2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:33

Many people for various reasons need financial assistance, as force majeure circumstances arise in their lives. Such assistance can be requested at the place of work. To do this, a competent application for financial assistance is drawn up. A sample of this document can be used to ensure that it contains all the necessary information about the applicant. Based on this document, the employer issues an order stating exactly what amount is assigned to the employee.

The concept of financial assistance

The legislation clearly states that every head of a state-owned company must provide material assistance to his employees. It is not included in their wages. Many employers always meet halfway for their employees, so if any specific and unforeseen situations arise in the life of citizens, they can count on an additional cash payment.

Such a payment is made by issuing an appropriate order by the headcompanies. Additionally, local regulations may establish the possibility for employees to receive appropriate assistance. Often, measures to provide material support are prescribed in a collective labor agreement.

In large organizations, a special cash fund is formed at the beginning of the year, intended for additional payments to employees.

When will funds be released?

An application for financial assistance can be made by employees for various reasons. Most often, the need for such support arises in the following situations:

- registration of annual leave, during which the employee plans to travel, therefore, needs additional funds in addition to vacation pay;

- childbirth;

- marriage;

- retirement;

- death of a close relative;

- forced long-term treatment;

- registration of work injury;

- getting a certain disability group.

The above situations are indeed a good reason to receive material support from the management of the company where the citizen works. When making an application for financial assistance due to various circumstances, it is necessary to indicate a specific reason for applying for such support.

To such a statement, it is necessary to attach other documents that serve as evidence of the occurrence of a specific event in the life of a citizen. As suchdocument may be a birth certificate of a child or marriage registration.

General points of appointment of assistance

If an employee of any company really realizes that he needs material support, then he must formally request it from the management of the company. For this, a corresponding application is made. It states the reason for the payment. It is advisable to use a sample application for financial assistance in order to avoid any mistakes.

The main nuances of assigning such a payment include:

- payments are provided not only by local regulatory documents of the company, but also by federal law, but this only applies to government agencies;

- in private companies, the manager may refuse to pay material assistance;

- the amount of this payment is set by the direct director of the organization, for which it takes into account what position the applicant holds in the company, whether he was brought to disciplinary responsibility over the past year, what salary he receives, and also how much money is available in the corresponding fund.

Often, the collective agreement specifies the maximum amount that can be transferred to employees annually in the form of support. For this, a fixed rate or some percentage of salary can be used.

How to makestatement?

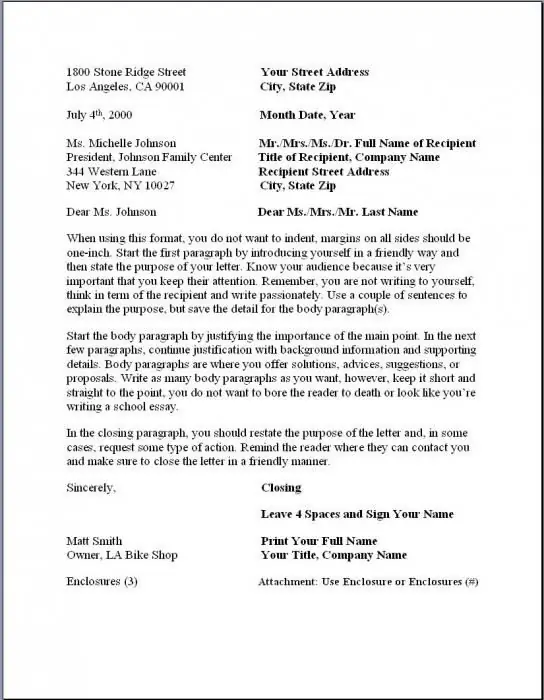

When generating this document, it is advisable to use a sample application for financial assistance. For this, a free form is used, but mandatory information should be included in the text. Some companies have special templates for applications for financial assistance that can be reviewed by the human resources department.

