2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

When a person invests his own money in an income-generating object, he expects not only to receive profit from the invested capital, but also to fully repay it. This can be done through resale or by obtaining such profits that not only bring interest, but also gradually return investments.

Introduction

When an investor invests his own capital in a certain object, he expects to receive a return and a profit. There are three popular ways to calculate estimated times:

- Straight-line return on capital method. Named after Ring.

- Capital return method based on the rate of return on investment and the recovery fund. Named after Inwood.

- Method of return of capital at risk-free interest rate and compensation fund. Named after Hoskold.

Summary

Let's literally describe what each of them is in a couple of words:

- Ring's method. It assumes the development of the scenario according to the following procedure: the reimbursement of the principal amount of the invested capital is carried out in equal installments. In this case, the amounts of payments will not differ. This method assumes that there will be an annual decrease in the value of the cash flow that is used to pay off the debt. Therefore, it cannot be used in cases where the income is uneven.

- Inwood's method. The rate of return on investment is equal to the factor of the recovery fund, which is calculated at the same interest rate as in the case of return on investment. The use of this approach is expedient with a full return on investments and receiving appropriate profits from them.

- Hoskold method. It is used in cases where the loss of part of the invested capital during the transaction is likely. The current income in this case is considered both as a compensation and as a profit from the investment. For example, this is true when demolishing a residential building that was rented out. Therefore, the return on investment according to the Hoskold method should be based on the fact that not only return the invested capital, but also make a profit from the manipulations performed.

Now let's look at them in more detail.

Ring Method

Now let's take a closer look at the mathematical aspects. Divide 100% of an asset's value by its remaining useful life to arrive at an annual rate of return on capital. In other words, you need a value that is the reciprocal of the life of the asset. The rate of return is the annual share of the initial capital that is placed in an interest-free replacement fund.

Let's consider a small example of investing. Suppose there is an investment for five years. The rate of return is 18% per annum. In this case, the annual straight-line return on capital would be 20%. This is achieved through simple manipulations: 100% / 5=20%. The capitalization ratio in this case will be 38%. For those who do not understand where this number came from: 18% + 20%=38%.

Inwood method

This approach is used when a decision has been made to reinvest the returned capital at the rate of return on the investment. Another name for this option is the annuity method. Here is a small example: the term of the investment is five years. Return on investment is 12%. The recovery fund factor (from its reinvestment) is 0.1574097%. Thus, the coefficient will be equal to 0.2774097%.

Hoskold method

The formula for this approach is applied when the rate for the initial investment is not high. And re-investment on it looks very unlikely. Therefore, the risk-free rate is assumed to be used as a support in the mathematical calculation.

To understand, let's look at a small example. There is an investment project that offers an income of 12% per annum on investments for a period of five years. Certain amounts, thanks to the return of funds, can be reinvested risk-free at a rate of 6%. Return ratecapital with such a recovery factor is 0.1773964. The coefficient in this case will be equal to 0.2973964.

What does the formula look like? The Hoskold method involves the use of a slightly more complex expression. In general, it looks like this: R cap.=R doh. Cap. + Δ R norm. return

The greatest interest in the calculations is Δ. After all, it depends on this symbol whether this value is beneficial or not. So, Δ will be equal to zero if the value of the object of assessment does not change. A positive value can only be with a decrease in its price. It displays the share that will fall. A minus value is set if it is planned to increase the value of the object. It also displays the share by which growth will approximately occur. The rate of return according to the Hoskold method must be taken into account adequately, otherwise unreliable data will be obtained, which will lead to financial losses.

About odds

The fact is that the methods in question do not exist on their own in a vacuum. A large role in their use is played by the coefficient of capitalization and return on investment. The first is used in assessing risk and displaying invested and received funds. The larger it is, the more profitable the deal is offered. True, you need to be careful. The higher the returns are promised, the more likely it is that the associated risks will move from the status of something ephemeral to a very real thing.

Another noteworthy return rateinvestment. It is used to show the profit or loss of a certain investment as a percentage. Its formula looks like this: (income - losses) / investment amount100%.

What difficulties might arise?

