2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:49

Collecting a package of necessary documents is the first step in obtaining any loan. Depending on the chosen bank and the loan program, their list may vary: some of them are required without fail, others - only when applying for a certain type of loan. At the same time, the borrower's chances of obtaining a particular loan increase significantly if there are some certificates and references in the credit file. What documents you need to provide to obtain a loan, which of them are mandatory and which are not, and how the packages of documents differ in different banks, are described below.

Standard set of documents

Regardless of the selected loan product, the manager will provide the borrower with a list of what documents are needed to obtain a loan. The client undertakes to provide the original passport and photocopies of all its pages, which can be certified by the borrower himself, as well as the signature of the bank manager accepting the documents, and the stamp of the credit institution. Additionally, filling out an application for a loan and a questionnaire is required. Some banks offer customers an application-a questionnaire that combines both forms.

List of standard documents for applying for a loan

Most banks give their customers lists of what documents are needed to obtain a consumer loan, and which documents are required to obtain a mortgage. As a rule, you will need:

- A copy of the work book certified by the personnel department or any other document that confirms the employment of the client - a certificate from the employer, a contract, an extract from the work book. Such documents must indicate the place of work, position and length of service. Each page of the document must be certified. Seafarers are required to provide a passport, contracts for the last few years and their official translation into Russian.

- Income statement. It can be issued in the standard form 2-NDFL or in the form issued by the bank. It is certified by the seal of the employing organization and signed. It should contain information on the amount of income of the borrower for the last six months at least. If, in addition to wages, a bank client has a third-party source of income (from renting out real estate, pensions, etc.), then documents confirming it are provided - such papers can significantly increase the chances of obtaining a loan.

- Documents that confirm the fact of a deferment from military service - a military ID, registration certificate and others. Only required if the borrower is under 27.

Many financial institutions may require additional documents in addition to the above documents. What documents are neededfor additional credit - described below.

Additional documents required by the bank

The documents listed below can be prepared not only at the request of a credit institution, but also on the personal initiative of the borrower. Most of these papers can not only confirm the social status of the borrower, but also positively affect the assessment of its solvency. Such documents can be provided to the bank when applying for both a consumer loan and any other loans and loans secured by property - real estate or a vehicle. What documents are needed to obtain an additional loan?

- Car registration certificate or driver's license.

- TIN.

- Pension fund insurance certificate.

- Passport - if available.

- All insurance policies - CASCO, OSAGO, compulsory medical insurance and others.

- Original certificate confirming that the borrower is the owner of the property, or a copy of it.

- Bank statements, any documents confirming the existence of these accounts or securities.

- Photocopies of papers on education received: certificates, diplomas, certificates.

- Account statements, copies of previously issued loan agreements, certificates from credit institutions confirming the absence of debts.

- Copies and originals of birth certificates for children, marriage or divorce.

A credit institution, when applying for a consumer loan aimed at purchasing goods - for example, household appliances - may require the borrower to provide an invoice from the store; when applying for a loan for education - an agreement concluded with an educational institution, and a copy of its license certifying its right to conduct such activities.

Applying a loan at Sberbank

To receive money on credit, a potential borrower can apply to one of the most popular banks - Sberbank. What documents are needed to obtain a loan in it?

If the borrower has never used the services of this credit institution before, then the requirements for it are much stricter than for other clients, and the verification of the received documentation will be carried out many times more thoroughly.

Required documents

The loan officer must receive the following papers from the borrower:

- Identity document - passport.

- Employment book, contract with the employer or any document confirming the presence of a permanent place of work.

- Certificate and extract from the USRR are provided by individual entrepreneurs.