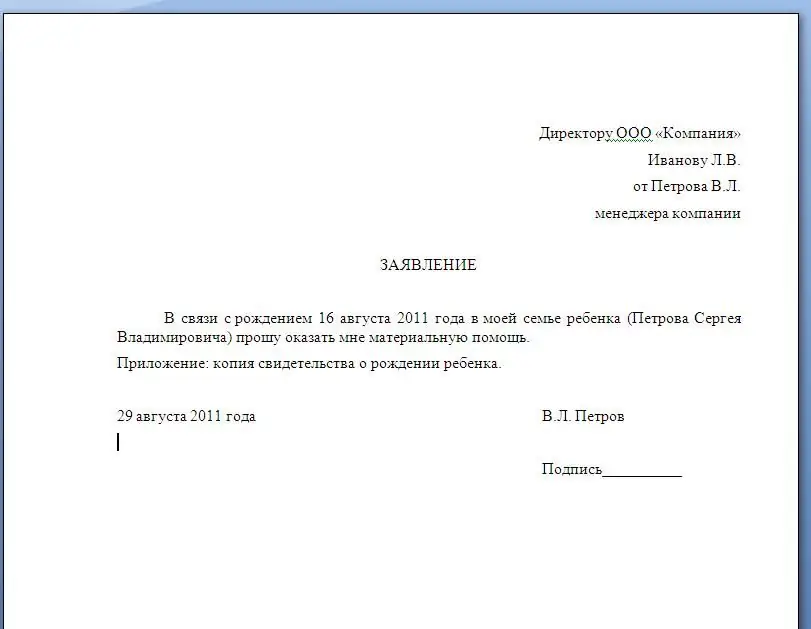

When compiling this document, the following information must be entered:

- name of the organization in which the citizen works;

- information about the head of the company, since it is in his name that the application is being formed;

- information about the applicant provided by his full name and position held in the company;

- indicate the name of the document that is an application for assistance in the form of material payment;

- the text contains a direct request for additional funds in connection with the occurrence of any unforeseen and difficult events in the life of an employee of the organization;

- give the reason for the award, which can be represented by the death of a relative, a serious illness or the appearance of a baby in the family;

- reference is left to a legislative act, local internal company documentation or a collective agreement if these documents indicate the possibility for an employee to receive assistance from an employer;

- lists the documents attached to the application, which confirm the validity of the request;

- at the end the applicant's signature is put, and the date of transfer of the document is also indicatedcompany representative.

See below for a sample leave application.

What documents are attached?

Usually, employers do not require applicants to provide evidence of reasons for applying for financial assistance, but it is advisable to send such supporting documentation along with the application. Additionally, confirmation is often required that other types of material assistance were not received by the citizen from other sources.

If two family members work in the same company, then only one of them can be assigned a payment. For the competent preparation of the document, it is advisable to use a sample application for material assistance. Other documents are attached to it, which depend on the reason for the appeal:

- Long treatment required. If an employee falls ill and needs expensive treatment, he can ask the employer to transfer a certain amount used to pay for the services of medical organizations. To do this, it is required to attach a medical certificate to the application, which indicates the diagnosis, and also prescribes how much money is required for treatment. Additionally, an extract from a medical card, a medical history and checks for paying for services or purchasing medicines are requested from a medical organization. If rehabilitation in a sanatorium is required, then the attending physician must issue an appropriate referral, which has his signature and the seal of the organization.

- Death of a close relative. Often employees of differentcompanies file an application for financial assistance in connection with the death of a family member. Help is provided if a really close relative dies, which includes parents or children, as well as sisters and brothers. When drawing up an application, it is important to indicate the degree of existing relationship. A copy of the death certificate is attached to the application.

- Happy baby. If a baby appears in the family, then this always leads to unforeseen and significant expenses. Therefore, at the place of work, the father can receive material support in the form of a large amount of funds. To do this, they draw up an appropriate statement, which states that he had a child. The baby's birth certificate is attached to this document.

A sample application for medical assistance can be viewed below.

Can I ask for vacation pay?

Going on vacation is a good enough reason to ask the place of work for a certain amount of funds. It can be used for travel or other purposes. To do this, a competent application for financial assistance for vacation is drawn up.

In some state organizations, directly in the statutory documentation, it is indicated that it is possible to transfer a certain payment to employees before they go on annual standard leave. In this case, the employer will not be able to refuse to transfer funds. It is advisable to study in advance a sample application for financial assistance for vacation,to correctly compose this document.

The nuances of getting help for treatment

Often, employees of different companies have a question about how to write an application for financial assistance to pay for treatment. To do this, it is important to indicate directly in this document the reason for receiving the cash payment.

Assigned such funds under a collective agreement or other local act, so commercial companies by law may refuse an employee to receive such assistance. They can pay 4,000 rubles to avoid paying tax, since such a payment is presented as a gift.

The initiative must come exclusively from the employee directly, so assistance is provided on a declarative basis.

How is an employer's payment processed?

