2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

A peculiar shadow of a wide variety of conjectures and theories has been trailing behind every organization called a hedge fund for several decades. Unfortunately, there is still nothing surprising in this, and the true essence and specifics of the work remain a kind of dark horse even for seasoned economists. In many ways, this is provided by the term "hedge" in the title - in the environment of financial management, this, in general terms, means providing coverage for financial risks.

Of course, the delusion of clients about such organizations, which many somehow perceived solely as insurance against various problematic situations in the field of finance, were generously flavored with numerous positive reports from the funds themselves about the success of their activities. However, in reality, this financial mechanism does not work as expected, and this is clearly something that every investor interested in profit should know.

The essence and purpose of the organization

Hedge funds are a private investment partnership, the purpose of which is to maximize the return on the funds invested by investors for a given risk, or to reduce the risk for a given return (this explainsthe term "hedge" in the title - from the English. protection, insurance). The very essence of such funds lies in one simple idea of obtaining a constant profit based on the investments of depositors, regardless of the current situation in the market: whether it is either an unprecedented decline or a tangible growth. For such tasks, complex financial strategies are used, often also including leverage, buying shares long or short, and many others.

The whole range of various financial operations that the fund can undertake is extremely wide. And solely risk management in the market is rather the prerogative of only certain hedging organizations, for the most part this aspect is only one of the possible tools for working with finance, but by no means the only function.

Mostly, investors' funds are invested by managers in publicly traded securities, however, in essence, they are able to invest in literally everything that, in their opinion and strategy, can bring profit in the future: land, real estate, commodity market, currency etc. The only restriction in this regard is prescribed directly in the investment declaration of the fund.

At the same time, in practice, such wide investment opportunities are not available to everyone who wants to increase their fortune: access to the hedge fund is open to either "accredited" or professional investors whose equity must exceed at least $1 million (excluding the cost of its main residence). This limitation exists in view of the fact thatprofessional investors are already sufficiently prepared for the difficulties and risks that a broad investment declaration of hedge funds implies. The limit on the number of investor participants is determined by the US Securities and Exchange Commission and is a maximum of 99 people, of which at least 65 must be, as mentioned at the beginning, "accredited" (an investor whose net income, according to US law, must be at least $200,000). Given the wide range of possible actions of the fund, the risks can be extremely high, which at the legislative level obliges investors to invest in such a way that their complete loss does not entail any damage to the family budget.

The birth of the revolution and its indelible mark on the global economy

Unique for its time and generation, a profit-making strategy was invented by American economist Alfred Winslow Johnson, who founded the first ever hedge fund in 1949. Authorship in the name of the hedged fund, likewise, belongs to him. He published the results of his work only six years later, in 1965, which made a lot of noise and interest in the market. In it, he described in detail the entire strategic mechanism for making money in a falling and rising market through the use of combinations of selling overpriced and buying underpriced stocks.

The former are securities with a high current value, but there are some signs - the harbingers that their price will collapse in the future. Underrated - withexactly the opposite, when the value of shares is low, but they have some prerequisites and potential for growth.

Using the strategy described above in general terms, Jones achieved impressive results - the value of his investments over the ten years of the fund's existence reached 670%.

Successful strategy has become enormously widespread, and by 1968 in the United States, the Securities and Exchange Commission had registered about 140 investment partnership associations that fell under the definition of "hedge fund".

However, the financial idea, revolutionary for its time, turned into a real financial disaster closer to 2008-2009, referred to in wide circles as the "great recession". Generated largely by numerous and increasingly complex financial speculations, the global crisis of those years received a lot of influence from the hedge funds themselves, and hedge funds are, at their core, speculative organizations. However, for the sake of objectivity, it is worth noting that the first bursting bubble of this financial storm was precisely the housing one. Outstanding mortgage loans, which were issued on an astronomical scale at that time literally for everyone (in a considerable amount and for those whose solvency could not close the issued debt obligations at all), dragged the entire financial and credit sector to the bottom, after which the crisis in full least spread to the real economy of the United States and countries of other continents.

