund.

How to transfer a pension from the NPF to the PFR through the Pension Fund of Russia?

The fastest and most affordable way to return tostate fund, is a visit to the department of the body. The refund is carried out according to the same scheme as when visiting the NPF. The client applies with a passport, SNILS and OPS agreement, fills out an application. Next, the FIU officer draws up an application and issues a form to the citizen indicating the acceptance of documents for processing.

Service execution period - up to 1 year. Funds are transferred to the state fund no later than the end of the 1st quarter of the year following the sending of documents for processing.

When processing documents through the Pension Fund of Russia, the client, after 1-10 days, is called back by the PFR employees to confirm his decision. After that, the application is transferred to the authorized service, which returns the resources to the Pension Fund.

Alternative options for returning to the Pension Fund

Those who actively use the Internet want to know how to switch online from NPF to PFR ("Gosuslugi", website of the Pension Fund of the Russian Federation). The Gosuslugi website was developed on the initiative of the Government of the Russian Federation, taking into account the wishes of millions of Russians. It helps citizens to get documents, sign up for a queue at a kindergarten or a doctor, as well as arrange the necessary service without leaving home.

But not all types of services and operations are available through the functionality of the Unified State Portal. In particular, it is currently impossible to return the funded part of the pension back to the Pension Fund of the Russian Federation with the help of Gosuslug. But using the password and login from the portal system, clients can go to the website of the Pension Fund and sign up for a consultation online.

Online transfer processing

Currently, there is no online way to transfer a pension from an NPF to a PFR. The only option that non-state funds offer clients is to conclude an agreement online or terminate it due to retirement.

When a citizen reaches retirement age, the contract of compulsory pension insurance expires, and the accumulated pension is paid to him. There are 2 options for receiving funds: the payment of a lump sum or an increase to the main part. In the first case, you must contact the branch of the non-state pension fund and write an application for the purpose of payment. The second requires you to provide data to the Pension Fund of Russia.

The funded part of the pension does not affect the amount of the state benefit and is paid regardless of it. Clients can find out about the size of the funded part of the pension, taking into account all interest and allowances from the NPF, by calling the fund's hotline, in their personal account or upon request at the company's office.

How to check the status of the funded part of the pension: options

If a citizen knows how to transfer from an NPF to a FIU, or has already written an application for a transfer, he needs to make sure that his service is being performed successfully. This can be done in several ways:

- Through "Gosuslugi". In the "Pension, allowances and benefits" section, a citizen can receive an extract on the state of his personal account. The statement showsa company that is the current insurer of the client: PFR or NPF.

- Through the FIU website. Using the passwords of the website "Gosuslugi" the client can get information on the website of the Pension Fund of the Russian Federation. The extract is available as a pre-order. A citizen can get a certificate at any branch of the FIU.

- In the Pension Fund. A passport and SNILS are required for the visit. When visiting the PFR office, a specialist will print out a certificate within a few minutes.

If the client in the "insurer" column sees that he is still a contributor to the NPF, he can re-apply for a pension transfer to the Pension Fund. Information may be displayed with a delay if less than 6 months have passed since the provision of the service.

Only one who is a client of a non-state company can receive a certificate. The exception is cases where the representation of interests is confirmed by relevant documents, for example, a notarized power of attorney. Only the depositor himself can order a certificate online or transfer to the FIU.

Recommended:

What is better - own funds or borrowed funds?

Some founders of enterprises invest exclusively their own funds in the development of their business and use only them, while others, on the contrary, use only borrowed funds. What are these types of capital and what are the advantages of each of them?

Sberbank mutual funds. Reviews of mutual funds of Sberbank

If it's time to think about where to invest the accumulated or earned any amount of money, and the word "investment" says almost nothing, then you have reason to rejoice. Mutual funds of Sberbank of Russia are the best investment option

Gazprombank, mutual funds (mutual investment funds): deposit features, exchange rate and quotes

UIF is designed for investors who want to minimize their risks. The goal is to provide income above bank deposits and inflation. Managers invest shareholders' funds in bonds with a high trust rating, including federal loan bonds (OFZ)

Hedge funds in Russia and in the world: rating, structure, reviews. Hedge funds are

The structure of hedge funds, still unrestricted in the financial sector and inaccessible to the general public, remains the subject of ongoing disputes, discussions and litigation

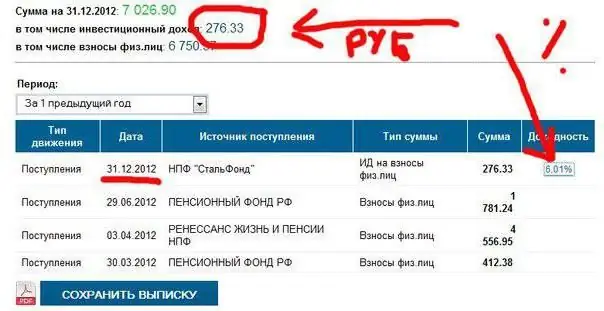

NPF "Stalfond": rating among other funds. Non-state pension funds

Choosing a non-state pension fund is not as easy as it seems. There are many similar organizations in Russia. One of them is "Stalfond". What are her pros and cons? How good is the company? What is the place in the rating of NPFs in Russia?