2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:45

Today it is necessary to determine what rating NPF "Stalfond" has among other funds. You will also have to understand how this organization is stable and reliable. After all, it is not so easy to choose a non-state pension fund for the formation of the funded part of the pension. Therefore, you will have to pay attention to the numerous factors that influence the opinions of customers. Reviews often help to judge the integrity of an organization. And in the case of "Stalfond" the situation is exactly the same. What do customers and employees say about the pension fund? How well does he provide his services? And what places in the rating of non-state pension funds does it occupy in Russia at the moment? It is not so difficult to understand all this. Only after a complete picture of the NPF is formed, it is worth making a decision to open a deposit and start saving money for old age.

About activities

What does NPF "Stalfond" do? Rating among other funds, trust indicators and profitability - all this is very important. But first, clientsmust understand why they are contacting the company.

Stalfond is a pension fund that insures citizens. That is, it allows the formation of pensions for the population. In addition, as the managers assure, when opening a deposit, you can slightly increase the funds available on the account. This is the yield.

For the nature of its activities NPF "Stalfond" reviews are mostly positive. No cheating, no specific features. Just a place where it is proposed to form savings for old age, as well as increase them in a passive form.

By country

The next nuance that is taken into account is the distribution of the fund throughout the country. Larger organizations are more trustworthy. This is exactly what the Stalfond pension fund is like.

He has been working since 1996. There are branches of the company in almost every city in Russia, even in the smallest settlements. On the official page of "Stalfond" you can see the exact addresses of the organization in a particular region. There is no problem with this.

Many people are pleased that "Stalfond" is a large company. This, as potential and real customers assure, inspires confidence. In any case, a large pension fund is unlikely to close quickly. This means that no money will be wasted. This opinion is shared by many residents of the Russian Federation. Thus, the scale of the organization indicates that it will not be necessary to work with scammers

Popularity Rating

What is the rating of NPF "Stalfond" among other funds? It is very difficult to answer this question. After all, statistics show different places. Much depends on the public being surveyed, as well as on the main evaluation criteria.

As a rule, Stalfond is among the top 15 non-state pension funds in Russia. Most often you can see this organization in 10-12 places. It is this indicator that the population is advised to focus on.

It turns out that this fund is not the best in Russia. It has its shortcomings, which push the organization far from a leading position. Nevertheless, NPF "Stalfond" rating among other funds is not the worst. You can trust this company, but you should not consider it ideal. Some disadvantages still need to be prepared.

Yield

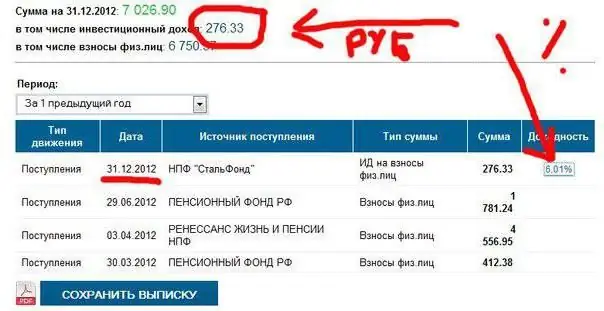

The next evaluation criterion, which is often decisive, is the return on investment. What is the profitability of NPF "Stalfond"? This question interests most potential customers. After all, not everyone sets a single goal - the preservation of pension savings. Some people want to get a good return when opening a deposit.

In this area, "Stalfond" earns very mixed reviews. There are even negative opinions. Why? All due to the fact that initially JSC NPF "Stalfond" promises an annual yield of 18%. But in practice it turns out that in a yearthe increase is about 8-8.5%. The difference between the real picture and promises is serious. This turns some people off.

However, this phenomenon is easily explained. It's all about inflation. In the conditions of the current crisis, it is not possible to provide the desired profitability. All NPFs have a similar situation with profitability. Only one thing is clear - the pension fund "Stalfond" really increases savings. Not too strong, but the return is still there.

Trust

It is worth noting that the level of trust also plays a role. It indicates how strongly the population believes in the stability of the work of the organization. At the moment JSC NPF "Stalfond" is not in the highest place in terms of trust.

However, trust is still high. According to statistics, it is rated A +, or AA. This is a characteristic that reflects the "High Trust" status. However, the best trust score is AAA or A++. Before him, "Stalfond" did not get. And for all the time of its existence, such a mark has not been reached.