Shorting bank stocks, investment hedge funds arethereby only exacerbating the growing financial panic, significantly catalyzing the economic collapse of a global scale. And although part of the guilt of these organizations for everything that happened at that time is undeniable, but still not only they influenced those events. The greed of the consumers themselves, which is in no way inferior to the thirst for profit on the part of economists, attracted to the mass appearance of huge credit debts, which, in general, were absolutely disproportionate to their ability to pay.

Today, the world has recovered from the severe consequences of the crisis, and the control over the activities of hedge funds has been significantly updated after a barely repairable blow to their image as financial institutions. In total, the global market includes about 12,000 hedge funds, whose managing assets amount to trillions of US dollars. However, due to the complex and in most cases extremely confusing legal structure of these organizations, it is extremely difficult to calculate more accurate amounts of assets of specific funds.

Structural components of a single mechanism

Hedge funds are, in most cases, partnerships unique in their organization with many features and nuances. Some are incredibly complex and confusing, while others manage with the most simple and transparent structure - it all depends solely on the goals, strategies and methods of the fund. However, almost any hedge fund structure consists of the following key elements:

- Investors are exactly those people, without whose assets the existence and activity of the fund itself is impossible. The organization offersinvestors their services, those, if they agree, invest some part of their capital. After that, as a result of its correct use, profit is made on the market on this basis, both for the client and for the fund.

- A guarantor bank, or a custodian, is a bank whose main task is to ensure the safe storage of investors' assets, whether it be currency, securities, precious metals, etc. In some cases, the fund can attract "its own" a bank for conducting and / or processing transactions (however, this is mainly a task already for the primary broker). In addition, the custodian also prepares reports on transactions made through the fund's account; checking the compliance of the real policy of the manager with the list of goals stated in the charter of the fund. Of course, this role is usually played by a large bank with a solid positive reputation.

- Manager - a person or, as a rule, a company that determines the entire investment strategy, while being responsible for each of the fund's decisions. In addition, the hedge fund manager also oversees all operations.

- Board of Directors - oversees the activities of the manager, as well as the firms providing services to the fund. The Board is authorized to resolve disputes and conflicts between shareholders and managers, to appoint personnel to key positions of the fund. It is the members of the council who are personally responsible (up to criminal liability) for the fund's compliance with all the principles and rules prescribed in the memorandum.

- Administrator - definesthe net asset value of the fund, regardless of the manager, which gives a significant reduction in risks in the event of a valuation error of the latter. However, most administrators take on the functions of accounting, paying bills, notifying shareholders with activity reports, distributing profits to shareholders, and subscribing to and redeeming shares/shares of the fund.

- Primary Broker - This role is usually played by a large investment bank that does not execute one-off trades on behalf of a hedge fund like a regular broker. The Primary Broker provides the Fund with a range of professional services related to clearing (cashless settlement between enterprises/companies/countries through goods/securities/services), custody services and operational support.

- Auditor - a person who checks the compliance of stock statements with accounting standards and financial legislation. The manager usually conducts an audit annually, but even such rare audits do not detract from this position in the structure of the organization - without an auditor, other service companies or third-party agents are unlikely to agree to service the fund.

- Legal consultant - is required to ensure the fund's licensed status, which is issued by authorized regulators subject to a number of specific requirements. The license opens up a much wider scope for opportunities and recruiting an investor base, but, in addition, a consultant is often used to conclude various contracts and agreements.

This is how the structure lookshedge fund. Again, in various cases, this scheme in practice can be even more simplified (even with the absence of any of the above frames) or much more tortuous and complex.

"Typical fund": varieties and classifications based on investment strategy

Besides this, regardless of the structural component, the International Monetary Fund distinguishes three types of hedge funds:

- Global funds - their activity extends throughout the world market. However, this type of fund usually develops its strategy on the basis of analysis and forecasts of the dynamics of shares of individual companies.

- Macro-funds - work exclusively within a specific national market. Usually based on the macroeconomic and financial characteristics of a particular country.

- Relative value funds are the original classic type of hedge funds, as they were at the very beginning of their existence. They carry out financial transactions within the stock market of any one country, using the good old strategy of selling overvalued and buying unvalued shares. At the same time, the manager constantly monitors the current situation on the market in order to choose the most appropriate moment for the transaction and get the maximum profit.

