2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:25

Credit card processing is popular with banks as customers appreciate the convenience of the product. But not everyone has access to a means of payment with a grace period, because the bank imposes certain requirements on the borrower. Not all customers know how many years they give a credit card and what certificates are needed to obtain it. Conditions and rates for credit cards in banks differ, but there are common points.

Who can own a credit card?

To issue a means of payment, the bank must be confident in the client. Therefore, the lender makes certain requirements for borrowers:

- Citizenship. Credit cards are generally not issued to expats and foreigners.

- Having a permanent income. Not all companies require confirmation, for example, in Tinkoff, it is not necessary to present certificates to issue a credit card. But in the questionnaire, the client is required to indicate what is his permanent income. Thisthe bank can verify the information.

- Registration on the territory of the Russian Federation. It is enough to have a permanent residence permit in any of the regions where the lender's branch is located. If the borrower has a temporary registration, it is allowed to issue a credit card at its address.

- Good credit history. There are cases when credit cards were received by customers with delays. But in 9 out of 10 applications for unreliable borrowers, the bank refused to issue a credit card.

Documents for a credit card

The list of requirements may vary depending on the bank.

What documents do I need to apply for a credit card?

- Russian passport. The main document, without it, no bank will consider an application for a credit card. An analogue can be a military ID for contract employees.

- Help 2-personal income tax. To convince the bank of a regular stable income, a certificate of income certified by a seal and signature is required. It should be remembered that the validity of the document is limited.

- Copy of work book. Sometimes it replaces the income statement, but it may be required in aggregate. If you have a copy, you should take the original book with you. The credit manager must check the copy of the document for authenticity.

- SNILS. The "Green Plastic Card" serves as an additional identification document for the borrower.

It is not necessary to take all documents at once. It is recommended to clarify what requirements the bank imposes on certificates before issuing a credit card. The easiest way to do this is on the official website.credit institution.

Credit card: at what age can one get it?

The presence of all required documents is not a guarantee of obtaining a card. The borrower must comply with other requirements of the bank. For example, to know how old they give a credit card in order to match the age. Contrary to what most borrowers think, few lenders approve credit cards for people under 21.

The exception is Tinkoff, the leading online bank in Russia. The lender willingly issues credit cards to citizens aged 18 years and older. It is believed that Tinkoff is one of the most "loyal" banks in terms of requirements for borrowers. According to reviews, even customers without a permanent income and with delays could order a credit card. Borrowers under 21 who know how old Tinkoff has been issuing a credit card can try applying online.

But in most banks, the chances of becoming a credit card holder are only after the age of 21. To figure out where it is best to apply for a credit card, it is recommended to analyze the conditions of the leading credit card issuers: Sberbank, Tinkoff and Alfa-Bank.

Terms of "Tinkoff Bank": features

Compared to other popular credit card issuers in Russia, almost everyone can get a payment instrument with a bank limit at Tinkoff. The lender does not impose strict requirements on customers and issuescredit cards from the age of 18.

Limits for borrowers are limited: you can get a card without certificates only for amounts up to 300 thousand rubles. The exact size of the credit limit will be known only after consideration of the application by the bank's managers. The client must indicate in the application how much credit funds on the card he needs.

With sufficient solvency, the requirements of the borrower will be satisfied. If the borrower's income is not enough to calculate the limit, he will receive a credit card with the highest possible financial conditions for him.

Delivery of Tinkoff cards

All applications for Tinkoff credit cards are accepted online. Delivery is carried out by the bank courier within 1-7 days from the date of ordering the card. At Tinkoff, credit cards from the age of 18 are issued in any region of the Russian Federation, since the bank has no branches. You can get a credit card in the office, at home and in any place convenient for the client.

Interest rates of "Tinkoff Bank" are competitive: the bank offers credit cards from 12% per annum. But not everyone approves of such a favorable percentage. On average, the interest rate on Tinkoff credit cards is 19.9-22.9% per annum. The card earns cashback in partner stores up to 30%.

Sberbank credit cards for payroll clients: how to get, features

Sberbank credit cards are well-deservedly popular with the public: customers can get a card with an approved limit for free at anydepartment. The conditions are relevant for payroll card holders who do not have a valid Sberbank credit card.

How old is a credit card in Sberbank issued free of charge? Participants of the salary project can become the owner of a credit card at the age of 21 years. In order to check if the client has a card with a pre-approved bank limit, you need to contact any branch of Sberbank with a passport. The operation of issuing a credit card, if approved, takes no more than 15 minutes.

Sberbank clients have advantages over other borrowers: credit card limits for them have been increased to 600,000 rubles. The interest rate for the use of borrowed funds is lower, it is 23.9% per annum.