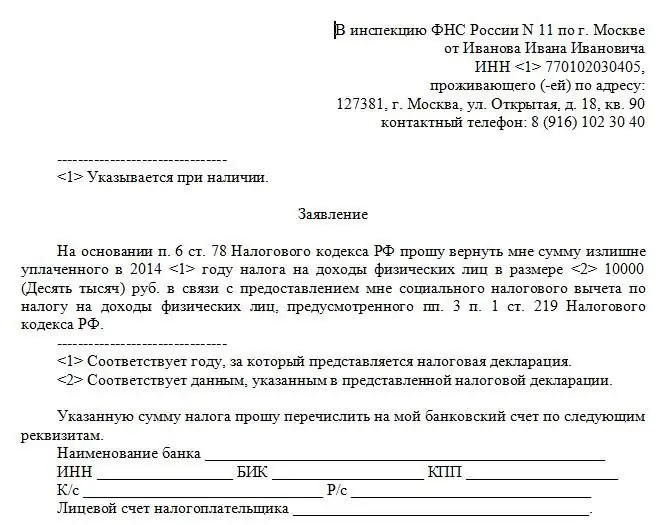

- Reference 2-NDFL, tax returns stamped by the Federal Tax Service.

- Documents confirming an additional source of income - for example, from renting out real estate or third-party part-time work. Bank notification of thisincrease your chances of getting a loan.

- Men under the age of 27 must provide a military ID in order to avoid delaying loan payments due to military conscription.

- Persons acting as guarantors should not have any debts to credit institutions. In addition, they are required to provide a similar package of documents to the bank manager.

The borrower may, on his own initiative, present to the bank papers confirming his right to own real estate or any other property. Such certificates will confirm the client's solvency and increase his chances of obtaining a loan.

Getting a loan from Rosselkhozbank

A standard set of papers required to obtain a loan is available in every bank; Rosselkhozbank is no exception. What documents are needed to obtain a loan from this financial institution?

The loan agreement is executed after the submission of the following documents:

- Each person involved in the design of a loan product fills out a questionnaire. The application form can either be taken at the institution or found on the official website of the Russian Agricultural Bank.

- Identity document. In most cases, a passport is required.

- Employment contract or book - a paper confirming the employment of the borrower. Such documents are certified no later than a month before the date of application.

- Help 2-NDFL or similar form issuedbank and confirming the amount of income of the borrower. If the loan is issued for a pensioner, then you must present an extract on the calculation of the pension.

- Military ID.

The above lists what documents are needed to obtain a loan. Providing a full package to Rosselkhozbank will help you get a loan and increase your chances of getting it.

Getting a loan from Sovcombank

One of the most successful banks today is Sovcombank. What documents are needed to obtain a loan in it?

- Passport of a citizen of the Russian Federation.

- The second document confirming the identity of the borrower. It can be any paper - driver's license, military ID, medical policy.

- Tax certificate in the form of 2-personal income tax or a special document issued by the bank.

- Employment contract or work book.

What documents do you need to get a loan for a pensioner?

A pensioner who receives his pension at Sberbank, for example, when applying for a loan, must provide only a passport, since all the necessary documents are already stored in a credit institution. If the pension is accrued by one bank, and the loan is issued in another, then you need to take a certificate from the Pension Fund on the amount of the pension.

Drawing up a loan agreement at a bank requires the provision of a certain package of papers. What documents are needed to getloan, and in which specific banks - described above.

Recommended:

How old do you get a credit card? What documents are needed to apply for a credit card

Credit card processing is popular with banks as customers appreciate the convenience of the product. But not everyone has access to a means of payment with a grace period, because the bank imposes certain requirements on the borrower. Not all customers know how many years they give a credit card and what certificates are needed to obtain it. Terms and rates for credit cards in banks are different, but there are common points

How to get a loan if you have a bad credit history: an overview of banks, loan conditions, requirements, interest rates

Often a loan is the only way to get the required amount within a reasonable time. By what criteria do banks evaluate borrowers? What is a credit history and what to do if it is damaged? In the article you will find step-by-step recommendations on how to still get a loan in such a difficult situation

Which bank to get a loan? What documents are required for a bank loan? Conditions for granting and repaying a loan

Big plans require solid funds. They are not always available. Asking relatives for a loan is unreliable. People who know how to handle money always find successful solutions. In addition, they know how to implement these solutions. Let's talk about loans

How to repay a loan with a loan? Take a loan from a bank. Is it possible to pay off the loan early

This article helps to deal with the refinancing agreement, which is one of the most successful loan repayment options

Tax deduction for treatment: who is en titled, how to get it, what documents are needed, rules for registration

This article will tell you how to get a tax deduction for treatment. What is it and what are the rules for issuing a return?