Of course, the variety of hedge funds on the world market does not end with the official classification, because little prevents managers from creating many additional subspecies and branches, if necessary.

More on Hedge Fund Operations

Partnership policyThe vast majority of hedge funds are aimed at long-term membership of investors, so that their deposits remain at the disposal of the fund for long periods. This mainly concerns the exit rules: the contributor needs to warn the organization about such a decision in advance, while the interval between notification and termination of membership can reach up to 2-3 months (depending on the established regulations). Another alternative often encountered in practice is the immediate withdrawal of the entire deposit in cash, however, the prices for the purchase / sale of assets are determined directly by the fund itself. And, of course, in most of these cases, the difference between them is quite significant.

Thus, when joining, leaving, or with a partial decrease in its contribution, the entire volume of investments of each partner is reviewed and, accordingly, the share ratio also changes. Termination of the membership of a certain number of investors can significantly increase the total amount of profit among the remaining ones: management can pay off departing investors with far from the most successful investments, leaving more promising assets in their portfolio. Thus, after some time, the hedge fund can experience a sharp increase in return on capital due to the contribution that previously participated in the creation of income and was subsequently withdrawn to the exiting investors, but who had not yet had time to receive the percentage of benefits due. However, if there is a strong exit trend in the hedge fund environmentinvestors, then no one is immune from the completely opposite effect in the form of a mass panic exit of partners. Often this is fraught not only with a drop in return on capital, but also with the complete bankruptcy of the entire organization.

More controversial than the broad scope of investing in finance is the expanded commission system. Hedge funds receive not only a single operating cost ratio, but 2% for the management of the assets themselves and 20% of any profits made. At the same time, even if the manager suffers losses and does not bring any income at all, according to the memorandum of association, he is in any case en titled to these 2% of the total volume of controlled assets (such a system was appropriately called "2 and 20"). A similar commission system is practiced by the vast majority of hedge funds on the planet. However, many analysts today emphasize the trend of gradual transition of funds to the "1 and 10" system. In the case when the manager does not charge charges at all simply from the disposal of assets, this is covered by a higher percentage of commissions from the profits received.

In pursuit of big profits: modern investment strategies

Extremely diverse investment opportunities and areas, as well as the influence of many different factors, constantly contribute to the generation and implementation of new earning technologies for hedge funds. However, despite this, the modern basic strategies for working in the financial field can be quite classified into several general types:

- Long/short position - hedge funds usually work with 40% of their assets using this strategy. It consists in the acquisition of undervalued assets (long) and the sale of overvalued assets (short).

- Market-neutral arbitrage (Market-Neutral Arbitrage) - works only when the same assets diverge in value on different exchanges. The manager enters a long position on overvalued assets on one exchange and a short position on another - where the same assets are overvalued.

- Reaction to events (Event Driven) - the strategy is based on the unfair value of the shares of any enterprises that have undergone certain changes (be it a merger, acquisition, reorganization, etc.). The manager catches a favorable moment for the operation (buy/sell) before the market evens out these unfair prices.

- Short Bias - with this strategy, the fund basically holds short positions, earning on falling markets.

- Real value (Value) - investing in securities that are sold at a discount to the main assets or undervalued by the market.

- Crisis securities (Distressed Securities) - purchase at a large discount of shares and liabilities of companies that are on the verge of bankruptcy or restructuring. Investing according to this strategy assumes that as a result of internal changes, the selected companies will become more powerful, bringing along profits.

Funds often resort to mixed strategies, using several of them to make a profit at once.above operating methods.

Regulatory regulation: what are the rules of the game and leverage for hedge funds?

For quite a long time, hedge funds stood apart in the world market due to their closeness and weak regulation of financial transactions. However, of course, there could never be any talk of complete anarchy and freedom of action - the normative regulation of funds was, is and will always be. Today, given their rapidly growing influence on the global market and the increasing frequency of various violations and insider trading, special commissions and authorities monitor and control them more carefully than ever before.

