2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:31

Forms of tax control are ways of a certain expression in the organization of certain control actions. These may include: taking explanations from payers, verifying credentials, as well as inspecting territories and premises that can be used to generate income.

The main forms of tax control can be divided into several groups on certain grounds.

So, firstly, based on the time of its holding, the following types are distinguished:

- preliminary, carried out before the reporting period for each type of collection, before a decision is made on the issue of granting tax benefits to the payer or changing the timing of the corresponding payments to the budget;

- current, carried out during the reporting period;

- following, carried out at the end of the reporting period using the results of the analysis and audit of financial and accounting documentation.

Secondly, tax control forms are classified based on the subjects represented by the following services:

- tax and customs authorities;

- off-budget public funds.

Thirdly, tax control can be allocated depending on its location:

- outbound (at the location of the payer);

- capital (according to the location of the relevant service).

There are other forms of tax control, based on its definition. In other words, this term implies the implementation of a type of activity of state bodies, implemented in certain forms to obtain the necessary information on compliance with the norms adopted by the relevant legislation with a mandatory check of the timeliness and completeness of the fulfillment by payers of obligations to pay certain fees to the budget.

So, in the specialized literature, there are four main forms of tax control:

-

forms of tax control are tax operational value;

- offsite and cameral;

- administrative;

- monitoring;

- state-level tax accounting.

Without exception, all forms of tax control are under the jurisdiction of the relevant authorities. Based on this, they are given various tasks.

Thus, the tax control of state importance is aimed at solving problems based on the accounting of business entities, as well as otherelements of this area of public administration.

The main task of operational tax control and monitoring is considered to be obtaining objective and reliable information regarding the current activities of payers. This should include tracking tax receipts.

Exit and cameral control is based on the implementation of verification of the fulfillment of obligations in the field of taxation. The main instrument of this type of activity is a tax audit.

The tasks of administrative control in this area is to track and verify the participants in such relationships, which are endowed with additional powers in the field of administration. An example is monitoring the performance of official duties by tax officials.

Recommended:

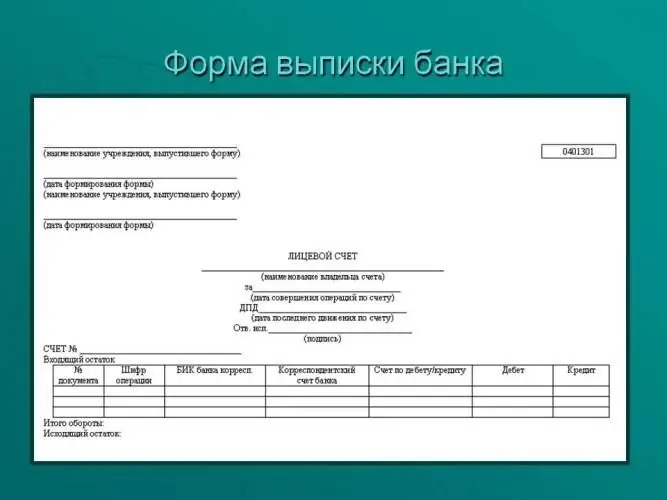

A bank statement is The concept, necessary forms and forms, design examples

When purchasing any banking product, any client, sometimes without knowing it, becomes the owner of an account with which you can carry out income and debit transactions. At the same time, there must certainly be a certain tool that allows any client to exercise control over the movement of their own funds. This is a bank statement. This is a document that is usually issued upon request to the client. However, not everyone is aware of this possibility

Mutual settlements between organizations: drawing up an agreement, necessary documents, forms of forms and rules for filling out with examples

Settlement transactions (offsets and settlements) between business entities are quite common in business practice. The result of these operations is the termination of the mutual rights and obligations of participants in civil relations

Tax and tax payments - what is it? Classification, types, concept and types

Currently, the tax system is a set of taxes and fees established by the current legislation of the Russian Federation, which are levied in the budgets of different levels. This system is based on the principles provided by law. Let us consider in more detail the issues of essence, classification, functions and calculation of tax payments

Tax control: bodies, goals, forms and methods

Tax control is a special type of activity of specialized bodies. Employees of this service are authorized to conduct tax audits, as well as to supervise the financial activities of entities of all forms of ownership. How are tax controls and tax audits carried out? What are their goals and what types of these actions are there? Let's consider these points in more detail in the article

Tax rate for transport tax. How to find the tax rate for the transport tax?

Today we are interested in the tax rate for transport tax. And not only it, but in general taxes that are paid for the fact that you have this or that means of transportation. What are the features here? How to make calculations? What is the due date for paying transport tax?