For all the apparent simplicity, there may be certain hitches. For example, sales prices are opaque information. Therefore, there may be differences between nominal values and actual results. It is best to apply mathematical models in a stable market. Interestingly, deviations are provided when moving in both directions. For example, as the market grows, the capitalization ratio will decrease. Of course, it cannot be said that parameter improvement is a bad deviation. But it leads to the fact that the mathematical model used needs to be corrected.

Separately worth mentioning the use of borrowed funds. After all, alas, it is not always possible to manage solely with your own finances. In this case, it is necessary to use the concept of net operating income for one time period and the reversion price is not calculated. If borrowed funds were used, then it is better to pay attention to the method of linked investments.

Specifics to consider

Now let's talk more about application aspects. It is always necessary to calculate the main questions. If you don’t like the answer, then this is an occasion to think about the appropriateness of the actions taken.

For example, can the cash flows of an investment project compensate for the investments made and make a profit? Let's consider a very simple option. A person takes money to the bank and opens a deposit. After the expiration of the contract, you can receive both the principal amount and the interest due. Of course, if the bank does not go bankrupt. But in this case, you can count on the preservation of the principal amount, if it does not exceed the maximum established by law. Therefore, you only have to worry about the reliability of a banking institution and the proposed interest rate. But if the cash flows of the investment project are directed to the acquisition of real estate, then care should be taken to ensure that investments are compensated. That is, receiving a deposit of 10% for this case is clearly not enough if the project is planned to work for ten years. Ten percent profit is possible only if the return on investment is 20%. If less, then the payback period will increase. And this will make the project less attractive. Otherwise, twenty percent is enough to send half of it to reimburse the investment, and consider the remaining 10% as your well-deserved income.

Conclusion

Here are the methods of Hoskold, Ring and Inwood. And together with them, it is also estimated how the return on investment capital is calculated. Mathematical calculations will allow you to find out how much time you need to wait until the capital is reimbursed and profit is received, what will be its final size. Although it should be noted that when decidingreal problems will be somewhat more complicated than discussed in the article. The mathematical formula can be modified to take into account certain points in order to minimize the likelihood of financial losses.

Recommended:

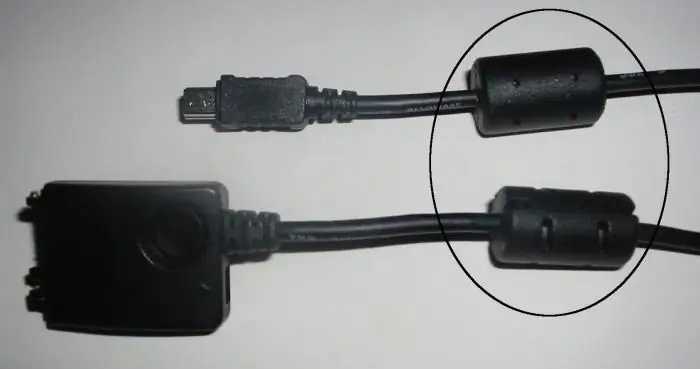

Ferrite ring - what is it? How to make a ferrite ring with your own hands?

Each of us has seen small cylinders on power cords or on cables for matching electronic devices. They can be found on the most common computer systems in the office and at home, at the ends of the wires that connect the system unit to the keyboard, mouse, monitor, printer, scanner, etc. This element is called the "ferrite ring". In this article, we will look at the purpose for which manufacturers of computer and high-frequency equipment equip their cable products with these elements

Evaluation of investment projects. Risk assessment of an investment project. Criteria for evaluating investment projects

An investor, before deciding to invest in business development, as a rule, first studies the project for prospects. Based on what criteria?

How to recover a lost pension insurance certificate?

Lost your pension insurance certificate? No problem! It can be restored. If you are officially employed, then you need to contact the personnel department, if not, the nearest branch of the pension fund

Investment: investment multiplier. Investment multiplier effect

The investment multiplier is a coefficient that shows the change in gross product along with investment. Its effect can be seen by considering a specific example

What is capital investment? Economic efficiency of capital investments. Payback period

Capital investments are the basis of business development. How is their economic efficiency measured? What factors influence it?