In particular, the JOBS Act (Jumpstart Our Business Startups Act), introduced in March 2012, after some time had quite significant changes in the work of hedge funds. Designed as a measure to encourage funding by various small business institutions, the act weakened the control of the securities market. Thanks to the new law, hedge funds, given their wide investment opportunities, have become almost the main providers of capital for start-ups and small businesses. This act subsequently had a major impact in September 2013 in lifting the ban on advertising for hedge funds and firms offering individual placements.

In many countries, hedge funds are required to report to government financial authorities at the first request for large positions in foreign exchange contracts, and to report their positions recently.issued or to be issued securities. Such measures are introduced specifically to limit money laundering and strengthen capital controls to ensure that large players do not infringe on the interests of small players in the market.

Besides this, the policy of state control of hedge funds is also aimed at reducing the systematic risks of destabilizing the financial system as a whole. This is reflected in the regulation of margin requirements, collateral and limits set by financial intermediaries for individual clients.

To mitigate risk with hedge fund lending, major prime brokers and banks re-evaluate their positions against the market prices of the funds they lend to on a daily basis. These loans must be secured by appropriate collateral in the form of valuable assets. In addition, banks have the right to set limits on lending for each fund separately, based on their own monitoring of the investment strategy, monthly income, cases of investor withdrawal and the history of business relationships.

The most successful hedge funds in the world these days

Meanwhile, not the best times for hedge funds continue to drag on since last year. Overall earnings have been below the average for the past few years: the biggest hedge funds made $517.6 million last year, what? according to some experts? better than 2014, but a whopping 40% worse than 2013 earnings.

However, the price of allassets involved in one way or another in the activities of hedge funds increased by about $51.7 billion, reaching a total estimated value of $2.97 trillion.

The negative downward trend in profits is clearly reflected not only in the tangible financial losses suffered by even the best hedge funds in the world, but also in the obvious changes in the ratings of the strongest market participants. Such well-known figures as John Paulson of Paulson and Co., Leon Cooperman of Omega Advisors, and Daniel Loeb of Third Point lost their positions. In their former places, such players as Ken Griffin from Citadel and James Simons from Renaissance Technologies firmly established themselves. Both managed to earn a record $1.7 billion in 2015, thus quite deservedly ascending the podium of the strongest hedge fund managers.

The rating of hedge funds can change beyond recognition, ruthlessly throwing seemingly time-tested and market leaders to the bottom. Whether the current top players will remain at their positions without suffering significant losses by the end of the year, only time will tell. In the meantime, these ten managers hold the leadership among all hedge funds on the planet:

| Manager | Fund | Profit |

| Kenneth Griffin | Citadel | $1.7 billion |

| James Harris Simons | Renaissance | $1.7 billion |

| Rey Dalio | Bridgewater | $1.4 billion |

| David Tepper | Appaloosa | $1.4 billion |

| IsraelEnglishman | Millenium Mgmt | $1.15 billion |

| David Shaw | D. E. Shaw | $750 million |

| John Overdeck | Two Sigma | $500 million |

| David Siegel | Two Sigma | $500 million |

| Andreas Halvorsen | Viking Global | $370 million |

| Joseph Edelman | Perceptive Advisors | $300 million |

Russian hedge funds: ratings, prospects and emerging trends

Not the most profitable times for hedge funds also affected the Russian counterparts of US traders. Demonstrating negative returns, the situation with domestic funds in general looks less colorful than in the Western market, where such institutions are considered one of the most reliable financial instruments, consistently bringing up to 20% return on investment with minimal risks in most cases.

In Russia, investment funds are mainly represented by mutual funds (Unit Investment Fund) and OFBU (General Banking Management Funds). Especially hedge funds in Moscow quite often have the status of trust management. The total number of domestic hedge funds now stands at about six dozen. A similar figure was recorded in the mid-eighties in the United States, where the market at that time already really appreciated hedge funds. In Russia, the legislative framework significantly limits the tools for the activities of funds, preventing the use of a vast number of strategies for working in the market. For the sameFor this reason, a huge part of Russian investment partnerships are registered in offshore zones.

Therefore, the adoption of a number of changes in the legislation on this issue can significantly stimulate Russian hedge funds and their economic growth, allowing them to adopt a much wider range of strategies.