This is not a reason to refuse investments. After all, the trust of the population is still quite high. So, you should not be afraid of cooperation with the organization. If anything, it gives its customers a sense of security for their money. This is how some contributors express themselves.

tno only one thing - the pension fund "Stalfond" really increases savings. Not too strong, but the return is everythingstill available.

Maintenance

Another component is the quality of customer service. This factor plays an important role in the direct assessment of the company's performance. NPF "Stalfond" has a "Personal Account". It allows you to work online with the services of the organization without any problems. If necessary, you can order a certificate of the state of the personal account. Or even get advice from employees. Only, as many clients say, "Personal Account" works with some interruptions. Certificates are made for a long time, it is not always possible to log in. Small, but still flaws.

But in the offices of "Stalfond" things are different. The speed of service leaves much to be desired, but according to the opinions of visitors, the employees answer all questions. They are doing their best to attract new investors. To some, such initiatives seem suspicious. But at the same time, no direct negative is expressed.

Contracts are made without any problems. Only, as some assure, "Stalfond" does not explain the rights of depositors in the best way. Because of this, there are opinions according to which the pension fund under study is a scammer. At the same time, one should not forget that the organization has won the trust of visitors and has been operating in Russia for a long time. This means that such accusations are unfounded.

From now on, it is clear how the NPF "Stalfond" "Personal Account" works, as well as offices. In general, there are no serious complaints. Butpopulation draws attention to some shortcomings.

About payouts

How does a non-state pension fund pay pensions? In this area, NPF "Stalfond" earns customer reviews, as in most cases, ambiguous. Why?

On the one hand, cash is paid out. If desired, a citizen at any time has the right to terminate the contract and transfer savings to another organization. On the other hand, payments are sometimes received with delays. Similar situations occur in almost all NPFs, but the leaders in Russia usually do not take them so seriously.

Despite the delays, Stalfond still transfers funds in the prescribed amounts to its customers. This means that it fulfills its obligations. Accordingly, it is not worth completely refusing to cooperate.

Miraculous Fusion

The last thing potential investors should consider is that in 2016 Stalfond ceased to exist as a separate organization. It merged with another non-state pension fund. And now its name is "Future". This is the same as NPF "Stalfond". Head office address: Moscow, Tsvetnoy Boulevard, 2.

"Future", as practice shows, in Russia is in great demand. The level of trust in this fund is A ++, this organization occupies the same positions as its component ("Stalfond").

Should I invest? Everyone decides for himself. The main thing is that the NPF really pays money, allows you to provide good profitability and provides quality customer service. The organization has its drawbacks, but everyone has them. From now on, it is clear what rating NPF "Stalfond" has among other funds according to the main evaluation criteria. This is far from the best place for the formation of the funded part of the pension. But not the worst either. If you wish, you can save and even increase a little in the "Stalfond" funds.

Recommended:

Whom to entrust pension savings? Rating of pension funds

Pension insurance reform involves independent management of the funded part of the pension by each citizen. In order to reasonably distribute your savings, you need to have some information, for example, to know the rating of Russian pension funds

NPF "European Pension Fund" (JSC): services, benefits. European Pension Fund (NPF): customer and employee reviews

“European” NPF: is it worth transferring savings to a fund with European standards? What do clients think of this fund?

Contributory pension: the procedure for its formation and payment. Formation of insurance pension and funded pension. Who is en titled to funded pension payments?

What is the funded part of the pension, how you can increase future savings and what are the prospects for the development of the investment policy of the Pension Fund of the Russian Federation, you will learn from this article. It also reveals answers to topical questions: "Who is en titled to funded pension payments?", "How is the funded part of pension contributions formed?" and others

Hedge funds in Russia and in the world: rating, structure, reviews. Hedge funds are

The structure of hedge funds, still unrestricted in the financial sector and inaccessible to the general public, remains the subject of ongoing disputes, discussions and litigation

"Sberbank", Pension Fund: reviews of clients, employees and lawyers about the Pension Fund of "Sberbank" of Russia, rating

What reviews does Sberbank (pension fund) get? This question is of interest to many. Especially those who plan to save money for old age on their own. The fact is that Russia now has a funded pension system. Part of the earnings is required to be transferred to the fund for the formation of future payments