Standard conditions for obtaining Sberbank cards

If a client does not receive wages to an account or a Sberbank card, a credit card is also available to him, but on different conditions. The cost of a classic Sberbank credit card will be 750 rubles a year, and a "gold" credit card will cost the owner 3,000 rubles.

The age of obtaining a Sberbank credit card for those who are not a participant in the salary project does not change. Limits on Sberbank cards are similar to the conditions in Tinkoff: you can get a credit card with borrowed funds in the amount of up to 300 thousand rubles.

Knowing how many years they give a credit card at Sberbank, you need to keep in mind that the document requirements for other borrowers are more stringent. You need to convince the bank of yoursolvency. To do this, the client must provide a certificate of income or a copy of the work book.

Application for a card is considered within 2 days. If approved, the client receives a credit card with a limit from Sberbank. The interest rate is fixed - 25.9% per annum.

Sberbank, unlike Tinkoff, is demanding on the borrower's credit history. If the payer made delays, has outstanding obligations, it is unlikely that the bank will approve his credit card. In this case, it is recommended to deal with debts in order to improve your credit history and pay off at least part of your financial obligations. This will increase the client's solvency and its attractiveness (as a borrower) for the bank.

Alfa-Bank credit cards: conditions for obtaining

"Alfa-Bank" issued more than 5 million credit cards "100 days without interest". It is no coincidence that the well-known product of the bank has earned the trust of borrowers: almost all citizens can get a credit card.

How old do you get a credit card at Alfa-Bank? Customers aged 18 and over can receive "100 days without interest". Loyal conditions apply to all citizens of Russia.

To receive a credit card for up to 50 thousand rubles, only a Russian passport is required, over 50 thousand - a second document, for example, SNILS.

If a borrower is interested in a credit card with a limit of more than 100 thousand rubles, he must bring a certificatefrom work.

The disadvantage of Alfa-Bank credit cards is the high cost of the product: you can get a card with a commission of 1,190 rubles a year.

Recommended:

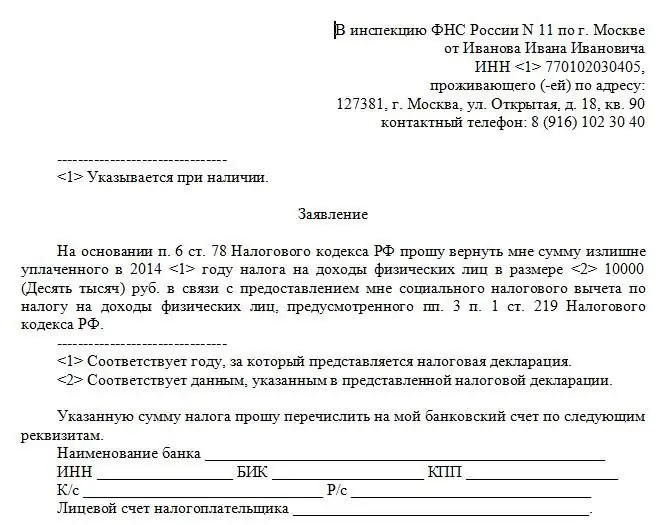

Tax deductions for individual entrepreneurs: how to get, where to apply, main types, necessary documents, rules for filing and conditions for obtaining

Russian legislation provides for a real possibility of obtaining a tax deduction for an individual entrepreneur. But often, entrepreneurs either do not know about such an opportunity at all, or do not have sufficient information about how it can be obtained. Can an individual entrepreneur receive a tax deduction, what kind of benefits are provided for by Russian law, and what are the conditions for their registration? These and other questions will be discussed in the article

How old do you have to be to get a bank card? Requirements, features, experience of other countries

According to article 28 of the Civil Code of the Russian Federation, the right to dispose of property is granted to children from the age of 6 with the consent of a parent or guardian. However, in practice, a different picture is observed: not every Russian bank is ready to issue a payment card at such a young age. Most often, a "children's" card is issued as an additional card to the main one

Tax deduction for treatment: who is en titled, how to get it, what documents are needed, rules for registration

This article will tell you how to get a tax deduction for treatment. What is it and what are the rules for issuing a return?

How old do you have to be to get a bank card? Youth cards. Debit cards from 14 years old

More than a third of parents regularly give their children pocket money for personal expenses, another third do it from time to time. Schoolchildren and students up to 17 years of age receive most of the funds in the form of cash, but very few use plastic cards

What documents are needed to get a bank loan?

Loan processing: what documents must be submitted to the bank to receive money. Lists of documents in different banks: what are the requirements