2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

In accordance with the legislation of the Russian Federation, budgetary institutions are required to plan financial and economic activities and fix the procedure for its conduct in a separate document. How it should be drawn up is also regulated at the level of regulations. What are the features of the formation of a plan for the financial and economic activities of a budgetary organization? What information can be reflected in it?

Overview of the business plan

Let's first consider what the document in question is. Financial and economic activity is a set of management decisions of an organization related primarily to the planning and distribution of income and expenses of an economic entity, taking into account the rules of law, requirements, regulations and recommendations of the competent authorities that are relevant to the activities of the institution.

In the case of the budget system, the essence of financial and economic activity is understood, in general, in a similar way. The way in whichthe plan in question should be formed and approved, determined at the level of the federal legislation of the Russian Federation. These procedures are quite strictly regulated in the relevant legal norms.

The authority that has the main competencies in terms of regulating the planning of income and expenditure of state and municipal structures is the Ministry of Finance of Russia. This state structure issues various regulations that regulate the procedure for planning financial and economic activities by budgetary institutions. Before considering the order in which the financial and economic activity plan of a budgetary institution should be drawn up, an example of a relevant document, we will therefore study which sources of law regulate the formation of this source.

Drafting a financial plan for a budgetary organization: governing legislation

The main normative act that must be observed when drawing up the plan in question is the Order of the Ministry of Finance of Russia No. 81n, adopted on 2010-28-06. It reflects the requirements for the corresponding plan. This normative act was adopted in order to fulfill the provisions of federal sources - the Federal Law "On Non-Commercial Organizations", as well as the Federal Law "On Autonomous Institutions".

The provisions of Order No. 81n should take into account the state or municipal budgetary institution, as well as an autonomous one. Let us consider the content of the relevant normative act in more detail. Let's start with its general provisions.

Order No. 81 on the preparation of a financial planbudget institution: general provisions

The most important norm of the considered section of Order No. 81 can be considered the one according to which the plan according to which the budget estimate of the institution is formed must be developed annually if the budget is adopted for 1 financial year, or taking into account the planning period (if it is included in the period of validity of the normative act approving the state financial plan). If necessary, the founder of the organization that forms the document in question can detail its structure in terms of reflecting quarterly or monthly indicators in it.

Order 81: Making a Plan

Order No. 81 also determines how a plan for the financial and economic activities of a budgetary institution should be drawn up. An example of any document of the appropriate purpose should be drawn up taking into account these requirements.

The source in question should be formed based on the fact that the indicators in it are reflected on a cash basis with an accuracy of 2 decimal places. The plan must comply with the form developed by the founder of the budgetary organization, taking into account the requirements reflected in Order No. 81.

Thus, the plan of financial and economic activities of a budgetary institution (an example of its fragment will be given below) should consist of the following parts:

- header;

- main content area;

- design part.

Header of plan

The title shouldreflect:

- approval stamp of the plan, which fixes the title of the position, the signature of the employee who has the authority to approve the document, its transcript;

- date of putting the plan into circulation;

- document title;

- plan formation date;

- the name of the budget institution, the unit in which the document was developed;

- name of the authority that established the budget organization;

- other details necessary to identify the institution - TIN, KPP, code according to a special register;

- information about the financial year, in cases provided for by law, supplemented by the planning period;

- the names of the units of measurement of those indicators that are included in the document.

Content of the plan: text area

The content area of the document in question consists of 2 parts - text and tabular.

The first should reflect:

- the goals of the organization's activities, determined in accordance with the provisions of the law;

- types of activities of the organization, determined by the charter;

- lists of works and services performed by the organization;

- book value of real estate, which is assigned to the organization on the principle of operational management, movable property, including especially valuable;

- other information included in the plan by decision of the founder.

Content of the plan: tablespace

The plan also includes several tables. They reflect:

- indicators of financial conditionorganizations, including those dealing with assets and liabilities;

- information on receipts and payments;

- indicators of payments related to the purchase of goods, works, services;

- information about the funds that the organization temporarily manages;

- reference information.

The tabular part of the plan may reflect other information in accordance with the decision of the body that established the budget organization.

In the event that social institutions or other state or municipal structures change jurisdiction, the plan must be drawn up in the manner prescribed by the competent authority to which the organization will be accountable.

Forming part of the plan

The plan under consideration must be certified by the signature of the competent persons of the organization - the director, the head of the accounting department, as well as the employee who compiled the document. These details are recorded in the design part of the document.

If the organization developing the document in question is an autonomous institution, then the plan must be certified by the head of this structure on the basis of the opinion received from the supervisory board. Financial and economic activity is a responsible direction in the development of an organization, and therefore its planning may require additional approvals from competent persons.

However, if the document in question is drawn up by a structure in the status of a budgetary institution, then inIn general, its approval only by the director is sufficient - unless otherwise established by the body that established the relevant organization. If the plan is drawn up by a department of the institution, then it is put into effect by the head of the organization.

Plan of financial activities of a budgetary organization: nuances

There are a number of nuances that characterize the formation of the document in question. Thus, the planned indicators of income and expenditure, reflected in the tabular section of the plan, should be determined during the preparation of the draft budget for the financial year, supplemented in the cases provided for by law by the planning period. At the same time, subsidies are taken into account:

- to ensure the fulfillment of the state task, provided for by the Budget Code of Russia;

- to invest capital investments in real estate provided on a competitive basis.