The head of the company, after receiving an application from the employee, decides on the advisability of providing him with support. If it is positive, then it is correctly drawn up, for which an order is issued. The following information is entered into it:

- organization name;

- information about the head of the company;

- reason for publication, represented by the provision of financial assistance to a certain worker;

- indicates the amount of the payout;

- the reasons for transferring funds are given, for which you need to focus on the text of a previously received application;

- date of issue of the order;

- signature of the head and seal of the organization.

This document is transferred to the accounting department, after which the transfer takes placefunds to the employee.

Taxation of payments

Based on Art. 217 of the Tax Code, payments transferred to employees in the form of assistance are not taxed if their amount does not exceed 4 thousand rubles. If a large amount is issued, then it is represented by a part of the salary, from which personal income tax is charged in the amount of 13%.

If the payment is intended for an employee who has a child, then the amount is not taxed if it does not exceed 50 thousand rubles.

The legislation of the Russian Federation does not fix a specific form of application for financial assistance, so employees of different organizations can compose the text in any form. Often, HR specialists offer samples of such documents. If the organization is state-owned, then the employer does not have the right to refuse to assign such support if the employee has a good reason. Often such information is written in the statutory documentation.

When making such a payment, you can indicate in official documents that it acts as an encouragement or compensation. If a small amount is issued, not exceeding 4 thousand rubles, then often such a payment is not formalized.

Rules for awarding aid

An employee who wants to receive a payment from an employer must use the sample application for financial assistance in order for the required amount of funds to be transferred to him. When assigning a payment, the following rules are taken into account:

- Aid is transferred only at a time, so the amount cannot be divided into parts and paid several times a month;

- it is allowed for the application to be handed over by the authorized representative of the employee if he is being treated in a medical institution, but this person must have a power of attorney certified by a notary public;

- the amount should not be calculated taking into account the position the citizen occupies in the company's team;

- Even if there have been several absenteeism over several years of work, this cannot be the basis for denial of support.

The transfer of such payments is not the responsibility of the head of the company, so he has the right to refuse to pay any amount of funds to the employee. If the funds in the organization's reserve fund run out, the employer can use the unused profits.

Can I ask my employer for help without good reason?

An application for the provision of material assistance to employees can be drawn up even for people who have not experienced any specific events in life, but they are poor, therefore they are in a stable financial situation. To do this, it is important to have evidence that one person in the family has a sum of money that is below the subsistence level.

Under such conditions, you can not only apply at the place of work, but even apply to local authorities to receive support from the state. For this, appeals are made to the social security authorities.

Who else is being offered help?

Students who study full-time and receive a scholarship can count on material assistance. To do this, they must have evidence of their deplorable financial condition.

Even former employees of the enterprise who retired or were laid off can receive support. At the same time, state-owned enterprises cannot refuse to transfer funds if the need for payment is provided for by the content of their constituent documents. When making such an application, it is important to indicate the details of the bank account to which the funds will be transferred by the company.

Conclusion

All government organizations and many private companies provide material support to their employees in difficult situations. To do this, the employee must correctly draw up an application using current samples.

The amount of payment is determined by the direct manager of the company. A firm whose local regulations do not contain information about mandatory assistance may refuse to transfer such a payment to an employee.

Recommended:

What is financial grant assistance. Financial assistance free of charge from the founder

Property owned by an LLC and its founders exists as two separate categories. The company cannot rely on the money of its members. Nevertheless, the owner has the opportunity to assist the company in increasing working capital. You can arrange it in different ways

Material assistance to an employee: payment procedure, taxation and accounting. How to arrange financial assistance for an employee?

Material assistance to an employee can be provided by the employer in the form of cash payments or in kind. Sometimes it is issued to both former employees and persons who do not work at the enterprise

Business letters: writing examples. Example of a business letter in English

Business letters, etiquette in different languages, history of business and correspondence. The importance of writing letters correctly

Application for the return of state duty to the tax: sample writing

When a citizen applies to state executive bodies, a state duty is paid to the budget. Its size is determined by the significance of the actions that the representative of the authorities or the applicant will perform. A sample application for the return of state duty to the tax is presented in the article

Application for a refund of personal income tax for treatment: a sample and an example of filling

For more than a year, a taxpayer working on a white salary has the right to a so-called refund, or social tax deduction. It is issued at the local branch of the Federal Tax Service by filing a declaration. It is possible to return the taxes transferred to the state for expensive treatment or the purchase of medicines. To do this, you must fill out a special application. What is an application for a refund of personal income tax for treatment? How to fill out and what documents to attach to it we will tell in the article