And although hedge funds are not as common in Russia as in the West, we still have impressive examples of leaders who can compete with competitors at the international level. The most productive of them was VR Global Offshore Fund, whose profit for the year amounted to 32.32%. But VR Global Offshore Fund managed to achieve such a record yield for the domestic market by blocking funds: the fund has the largest percentage of pen alties for investors for early exit - 4.5%. Diamond Age Atlas Fund earned less - 22.92% of the total profit, leaving Copperstone Alpha Fund in third place in the rating. The bronze medalist managed to grow by 22.06% over the year.

Finally, in fourth place is Burnem Asset Management, whose revenue for last year was 17.63%.

All four of the above funds hold approximately 80% ($3.425 billion) of all assets compared to other competitors on the Russian market. At the same time, more than half of these funds - 1.634 billion - belong to the VR Global Offshore Fund.

Personal experience with hedge funds in the reviews of market players themselves

Today, hedge funds are one of the most profitable and at the same timethe most stable investment partnerships among many other investment alternatives in today's market. Large professional entrepreneurs and businessmen in search of profit, as a rule, always mark the hedge fund as the highest priority financial institution to which they entrust their hard-earned money. The reviews are negative, the reviews are positive - hardly anyone now trusts the opinion of strangers - "depositors" on the Web, when fake accounts have become almost one of the main tools of commerce.

Another thing is that there have always been risks, there are now and will be in the future, especially in the economy. Thus, not every hedge fund can actually be an investment partnership, but rather creates a fake around its name for the sole illegal purpose of fraud.

One of the most high-profile cases was Bernard Madoff's scam, which cost investors Madoff Investment Securities about $50 billion. His investment fund, which cost several million US dollars to enter, was known to many people from high society. Madoff himself was also known for his generous philanthropic donations to cancer and diabetes research, US Democratic Party campaigning, and cultural and educational institutions.

However, this did not save the fund from the inevitable restructuring after the 1995 crisis from investment partnership tofinancial pyramid. However, the bubble he created burst in late 2008, after which Madoff was sentenced to 150 years in prison.

Truly experienced players (people who have already earned more than the first million by investing funds) first of all recommend taking a closer look at the minimum amount for entry. If it is equal to or even less than $50,000, then be sure for sure - you are faced with a hype disguised as a hedge fund. For example, foreign hedge funds tested by time and dozens of clients accept investments from at least $100,000.

Recommended:

Sberbank mutual funds. Reviews of mutual funds of Sberbank

If it's time to think about where to invest the accumulated or earned any amount of money, and the word "investment" says almost nothing, then you have reason to rejoice. Mutual funds of Sberbank of Russia are the best investment option

Organizational structure of Russian Railways. Scheme of the management structure of Russian Railways. Structure of Russian Railways and its divisions

The structure of Russian Railways, in addition to the management apparatus, includes various dependent divisions, representative offices in other countries, as well as branches and subsidiaries. The head office of the company is located at: Moscow, st. New Basmannaya d 2

Investment funds of Russia: types and rating

Investment funds provide a good opportunity to have additional income. Before making a decision on investing your funds, you should familiarize yourself with the types of funds and their rating

"KIT Finance" (non-state pension fund): reviews and place in the rating of pension funds

"KIT Finance" is a non-state pension fund that is of interest to many citizens. Can he be trusted? What do members and staff think of the organization? How reliable is this fund?

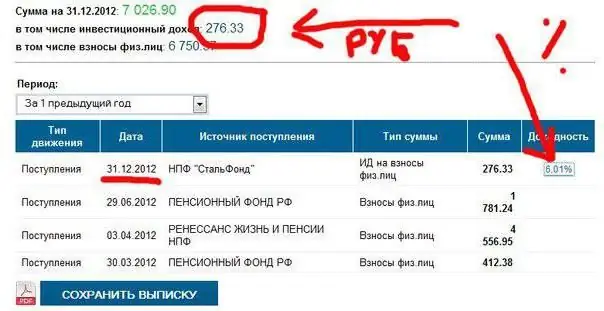

NPF "Stalfond": rating among other funds. Non-state pension funds

Choosing a non-state pension fund is not as easy as it seems. There are many similar organizations in Russia. One of them is "Stalfond". What are her pros and cons? How good is the company? What is the place in the rating of NPFs in Russia?