In addition, a number of other indicators are taken into account. Namely:

- public obligations to citizens, expressed in monetary terms;

- budget investments.

As for income targets, a state or municipal budgetary institution should take into account similar subsidies when determining them, as well as:

- receipts from the provision of commercial services by the organization according to the charter, that is - for the main types of its activities;

- income from the sale of securities - in cases provided by law.

Information can be recorded:

- value of publicobligations to citizens, which must be fulfilled by the organization in cash;

- amount of budget investments;

- the amount of funds that are in the temporary management of the institution.

The information reflected in the plan can be formed by the organization on the basis of the information that is obtained from the founder. Some of the relevant indicators may be of an estimated nature, such as those related to the generation of revenue from the provision of commercial services.

The cost of maintaining the infrastructure of the institution, which are associated with the purchase of certain goods, works and services, should be detailed in the plans:

- for procurement to meet state or municipal needs under the law on contractual relations;

- for purchases made in accordance with the provisions of Federal Law No. 223.

Formation of a financial activity plan: document approval features

There are also a number of nuances that characterize the procedure for approving the plan in question. Thus, it can be noted that the authority that establishes social institutions and other state and municipal organizations has the right to put into circulation a single form of a document intended for use by both autonomous and budgetary structures or 2 independent forms for each type of organizations. Similarly, rules for filling out relevant documents can be adopted.

The plan, as well as information supplementing it, can be clarified directly by the institution after the budget regulation is approved. After - it is sent for approval, which is carried out taking into account the norms fixed in the requirements under Order No. 81n. If the clarifications are related to the implementation of the state task by the institution, then they are made taking into account those indicators that are established in the corresponding task. In addition, the target subsidy allocated for the purpose of its implementation is taken into account. The relevant requirements are also established by Order No. 81n.

Changing the business plan

In some cases, the budget estimates reflected in the plan in question are subject to change. This procedure involves the formation of a new document of the appropriate type, the provisions of which should not contradict the cash indicators of the original version of the plan. The decision to correct the document is made by the director of the organization.

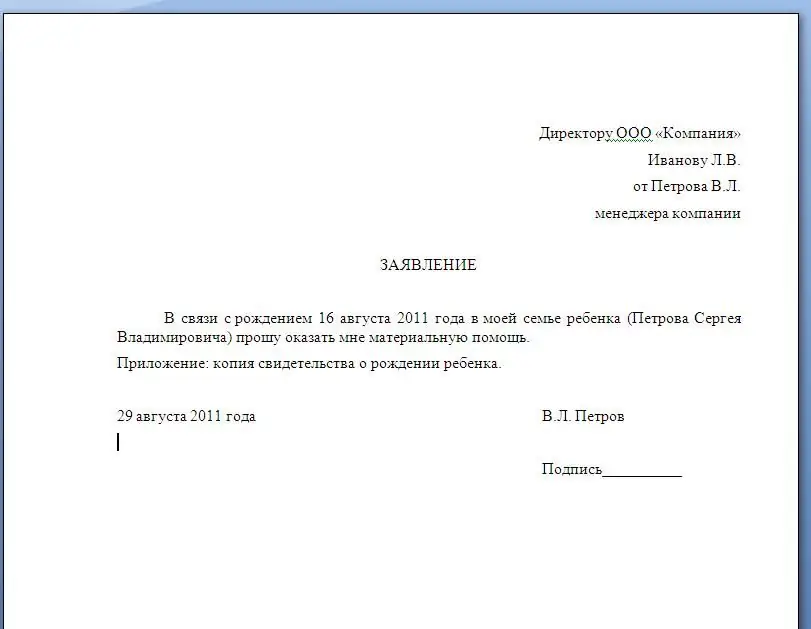

How might a plan of financial and economic activities of a budgetary institution look like? An example of this document in terms of one of the key components is in the picture below.

It is very important to comply with the requirements for the structure and content of the relevant plan established by law, as well as at the level of decisions of the authority that established the budgetary organization.

Recommended:

Job responsibilities of an economist in a budgetary institution (for a resume)

Economist is a profession with a very wide range of functional duties, varieties and branches of activity. Economists are in demand everywhere in one form or another, with different job titles and a list of tasks under control. Today, this direction is very popular among young people who choose their future professional environment, speci alty and future workplace. This article will discuss the job responsibilities of an economist in a budgetary institution

Application for financial assistance: sample and form of writing with an example, types of financial assistance

Material assistance is provided at work to many employees who have significant events in their lives. The article provides sample applications for financial assistance. Describes the rules for assigning payments to the employer

Inventory in a budgetary institution: rules and stages of implementation

Any economic activity at the enterprise assumes the presence of specific savings in its possessions. This includes tangible and intangible assets, fixed assets, finished products or goods for sale, monetary assets and other property. Whatever the firm - large or small, industrial or commercial, public or private - it must recalculate the list of property present on it by conducting an inventory

Financial institutions, their types, goals, development, activities, problems. Financial institutions are

The financial system of any country has a key element - financial institutions. These are institutions that are engaged in the transfer of money, lending, investing, borrowing money, using various financial instruments for this

Analysis of financial and economic activities - theoretical foundations

The transition to market relations requires all enterprises to increase production efficiency, which, in turn, will increase the competitiveness of their products. The most important role in solving this problem is played by the analysis of financial and economic activity. With the help of this scientific discipline, strategic development plans are developed, management decisions are scientifically substantiated, and their implementation is monitored