2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

In doing business, every enterprise must have capital to invest in asset formation. It includes the total cost of all funds in tangible and intangible form. The multidimensionality of the concept of "capital" is characterized by dozens of definitions, but in this case, the types of capital will be considered according to the ownership of the enterprise, which allocate own funds and borrowed funds.

Borrowed capital means borrowed funds (bank credit, commodity credit, financial leasing, issue or other values), on a repayable basis, with the help of which the enterprise is financed. All of its forms are financial obligations that the company must repay on time. In terms of validity, they can be short-term - up to a year, and long-term - more than a year.

Own funds are characterized by the fact that they belong to the enterprise on the basis of ownership and are used for its development. They have a higher ability to generate profit in any areaactivities, because when using them, you do not need to pay loan interest. The assets formed at their expense are the net assets of the company, which ensures its financial stability. The main sources of own funds are external and internal. K

external include: authorized capital (the amount of funds provided by the owners for the implementation of activities); gratuitous financial assistance to the enterprise; attracting share or equity additional capital, etc.

Internal sources include: profit remaining at the enterprise; depreciation charges, etc.

The high performance of an enterprise depends on the structure of capital used. This structure is the ratio of own and borrowed funds involved in the process, and affects the return on assets, stability, and solvency of the enterprise, and also determines the ratio of the degree of risk and profitability during the development of the company. Therefore, if the company uses only own funds, then it has great financial stability. However, it also limits its growth rates, not being able to form an additional volume of assets, and not using the increase in profits on invested funds.

A company that uses only borrowed funds has great potential for its development and the possibility of increasing profitability, but this generates financial risk to a large extent andbankruptcy, which increase with an increase in the proportion of borrowed funds to the total mass of capital. In practice, you can see that there is no single recipe for how to use equity and borrowed funds. Nevertheless, there are a number of factors, taking into account which, it is possible to purposefully form a structure, providing the necessary conditions for the efficient operation of the enterprise.

Recommended:

Borrowed funds - concept and meaning

The article reveals the concept of borrowed funds, their significance in the activities of the enterprise, as well as ways and forms of raising borrowed capital

Sberbank mutual funds. Reviews of mutual funds of Sberbank

If it's time to think about where to invest the accumulated or earned any amount of money, and the word "investment" says almost nothing, then you have reason to rejoice. Mutual funds of Sberbank of Russia are the best investment option

Gazprombank, mutual funds (mutual investment funds): deposit features, exchange rate and quotes

UIF is designed for investors who want to minimize their risks. The goal is to provide income above bank deposits and inflation. Managers invest shareholders' funds in bonds with a high trust rating, including federal loan bonds (OFZ)

Hedge funds in Russia and in the world: rating, structure, reviews. Hedge funds are

The structure of hedge funds, still unrestricted in the financial sector and inaccessible to the general public, remains the subject of ongoing disputes, discussions and litigation

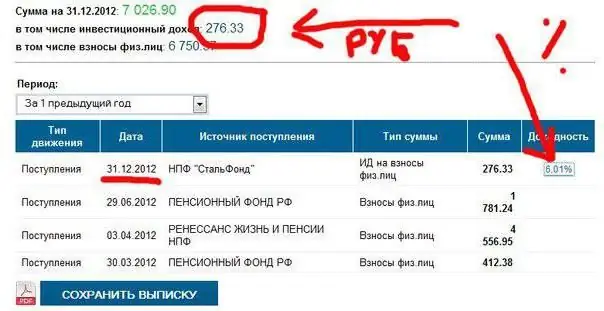

NPF "Stalfond": rating among other funds. Non-state pension funds

Choosing a non-state pension fund is not as easy as it seems. There are many similar organizations in Russia. One of them is "Stalfond". What are her pros and cons? How good is the company? What is the place in the rating of NPFs in Russia?